Since nuclear energy is a risky business for commercial operators , it’s crucial to get government assistance through regulated cost recovery & price guarantees.

Southern Co. has snatched defeat from the jaws of a different kind of defeat.

On Wednesday, its subsidiary, Georgia Power Co., reached an eleventh-hour agreement with the three other owners of the Vogtle nuclear construction project to move forward with it. One of them, Oglethorpe Power Corp., had earlier demanded a cap on the risk of further cost increases, prompting a sharply worded press release from its, er, partners (“Oglethorpe Power is using the vote to try to burden others with its obligations …”).

Still, Oglethorpe ultimately got its cap. Georgia Power agreed to take on a disproportionate share of the risk of future cost increases in exchange for greater control over Vogtle’s future. As Greg Gordon, utilities analyst at ISI Evercore, put it in a report on Thursday:

We view this agreement as a pyrrhic victory for [Southern Co.] as it increases financial risk for shareholders in return for control over future decisions regarding the project’s future.

This project will likely weigh on Southern’s stock for a year or more as construction continues — along with the risk of further increases in a budget that has already doubled to $28 billion.

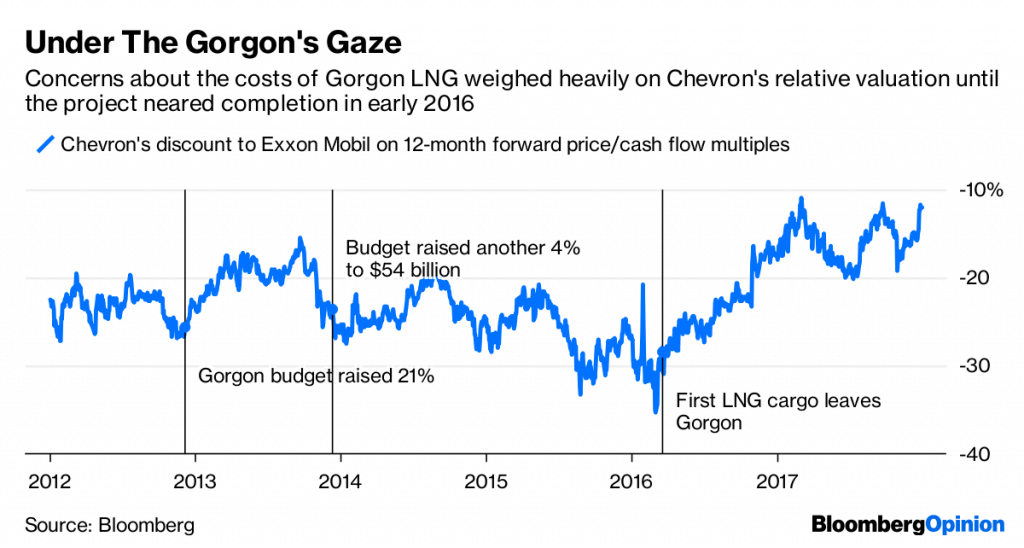

This is so often the curse of megaprojects. Gordon’s warning about Vogtle casting a shadow over Southern until investors can really see the end of the line brought to mind another major energy project of recent vintage: Chevron’s Gorgon liquefied natural gas project in Australia.

Chevron took the final investment decision on Gorgon in September 2009 (coincidentally, a month after Georgia Power filed its application with the state regulator for certification of Vogtle). Gorgon didn’t ship its first cargo of LNG until March 2016, and the budget, already put at a hefty $37 billion when construction began, had swelled to more than $50 billion. Unfortunately for Chevron, the last year or so before Gorgon’s startup coincided with the beginning of the oil crash; and the cash going out the door to the huge project, and concerns about further setbacks, weighed heavily on the stock. The pressure didn’t let up until Gorgon got going:

The thing that links these two projects is their sheer scale and long timelines at a time of profound change in energy markets. When Vogtle’s application was being filed, power demand in the South Atlantic region was expected to have risen by 16 per cent by now; instead, it has fallen (see this). Alongside that, we have had a shale boom that has crushed natural gas prices to less than $3 per million BTU — and thereby wholesale power prices — in much of the U.S. The dramatic fall in the cost of renewable power has compounded this.

While Vogtle may well be completed due to sheer political doggedness, it won’t be for any reasonable economic reason. Even assuming no further overruns, it will already cost more than $11,000 per kilowatt of capacity, multiples of what a new gas-fired plant or utility-scale solar array would cost. As Chris Gadomski of Bloomberg NEF put it to me on Thursday:

I doubt any more new large reactors will be built in this country as long as natural gas prices stay below $8 [per million BTU] and renewable technology remain in favor.

Nuclear power proponents rightly point out that it provides vast quantities of carbon-free, uninterrupted energy. They also raise concerns about the U.S. falling behind on nuclear technology. That may be a valid concern, but does rather raise the question as to why the good ratepayers of Georgia should be saddled with the costs of maintaining national security.

The problem, however, is that these plants are gigantic, one-off projects prone to cost overruns and requiring years of planning and construction before they generate a cent of revenue. This is just an unacceptable risk for most commercial operators, and why government assistance in the form of regulated cost recovery, price guarantees or finance is so often crucial to getting them built.

The competitive landscape has changed enormously in just the past decade. Besides shale gas and renewables, energy-efficiency, smart demand management and distributed generation have all begun to crowd onto the field. The newer technologies in particular may not carry the scale of a nuclear plant, but they do have the advantage of being scalable. That is, they can be deployed (and paid for) in a series of smaller steps to align with demand, rather than as a big, one-shot megaproject.

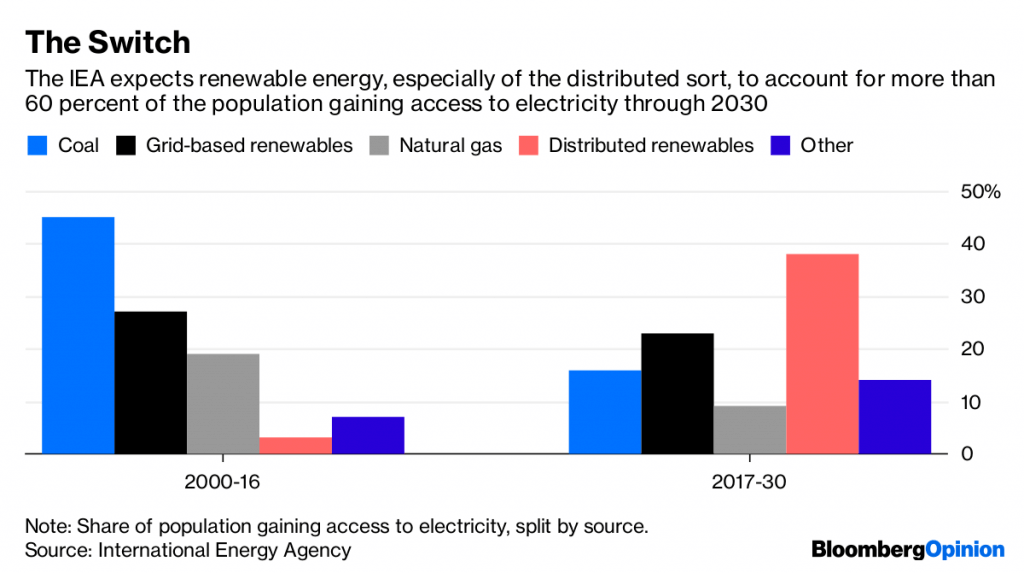

It is telling that an International Energy Agency report published last year on the 1.1 billion people lacking access to reliable electricity barely mentions nuclear power. The breakdown of where the IEA thinks electricity for those lacking it will come from is also telling:

Besides the obvious increase in renewable energy’s share, the most pertinent aspect here is the enormous increase in distributed generation. For many of the poorest people seeking access to power, recreating the massive, centralised grids (and fuel distribution systems) of the developed world is a non-starter. Modular, local systems are more feasible. The U.S. isn’t sub-Saharan Africa, of course. But in an era of flat demand and increasing supply options, nuclear power faces a similar challenge. –Bloomberg