Chana prices in India have been ruling below their minimum support price (MSP) levels since the last two years. But unlike cereals, edible oils, and vegetables, where inflation is regularly reported, falling prices of such crops seldom make it to the national media. These prices are important for farmers who make sowing decisions. Usually, higher prices encourage acreages and vice versa. Chana is a rabi crop and now is the season when farmers would be deciding if they should sow the crop. Therefore, it is important that we revisit the reasons why prices of chana have been below MSP and what can the government do to lift the chana farmer and trader sentiments.

Chana in India’s pulses basket

Chana is one of the most important pulse crops in the country. Last year, India produced about 14 million metric tons (MMTs) of chana (half of the country’s total pulses produced is chana). Globally, India is the largest producer and consumer of chana. Close to 70 per cent of global chana is produced in India (as per FAO for T.E. 2019-20). Other chana-producing countries include Australia, Turkey, Russia, Myanmar, Canada, and Pakistan. Despite being the largest producer, India is a net importer of chana. It imports mainly from Tanzania, Sudan, Myanmar, and Australia. Currently, there is an import duty of 44 per cent on kabuli chana (chickpeas) and 66 per cent on desi chana (Bengal gram). Import from the least developed countries (LDC) like Tanzania and Sudan is on zero duty.

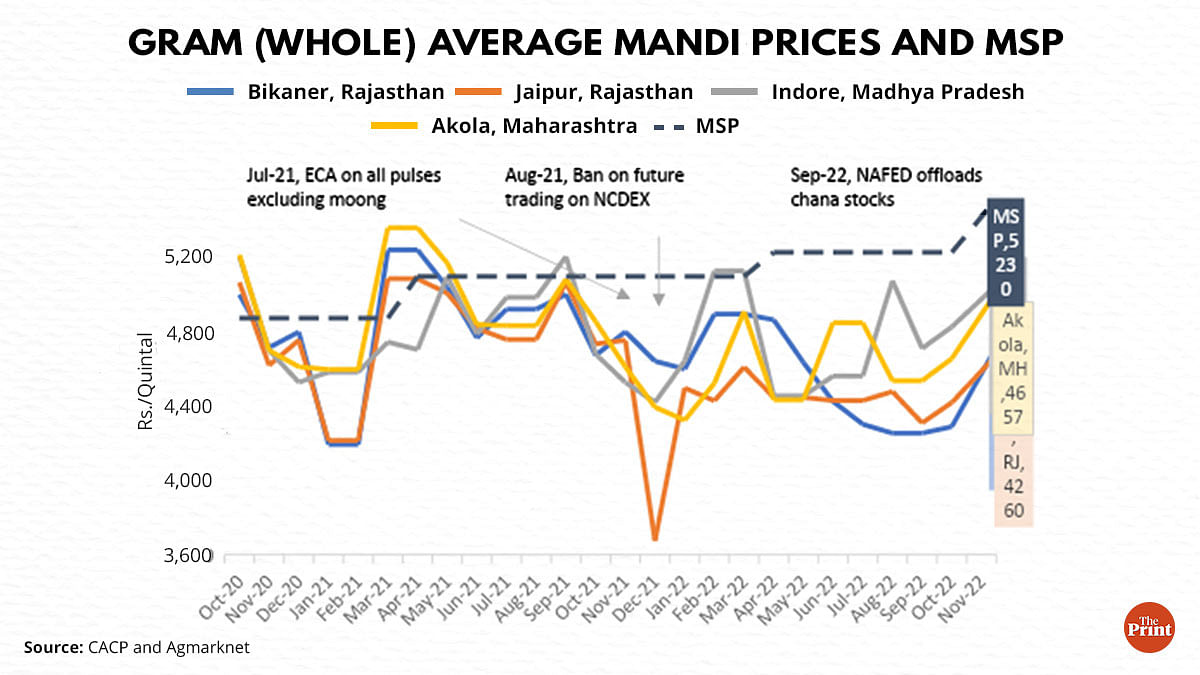

About 75 per cent of India’s chana is produced in four states – Rajasthan, Madhya Pradesh, Gujarat, and Maharashtra. In key chana mandis, prices of chana (whole) have been trailing their MSP by an average of 7 per cent in the last two years (Figure 1).

Figure 1.

Government’s action behind the lower prices

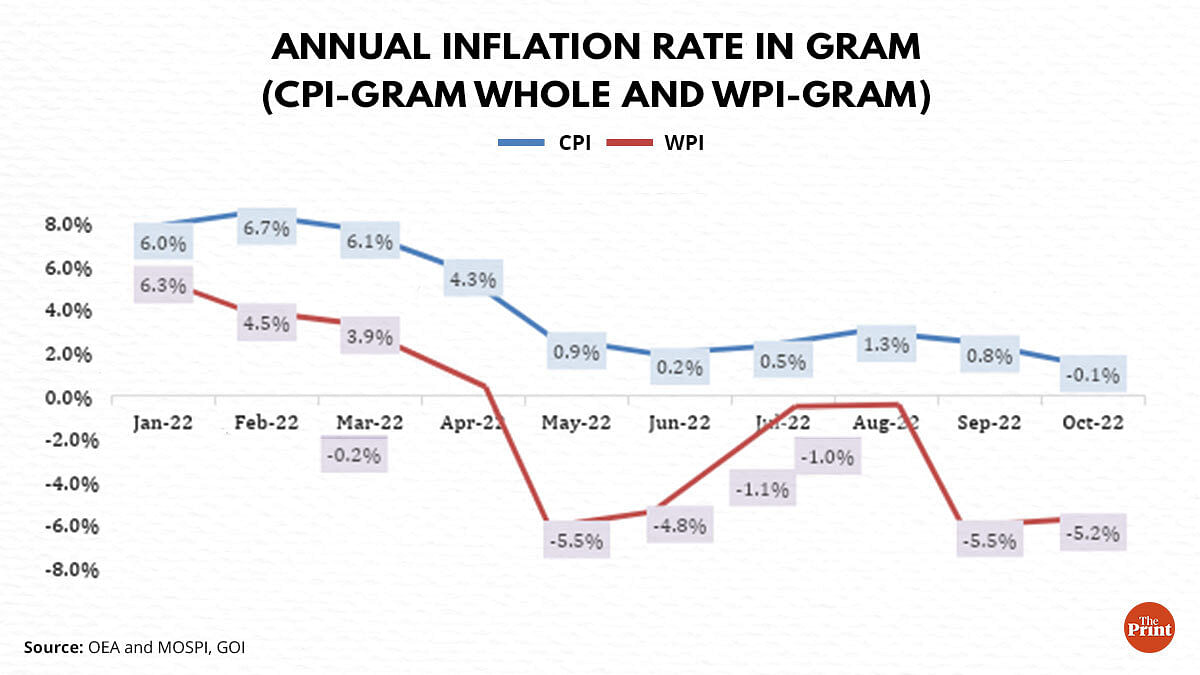

Even though the mandi prices were lower than the MSP, both the consumer price index (CPI) and wholesale price index (WPI)-based inflation rates for the chana (as did for most other pulses) registered double-digit inflation rates until September 2021. Since pulses are a staple to Indian diets, the government undertook multiple actions to curb price rise.

It acted by, inter alia, (i) imposing provisions of Essential Commodities Act (ECA) in July 2021, (ii) allowing ‘free’ imports in May 2021, and among other things, (iii) signing MOUs with Mozambique, Malawi, and Myanmar to import pulses–March and June 2021, respectively. While most of these decisions were for tur, masur, and urad, in case of gram, the National Agricultural Cooperative Marketing Federation (NAFED) was directed to offload chana stocks. On 16 August 2021, Securities and Exchange Board of India (SEBI) directed the National Commodity & Derivatives Exchange Limited (NCDEX) to suspend future trading in chana (along with 6 other commodities). The ban comes to an end on December 21, 2022. Overtime, chana fell still further (Figure 1).

Later, to provide support to falling prices, the government procured about 2.6 MMTs of chana in March-May 2022. This high level of chana procurement was unheard of in the past. Despite this, chana prices continued to stay below MSP (Figure 1). Inflation rate, (at wholesale and retail level) too showed slower growth or deceleration in chana prices since April this year (Figure 2).

Figure 2.

Chana outlook for 2022-23

Domestically, chana sowing has begun for the rabi season 2022-23. As on 25 November 2022, chana acreage stands at 6.71 million hectares (about 0.35 per cent higher than last year’s 6.69 million hectares). The sowing will be complete by the end of this month and we will have to wait until December/January to get its complete picture.

As per our ongoing assessments, compared to last year, chana acreage is expected to shrink this year by about 5 to 8 per cent. Acreages are likely to fall in MP, Rajasthan, and UP, primarily driven by two factors: (i) higher and more lucrative opportunities in crops like wheat, spices, and mustard (ii) lower farmer and trader sentiment towards chana due to its low prices, high levels of NAFED stocks (as of 8 November 2022, NAFED has about 2.1 MMTs of chana stocks) and suspension of future trading.

Globally, due to adverse weather events in Pakistan and Australia, their upcoming chana crops are likely to have suffered huge losses, possibly indicating lower global supplies in the coming year. In case of Canada too, despite bumper production of chana, exports are predicted to be lower this year on account of lower domestic stocks. So, are chana prices going to rise in the coming months? We will have to observe closely.

Also read: India’s real food problem isn’t hunger but loss and wastage

Indian chana to bear the brunt in 2023

When the government uses multiple tools to ensure that the price of a crop stays low, it effectively imposes a disproportionate burden of subsidising consumers on farmers. This is referred to as consumer bias in government policies. While lower prices support consumption, they disincentivise farmers from sowing the crop next season.

For traders who take positions in physical markets by buying, storing, and selling large quantities of crops in geographically spread markets, commodity exchanges like NCDEX offer a natural avenue for hedging. By locking prices for future sale, they insulate themselves from price risks. When the government bans futures trading, these traders are left unhedged and unwilling to take large positions and hold stocks. Again, adversely impacting the farmers.

Even if the 2023 chana output is lower, the government has enough NAFED stocks to diffuse any building price pressures. It also has avenues of opening imports. The farmers too have the option of shifting to other, more lucrative crops. Everyone is a winner but the chana crop will be a loser. With traders and farmers moving away from it and imports filling in the gaps, the drive for Atmanirbharta in chana will surely suffer a setback.

Over the years, very strategically, the government has invested in the National Food Security Mission (Pulses) over years. It has offered lucrative MSPs, ensured higher levels of procurement, and facilitated investments in processing and storage. Farmers too have responded positively and production of pulses has soared in the economy. However, by keeping prices low for crops like chana, the government may actually be eroding some of the gains it achieved through its mission.

Also read: World is worried about India banning rice exports, but no threat to food security yet

Going forward

In the run up to elections, it is unlikely that farmers’ price incentives will be prioritised over the objective to keep food inflation low.

But the importance of stability of policies is critical for all players in the value-chain of any crop. It takes years to invest and build a chain, however, two consecutive years of losses will disincentivize many investors in the crop. Delivering transparent prices and efficient markets were two of the few tenets of the withdrawn Farm Laws. By distorting markets with knee-jerk reactions, GOI may be going against the grain of these laws.

We have been writing about the brimming crisis in pulses, particularly in gram.

These pulses are important for India’s nutrition and ensuring its higher production is critical both for the country’s crop diversification plans and its drive for achieving nutritional security. It has been close to two years now that chana prices have been ruling low. The government should revisit its policies, provide stability and predictability to its actions and save the crop before it is too late.

Shweta Saini is an Agricultural Economist and Co-founder and Khatri is Consultant at Arcus Policy Research. Views are personal.

(Edited by Tarannum Khan)