The defence pensions debate in India has become a big policy debate.

When India’s first Chief of Defence Staff (CDS) Bipin Rawat recently drew attention to the issue of “unsustainable” defence pensions, predictably a number of enduring myths propped up to justify the status quo.

We bust five such myths.

Myth 1: The defence pension bill is still manageable; all it needs is tweaking defence expenditures and revenues

This first myth refuses to acknowledge the severity of the problem itself. The rationale is that if we could go on with the current system for so long, we can surely continue to do more or less the same thing for the next decade too, without any significant negative impact on the effectiveness of our armed forces. This is a myth because it fails to take into account the recent increases in the pension bill on account of One Rank One Pension (OROP) disbursements.

Being a defined benefit scheme that resets periodically based on current employee compensation, the Narendra Modi government has committed itself to a perpetually growing liability by agreeing to OROP. Since its implementation, the fiscal implications are already making their mark: in 2015-16, before the OROP was introduced, defence pension expenditure was at ₹54,000 crore. By FY 2020-21, it had more than doubled to ₹1,33,825 crore.

Such a rapidly expanding expenditure faces the imminent risk of becoming unserviceable. Economists Renuka Sane and Ajay Shah say that the implicit pension debt (expressed in terms of Net Present Value of all future pension disbursements) may be nearly 50 per cent of the GDP, a fiscally unsustainable burden. This is likely to rise even further as life expectancies increase. So, doing more of the same is no longer an option.

Also read: Growing defence pensions a problem. But CDS Rawat’s retirement age proposal not the solution

Myth 2: The defence pension bill does not affect the effectiveness of the military instrument

The rationale here is that the rise in defence pensions does not amount to a decrease in defence preparedness; all the government needs to do is make even higher allocations for capital procurement. This is a myth because the rise in the pension bill has been accompanied by an almost equivalent drop in the expenditure on capital expenditure this decade. Laxman Kumar Behera and Vinay Kaushal, researchers at the Institute of Defence & Analysis (IDSA), write:

“…the entire increase in the pension’s share (from 2011-12 to 2020-21) has come at the cost of the capital procurement, which together with Stores has dwindled by 11 percentage points from 36 per cent in 2011-12 to 25 per cent in 2020-21. In other words, the fast rise in the pension expenditure has a significant crowding out effect on stores and modernisation, two major components that determine nation’s war-fighting ability.”

Moreover, it is unlikely that there will be any dramatic rise in the priority accorded to overall defence expenditure in a developing country that has many other competing demands. The implication is clear – the rapidly rising pension bill’s direct casualty is the modernisation of the Indian armed forces.

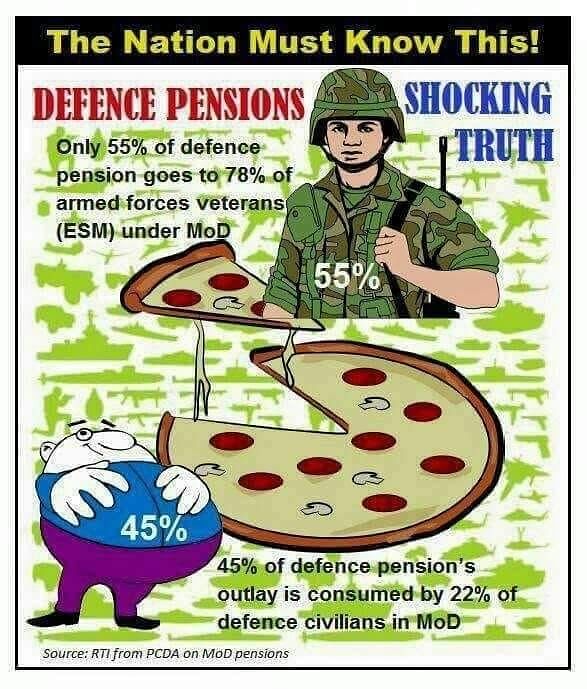

Myth 3: Defence civilians contribute disproportionately to the pension bill rise

A picture doing the rounds in the WhatsApp groups of veterans is that defence civilians account for more than 45 per cent of the total defence pension expenditure. The solution implied is to just reduce the number of defence civilians to reduce the defence expenditure.

This is a myth because based on the last available data from 2016-17, defence civilians’ pensions was only 20 per cent of the total defence pensions expenditure. This is not to say that the number of defence civilians are low. In fact, the Indian military’s ‘tooth-to-tail’ ratio of about one soldier to 1.15 civilians is considered quite high and any proposed change to this ratio again needs to be on the basis of operational requirements. However, even if that’s done, the impact on total defence pension outgo will not be significant. Moreover, unlike the OROP for defence personnel, new defence civilians have now been made a part of the National Pension System (NPS), so the pension expenditure incurred per civilian by the government will go down over the years. Thus, blaming defence civilians alone for the rising pensions bill is both unfair and inaccurate.

Also read: CDS Bipin Rawat on military retirement age at 58: Is greying army a good or dangerous idea?

Myth 4: National Pension System (NPS) for armed forces personnel is a political feasibility

NPS is a “defined contribution” scheme – the employee creates a corpus using their own savings and the pension is paid out of that. Such a mechanism helps reduce government’s own expenditure. Moving incoming defence personnel to the NPS is perhaps a long-term solution. However, the myth is that it is possible to make this shift under the current political circumstances.

In fact, the political feasibility of such a move is extremely low. Not only were defence personnel first left out of the NPS implementation, they were later brought under a new defined contribution scheme called One Rank One Pension (OROP) in 2016. The 2019 manifestos of both the Congress and the BJP claimed credit for OROP implementation. Given this reality, watering down the OROP to reduce pension amounts or replacing it with NPS will face massive resistance due to the endowment effect involved.

Also read: IAF, Navy delaying procurement due to funds crunch. And lesser said the better about Army

Myth 5: Lateral Induction cannot work because of conflicting organisational ethos

Lateral induction of armed forces personnel in other fighting forces within the government has long been proposed as one of the solutions to reduce the defence pension bill. The Standing Committee on Defence (SCOD) as part of its 33rd report to the Lok Sabha also highlighted this solution when it dealt with ex-servicemen issues. But it could not take off because of vehement opposition by the Ministry of Home Affairs. The opposition stems from a deep-seated perception that armed forces personnel are culturally unsuited for internal security duties.

This is a myth because it ignores the fact that a robust training mechanism can mould human capital, and that skills and organisational culture attributes are malleable. A few studies in other countries have even shown that police officers with prior military experience may be better prepared for the stress of police work. Earlier, we proposed a way to operationalise lateral induction in a way that addresses the worst fears of all security agencies. Instead of rejecting lateral movement altogether, the Narendra Modi government should implement the recommendations of the SCOD.

Finally, contemporary national security imperatives beg for measures to alleviate the burgeoning defence pension outflow. Our aim in highlighting these five myths is to bring urgency to resolving this problem. Business as usual is no longer an option for India.

Lt Gen (Dr) Prakash Menon is Director, Strategic Studies Programme, Takshashila Institution, Bangalore. Pranay Kotasthane is Research Fellow at the Takshashila Institution. Views are personal.

It’s only after orop that pensions are ok now.defence budger@0.3%of GDP is minuscule.i agree there is ample scope for cutting flab in armed forces..but so is the case in civilian side too.we need to shift to USA style..no govt employee should be permanent.10 years plus 10 years and another 10

years performance based.95% of govt employees are least productive beyond 50 years.

Keep me updated. Please let me informed what to do further for the said matter.

There are a few more ways of looking at this problem. Aren’t our defence forces far too large in number? Doesn’t that equal to quantity over quality? How about reducing the size of the force both in terms of combatants and the civilians? Why not go for quality and equipment? In modern warfare the role of numbers is far less important than the technology and quality of men.

It is a well articulated article which needs to be taken seriously by our defence planners.I have the following suggestions.

1.The Defence Production Units (HAL,BEL, Avadi and Medak Tank factories, BEML etc should be brought directly under the armed forces.

2.By producing our own weapons, we can reduce imports.

3.The Ministry of Defence should be manned only by military officers and men.There is no need for a defence ministry of ministry of Defence Production run by babus. The Cheif of Defence will be de facto Secretary as also the chiefs of staff.They will report only to Raksha Mantri, not some babu.

4.Military training should be made compulsory . Only officers having served in Siachen , North East or Kashmir should be allowed to sit for IAS/IPS examinations. Retired Defence personnel should get preference in other government departments.

5.Why are we blaming OROP? This facility has been enjoyed by bureaucrats for a long time.

Sir here is small doubt if minister can run their state after 60age also then why should we defence civilian who work like peon,safai,watchmen can’t work after 60age.i am confused why only minister don’t have any age limit to run country.after 60age minister also get retired then they ask pensions.we are surving our country for 30yrs why can’t we get pension.because govt in loose.govt will never be in lose.first civilian get very less salary no Insurance like defence people.if they died by medical illness also they get 25lakhs.if civilian die 15000explain the difference.they r uniform person ok.atleast give pension to secure our family life.

Dear Ms Seema , members of Defence Forces give contribution from their pockets for their pensions,none else pays for it.

One of the worst article I have gone through. Gen have no clue what is he writing. If the fund allocation for the modernization is less , increase it but why blame the pension of a soldiers as a reason ? Fiscal prudence is the answer !!

Govt must bring the financial situation under control and stop the plundering.

Who is to blame for huge NPAs ?

Who is responsible for Banks Collapse ?

If you have no worth while solution, kindly do not attempt. Why unnecessarily you drag the pension of soldier to rescue ? Will you please write that the reverting of pension of Civilians to 3 CPC is the answer ?? 33% .

Tx to these myopic views of these generals .who have secured everything for themselves till date and then they write such articles. A common Citizen like us will take it as gospel truth since they add the Rank of General and we think he must be write. Sorry this is big LIE. Our brothers in Armed Forces will tellu how they are taken for granted. General did not speak about sick Defence Production, outdated PSUs like Vehicle Factories and so on, DRDO like organisationns and many more. Who is stopping to increse some part of Defence Budget for Modernisation only when required, since a large part of this Defence Budget lapses every year and goes back to Government every year. I wish some one sensible really studies thematter go for some good pratical and solution. By the Way Pension is never a problem its just created with hype to penalise our Veterans, otherwise their are thousands of schemes Government money is not utilised properly and lossesare their. Remember a Coubtry which does not take cate of its Soldiers always pay very heavy price…..

Those retired persons gave their youth staying away from family ,staying away from democracy staying away from all the good things life can offer in the flag end they have no clue but to enjoy life however they can so kindly dont generalize. Army/military isnt a democracy please spew your venom elsewhere .just because you gave a phone and internet dont just go on commenting on everything.

Increase retirement age to 58 years across the board

Lateral entry to other forces should be allowed as they r anyday better trained better disciplined

Increase defence budget in capital head

Non productive units should be closed down

Would sure as hell like to question the esteemed general a few issues

1. Do pension of soldiers cost so much??

2. Can a nation not support payment for its soldiers

3. Every year we can have crores of rupees waived off on incentive schemes loan waivers etc but nation doesn’t have money for its soldiers

4. Is it an army of nation or a bloody corporate where we have to either decide better equipment or well being of soldiers??

If the general is so concerned of pension, please forgo your own and then write Articles

Don’t become a buddhejivi after u retire… Have some moral uprightness..

market rate also change since last yr…

The above comment doesnot appear to be very correct. Some retirees are just been able to meet their family requirements. With their pension. . The children of defence services retirees are working overseas and they sponsor their parents trip when they need them for either delivery of child or for a family function. The myth of too much money is not at all true. People who sacrifice their lives in line of duty have to be looked after by any Nation for it’s own survival.

All that we as civilians know is that many retired officers openly say that they get so much money that they don’t know what to do with it. As a result they are found taking various foreign trips to exotic locations and somehow burning the cash. That doesn’t even boost India’s GDP !!