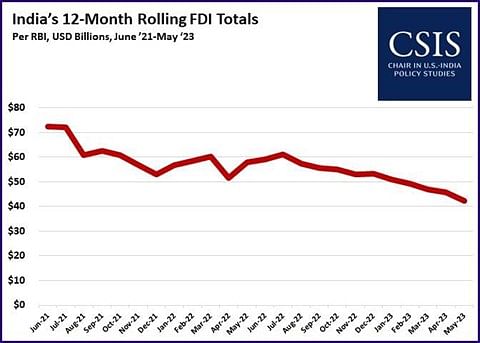

For much of its 9-year run, the Modi government has trumpeted its relative success in attracting higher levels of foreign direct investment. However, FDI has plummeted over the last two years. A few investment announcements from mobile phone suppliers and semiconductor firms do not appear to indicate a larger groundswell of investment. To renew investor confidence, the Indian government must take meaningful steps immediately rather than postponing action until after next year’s national election. The quickening pace of evolving supply chain requires fast action.

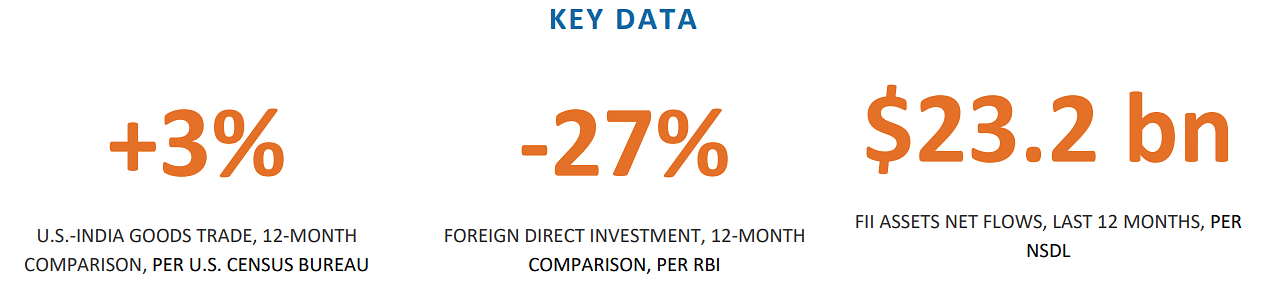

In the seven years leading up to Prime Minister Modi’s election in May 2014, India averaged $27b in foreign direct investment per year (looking specifically at new equity and acquisitions, not reinvested earnings and other forms of capital). In the nine fiscal years since, India has averaged over $47b in annual FDI, a 74 per cent jump.

There are many reasons for this increase, but a few stand out.

- Relaxed FDI Restrictions: The government moved fast to ease foreign investment restrictions, with twenty-seven sectoral relaxations in its first two years in office.

- Ending New “Retrospective Tax” Cases: The government put new parameters around using the “retrospective taxation” principle adopted at the end of the Congress-led United Progressive Alliance (UPA) regime.

- Economic Liberalization: The Modi government made momentous decisions in its first term to roll out major economic reforms. Notable reforms, as we tracked through our India Reforms Scorecard, include the Goods and Services Tax (GST), the Insolvency and Bankruptcy Code, abolishing the “small scale industries” reservation list in manufacturing, and key sectoral reforms like the Hydrocarbon Exploration and Licensing Policy (HELP). The World Bank’s erstwhile “Doing Business” index became a beacon for specific reforms.

- Courting Investors: Prime Minister Modi used his foreign trips far more aggressively than his predecessors to “sell” the India story. This level of direct access to key decision-makers provides confidence to investors that they will find government support if and when investments hit roadblocks. The re-constitution and invigoration of Invest India was also important and added much-needed energy and professionalism in India’s approach to courting potential investors.

- Competitive-Cooperative Federalism: Much of India’s investment environment is de facto controlled by state governments. Through initiatives like the “Business Reforms Action Plan (BRAP), which ranked states’ business environments, the Union government pushed states for transparency and accountability. The dissolution of the Planning Commission and its replacement with the NITI Aayog created a much-needed enabling ecosystem to promote competitive-cooperative federalism.

However, as I noted in my June 2023 U.S.-India Insight, the pace of reforms has noticeably slowed. This has happened despite government measures such as Production Linked Incentives, aimed at increasing investments. However, it has been nearly eighteen months since the government made any relaxations to foreign investment regulations. The parliament has not been able to function normally due to political friction among parties, so pending legislative reforms in areas like energy and ports administration are stuck. With several key state elections later this year, and a national election just 10 months away, there is a danger of postponing policy decisions for a year.

These are not “normal times”. As countries focus on decoupling from China, and de-risking their supply chains, other countries such as Vietnam, and Indonesia are actively courting investment. Major investors are also looking for new markets as they diversify their global manufacturing footprint.

Also Read: What FDI cheerleaders won’t tell you—UP has higher wage rates than Karnataka, Maharashtra

To remain ahead of the pack, India cannot delay taking big steps.

- Improve the BRAP. The BRAP, outlined above, has only been prepared intermittently. Since it is based on states’ self-reporting, there are important questions about the credibility of The Department for Promotion of Industry and Internal Trade (DPIIT) must commit to making this an annual process and build stronger mechanisms to ensure the veracity of information supplied by states.

- Shift FDI Caps to a Negative List. Dozens of sectors in India are still governed by FDI restrictions. Some of these are necessary due to security and social But other sectors should be freed immediately. A negative list will provide important assurances to investors that their investments will not subsequently be upended through future sectoral “micro-definitions” emerging, as has happened in the past with stock exchanges, white goods manufacturing, and non-inventory e-commerce.

- Remove Sub-Regulations Applying Only to Foreign Firms. Several sectors have regulations that make for an uneven playing field for foreign firms. The list includes insurance, retail, marketplace e-commerce, and more. India’s recent move to gradually open the legal services space to foreign firms is a welcome sign.

- Conduct a Top-Down Review of Pending Regulations for Business Impact. The government should consider a time-bound review of pending regulations to assess the impact on Clearly, regulations must balance a range of stakeholders including consumers, companies, and civil society. Key reforms like the Digital Personal Data Protection Bill could have a tremendous impact on India’s ability to attract and keep foreign investors. Any legislative and regulatory changes contemplated between now and the national election should be viewed through this lens.

Calling for bold reforms ahead of an election would appear self-indulgent and ignorant of political realities. But as we have seen with recent steps like reducing foreign investment barriers in strategic sectors like defense and telecommunications—the political blowback from times past has diminished dramatically over time. Much can be done to reinvigorate interest in foreign investment and perhaps land some notable investments in the coming year. The danger of waiting is unusually cogent now.

The author is the Senior Adviser and Chair in U.S.-India Policy Studies. Views are personal.

This article was originally published on CSIS website with the title — An Agenda for India to Re-Ignite Interest among Foreign Investors.