New Delhi: Three things of significance have happened in India’s banking and finance sector.

Finance Minister Nirmala Sitharaman announced that 21 nationalised banks would merge to become 12, something of a rescue operation for Yes Bank was reportedly in the works, and a new study by Professor Amartya Lahiri of the University of British Columbia found that while deposits since demonetisation went up, lending by banks did not.

If banks are not able to lend, the banking business comes to a standstill. The big problem right now in the Indian banking system is that there is a loss of confidence on the part of both lender and borrower.

How government banks destroy value

Government banks are suffering more because they have the sword of Central Bureau of Investigation (CBI) and other anti-corruption agencies hanging over their heads. This in turn makes them more diffident about lending, leading to value erosion and wealth destruction.

A good way to establish this is to look at market capitalisations of both private and government banks. India’s largest (and oldest) public sector bank, the State Bank of India (SBI), has a loan book value of Rs 23 lakh crore and a market cap of Rs 2.57 lakh crore.

HDFC Bank, by comparison, has a market cap of Rs 6.31 lakh crore. This number alone has the values of all the PSU banks put together, with Rs 2 lakh crore to spare.

Even though it is much younger than SBI, Kotak Mahindra Bank has a market cap of Rs 3.17 lakh crore. ICICI Bank, despite the crises it has faced, is capped at Rs 3.27 lakh crore.

This is the kind of value loss that governments have caused in their own banks.

Also read: India’s first credit card IPO set for success despite market turmoil caused by coronavirus

The big bank merger

Vijaya Bank and Dena Bank had earlier been merged with the Bank of Baroda, which are together valued at Rs 37,000 crore.

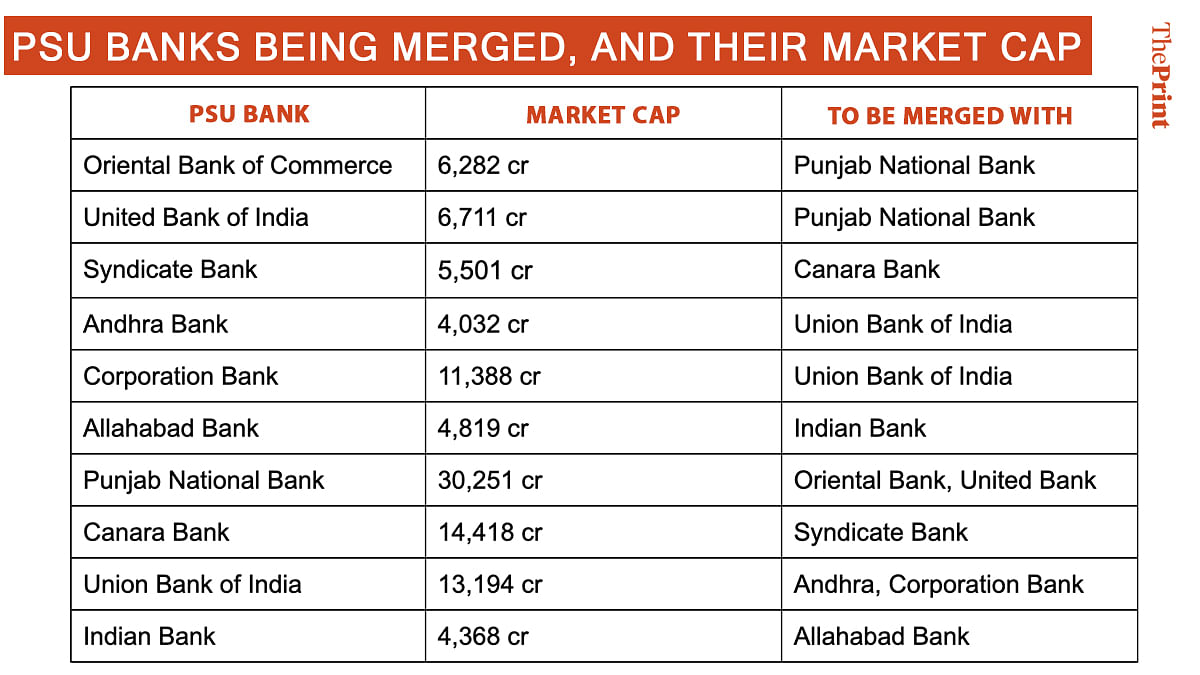

Now, United Bank of India and Oriental Bank of Commerce will be merged with Punjab National Bank, Syndicate Bank will be merged with Canara Bank, Allahabad Bank will be amalgamated with Indian Bank, and Andhra Bank and Corporation Bank will be consolidated with Union Bank of India.

Mergers will work if costs are cut down. Even better would be freeing them from government regulations and controls on lending. As long as they fear regulation, they will not lend.

The case for governments to get out of banking

Bandhan Bank, which got a licence only three to four years back, has already grown to a market cap of Rs 68,353 crore. The value of this bank is more than all the banks that are being merged on 1 April, barring Punjab National Bank.

Axis Bank, which was in a crisis till a few years ago, has come back with a market cap of Rs 1.39 lakh crore — more than all the public banks combined, including PNB but excluding SBI.

AU Small Finance Bank, which was set up in 2017, is valued at Rs 35,715 crore — this is more than Bank of Baroda even after its merger.

This only illustrates further how governments should eject themselves from this business. Twelve badly run banks are no better than 21 badly run banks. The government must free them up.

Amartya Lahiri’s study shows that as of September 2019, deposits have grown to Rs 140 lakh crore, while credit is only about Rs 95 lakh crore — this means Rs 46 lakh crore is somewhere in the banking system. What banks cannot lend profitably will need to be put in government bonds or the RBI, which is usually less than what banks are paying depositors. In this way, banks will continue to make losses.

Also read: Seizing Yes Bank could lead to a contagion, analysts say

The way out

The first thing that has to happen is an improvement in the business environment. For this, the government has to accept that it is a value destroyer, and should not be running these banks. It similarly needs to realise that it cannot run businesses, and that the promise of minimum government has to be kept in running business and industry.

It must give up the idea that public banks are more virtuous than private ones in terms of lending to the needy, because everyone is governed by the same regulations in terms of agricultural credit, etc.

Even when in trouble, private sector banks are not irretrievable.

What can the government do with PSU banks? It can make them autonomous and board-run. It should also remove the Comptroller and Auditor General, CBI and other agencies from their watch, and let perhaps one agency be an auditor. Unless there is theft, the lending process needn’t be criminalised.

Finally, unless the government brings down administered rates, it will be difficult to bring down interest rates.

Also read: To use cryptocurrency or not is no more a question in India. RBI must now fix payment market

Though true, but all banks seldom cares for recovery of big loans, as compared to when they act in small loans. Bcos they had connived/compromised in such loans. In fact big sharks are looting public money. Reputation of all banks compromised. Only common man suffers

The very first thing to notice in the post is that the writer is biased. He doesn’t know anything about banking sector like how it works. I can say this because there is no mention of CRR and SLR, he just knows two words, Lending and Deposits. If Govt gives us

(I am banker) freedom to do our duties then banks can grow. But for the sake of vote bank, they pressurise PSB to implement Govt Schemes which are not fruitful to public. They decide our targets. If a PSB wants to recover loan dues, then FM gets angry and says those things which she doesn’t understand very well. She hardly understands Economy. One day PSB will be history. The last thing, if we become private sector banks, then we will recover loans from public using goons, like private sector banks. Then there would be only profits and market capitalisation will be more than a private sector bank…

Such a biased article. Privatisation of everything is not a magic wand that will change everything. Banks not lending has more to do with fear of NPA’s rather than agencies. The biggest question is Can we move to a solution that solves NPA problem at its root that is not lending but making borrower capable of returning back?

Exactly, brother. The writer of the article is extremely capitalism friendly. If the government exits the banking sector, private players will drive up interest rates. This is such a bullshit article lol

Bro we have private and public sector banks but it seems only private sector banks are doing good as compare to PSBs. So what he says is right. The way RBI has control on private and PSBs right now the same can be continued even after the privatisation of all PSBs.

The credit deposit ratio of Banks with the accretion of 140 lakh crores deposit is sub optimal.

SBI has a credit deposit ratio is stated to be about 85%

There is emphasis on mass banking without strengthening the existing system of bank management,

The non collection of NPA have eroded capital base and and low credit deposit ratio has cut into

the bank’s profitability

The three Cs ,you are right about them viz,CAG,CBI and CBC have taken the initiative out of bank managers to run about and canvas business.

Technology can only be a tool if other basic things in the system are ok.,They cannot replace them.

RBI ,now with Govt, should highlight the need for financial prudence and discipline in dealing

matters affecting the functioning of Banks.

Out of the 140 lakh crore deposits, about 31 lakh crore would be locked up in CRR and SLR, so the entire 46 lakh crore is not ‘somewhere in the banking system’, may be 15 lakh crore is.

In case of Yes Bank, the value destroyer is a private sector bank and the bank that comes to rescue is a public sector bank. So, why blame public sector banking? Whenever a bank goes under due to bad governance or bad lending , everybody expects government to come forward to rescue, be it a cooperative, private or public sector bank. Depositors in India presume implied sovereign guarantee to safeguard their interests. Should we forego this presumption and leave the fate of depositors to their own destiny? Government coming out of the banking industry is not an easy exercise, as it might appear on paper. Would the private sector in India handle the banking industry with prudence? The experience pertaining to Yes Bank and to some extent that of ICICI Bank and Axis Bank doesn’t reflect so. Are we prepared to accept spate of bank failures if privatization takes place?

I have long advocated privatisation of all the PSBs, possibly barring the SBI group. However, when one sees what is happening in and to the private banks, that old certitude breaks down.

Banks going kaput are a part & parcel of the capitalist system, in 2008 many blue Chip financial Organizations were rescued by the US FED in the Mecca of capitalism. Boom & Bust is like being born & dying , everyone has to endure that ,only God & religion are exempt.