If Numetal decides to pay for Essar’s defaults, bidding to resolve the high-profile bankruptcy will be one where the firm isn’t even bankrupt anymore.

The jewel gathering dust in India’s bankruptcy court can have a suitor after all. The two top bidders may stay in the race for Essar Steel India Ltd.’s 10 million-tons-a-year plant, the country’s top court ruled on Thursday, provided they first make banks whole.

There’s the catch. For ArcelorMittal, the payment required is for two unconnected defaults. The world’s biggest steel producer and Lakshmi Mittal, its billionaire controlling shareholder, sold their interest in Uttam Galva Steels Ltd. and KSS Petron Pvt. to become eligible to acquire Essar. That ploy didn’t work. However, a 70 billion rupee ($950 million) deposit in an escrow account, which ArcelorMittal opened anticipating disqualification, should be enough to end its legal troubles.

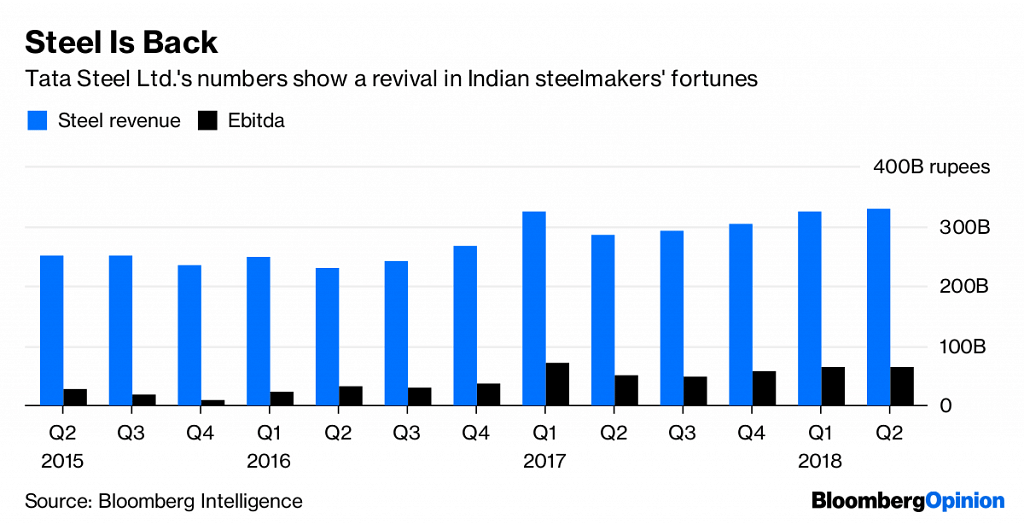

The challenge is knottier for the other bidder. Numetal Ltd., a consortium backed by Russia’s VTB Capital, was seeking to become eligible in the second round of bidding by disassociating itself from a trust connected to the Essar Group’s controlling Ruia family. The tycoons, who sold their oil refinery in 2016 to deleverage the group, are loath to also lose control of their steel business when prospects for the alloy are looking a lot better than they did two years ago.

But as I wrote last month, ArcelorMittal contended that the appellate authority of India’s insolvency tribunal wasn’t applying the eligibility norms fairly. The Supreme Court seems to agree. The Ruias are ruled out of bidding for Essar without first paying the 508 billion rupees the company owes creditors.

Just severing its association with the founders doesn’t put Numetal in the clear. It’ll have to pony up the cash instead. It’s unclear whether anybody would want to spend that kind of money without any guarantee of winning. Mittal’s revised offer for Essar itself is 420 billion rupees.

What if Numetal does decide to pay to play? Then the long-delayed process will take a more curious turn. In that case, the third round of bidding to resolve India’s most high-profile bankruptcy will be one where the company isn’t even bankrupt anymore.– Bloomberg