The Narendra Modi government’s move to ban wheat export was followed by several other measures to conserve stocks, which were projected to deplete in 2022-23 on account of lower procurement in the central pool, continuation of Pradhan Mantri Garib Kalyan Anna Yojana up to September, and the possibility 5 million tonnes being exported. Allocation of wheat was substituted by rice, even in predominantly wheat-consuming states. But how long will India’s rice stocks last? We examine its availability in 2022-23 and beyond.

Rice stocks have increased

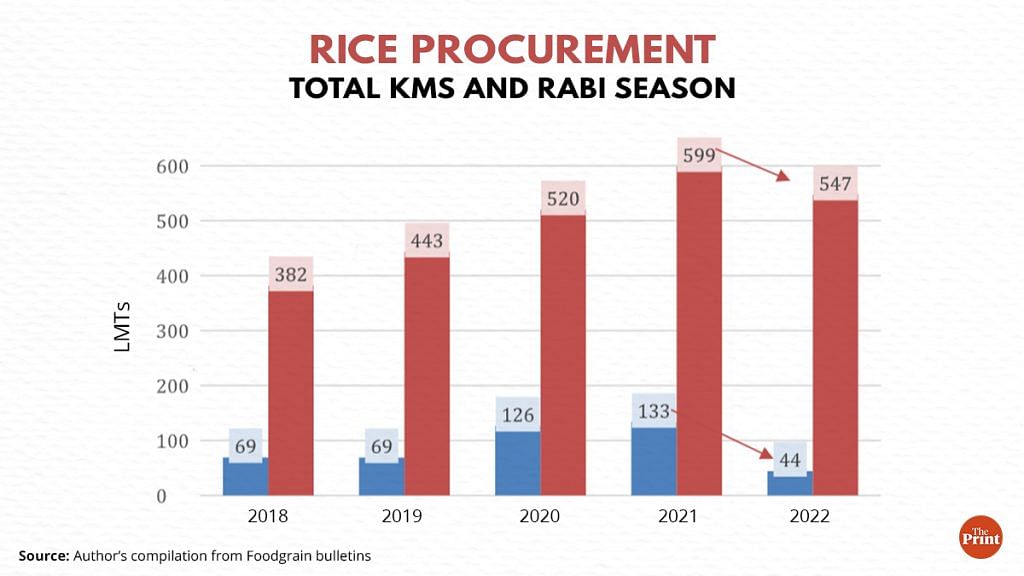

Procurement of rice for the central pool has increased over the last four years – from 382 lakh tonnes in Kharif Marketing Season or KMS (October-September) 2017-18 to 599 lakh tonnes in 2020-21. In the current KMS, about 503 lakh tonnes of rice was procured up to March 2022. This is higher by about 37 lakh tonnes as compared to last year’s rice procurement of 465 lakh tonnes up to March 2021.

In October 2015, the Modi government abolished the collection of levies from rice mills because there were apprehensions that the rice millers do not pay Minimum Support Price (MSP) to farmers. Levy was a system through which millers procured paddy from farmers. They were obliged to give up to 50 per cent of rice milled by them to government agencies for the Public Distribution System.

Andhra Pradesh and Telangana made good use of this change in policy and put in place an effective system of paddy procurement directly from farmers. They geared up their infrastructure also. Earlier, these two states procured rice largely by collecting the levy of 50 per cent on the rice milled by them. Andhra Pradesh increased its procurement from 40 lakh tonnes in 2017-18 to 57 lakh tonnes in 2020-21.

Telangana provided water to farmers through the Kaleshwaram Lift Irrigation Scheme (KLIS) and affiliated projects. This encouraged farmers to take up paddy cultivation on a large scale, which resulted in substantial increase in the area under paddy from 52 lakh hectares to 61 lakh hectares. Free electricity for agriculture also incentivised farmers to go cultivate rice. As a result, rice procurement in Telangana increased from 36 lakh tonnes in 2017-18 to 95 lakh tonnes in 2020-21.

Procurement of rice from the Rabi crop (April to October) has also picked up substantially after the Modi government increased the MSP of paddy by Rs 200 per quintal (12.9 percent increase for common paddy and 11.3 percent for Grade A paddy) in 2018-19. This decision was taken to fulfil the budget announcement of that year – fix MSP of all crops at 50 per cent higher than the cost of cultivation.

From about 69 lakh tonnes in KMS 2017-18 and 2018-19, the procurement of Rabi crop of paddy increased to 126 lakh tonnes in 2019-20 and 133 lakh tonnes in 2020-21.

The highest increase in procurement was in Telangana where it rose from 24 lakh tonnes in KMS 2017-18 to 62 lakh tonnes in KMS 2020-21. The question is whether Rabi rice procurement will continue to be as high this year as well.

Also Read: Cotton, other crops shouldn’t meet fate of wheat. Govt needs an empowered group

Is the rice enough for welfare schemes?

Early indications of Rabi rice procurement in April and May 2022 show that the pace of procurement of rice in Rabi is slower than in the previous three years.

This year, the procurement rice in Rabi is about 44 lakh tonnes, down from 66 lakh tonnes in 2020-21 and 80 lakh tonnes in 2019-20 in April and May. It is highly unlikely that the total procurement of Rabi rice will reach the level of the 135 lakh tonnes achieved in 2020-21. One reason is the advice of the Telangana government to reduce the cultivation of paddy. The second reason is the Food Corporation of India (FCI)’s decision to restrict procurement of boiled rice whose demand under the PDS is much lower than that of raw rice. And the third reason is possibly the unprecedentedly high levels of actual and potential exports of non-basmati rice from India.

In the current KMS, due to the highest ever procurement of 503 lakh tonnes rice from the Kharif crop (October to March), it seems that the procurement in the entire KMS this year may still reach 560-580 lakh tonnes. This should give assurance to the government that it can still meet its current requirement of National Food Security Act (NFSA) and PMGKAY (up to September).

In FY 2022-23, the allocation of rice and wheat for NFSA and other welfare schemes together is 575.5 lakh tonnes and 250 lakh tonnes respectively. This includes the allocation of 185 lakh tonnes of rice and 54 lakh tonnes of wheat under PMGKAY. So, rice procurement will be just about enough to meet the allocation.

Due to lower wheat procurement, the PMGKAY is not likely to be extended beyond September 2022. So, next year, the government will be in a more comfortable position to meet the requirement of food grains for its schemes. It is however assumed that there will be no natural calamity warranting extra allocations like PMGKAY.

Also Read: With MSP procurement for first time, ‘tricky’ moong spells good gains in Punjab mandis

Should we use rice stock for ethanol?

As of 8 July 2022, the area sown under paddy in the kharif season is about 23 lakh hectares less than last year. Then there’s the spectre of deficient rainfall in some regions.

As of 12 July 2022, Odisha and Chhattisgarh have made up the deficiency in rainfall due to good rains in the last ten days. The rainfall deficiency in Uttar Pradesh is about 61 per cent. Being a large producer of paddy, UP’s production will depend on well-distributed rainfall. High cost of diesel may also act as a disincentive to paddy cultivation. Paddy sowing is lagging in Chhattisgarh, Madhya Pradesh, Odisha and Punjab. In unirrigated areas, the farmers choose other crops if rains continue to be deficient in late July too. The crop in several areas of UP is already stressed. Total area under paddy is about 23 lakh hectares less than last year.

Even in this uncertain environment of lower area under rice, allocation to distilleries for ethanol continues. In Ethanol Supply Year (ESY) 2020-21 (December to November), the government allotted 81,044 tonnes of rice from FCI’s stocks that met the quality norms of Food Safety and Standard Authority of India (FSSAI).In ESY 2021-22, the allocation of rice for ethanol is 12.92 lakh tonnes against which 3.79 lakh tonnes has already been lifted from the FCI. The distilleries are getting rice from FCI at Rs 20 per kg. The economic cost of rice is Rs 42.93 per kg. Manufacture of ethanol from highly subsidised rice has become so attractive that by March 2022, 114 grain based distilleries had been set up with a capacity to manufacture 270 crore litres of ethanol. In the future also, they are likely to demand rice at such cheap rates.

If monsoon rains are erratic and unevenly distributed, the government may not find it easy to continue the allocation of rice for ethanol from FCI’s stocks.

The Modi government will do well to show prudence in its management of rice stocks because no one can predict the impact of climate change. Using food grains for ethanol may be an undesirable policy in the long run.

Husain, a former Agriculture Secretary, is co-promoter of Arcus Policy Research. Views are personal.