The high tariffs and related uncertainty threaten to dent the US and global growth outlook, stoke inflation concerns and erode confidence in dollar and dollar-backed assets. In the US, the leading indicators of consumer confidence and inflation are already flashing warning signals. The recent depreciation of the dollar could amplify the tariff-induced rise in prices.

In India, weak foreign directment investment flows, coupled with volatile portfolio investments, could keep the financial account under stress. The merchandise export outlook is clouded by tariff-related uncertainties, even as the 90-day halt on the 26 percent tariff is a relief. Downside risks to growth are rising with a challenging external environment and sluggish domestic consumption.

US: Sentiments tumble, inflation expectations surge

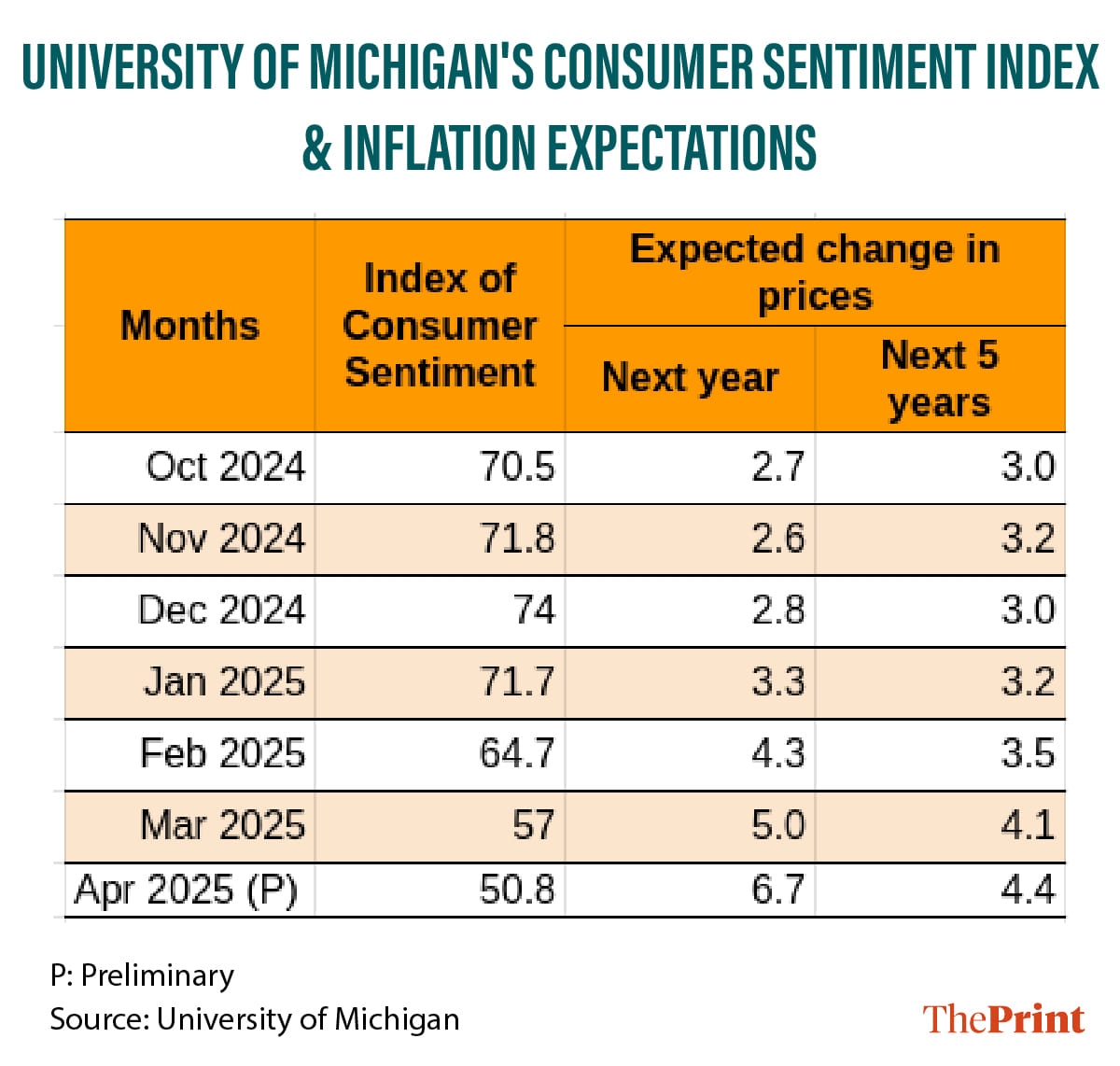

Consumer sentiments tumbled in April as inflation worries surged. According to the University of Michigan’s survey, consumer sentiment fell to 50.8 in April, down from 57 in March. The survey respondents’ expectation on inflation a year from now jumped to 6.7 percent, up from 5 percent in March. This is the highest reading since November 1981.

Sentiment decline is visible across all types of consumers. There are reports that the country’s biggest consumer spenders—young women—have scaled back their spending.

The US stocks have slid on Trump’s plan to impose sweeping tariffs on trading partners, fuelling concerns about economic slowdown and intensification of inflationary pressures. Markets rebounded sharply after the Trump administration announced a 90-day pause on tariff, but have retreated since.

Dollar & dollar-backed assets as safe havens

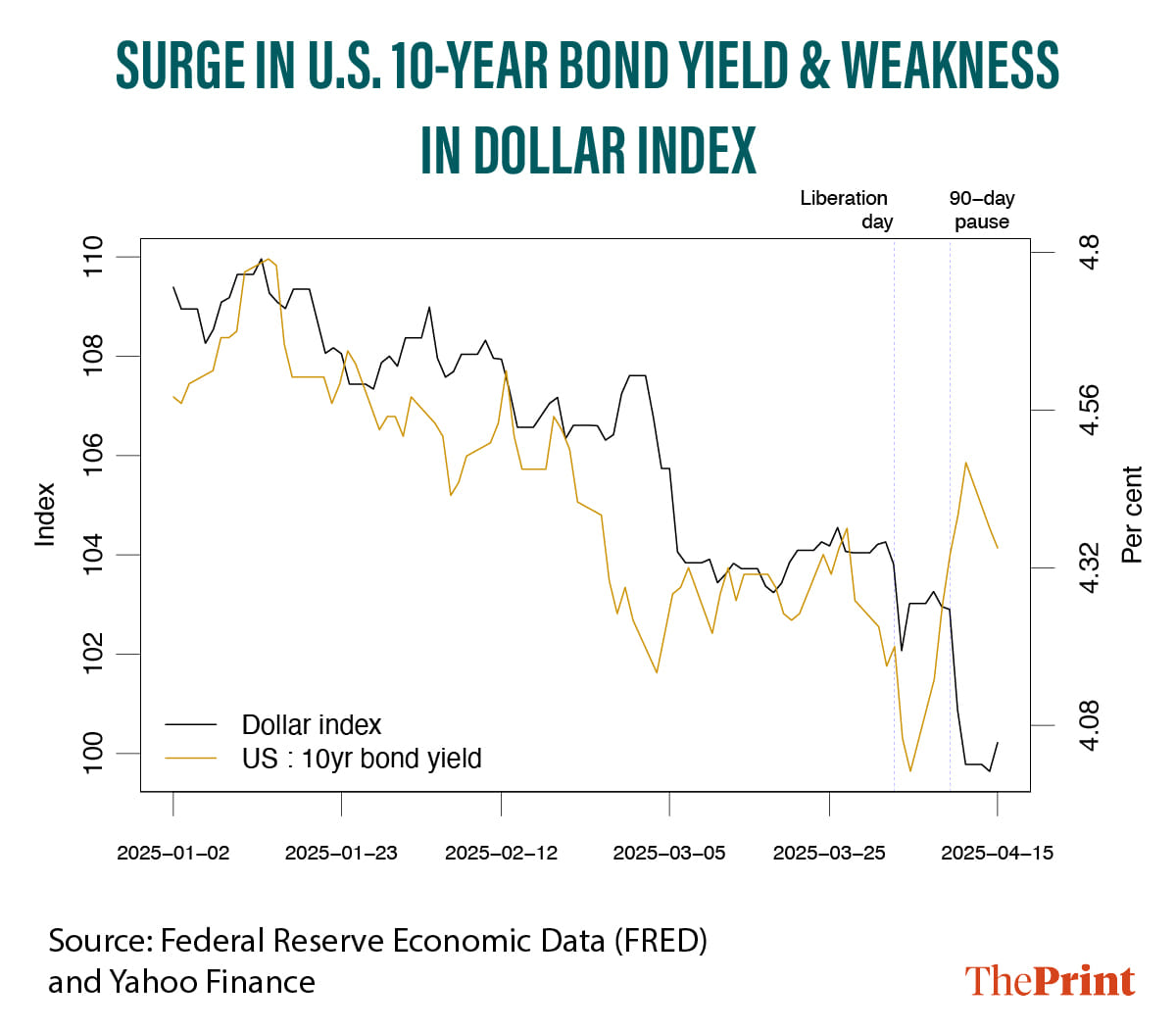

Typically, during market corrections, the US treasury appreciates, as does the US dollar because of their safe haven status. When the global economy shows worrying signs, investors flock to the safety of the dollar and treasury. This pushes up their prices and lowers their yields.

For several days during the current episode of market correction, the reverse has happened. In particular, between the announcements of “Liberation day” tariffs and the 90-day pause, the yield on the US 10 year bond surged from 4.2 percent to 4.5 percent. The 30 year bond jumped to 4.8 percent on 9 April from 4.5 percent on 2 April. The dollar depreciated by 1.5 percent during this period.

The aggressive nature and unpredictability of the tariffs have led investors to question the reliability of US treasuries as a safe haven. The unwinding of basis trade by hedge funds reinforced the downward price movements of US treasuries.

A deeper, more nuanced explanation for the spike in bond yields is that there is more structural shift going on with holders of treasuries seeking an alternative to the dollar. This has serious ramifications for the US. A sustained rise in bond yields owing to diminished demand would increase the cost of financing the US government debt. It would also raise the cost of home loans, auto loans and credit card spends for American households, and reinforce reduced consumer spending.

US: Recession fears mounting

The latest reading of the Federal Reserve Bank of Atlanta’s estimate of GDP nowcast suggests a contraction of 2.2 percent in the January-March quarter. This is a sharp slide from the four percent growth expected for this quarter in early February.

To be sure, not all estimates of nowcast point to a contraction. From a robust outlook at the beginning of the year, nearly all forecasters now have a bleak outlook of the economy in 2025, with the odds of recession rising significantly in the year.

Also Read: Credit growth likely to moderate as banks focus on liquidity. Pivot from loans to deposits likely

Impact on India’s Balance of Payments

While India is considered a domestically driven economy, given its rising goods and services exports, its sensitivity to US and global growth slowdown has increased.

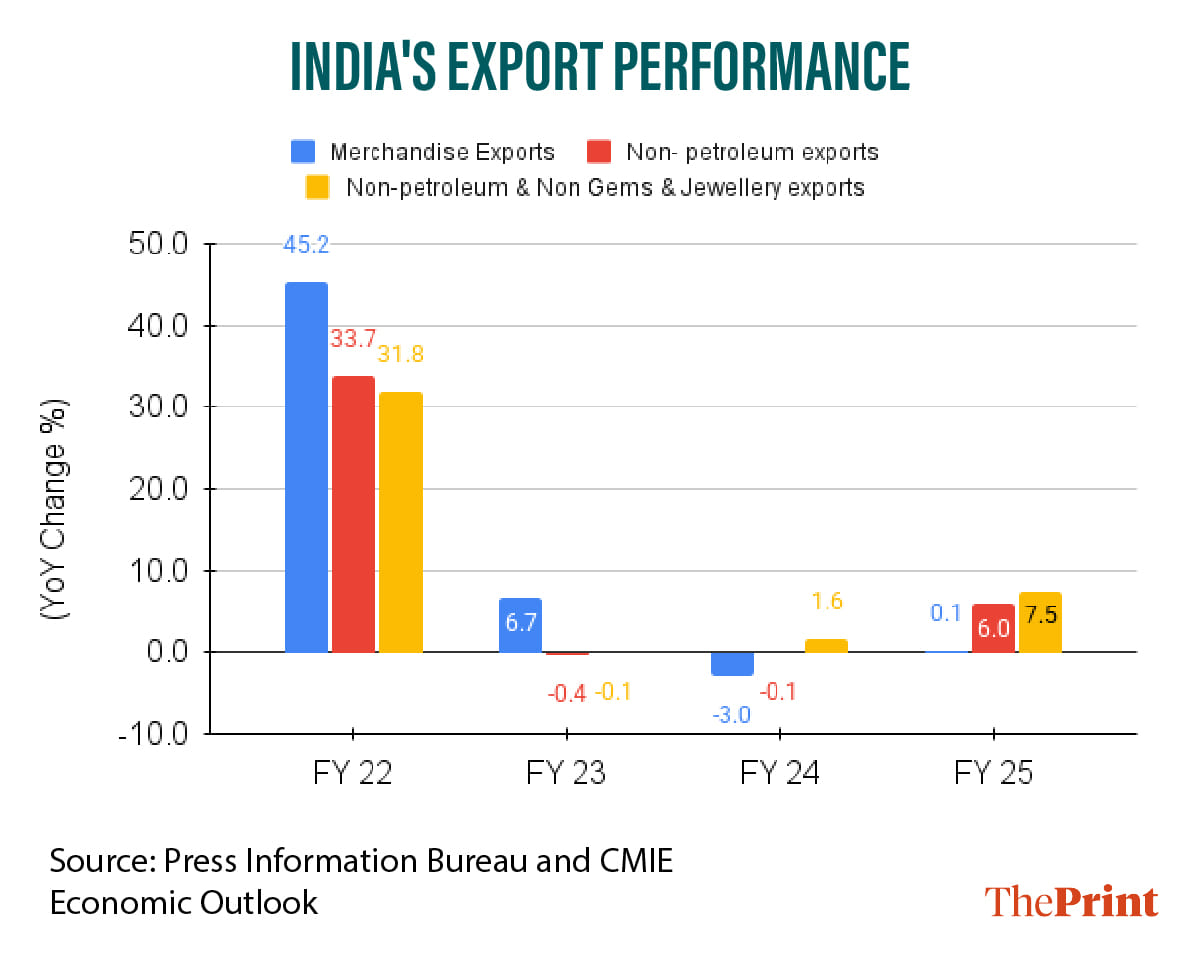

The trade data for FY25 shows that merchandise exports growth was flat at 0.08 percent, while services exports posted a strong growth of 12.3 percent. The slump in merchandise exports was primarily owing to subdued oil exports.

Netting out oil exports, non-oil exports grew by six percent, and after excluding gems and jewellery exports, the growth was a reasonable 7.5 percent. While merchandise exports are likely to be hit by tariffs, services exports would have to do the heavy lifting this year.

Early data shows some evidence of weakness in the services sector. The HSBC Services PMI for March shows that new orders from abroad rose at the softest pace in 15 months. The IT and software services sector is a key contributor to our services exports, accounting for approximately half of the total services exports.

Any slowdown in this sector could impact services export performance and, in turn, put additional pressure on the Balance of Payments. Salaries, wages and IT/services job index are reporting muted growth. Continued pressure on growth in the US, UK and Europe is likely to keep the IT sector growth range bound.

A trade deal is likely to lower down the effective tariff on Indian goods and cushion the hit to goods exports, but for this, India will have to lower its trade surplus with the US.

In the last financial year, India’s imports from China reached an all-time high of USD 113.45 billion. Imports are likely to rise further due to the escalation of tariff war between the US and China. As the US and China are effectively decoupled, there are concerns due to the possible surge in imports of US farm produce and factory goods from China.

Exporters from other countries facing higher costs could also divert their products to India, fuelling import surges. Volatility in markets and foreign portfolio flows are likely to keep the financial account in stress.

Disinflation in food prices & room for rate cuts

Driven by decline in prices of vegetable and protein-rich items, retail inflation declined to 3.34 percent in March.

Benign commodity prices and expectation of a good monsoon bodes well for food inflation outlook this year. Inflation is likely to remain aligned to the four percent target this year, giving room for an accommodative monetary policy this year.

Calibrated reduction in tariffs & expediting trade agreements

The unpredictability in trade policy is likely to continue. What are India’s options?

India needs to carry forward the reduction of tariffs introduced in the last two budgets to expedite the trade agreement with the US, and deepen trade ties with other countries. The reduction should focus on labour-intensive sectors, where India has a window of opportunity due to lower relative tariffs than its key competitors.

There should be a push towards diversification of trading partners to shield against the inherent unpredictability in US trade policy.

Radhika Pandey is associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Indian markets, rupee have recovered for now. The future trajectory depends on a mix of factors