The keenly awaited event in India’s bond market kicked off as India’s government bonds were officially added to J.P. Morgan’s Government Bond Index-Emerging Markets (GBI-EM) on 28 June. Starting with a one percent weightage in the index, this will increase by one percentage point every month over 10 months. By March 2025, Indian bonds will have a weightage of 10 percent in the bond index. The inclusion is likely to bring USD 20-22 billion of inflows in the Indian bond market.

The inclusion puts Indian bonds on the radar of foreign investors and could propel a diversified ownership base of government bonds, and potentially lower costs of borrowing. However, the inclusion will subject Indian bonds to heightened volatility, owing to shifts in global economic policies, sentiments and geopolitical disruptions, influencing bond prices and yields. At the same time, there will be expectations on fiscal transparency and accountability.

Despite the government bond market valued at USD 1.2 trillion, Indian bonds were previously not added to any major global or emerging market index due to complex norms governing foreign ownership of government bonds. Foreign investments in government bonds are subject to quantitative limits.

According to the latest Reserve Bank of India notification, foreign investment in government bonds is limited to six percent of the outstanding stock. A major milestone in this regard was the announcement of the Fully Accessible Route (FAR), by which foreign investors gained unlimited access to a select group of government securities. A subset of these securities (23 FAR securities), i.e., those that have at least 2.5 years of residual maturity, and have a minimum outstanding amount above USD 1 billion, are eligible to be included in the J.P. Morgan index.

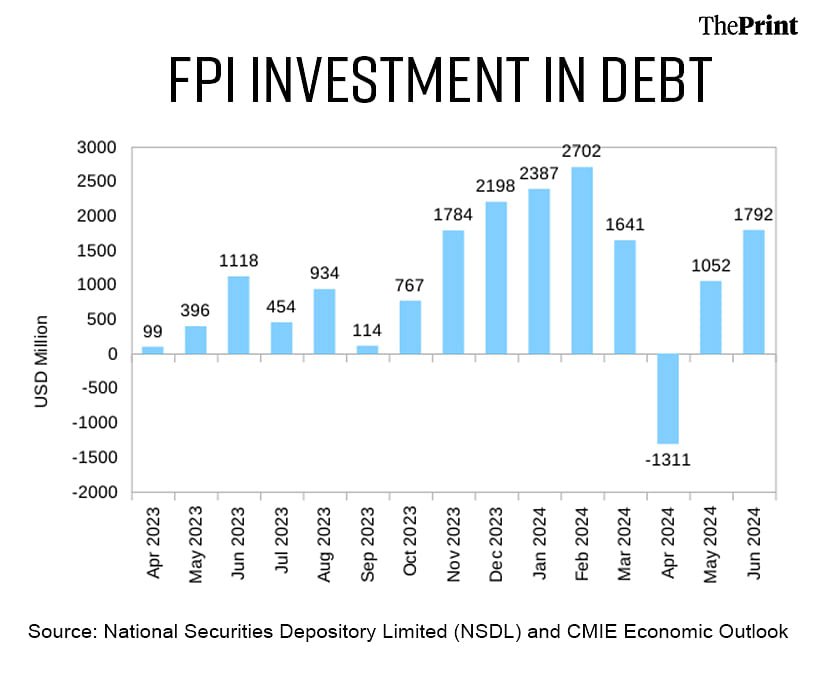

FPI investment in government debt

The inclusion of Indian bonds in the index has been a sentiment booster. Since the announcement in September 2023, there has been a gradual build-up of holdings of government securities by foreign portfolio investors. FPIs have been net buyers of Indian debt in all months except April. Since the inclusion on 28 June, FPIs have been net buyers on most days till 10 July.

Particularly, bonds in the FAR category saw inflows of almost USD 10 billion between 1 September, 2023 to 1 July, 2024. For a comparative perspective, the nine months preceding the announcement of inclusion saw foreign inflows to the tune of only USD 3.5 billion. Of the 23 FAR bonds, 17 saw an increase in the share of foreign investors on 1 July, 2024, compared to 1 September, 2023.

Implications of bond inclusion

The government’s quarterly report on public debt management shows that banks, RBI, insurance companies and provident funds are the major players in this market, holding more than 80 percent of the outstanding bonds. The share of foreign portfolio investors (FPIs), on the other hand, has been hovering around two percent.

Post inclusion, the share of FPIs in government bonds is expected to inch up to around three-four percent. Greater foreign participation will relieve pressure on banks and free up lendable resources at a time when banks are scrambling for deposits to support credit demand.

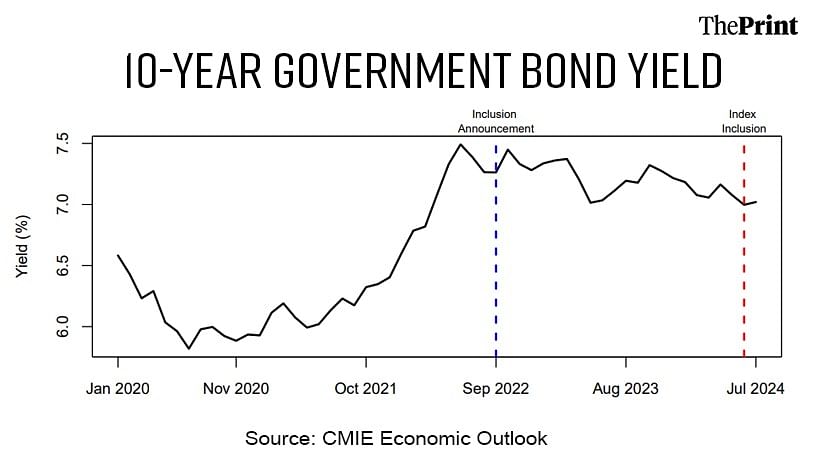

Greater demand for government bonds will keep a cap on government bond yields and cost of borrowing. Since government bond yields act as a benchmark for corporate bonds, there is expectation of lower costs for corporates as well. Since the announcement of bond inclusion in September last year, the yield on the 10-year bond has moderated.

Also Read: Highly vulnerable to extreme climate, crucial sectors in India need well-crafted green strategies

Focus on exchange rate & liquidity management

At the same time, bond inclusion will bring RBI’s forex and liquidity management into focus. A jump in dollar inflows could exert an appreciation pressure on the rupee. One option could be to allow the rupee to appreciate. However, it is likely that RBI will absorb the dollar inflows to minimise the impact on the rupee-dollar rate.

Absorption of foreign flows will lead to increase in domestic liquidity, that would in turn require RBI to tweak its liquidity framework. RBI could use the Standing Deposit Facility, a collateral-free instrument to mop up the excess liquidity.

Alternatively, it could ask the government to issue Market Stabilisation Bonds (MSBs) to sterilise foreign exchange interventions. Interest payments on issuance of MSBs would have to be made by the government. The fiscal cost of continued reliance on MSBs would be non-trivial.

Other instruments in RBI’s toolkit, such as Open Market Operations and long-term reverse repo auctions, could also be used. Any move to manage liquidity stemming from exchange rate intervention will have to be carefully considered such that it does not conflict with RBI’s inflation management.

Greater scrutiny on fiscal deficit and borrowing plan

As the investor base for government bonds broadens, there will likely be additional focus on India’s macroeconomic fundamentals. In addition to external metrics, such as current account deficit and external debt, there will be greater scrutiny on the government’s fiscal metrics and its broader macro-fiscal policy framework. Metrics, such as the government’s borrowing plan, quality of expenditure and buoyancy of tax revenue, will be keenly analysed.

Most important, however, will be the fiscal deficit, which stood at 5.6 percent of GDP for FY 2023-24. While the government is committed to reducing the fiscal deficit to 4.5 percent of GDP by FY 2025-26, any unexpected deviations from this path could likely undermine market confidence.

Further, public debt levels remain elevated (especially compared to peer EM countries), standing at around 82 percent of GDP for the current fiscal. To assuage these concerns, the government could amend the Fiscal Responsibility and Budget Management (FRBM) Act to provide a credible glide path for both the fiscal deficit and public debt stock over the medium term. Such a measure will likely go a long way to instill confidence in foreign investors and prevent ‘sudden stop’ of capital outflows.

Radhika Pandey is associate professor and Utsav Saksena is a research fellow at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: GST regime needs transformation. Rate rationalisation, simplification must be council’s key priority