The Reserve Bank of India (RBI) announced three unexpected measures in its June policy. First, it announced a larger than anticipated 50 basis cut in the repo rate, bringing it down to 5.5 percent. Second, the RBI announced a substantial 100 basis points cut in the Cash Reserve Ratio (CRR), which will inject an estimated Rs 2.5 trillion into the banking system. Third, the RBI changed its stance from accommodative to neutral, signalling a cautious stance towards future rate cuts.

A pro-growth policy

The policy announcements indicate a benign outlook towards inflation. The declining trajectory of inflation continued in March and April, with moderation in food inflation and steady core inflation. In its latest policy review, the RBI revised its estimate for Consumer Price Index (CPI)-based inflation to 3.7 percent from 4 percent earlier. On growth, while the RBI retained its projection of a 6.5 percent growth, it has highlighted global uncertainty, particularly due to renewed tariffs from July and volatility in commodity prices as risks to the growth outlook.

Will the rate cut boost growth? There are two important issues at play. One is the question of monetary policy transmission by lenders and the second more important issue: Will the supply side interventions, such as rate cuts and liquidity infusion, spur demand for credit?

Also read: India saw a resilient FY25, despite weak manufacturing. Keeping momentum will require reforms

Transmission issues

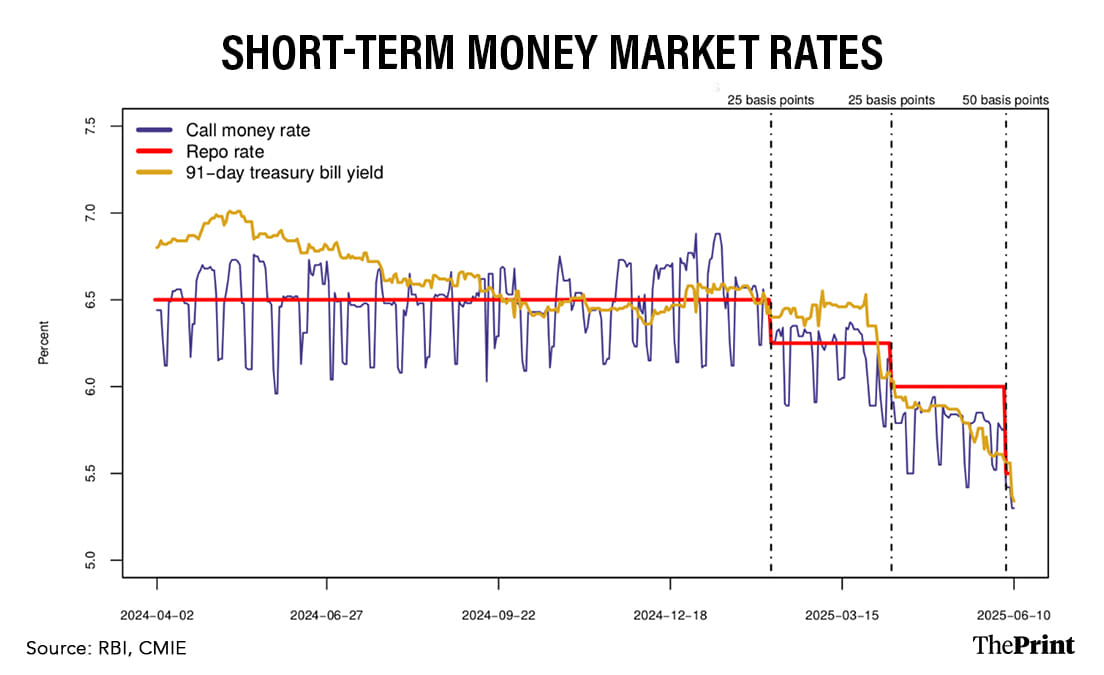

The transmission of repo rate cuts to short-term money market rates seems to be complete. With repo rate cuts, both the weighted average call rate and the 91-day lending rate have eased considerably.

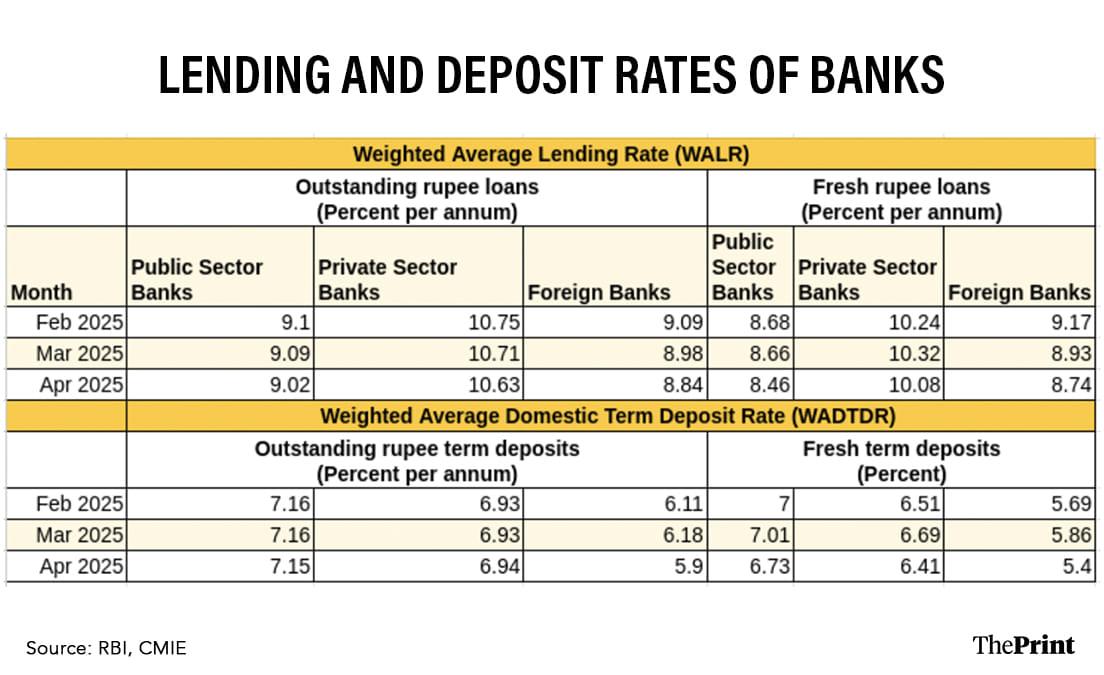

However, when looking at the long-term rates, particularly, lending and deposit rates of the commercial banks, this doesn’t seem to be the case. The pace of transmission to Weighted Average Lending Rate and Weighted Average Domestic Term Deposit Rate, has been slow and uneven.

With the total 50 basis point rate cut announced in February and April 2025, moderation in weighted average lending rate on fresh rupee loans across banks outpaced that on outstanding rupee loans. Cumulatively, from February to April 2025, weighted average lending rate on fresh rupee loans has reduced by 16 and 22 basis points for private and public sector banks, respectively. The cut was more pronounced for foreign banks at 43 basis points. However, in the case of weighted average lending rate on outstanding rupee loans the magnitude of reduction was smaller at 8 and 12 basis points for public and private sector banks, respectively, and 25 basis points for foreign banks.

Lending rates of commercial banks are typically composed of two components, mainly the benchmark rate and a spread (either business strategy or credit risk premium or both). Commercial banks have full discretionary powers when it comes to deciding on the spread. While benchmark rate is the interest rate that is computed using the methodology prescribed by RBI.

As of December 2024, around 61 percent of the total loans of the Scheduled Commercial Banks (SCBs) are linked to the External Benchmark Lending Rate (EBLR). While around 36 percent of total loans of SCBs are linked to Marginal Cost of Fund Lending Rate (MCLR).

EBLR, introduced in 2019, requires banks to link their lending rates to either repo rate, 91-day treasury bill yield or any other benchmark market rate published by the Financial Benchmarks India Private Limited (FBIL). While MCLR, introduced in 2016, requires commercial banks to use marginal cost of funds to compute their lending rates.

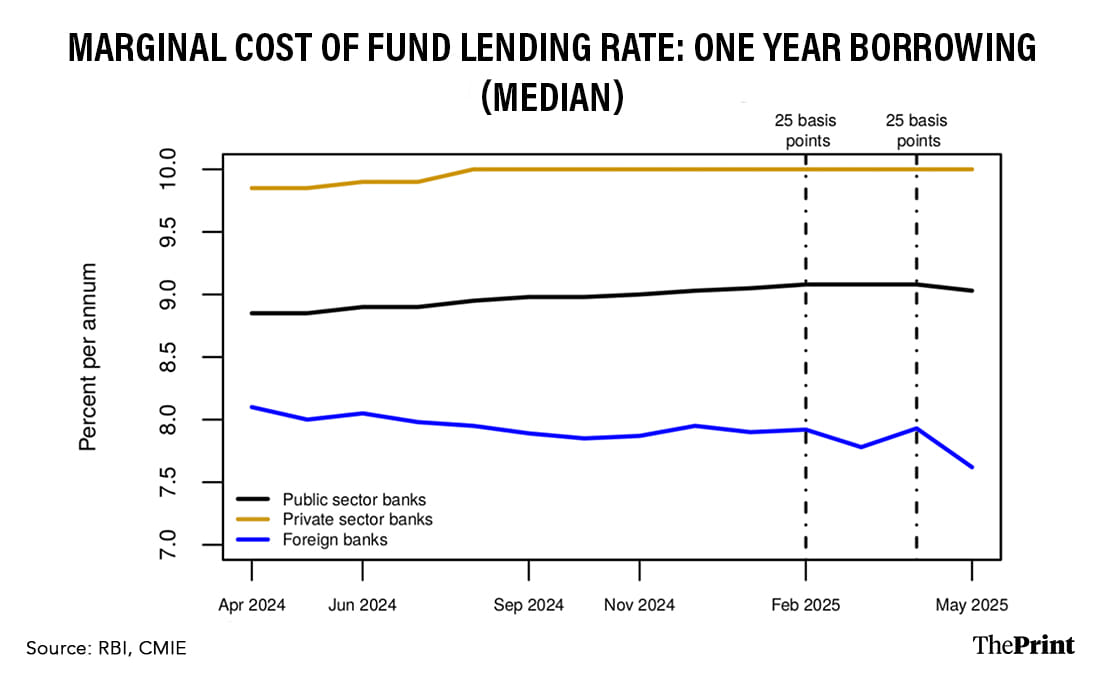

Loans linked to MCLR have posed a considerable hindrance in the transmission, as marginal cost of funds for banks doesn’t move in line with the direction of policy rates. Since February 2025, there has hardly been any change in the 1-year MCLR of public and private sector banks, while in the case of foreign banks, it has reduced by 30 basis points from 7.92 percent per annum in February to 7.62 percent per annum in May 2025.

Further, under MCLR, banks need to review their rates once every year while under EBLR, they are required to review their rates once every quarter. As a result, transmission of policy rate cuts is better under EBLR than MCLR.

Similar to weighted average lending rate, moderation in weighted average domestic term deposit rate on fresh term deposits was higher than on outstanding. Weighted average domestic term deposit rate on fresh term deposits moderated by 10 and 27 basis points for private and public sector banks, respectively, while for foreign banks it moderated by 29 basis points. In the case of outstanding term deposits, there was hardly any moderation in weighted average domestic term deposit rate of public and private sector banks, while that of foreign banks moderated by 21 basis points.

With repo rate cuts, Net Interest Margin of banks could take a hit, however the cut in CRR to 3 percent should cushion the blow. Further, with the banking system flush with liquidity, weighted average lending rate and weighted average domestic term deposit rate could ease further in the forthcoming months.

Credit demand falling short

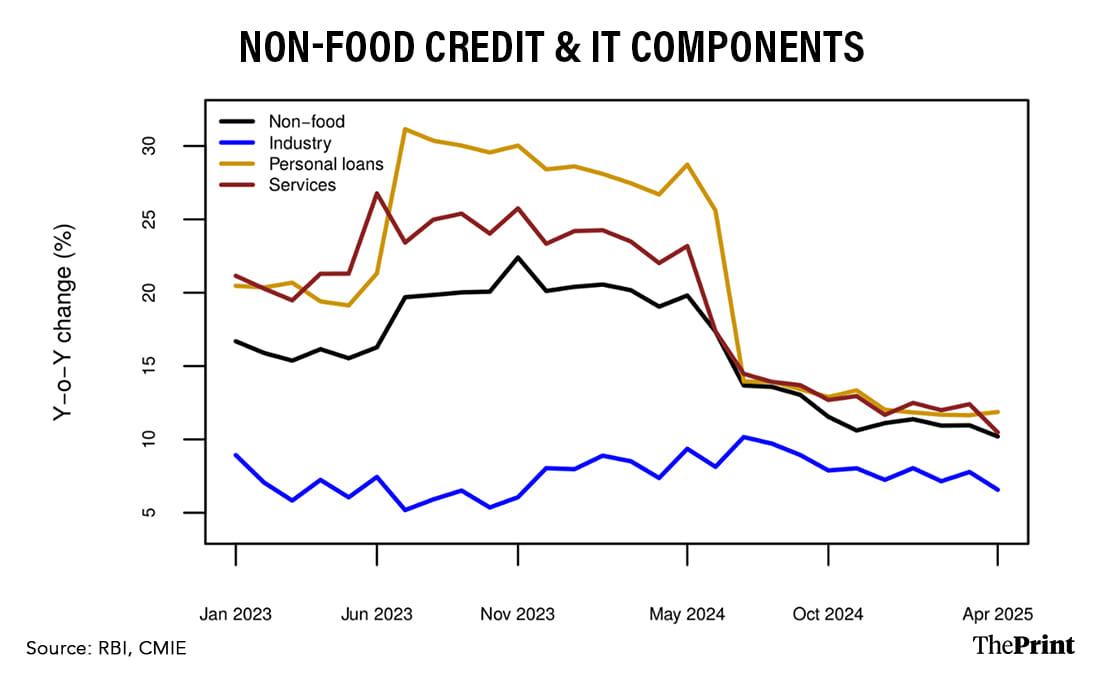

Since May 2024, credit growth has consistently been on a downward trajectory. Imposition of strict norms on unsecured lending by RBI, and RBI raising concerns regarding elevated credit-deposit ratio have curtailed credit growth. Further, lack of bank credit demand by corporates and households has also contributed towards the same.

Uncertainty surrounding global and domestic demand has led to corporates withholding their investments and thereby credit demand.

Despite a 50 basis point rate cut, credit demand hasn’t picked up. Alongside the 50 basis point rate cut in June 2025, RBI has changed the stance from accommodative to neutral. The decision to change the stance is a welcomed step, given the fact that now RBI should look at the impact of the rate cuts on credit demand.

Radhika Pandey is an associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.