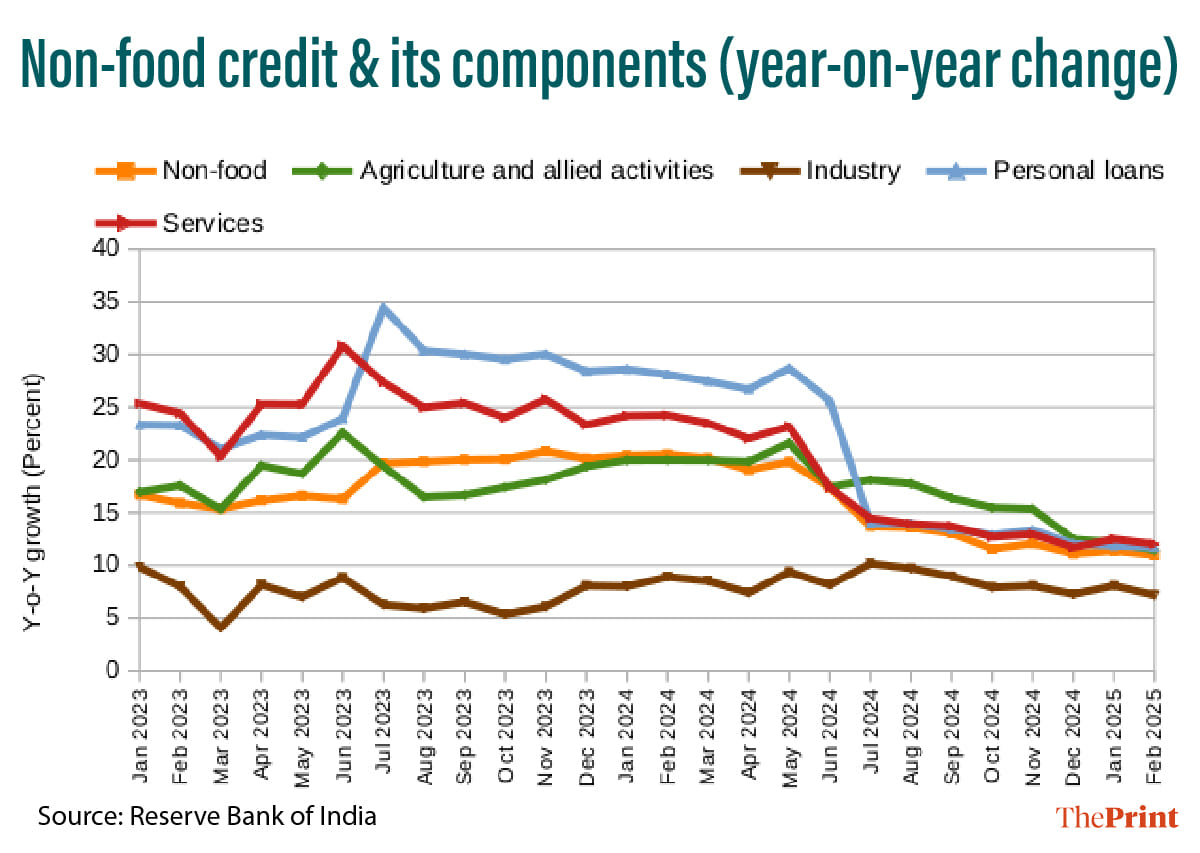

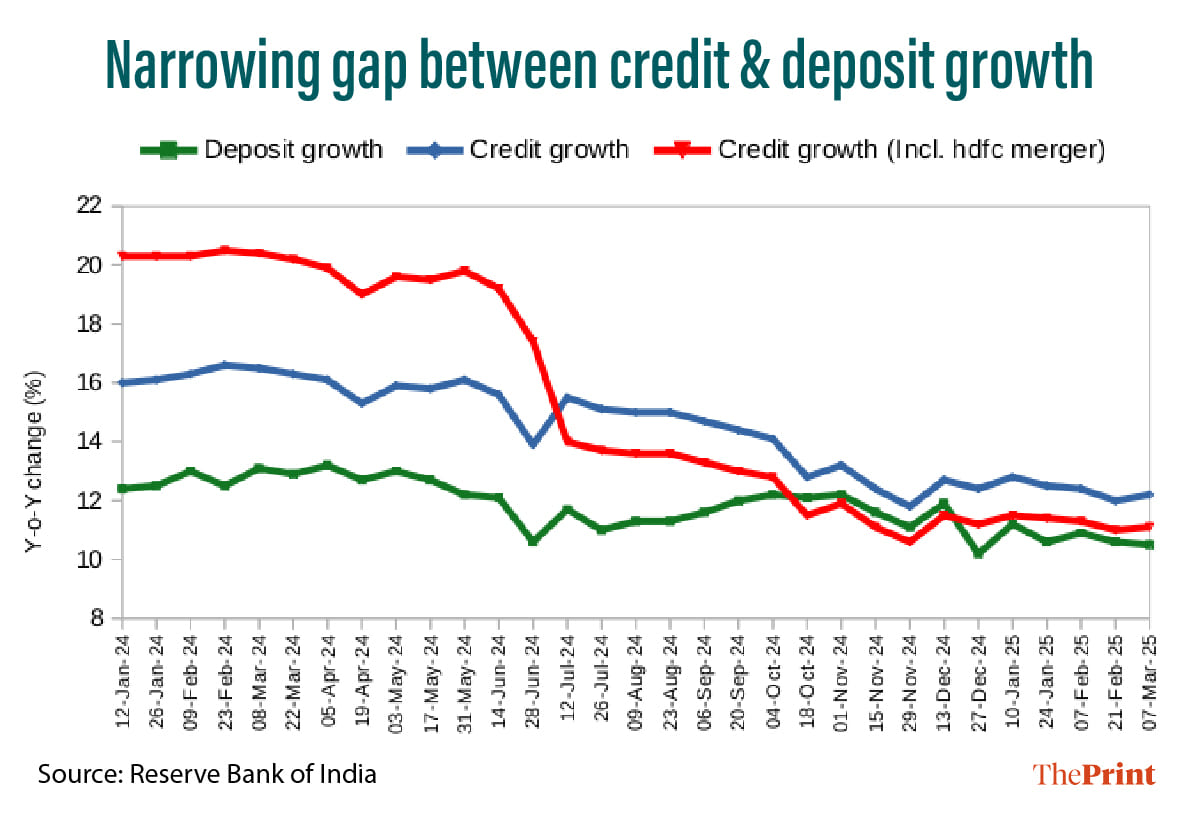

Credit growth by banks moderated to 12 percent for the fortnight ended 21 February, 2025, compared to 16.6 percent a year earlier. Personal loans and loans to services, the two segments that contributed to strong growth in credit till the middle of last year, have witnessed substantial decline. In particular, unsecured personal loans and loans to non-bank financial companies (NBFCs) have shrunk on account of regulatory tightening.

In parallel, gold loans have seen strong growth, partly reflecting a shift towards secured borrowings and rise in gold prices. Going forward, credit is likely to moderate this year on account of weaker demand and cautious approach towards unsecured lending. Banks’ focus will likely be on enhancing the deposit base to tide over liquidity constraints.

Broad-based moderation in credit growth, surge in gold loans

Credit to the services sector declined sharply to 13 percent, compared to 21.4 percent a year ago. The deceleration in credit to services was primarily driven by a slump in credit to NBFCs. Loans to NBFCs grew just 6.4 percent, compared to 14.7 percent a year ago. Further, loans to housing finance companies have seen a contraction.

Banks have trimmed their lending to NBFCs, in response to hike in risk weights on such exposure. In November 2023, the risk weight on banks’ exposure to NBFCs was hiked by 25 percentage points to 125 percent on systemic risk concerns, owing to the growing interconnectedness between banks and NBFCs.

To boost bank lending to NBFCs, the Reserve Bank of India has now restored the risk weights to 100 percent from the earlier 12 percent, starting 1 April, 2025.

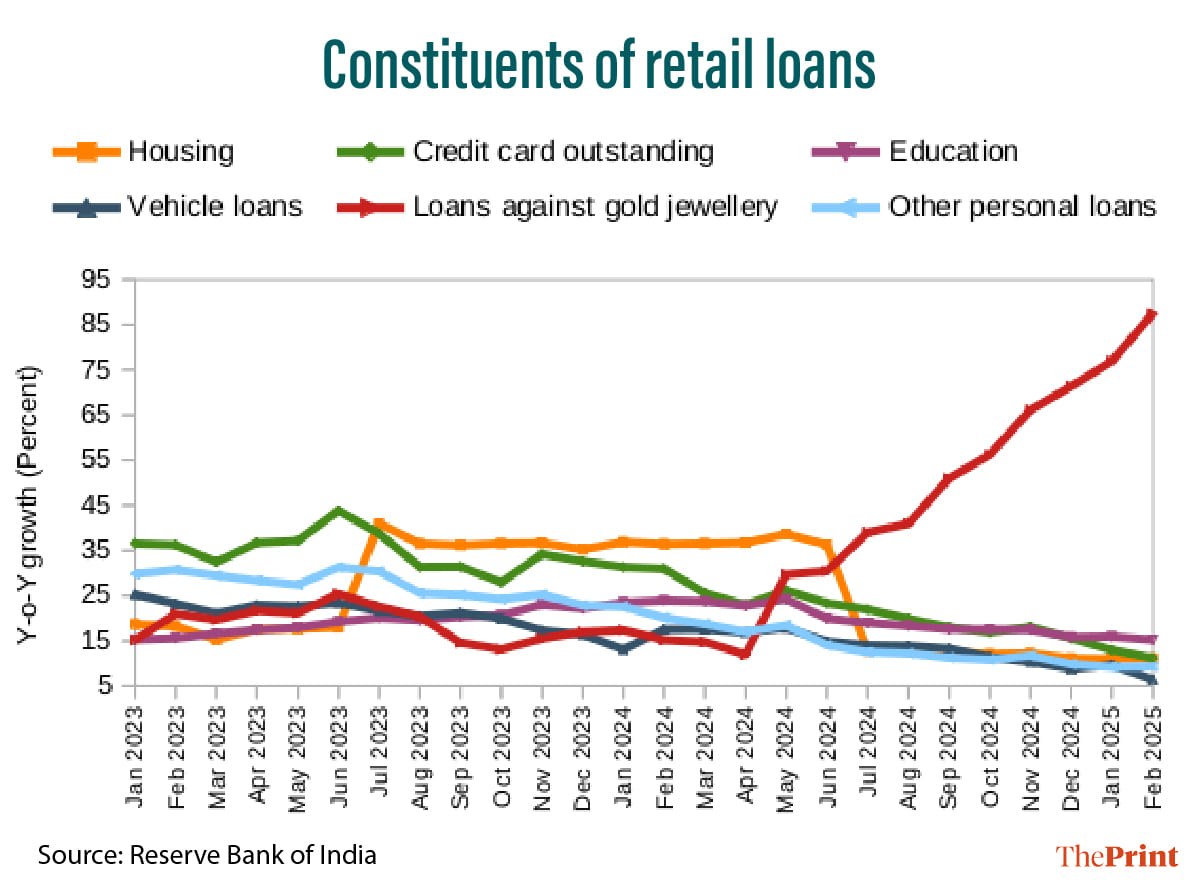

Retail loans also moderated to 14 percent from 18 percent a year ago. The decline is mainly attributed to a moderation in unsecured personal loans and credit card outstanding. Banks have turned more cautious towards unsecured loans after the RBI increased the risk weights on unsecured personal loans in November 2023.

A recent report by TransUnion CIBIL sheds further light on the evolving landscape of India’s consumer credit market. The report shows that the decline in retail credit growth is more prominent amongst New-to-Credit consumers for consumption-led credit products, such as credit cards and personal loans. Notably 41 percent of the new-to-credit consumers are young people born after 1995. The credit availability for such customers saw a sharp decline in the three months to December 2024. Tight credit supply for first-time young borrowers could restrict their purchasing power and limit demand.

Lower uptake of credit, albeit at a slower pace, is also visible among consumers with existing credit history, possibly underscoring an increasing level of household indebtedness.

The regulatory tightening has resulted in a shift towards secured forms of borrowing. Notably, loans against gold jewellery have been rising at a sharp pace in the last few months. As on 21 February, 2025, loans against gold jewellery grew by a whopping 87 percent. While partly an indication of a shift towards secured loans, the sharp surge in gold loans is also on account of an increase in gold prices, which allows borrowers to mortgage less gold for the same amount of loan.

Concerned about this surge, RBI has advised banks to review their policies and practices to contain the growth of non-performing assets pertaining to gold loans.

Also Read: Indian markets, rupee have recovered for now. The future trajectory depends on a mix of factors

Credit deposit trajectory in FY26

While credit growth has slowed, growth of deposits still lag the credit growth. This coupled with liquidity deficit, led banks to rely on borrowings through Certificates of Deposits (CDs) to meet the credit demand.

In the fortnight ended 21 March, banks issued certificates of deposits worth Rs 1.17 lakh crore, while in the fortnight ending 7 March, they borrowed nearly Rs 71,000 crore through the issuance of CDs.

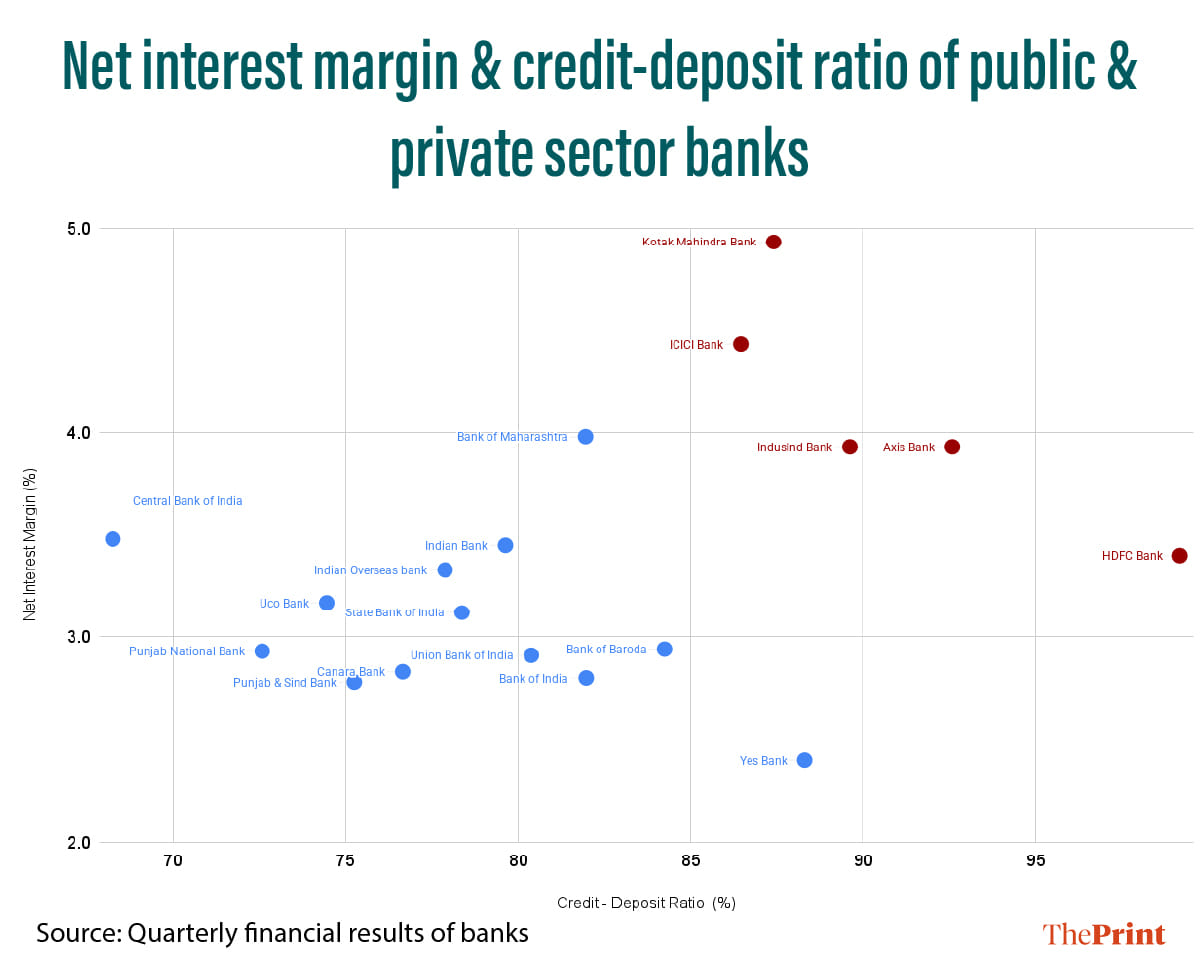

Going forward, the gap between credit growth and deposit growth is likely to shrink. The trajectory of credit-deposit ratio offers interesting insights on this. Private banks have higher C-D ratios and net interest margins, compared to their public sector counterparts.

In the last two years, private banks, in particular, focused on expanding their retail loan portfolio. However, with a surge in credit-deposit ratio and consequent liquidity crunch, they are now shifting their focus. This year, the focus is likely to be on enhancing their deposit base by offering higher rates on term deposits. The current bout of equity market volatility is also likely to enhance the appeal of term deposits for retail customers.

Loan growth is likely to stay sluggish this year. With policy uncertainty, private investment is unlikely to see a significant pick-up, and hence, credit to large industries is not likely to see a major turnaround this year.

Signs of sluggishness in urban demand, such as subdued growth of passenger vehicle sales, is likely to keep retail credit growth muted. This will be reflected in a shrinking gap between credit growth and deposit growth, and a system-wide moderation in credit-deposit ratio.

Radhika Pandey is an associate professor and Pramod Sinha is a fellow at National Institute of Public Finance and Policy.

Views are personal.