At the start of the week, the rupee witnessed its steepest fall in almost two years. The strong jobs data in the US, pointing towards slower pace of rate cuts, and resurgence in global crude oil prices were the fresh triggers for the fall of the rupee, which has already been reeling under pressure since November last year.

Further, China’s recent currency moves, Japan’s possible rate hike and domestic growth concerns are likely to keep Indian currency and markets on edge in the short-term.

Strong US macro data, uncertainty on monetary policy & markets

Data released by the US Bureau of Labor Statistics showed that the total non-farm payroll employment increased by 256,000 in December, up from a revised figure of 212,000 for November.

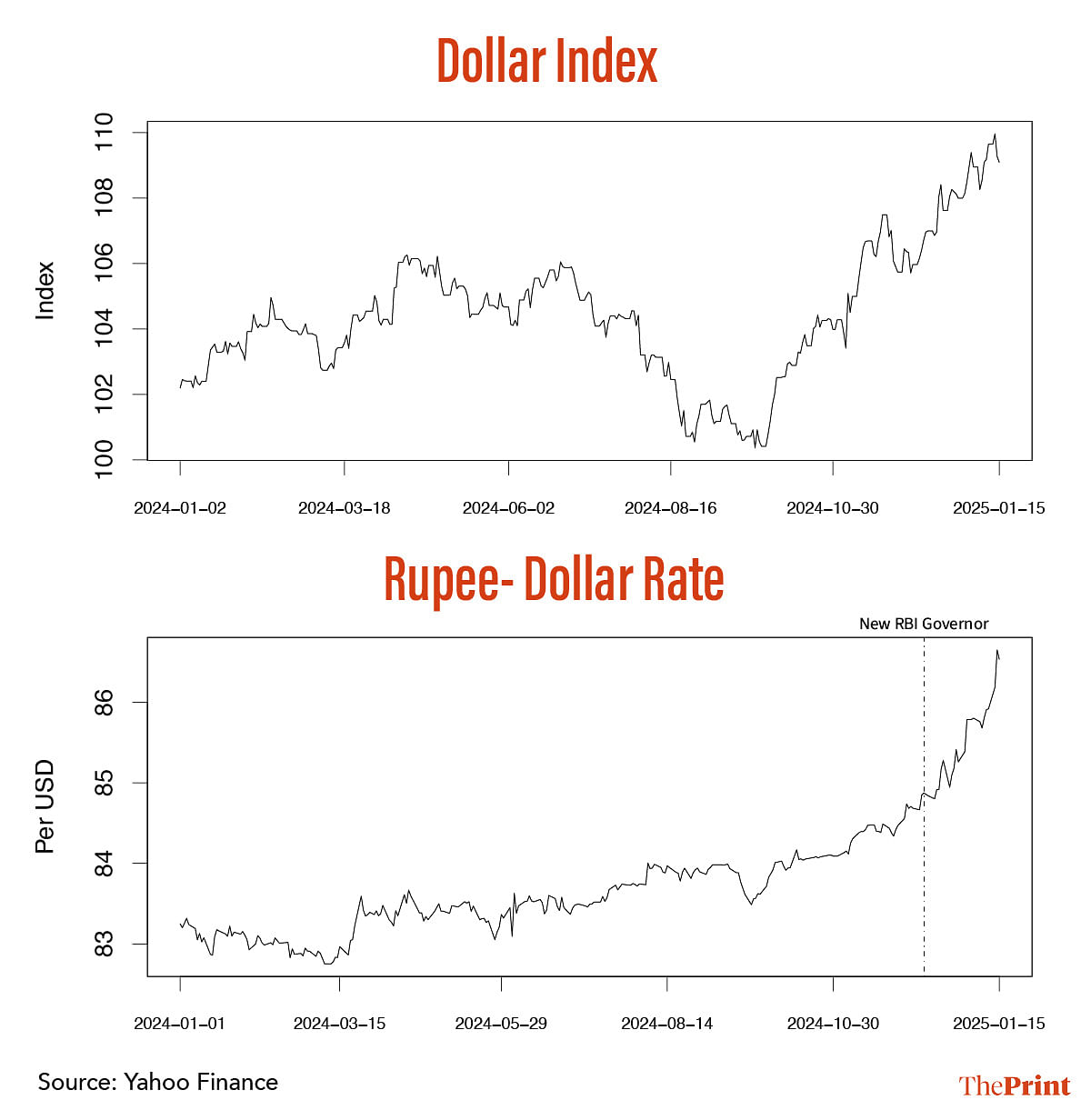

The unemployment rate came in at 4.1 percent against the expectation that it would be at 4.2 percent. A stronger-than-expected jobs data for December, coupled with inflation risks from the new Trump administration, have lowered the possibility of aggressive rate cuts by the US Federal Reserve. Consequently, both the dollar index and US bond yields have risen, putting pressure on emerging market economies’ currencies like India.

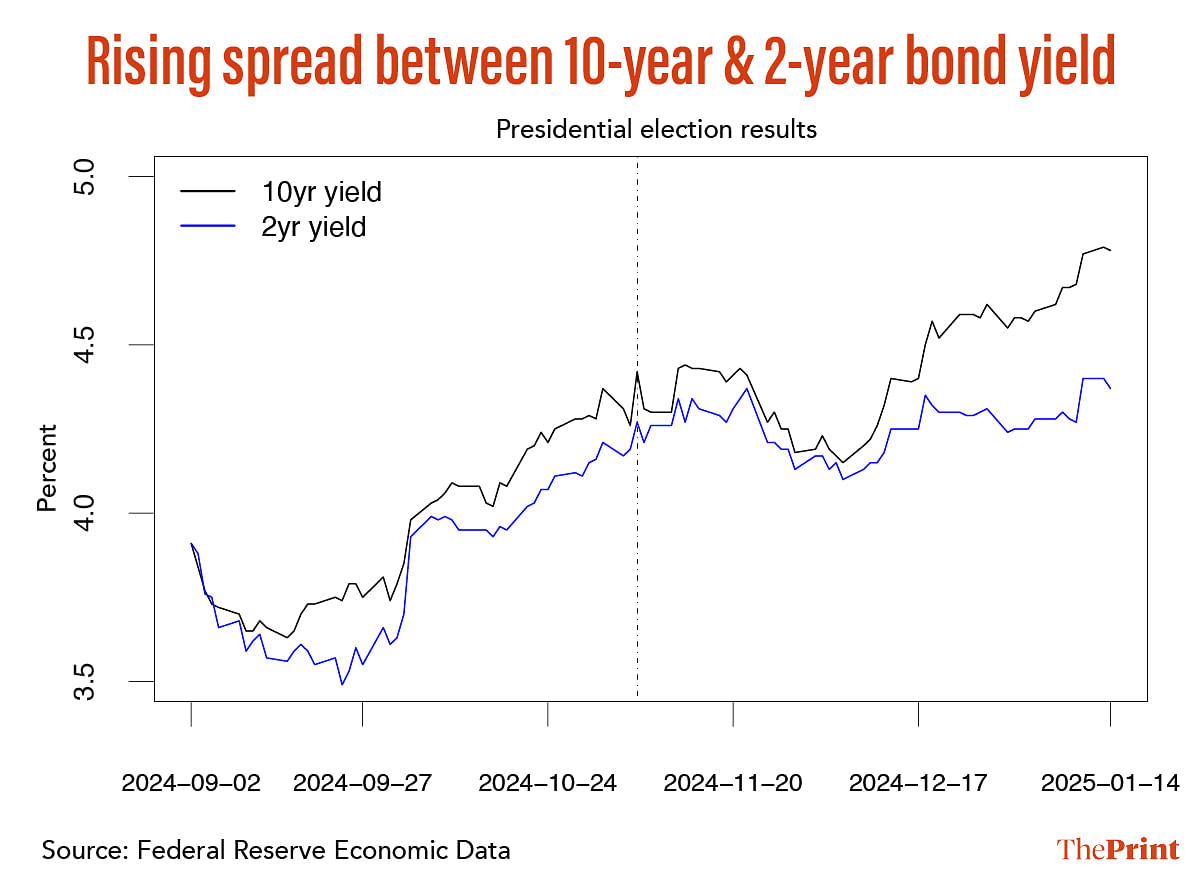

To be sure, the rise in the US bond yields is also attributed to uncertainty surrounding Trump’s policies. The clear manifestation of uncertainty is visible in the fact that the long end of the curve has risen more than the policy responsive short-end of the curve.

To put it differently, the yield curve has steepened markedly since November. This steepening is explained by a rise in term premium. Investors in long-term bonds are demanding higher compensation for locking in funds as they are uncertain of the likely path of the markets, the monetary policy, and in general, the economy.

The surge in bond yields, partly due to the reduced possibility of rate cuts, and partly due to the lingering uncertainty, has crucial implications for capital flows, currency and financial markets in emerging economies.

Fresh sanctions on Russian oil supply chain

Last week, the US Treasury imposed one of the most comprehensive packages of sanctions to disrupt Russia’s energy export revenue. It imposed restrictions on two Russian oil producers as well as close to 180 oil-carrying vessels that were exporting oil to different nations, including India. Sanctions have also been imposed on some insurance companies.

These measures have the potential to upend the International Energy Agency’s (IEA) projection of a significant oil supply surplus for 2025. Global crude oil prices, which ended 2024 at around USD 75 per barrel, have surged to above USD 80 per barrel, following the sanctions.

In the last three years, India has emerged as one of the largest importers of Russian oil. Between April and November, India imported crude worth USD 35.8 billion from Russia, accounting for 38 percent of the overall crude oil imports during this period.

While the supply for the next two months is not likely to be impacted, Indian oil refiners will now have to look for alternative sources of fuel supply, including from the Middle East, without discounts. This could impact the margins of oil marketing companies.

Rising oil prices have the potential to widen India’s current account deficit, adding pressure on the rupee. Retail inflation could see an uptick with the rise in crude oil prices.

The pressure on the rupee, alongside the additional concern of higher imported inflation, will complicate the RBI’s policy rate decision. Higher imported inflation could have implications for the upcoming budget as higher fertiliser, crude oil and commodity prices could inflate the subsidy burden.

Also Read: Govt estimates of GDP growth reveal several pain points. Budget 2025 should prioritise consumption

FPI sell-off, stronger dollar & China’s currency moves

Foreign Portfolio Investors have continued their selling spree in the first two weeks of January. The steady rise in the dollar index and lower-than-expected first advance estimates of GDP for FY25 contributed to the sell off.

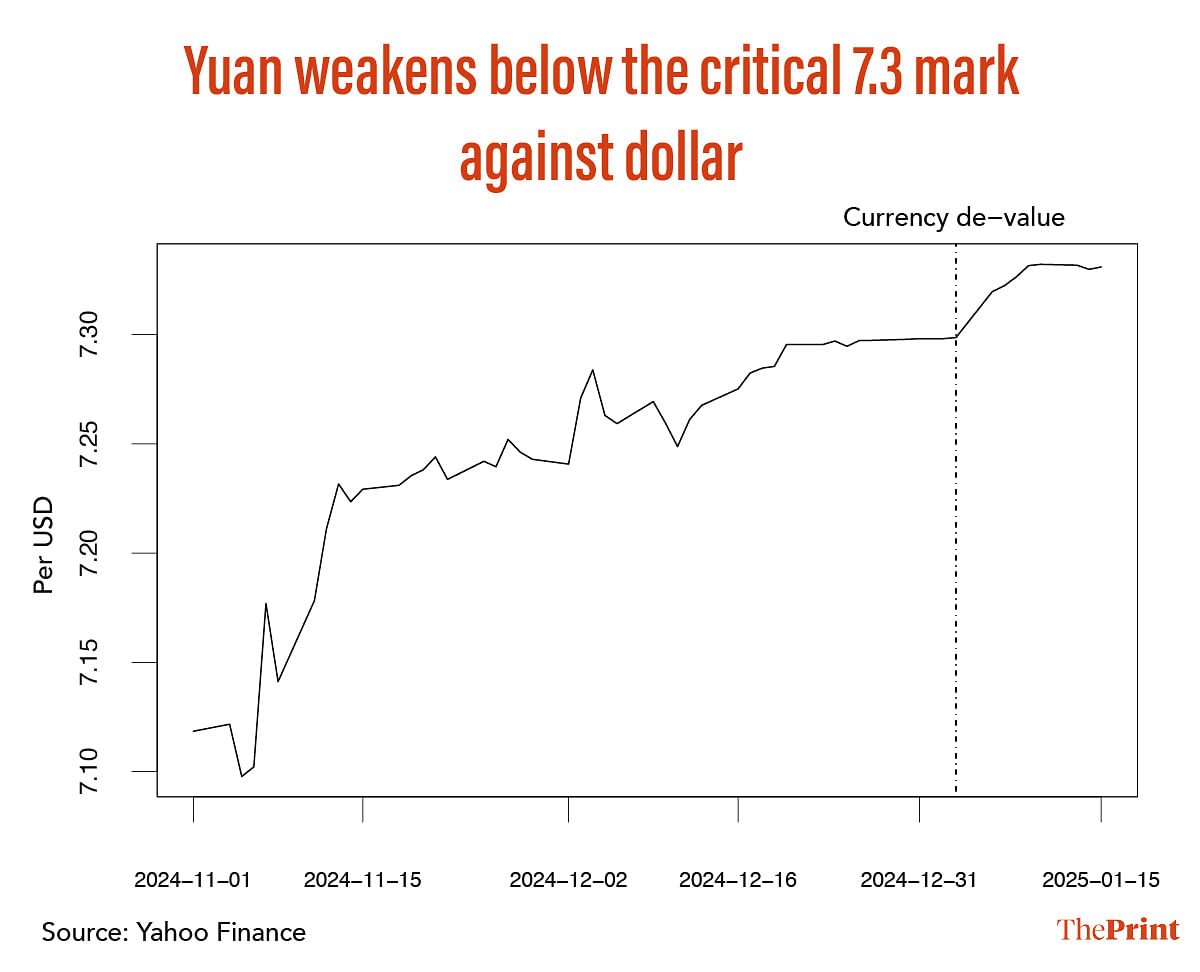

Notably, the recent currency moves by China have also put pressure on the rupee and intensified FPI sell-off. On 3 January, 2025, the People’s Bank of China allowed the yuan to weaken below the critical 7.3 mark against the dollar. Since then, the PBOC has been taking several steps to defend the Chinese currency. Chinese moves are likely to have a ripple effect on Indian markets and currency.

Bank of Japan has recently signalled that it may consider raising interest rates in the wake of a strong upward pressure on wholesale prices. The BOJ’s move towards interest rate hikes could redirect some of the investments back to Japan as returns on Japanese assets turn lucrative. On the trade front, while Indian exports to Japan may turn more competitive, the cost of imports from Japan would rise.

Letting the rupee depreciate

The new RBI governor is seen to be more open to a flexible rupee. This seems to be the appropriate strategy in the current environment of uncertainty.

The RBI’s tight grip over the currency has led to an elevated Real Effective Exchange Rate (REER). The 40 country trade-weighted REER stood at 108.14 in November, implying an overvaluation of about 8 percent. The change in approach will help correct some of the overvaluation in the rupee.

In the last two months of 2024, while the dollar index rose by 4 percent, the rupee weakened by 2 percent, so there is a scope to allow for rupee depreciation, while intervening to curb sharp swings.

The tight grip over the rupee through intervention has meant that the banking sector liquidity has taken a hit amidst slowing growth. While measures have been taken in the last few days, more may be required to address the liquidity deficit.

Radhika Pandey is an associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Indian banks have solid asset quality & profitability for now, but risks are emerging on both counts