As Haryana gets a new government, it is an opportune time to reflect on the state’s economic transformation and fiscal health. While Haryana has been able to contain its deficit, it needs to step up capital spending and limit committed expenditure.

The state is relatively better placed to generate revenues, but a series of poll promises would require further efforts to augment revenue generation capacity. Inclusive development, boosting female labour force participation, addressing unemployment among the educated youth and bridging the rural-urban disparity in inflation should be the new government’s priorities.

Haryana features as one of the better performing states in terms of per capita income. Haryana’s real per capita income is estimated at Rs 1.85 lakh for 2023-24, more than 75 percent higher than the national average. In nominal terms, the state’s per capita income at Rs 3.2 lakh is next to only Karnataka, Telangana and Delhi.

One of the key highlights of the impressive growth has been the state’s structural transformation involving a shift from agriculture to industry and services. The share of agriculture has dropped from 60 percent in 1969-70 to 16 percent in 2023-24. Faster growth in industry and services has led to an increase in the share of industry from 17.6 percent to 33 percent, and that of services from 21.7 percent in 1969-70 to more than 50 percent during the above period.

Also Read: With RBI’s new Monetary Policy Committee in place, a look at challenges that await its members now

Deficit and committed expenditure

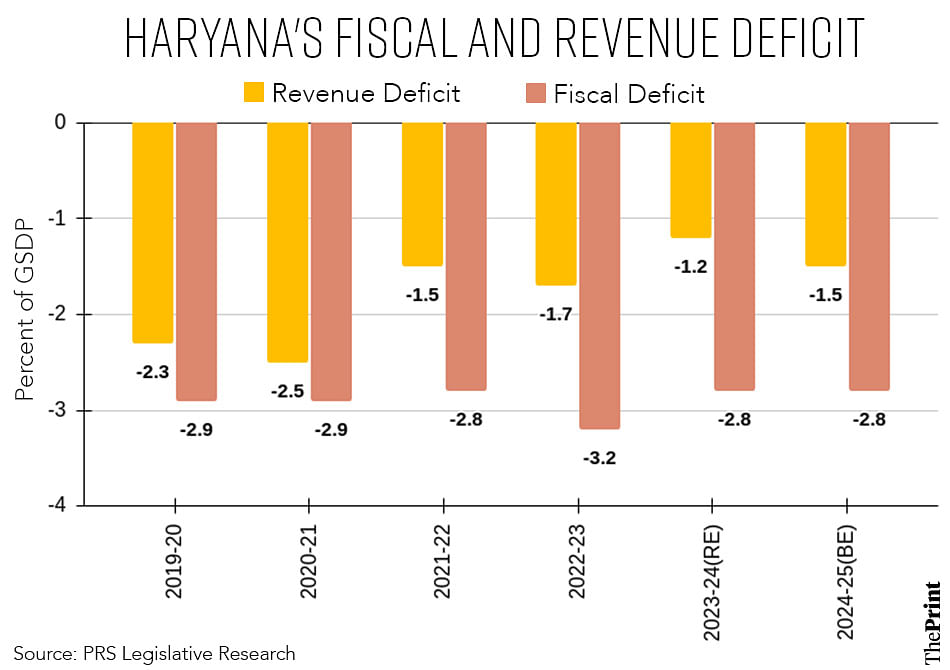

In recent years, Haryana has been able to maintain its deficit within the limits prescribed by the Finance Commission. The actual accounts show that the state’s fiscal deficit at 3.15 percent in 2022-23 was lower than the limit of 3.5 percent prescribed by the Finance Commission.

For 2023-24, the revised estimates show that the state was able to achieve a fiscal deficit of 2.8 percent, lower than the budgeted deficit at 2.96 percent of Gross State Domestic Product. However, the underlying reason for a lower deficit was the cut of 28 percent in capital outlay by the state.

In the current year as well, the state has managed to spend 21 percent of its budgeted capital expenditure during April-August. During the same period last year, it had spent more than 25 percent of its budgeted capex.

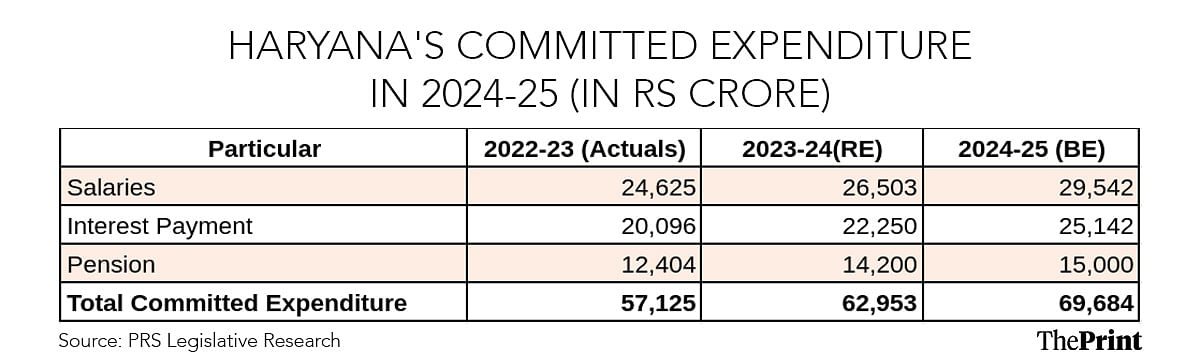

While most of the other states have managed to augment their capital spending post Covid, the same is not true for Haryana. The state’s capex push is seen to be hit by elevated levels of committed expenditure. Committed expenditure, accounting for payment of salaries, pensions and interest payments at Rs 69,684 crore, is budgeted at 60 percent of the state’s revenue receipts in the current year. For comparison, on average, states had budgeted 53 percent of their revenue receipts on committed expenditure last year.

Particularly worrisome is the share of interest payments in the overall revenue budget. State-wise comparison from Reserve Bank of India data shows that in 2023-24, Haryana budgeted 17 percent of revenue expenditure towards interest payments. This is much higher than the all India average of 12 percent. Encouragingly, the spending on pension as a share of revenue expenditure is lower than most of the states.

While the Fiscal Responsibility and Budget Management Acts (FRBM) of various states require them to eliminate revenue deficit, Haryana continues to be a revenue deficit state, implying that the state has to borrow to meet expenditures that are not asset creating or liability reducing. For the current year, the state has budgeted a revenue deficit at 1.5 percent of GSDP. For prudent fiscal and debt management, the state needs to move to a surplus on its revenue budget.

Capacity to generate own taxes and funding poll promises

Haryana relies on its own tax revenue for bulk of the revenue generation. In 2023-24, the state’s own tax revenue was budgeted at 60 percent of the revenue expenditure—higher than the all states’ average of 48.85 percent.

In 2024-25, Haryana’s own tax revenue estimated at Rs 84,551 crore is projected to increase by 15 percent over the revised estimates of 2023-24. But the revised estimates last year fell short of the budgeted estimates by three percent. The state’s own tax revenue projections for the current year look optimistic.

While the state is in a relatively better position to generate revenues, the task ahead for the new government would be to find adequate resources for funding its poll promises. Key poll promises include purchase of 24 crops at a guaranteed Minimum Support Price (MSP), ensuring government jobs for Agniveers, monthly payment of Rs 2100 to eligible women and provision of subsidised gas cylinders.

Inclusive development

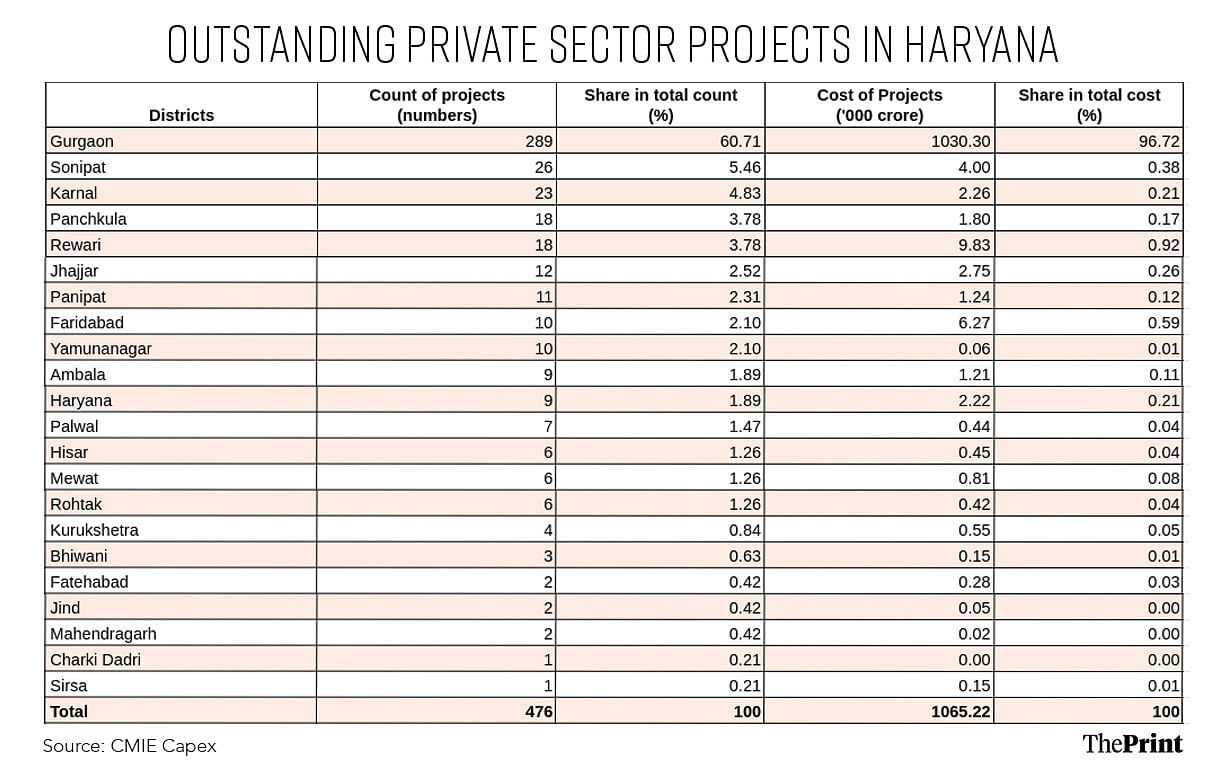

Haryana’s growth has been aided by its proximity to Delhi. Its key economic centre, Gurugram has played a significant role in the state’s economic development by way of the region’s contribution to tax revenue and attracting investments.

A look at the outstanding private sector investment projects in Haryana shows that a whopping 97 percent of the projects by value are in Gurugram. There is a scope for promoting other areas as investment powerhouses and education hubs to ensure a more balanced and inclusive growth. This will also foster employment generation in the state. In this backdrop, the government’s promise of construction of 10 industrial cities is a welcome step.

Employment metrics need further improvement

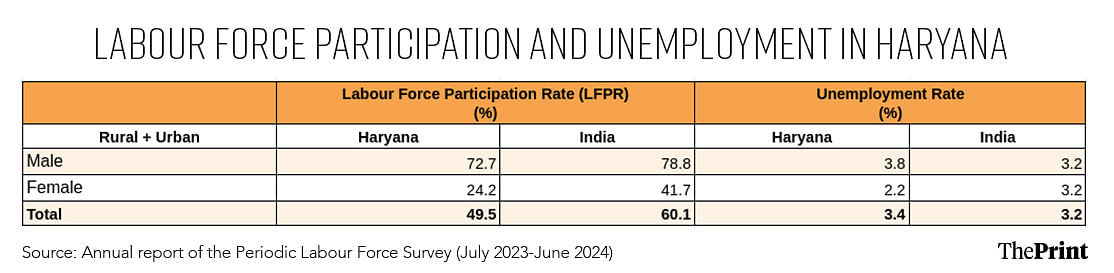

The report of the Periodic Labour Force Survey (PLFS) for 2023-24 shows that the state lags in the labour force participation rate in rural areas. In particular, the female labour force participation is significantly lower than the all India average. The state’s overall unemployment rate at 3.4 percent is seen to be marginally higher than the all India average (3.2 percent). But the unemployment problem amongst the educated youth needs policy attention.

Rural-urban disparity in inflation

Haryana has displayed considerable disparity between rural and urban inflation with rural rate outpacing urban. For the April-August period in 2024-25, while urban inflation was estimated at 4.1 percent, rural inflation was much higher at 5.8 percent. The disparity is on account of food inflation and inflation on miscellaneous components. Policy intervention should aim at durably bringing down inflation and bridging the rural-urban inflation gap.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: US Fed’s rate cut is likely good news for India. It may also help temper RBI’s stance