The past few weeks have seen sweeping changes in the digital asset landscape in the United States.

The landmark Executive Order, the US Securities and Exchange Commission (SEC) reversing the accounting guidance on digital assets, and the setting up of an SEC Crypto Task Force mark a strategic shift in government’s approach on digital assets—from being viewed as risky assets requiring strict enforcement, to instruments to promote US dominance in the global digital economy.

Clarity on crypto regulations

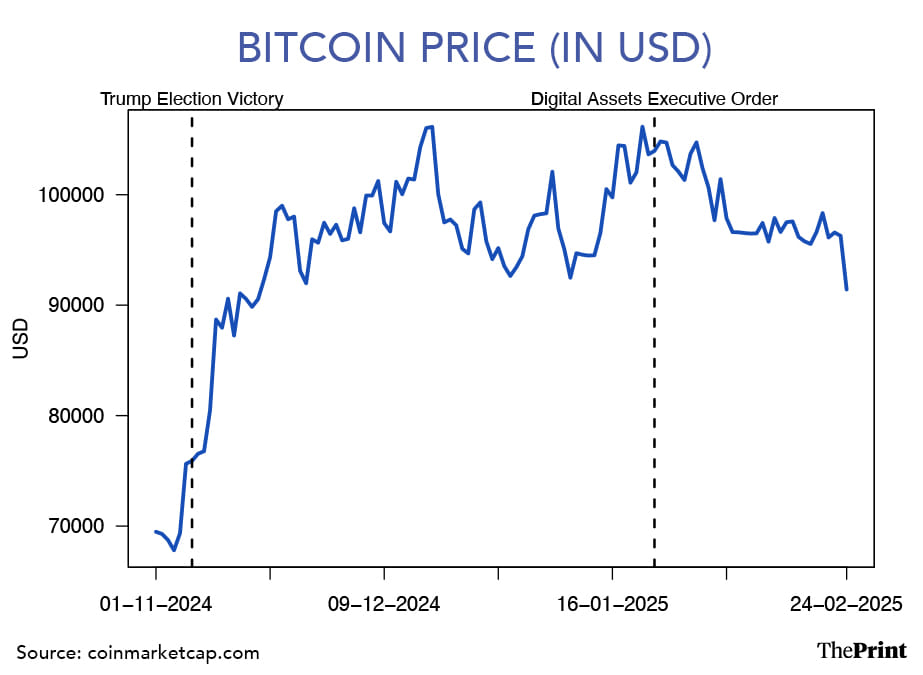

On 23 January, 2025 President Donald Trump signed an Executive Order (EO), titled “Strengthening American Leadership in Digital Financial Technology”, which aims to establish the supremacy of the US in blockchain innovation and reduce uncertainty on cryptocurrency regulations through well-defined jurisdictional boundaries.

At present, two regulatory bodies—SEC and CFTC (Commodities Futures Trading Commission)—are responsible for overseeing various aspects of regulating cryptocurrencies.

The CFTC primarily regulates commodities and their derivatives, such as futures, swaps and options. Since the definition of commodity also captures contracts for future delivery, CFTC regulates derivatives in cryptocurrencies. Thus, while it does not generally regulate the buying and selling of digital assets in the spot market, it has broad authority over derivatives products linked to cryptocurrencies.

In contrast, the SEC regulates securities. To the extent that digital assets represent an investment contract—involving an ‘investment of money, in a common enterprise, with a reasonable expectation of profits, to be derived from the efforts of others’ (the four-pronged criteria of the famous Howey Test)—they are classified as securities, and are regulated by the SEC.

The jurisdiction of SEC mainly focuses on Initial Coin Offerings. Notably, Bitcoin does not satisfy the four requirements of the Howey Test and is regulated as a commodity.

Over the past few years, a turf war has been brewing between CFTC and SEC over which agency should regulate cryptocurrency. The question of whether cryptocurrency is a commodity or a security remains unsettled. The changing attribute may make it difficult to establish the regulatory jurisdiction. As an example, when a cryptocurrency is issued by a developer, it could be a security, but when it is traded on an exchange, it may evolve into a commodity.

The recent EO seeks to address the turf battle by establishing unambiguous jurisdictional boundaries. It also talks about the creation of a working group to advise the White House on crypto policy. Among other things, the group is tasked with exploring a US cryptocurrency stockpile.

In a related development, the SEC has set up a dedicated task force to develop a clear regulatory framework for digital assets. The creation of the task force signals a shift in SEC’s approach from regulation by enforcement to one that prioritises engagement with industry players.

Also Read: In Trump 2.0 era, tariffs emerge as the go-to fix for US’s economic woes

Support to stablecoins, resistance to central bank digital currencies

A key objective of the EO is to promote the development of US dollar-backed stablecoins and align them with the government’s broader efforts to maintain the global dominance of the dollar. Stablecoins are increasingly being used as dollar proxies in international payments. Support for them is expected to bolster the use of dollars worldwide.

Going a step further, and in stark contrast to the policy priority of the Biden administration, the EO bans the issuance of Central Bank Digital Currency—a potential competitor to stablecoins—citing concerns over government overreach and financial privacy.

Considered inimical to financial stability, Trump’s order eliminates the possibility of a US CBDC in the near future. With its thrust towards private sector-backed digital assets, cryptocurrencies are likely to see greater adoption.

Interestingly, Bitcoin prices have declined post the announcement of the EO. Prices increased right before the announcement as there were promises of big moves. However, the decision pertaining to Bitcoin reserves did not live up to the market’s expectations. The announcements on tariffs and retaliatory tariffs by US trade partners also suppressed prices of Bitcoin.

Entry of banks in crypto market

In another move signalling the pro-crypto stance of the Trump administration, policy changes are announced to facilitate the institutional adoption of digital assets.

The accounting guidance (Staff Accounting Bulletin) by the SEC under the previous administration required banks holding digital assets for customers to recognise these holdings as liabilities on their balance sheets.

While the guidance was aimed at greater transparency, it was widely criticised as it significantly increased compliance burdens and prevented entities, such as banks, from entering the market. It was argued that entry barriers for banks would result in non-bank entities that lack expertise, such as appropriate risk management frameworks, entering the market giving way to systemic risks and reduced competition.

In late January, the SEC published new guidance and repealed the earlier one. The new guidance makes custodial services more feasible for banks, allowing greater participation by them in the digital assets market.

India’s cautious approach

In contrast to the US’ pro-crypto stance, the draft Income Tax Bill introduces strict reporting requirements for crypto transactions. As initial steps towards bringing crypto within the Indian financial framework, the bill expands the definition of virtual digital assets (VDAs) to include any crypto-asset that relies on a cryptographically secure distributed ledger to validate and secure transactions.

The new draft law imposes reporting obligations on entities handling VDA transactions and they have been brought under the definition of undisclosed income. This means that income tax authorities can initiate search against entities, wherein they may scrutinise operations for six assessment years preceding the year in which the search is initiated.

Therefore, any profit from trading of VDAs, whether short-term or long-term, that remains undisclosed will attract a tax rate of 60 percent.

These amendments signal the Indian government’s continuing cautious approach towards VDAs.

This should be contrasted with the increasingly crypto-friendly approach of the United States government. The EO and the new accounting guidance indicate that the administration aims to bring regulatory clarity, and establish itself as a global leader in digital assets and financial technology.

Radhika Pandey is an associate professor and Nipuna Varman is a research fellow at the National Institute of Public Finance and Policy.

Views are personal.