The Reserve Bank of India’s latest Financial Stability Report shows consistent improvement in banks’ balance sheets, with non-performing assets ratio at multi-year low, comfortably placed capital buffers and robust earnings. Given that India’s financial system is dominated by banks, the overall sound health of the banking sector is good news for financial stability, but the report points to some areas of concern that warrant closer scrutiny.

The bad loans in the education segment, increase in slippages from retail loans by private banks, and the interconnectedness between NBFCs and banks, need to be monitored. Climate change-related risk is emerging as a key source of concern from the perspective of financial stability.

Non-performing assets ratio at multi-year low

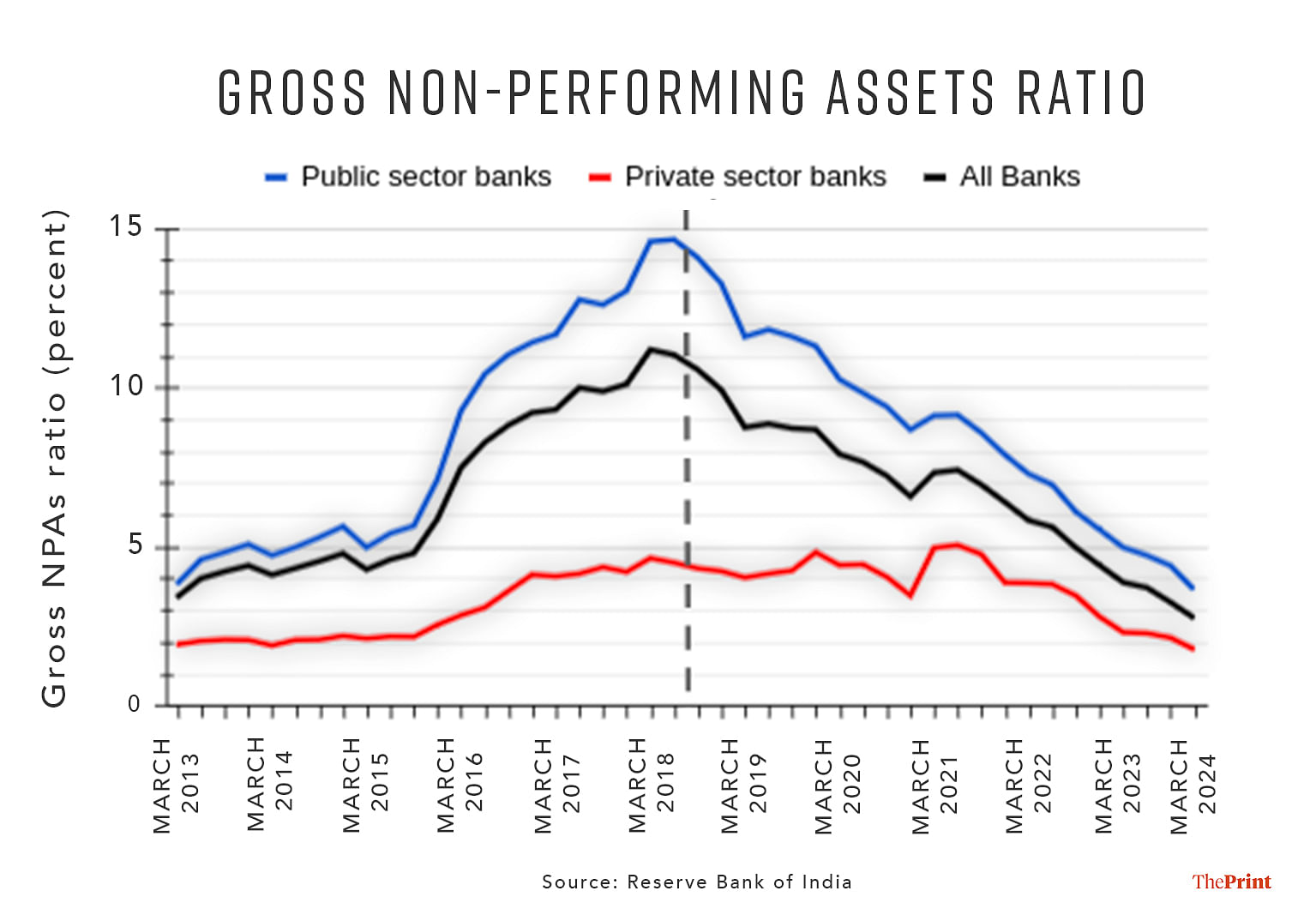

A key highlight of the bi-annual assessment of financial stability has been a sustained upward trend in asset quality of commercial banks.

Gross non-performing assets (GNPA) ratio of banks fell to a 12-year-low of 2.8 percent at the end of March 2024 from 3.2 percent in September last year. Net non-performing assets (NNPA) ratio fell to 0.6 percent from 0.9 percent during the same period. The GNPA ratio of banks is further expected to improve to 2.5 percent by March 2025 under the baseline scenario.

The fall in bad loans has been driven by a combination of write-offs as well as reduction in fresh bad loans. Encouragingly, the half-yearly slippage ratio (new NPA additions to as a share of standard advances) decreased across bank groups.

Public sector banks, which were plagued by a high proportion of bad loans a few years back, recorded a substantial 76 percent reduction in their GNPA ratio in the second half of 2023-24. Sector-wise, there has been a broad-based reduction in NPAs. However, the GNPA ratio in agriculture still remains high at 6.2 percent.

Also Read: Highly vulnerable to extreme climate, crucial sectors in India need well-crafted green strategies

Personal loans: Lowest NPAs, but signs of stress emerging

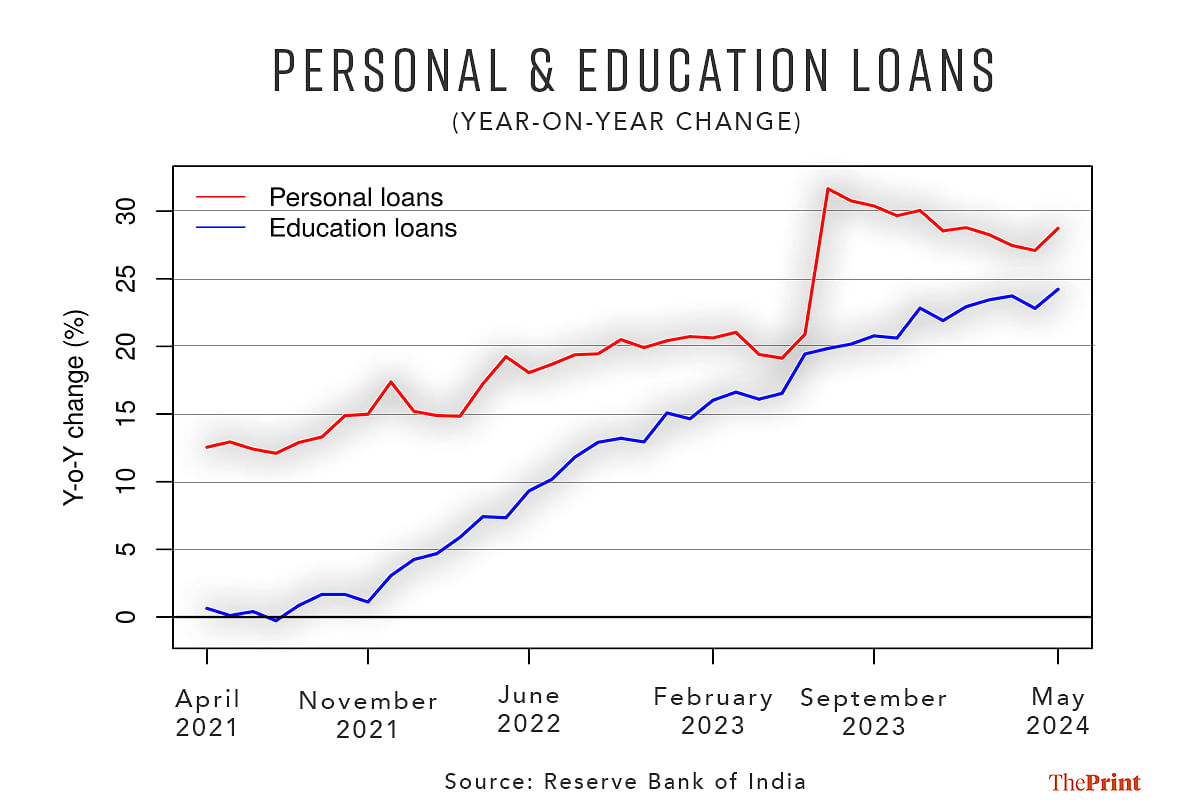

Within the personal loans category, surprisingly, the highest default was seen in the education segment, while the lowest was in housing. GNPA in education personal loans stood at 3.6 percent, compared to 1.8 percent in credit cards, 1.1 percent in housing loans and 1.3 percent in vehicle loans.

While the share of education loans in the overall personal loans segment is small, these loans have been rising at a fast pace. After the pandemic-induced lull, there has been an increase in the number of students opting to study abroad. Course fees have also risen, contributing to a rise in demand for education loans, but the lack of job opportunities, layoffs and hiring freeze may be responsible for the rise in impaired loans in this segment.

To be sure, education loans do not form a big part of bad loans, but large-scale slippages in this segment can be a cause for worry, particularly for public sector banks, where the share of NPAs in education loans is 3.9 percent.

Slippages or net additions to bad loans in the retail segment (excluding housing loans) is another area that warrants monitoring. While the stock of NPAs in retail loans declined to 1.2 percent in March 2024 from a high of 2.1 percent in June 2022, in the case of private banks, slippages from retail loans accounted for 40 percent of fresh additions to bad loans.

Capital position: Comfortable, but moderation in capital of private banks

The capital to risk-weighted assets ratio (CRAR) of public sector banks increased from September 2023, but private and foreign banks saw a moderation in their CRAR. These banks had higher shares of loans that were subject to enhanced regulatory scrutiny in November 2023.

To rein in the rise in unsecured personal loans, credit cards and loans to NBFCs, the RBI had increased the risk weights for such loans. Consequently, the risk-weighted assets grew at a faster pace, compared to the growth in total capital, resulting in a moderation in capital to risk-weighted assets ratio in the second half of last year.

Despite a moderation in CRAR, Indian banks have sufficient capital buffers to handle stress. Stress tests by the RBI indicate that even under a severe stress scenario, banks’ capital will remain above the minimum capital requirement of 9 percent.

Also Read: GST regime needs transformation. Rate rationalisation, simplification must be council’s key priority

Banks’ exposure to NBFCs

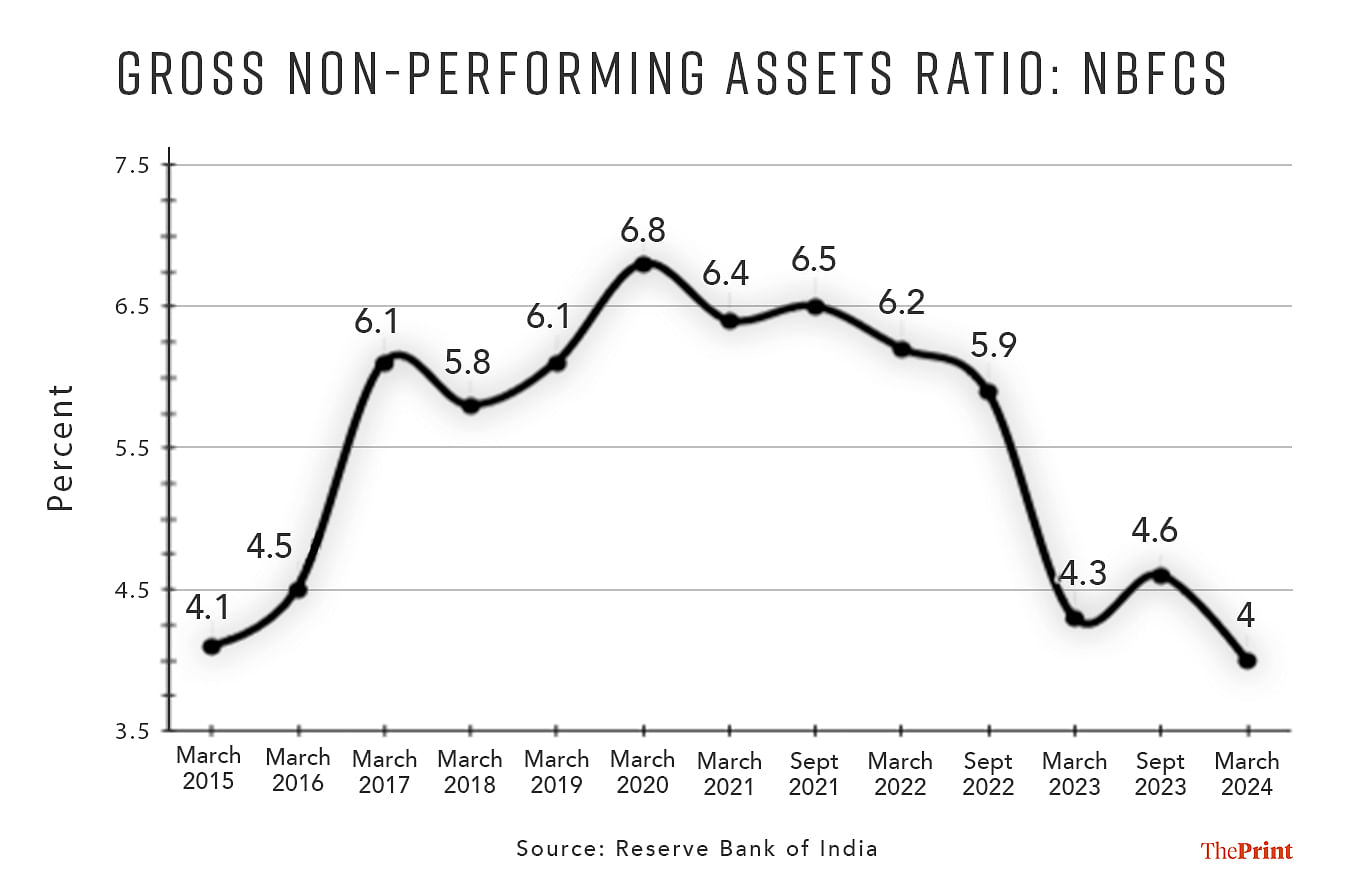

Non-banking financial companies, known for targeting niche loan segments, also saw a downward movement in their non-performing assets ratio to 4 percent in March 2024 from 4.6 percent in September 2023.

While there was a broad-based decline in GNPA ratio across sectors, the auto loan segment had the highest ratio amongst the retail segment. Since NBFCs are prone to asset-liability mismatches, it is imperative to review the metrics relating to the asset and liability profile of NBFCs.

These metrics also portray the sound financial health of NBFCs. For instance, the share of commercial papers (short-term loans) in total assets declined to less than 2 percent, long term assets constituted 65 percent of overall assets and short-term liability remained below 25 percent of total assets at the end of March 2024.

Much like previous reports, there are concerns around the interconnectedness between banks and NBFCs, and the potential spillover of risks from NBFCs to banks. The report shows that the NBFC segment has emerged as the largest net borrower of funds from the financial system.

Their gross payables of Rs 16.58 lakh crore far exceed the gross receivables of Rs 1.61 lakh crore. Bulk of the payables constitute long term funding from banks. Housing Finance Companies are also major borrowers from banks. With substantial funding from banks, failure of any NBFC or housing finance company could have a knock-on effect on banks.

Geopolitical risks have receded, but fresh sources of risks emerge

The RBI’s Systemic Risk Survey gives a comprehensive account of the various sources of risks to the Indian financial system. The findings show that the risks from geopolitical disruptions have moderated, but domestically, risks from climate change and consumption demand have emerged as some of the prime sources of risk to the Indian financial system.

For climate change-related risks, a whole work-programme on assessing the materiality of the risks, evaluation of impact, and identification of strategic responses, would be needed.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Shrinking gap between average rural & urban consumption spends good news, but inequality persists