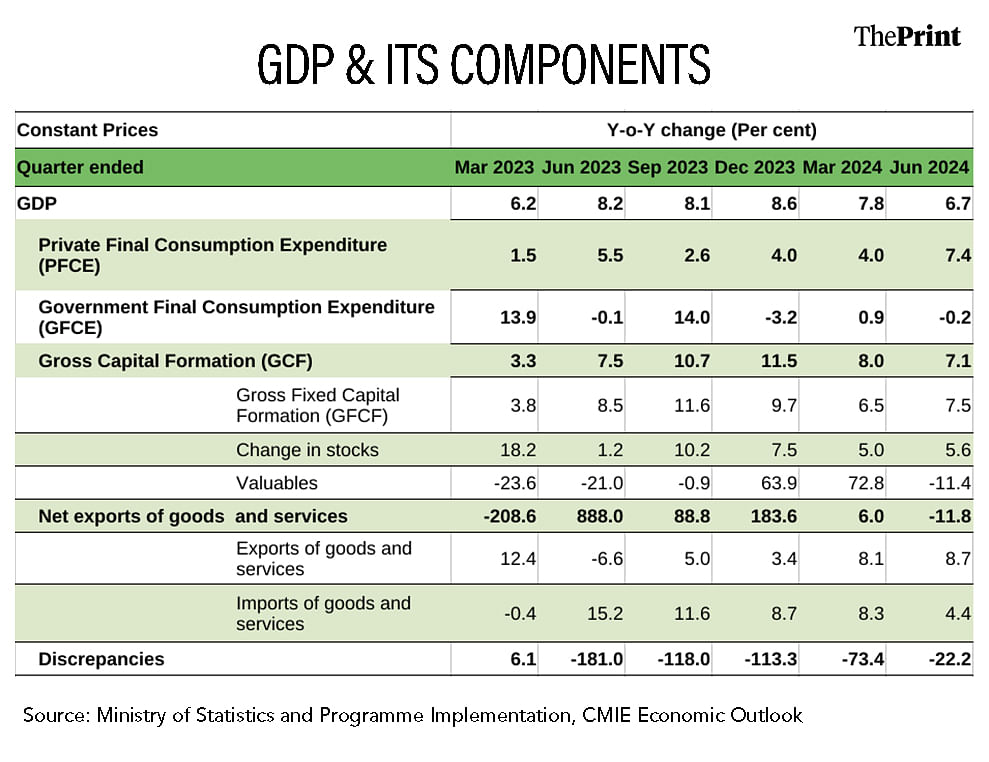

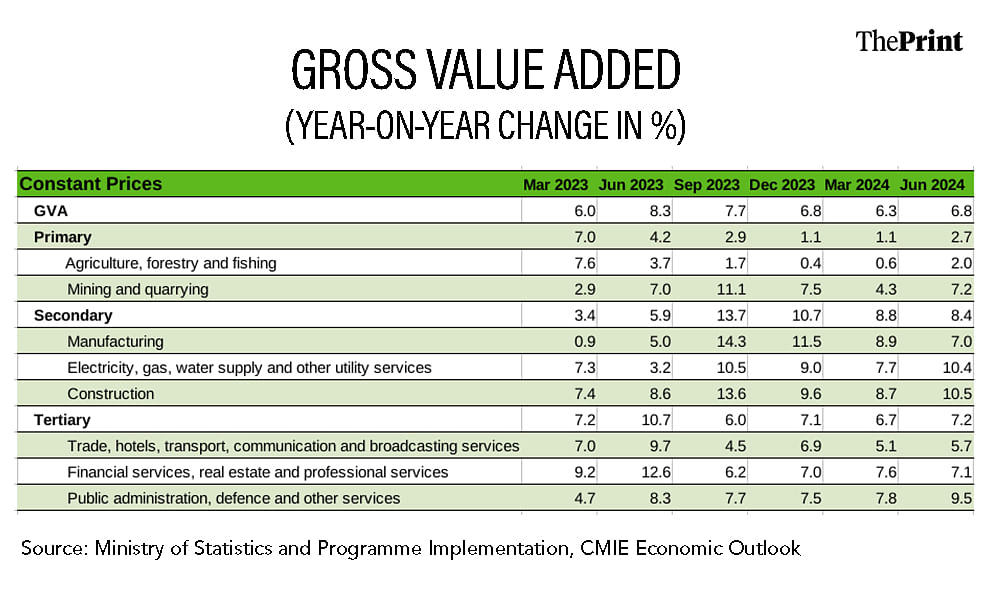

The Indian economy clocked a growth of 6.7 percent in the first quarter of FY 2024-25, sharply lower than the 8.2 percent growth in the same quarter of last year. The Gross Value Added (GVA), which is a more accurate measure of economic activity, grew by 6.8 percent, compared to the same period last year. This is an improvement over the 6.3 percent growth in GVA recorded in the previous quarter.

Though the headline GDP growth was the slowest in five quarters, it masks the favourable internals. Consumption and non-government capital formation picked up pace. On the activity front, growth was led by the secondary sector, while the tertiary sector performance was a mixed bag.

Going forward, government consumption and agriculture could see a rebound, but the slackness in urban consumption seen in the first quarter needs to be watched out. In the medium term, diversification of exports and focus on labour-intensive exports will foster growth and employment generation.

Pick-up in consumption & non-govt investment

A key highlight of the GDP numbers for the first quarter was the welcome recovery in private consumption. Growth in private final consumption expenditure accelerated to 7.4 percent in the quarter ending June. This is a significant rise as growth in consumption in the previous five quarters had averaged at 3.5 percent. In the previous year, even though GDP grew at a robust 8.2 percent, growth in consumption was anaemic at four percent.

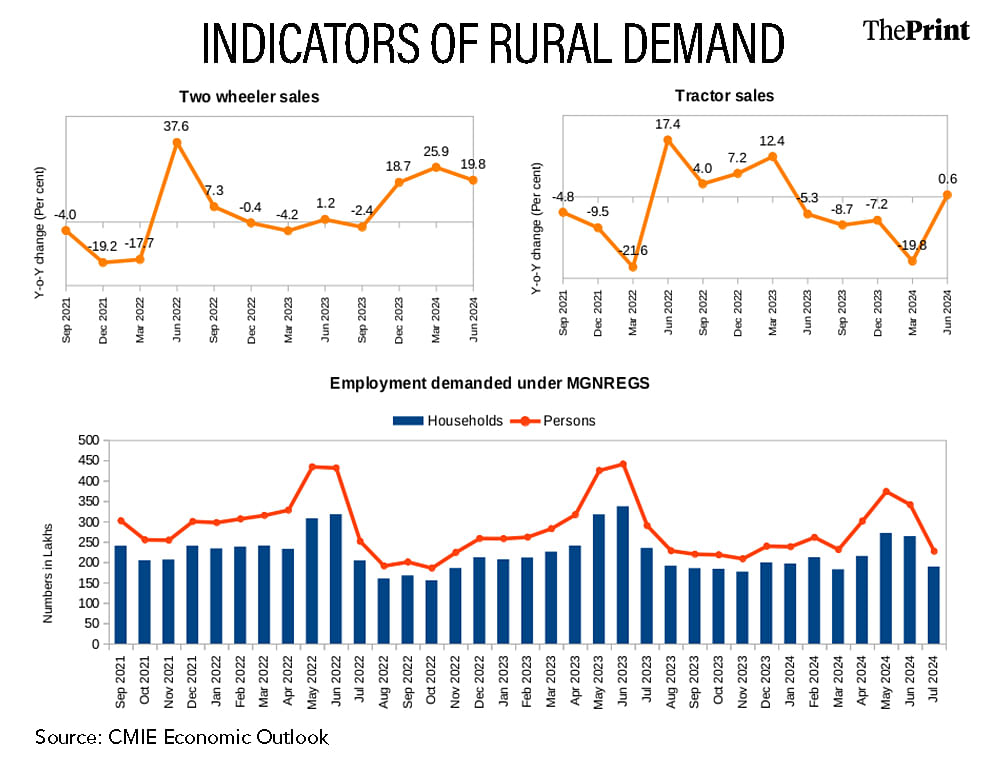

A series of high frequency indicators reflected a recovery in consumption, primarily due to improvement in rural demand. Two-wheeler sales and tractor sales picked up in the June quarter. The quarterly financial results of FMCG companies pointed to recovery in the mass consumer market in the June quarter. At the same time, there is sluggishness seen in urban consumption. Further, the lingering heatwave contributed to slackness in some segments of consumption, such as passenger vehicle sales.

The other key driver of growth from the demand side was the gross fixed capital formation (GFCF). GFCF grew by a strong 7.5 percent in the June quarter from 6.5 percent in the previous quarter. This is despite a 35 percent contraction in central government capex and almost a 20 percent contraction in states’ capex. A strong 7.5 percent growth in capital formation, despite a contraction in government capex, is suggestive of a pick-up in private and household capex.

Notably, household investment in real estate has remained strong as evident in the sale of residential units.

There are indications of improvement in private capex as well. The Reserve Bank of India’s latest survey shows an increase in capacity utilisation to 76.8 percent in the March quarter from 74.7 percent in the last quarter. Bank credit to large industries has been growing at a steady pace in the last three quarters. Noticeably, bank credit to large industries grew by 2.2 percent on a sequential basis. With a revival in government capex from second quarter onwards, the growth in the overall GFCF is likely to remain steady.

While exports of goods and services grew at 8.7 percent, government consumption spending contracted by 0.2 percent due to election-related restrictions.

On the whole, the two key laggards—consumption and private investment—picked up in the June quarter.

Also Read: Guaranteed pensions may cause fiscal ambiguity. Govt may have to raise pension outlay for UPS

Strong growth in secondary sector

On the economic activity front, agriculture grew at two percent, up from 0.6 percent in the previous quarter, but lower than the 3.7 percent growth during the same quarter last year. Agricultural performance was impacted by extreme heat and uneven rainfall. However, the strong Rabi harvest lifted agricultural performance compared to the previous quarter. The above normal south-west monsoon is expected to bolster agricultural production in the subsequent quarters.

The secondary segment posted a decent growth of 8.4 percent, driven by over 10 percent growth in electricity and construction and a seven percent growth in manufacturing sector. Manufacturing sector performance, however, was hit by lower profitability, owing to higher input costs.

The tertiary or services sector saw a distinct slowdown at 7.2 percent, which was particularly stark in the employment-intensive “trade, hotels, transport, communication and broadcasting services”. Growth in this segment dropped to 5.7 percent this quarter from 9.7 percent in the first quarter of last year. Financial services, real estate and professional services grew by 7.1 percent, down from 12.6 percent in the previous year’s first quarter, due to slower growth in aggregate deposits and credit.

The outlook

The World Bank, in its recent report, has revised India’s growth projection for the current fiscal to seven percent from the previous estimate of 6.6 percent. A rebound in the agricultural segment and pick-up in government spending should lift growth in the coming quarters.

While on an aggregate basis, consumption growth is expected to accelerate, a more even recovery in consumption still seems some distance away. The green shoots of recovery seen in private investment need to be sustained on a durable basis to ensure that growth reaches the seven percent mark this year.

The government aims for seven percent or higher growth in the medium term. In light of this, the World Bank’s recent report on India’s trade policy offers valuable recommendations. The report suggests that India should export a wider variety of goods to new markets and strengthen the connection between trade and employment. Prioritising labour-intensive exports, like textiles, apparel, leather, and footwear, could create more jobs and boost economic growth.

Radhika Pandey is associate professor at National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: India enjoys healthy trade surplus with Bangladesh. The political crisis can hurt trade, FTA chances