The International Monetary Fund (IMF), in its annual Article IV review, while reiterating that India is on track to be one of the fastest-growing major economies, has identified certain risks to its long-term growth prospects.

The IMF has raised concerns on the likely trajectory of India’s general government debt. According to its assessment, India’s general government debt could exceed 100 percent of GDP in the medium term. The IMF has flagged possible risks on banks’ balance-sheets from the sharp rise in personal and unsecured loans.

As part of its assessment, the IMF has reclassified India’s de facto exchange rate regime from “floating” to “stabilised arrangement” for the period of December 2022 to October 2023. The IMF noted that the Indian rupee traded in a very narrow range during this period, suggesting that interventions by the Reserve Bank of India (RBI) likely exceeded the level necessary to address disorderly market conditions.

The government and the RBI disagree with the IMF’s exchange rate re-classification, terming it as unjust and arbitrary. There are also disagreements on the Fund’s assertion that India’s general government debt-GDP ratio could exceed 100 percent of GDP in the medium term.

Also read: Food inflation getting more persistent & widespread and, unfortunately, showing no signs of easing

Re-classification of the de-facto exchange rate regime

The IMF classifies the exchange rate regime into 10 categories. On one extreme is where a country doesn’t have a separate legal tender of its own. The next category is when a country has a legal tender but its value is pegged entirely to the value of the currency of another country. Next come various levels of pegged currency systems with decreasing levels of linkage to another currency. On the other extreme are floating exchange rate regimes where governments or central banks exert minimal control over the currency, and, finally to free float exchange rate regime where exchange rate intervention occurs only in exceptional circumstances.

India’s de-facto exchange rate regime was classified as “floating”.

A “floating” exchange rate is largely market-determined and where exchange market interventions are done to arrest undue fluctuations in the exchange rate, without targeting a specific level of the exchange rate.

In its latest review, the IMF has re-classified India’s de-facto exchange rate regime to “stabilised arrangement” for the period of December 2022 to October 2023. In this regime, the exchange rate remains within a narrow margin of 2 percent for six months or more due to exchange market interventions.

While India’s de-facto exchange regime was classified as “floating” by the IMF, the central bankers have typically referred to the regime as “managed float”, implying the use of exchange market interventions to manage the exchange rate.

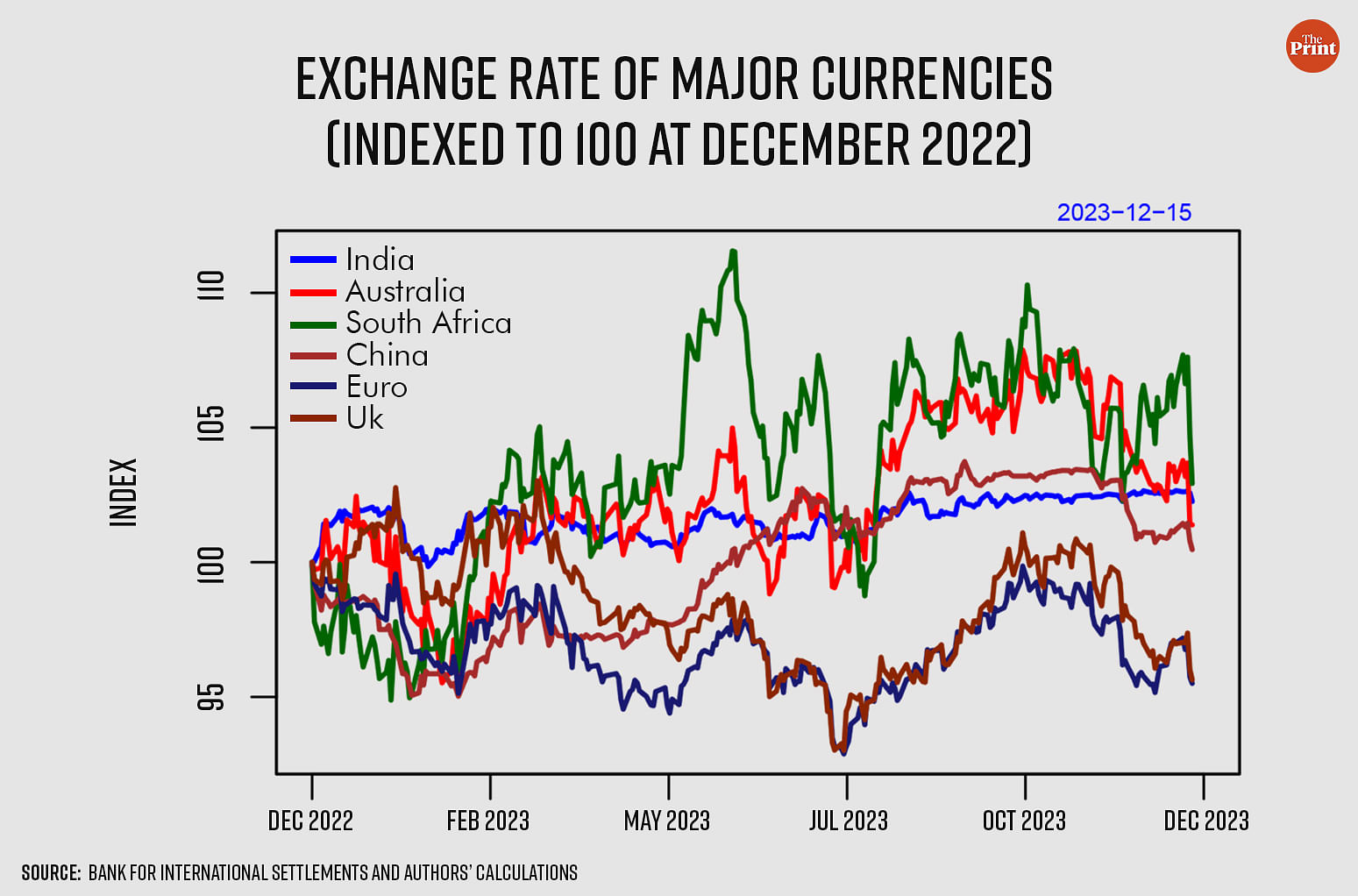

During the said period, exchange rate was broadly stable with fluctuation less than 2 percent. A comparison of exchange rate movements with some of the major currencies shows that the Indian rupee was the most stable from December 2022 to October 2023.

It is no secret that the RBI intervenes to prevent exchange rate swings.

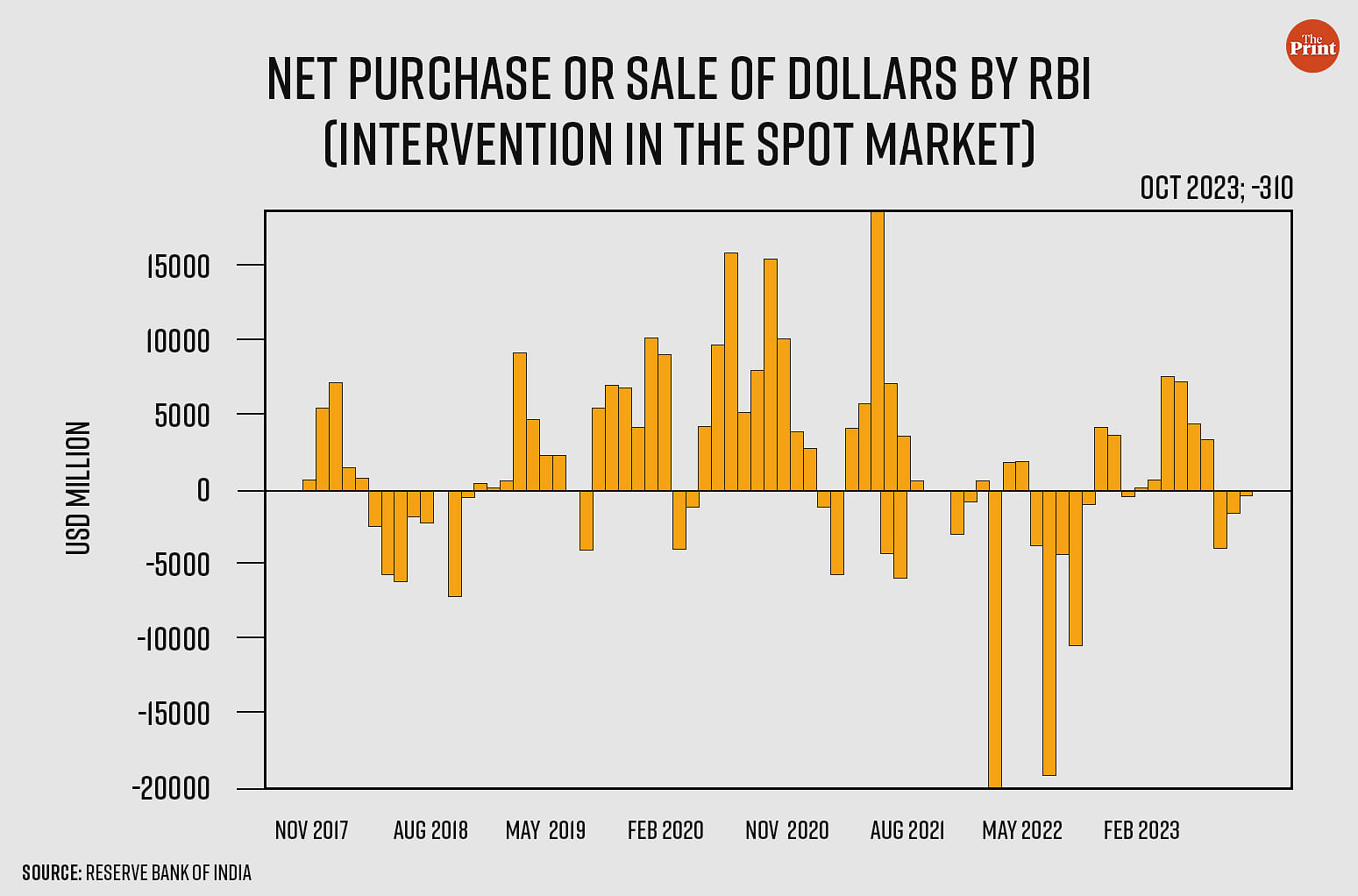

Between December 2022 and July 2023, the RBI made net purchases of dollars to prevent an appreciation of the rupee, with the exception of January, 2023.

In August, September and October 2023, the RBI was a net seller of dollars to prevent depreciation pressure on the rupee. Cumulatively, in April-October, the RBI made net purchases of USD 17.37 billion. Interestingly, the scale of intervention in the April-October period was the lowest in the last five years. In the three-year period prior to December 2022, the rupee depreciated by almost 15 percent despite excessive intervention by the RBI. The IMF’s choice of the time period to re-classify the exchange rate regime lacks explanation and thus seems arbitrary.

Risks to debt sustainability

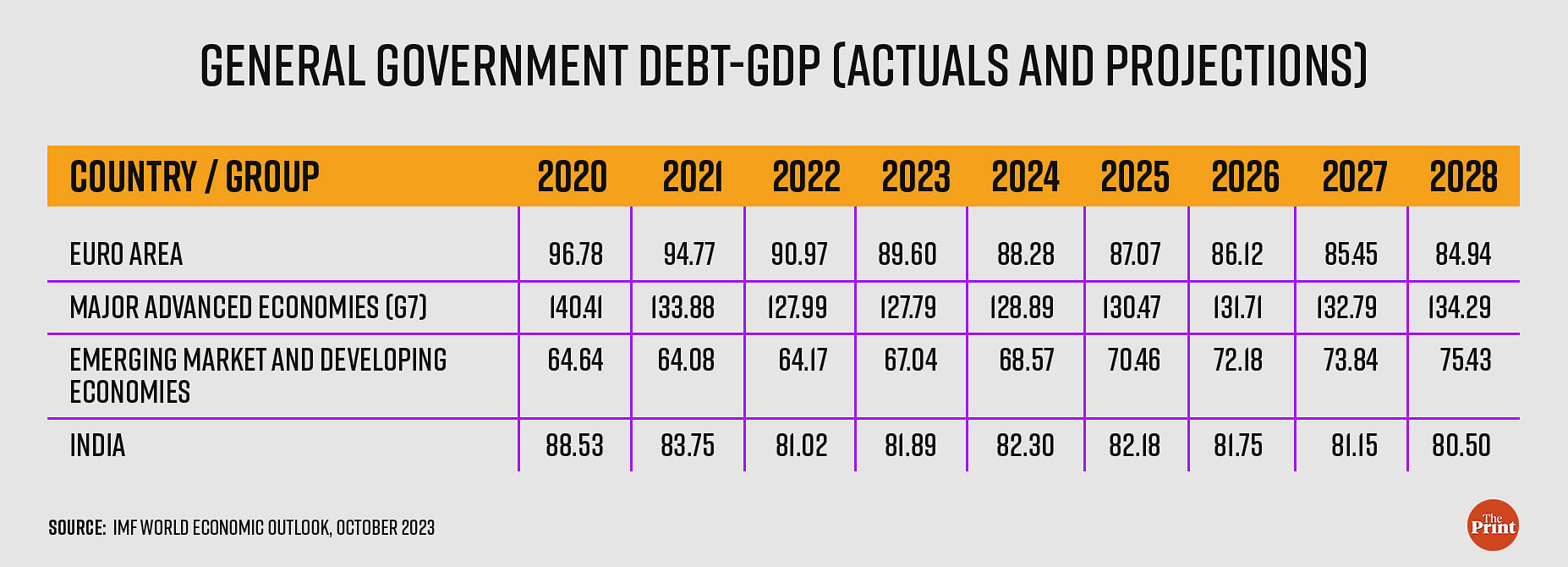

The IMF has flagged long-term risks to India’s general government debt trajectory. While the IMF projects debt to decline gradually over the projection period (till 2028), it notes that long-term risks to debt sustainability are high as substantial investment would be required to meet challenges relating to climate change mitigation and adaptation, particularly in the light of India’s ambitious commitments.

It is important to note that the spike in global debt during the Covid shock was primarily owing to advanced economies where debt surged to 140 percent of GDP. India’s debt was at 88 percent of GDP. Though it is likely to remain elevated and trend down gradually over the medium term, the possibility of debt crossing 100 percent of GDP seems extreme as of now.

The continued negative interest growth differential is likely to help maintain India’s debt sustainability. However, a more ambitious fiscal consolidation roadmap will help in a steeper reduction of India’s outstanding debt.

Useful proposals on fiscal responsibility legislation and data reporting

The IMF has put forth some useful proposals, such as the much-needed post-pandemic review of the Fiscal Responsibility Legislation, plugging gaps in data reporting and review of the state level fiscal responsibility laws. The IMF proposed that states could have different fiscal anchors (targets) depending on their current fiscal position and debt sustainability risks. This could make the state bond yield more responsive to the states’ fiscal performance.

Rapid growth in unsecured personal loans needs monitoring

The IMF in its review emphasised the importance of improved and enhanced banking supervision to address emerging vulnerabilities, particularly the rise of unsecured personal loans. The rapid expansion of unsecured loans could pose risks to banks’ balance-sheets and thus presents a case for prudential tools to limit the growth of such loans. At present, non-performing assets in the unsecured loan segment are low. For instance, State Bank of India in its recent analyst meet mentioned that NPA in the unsecured loan segment is only 0.69 percent.

The RBI has recently increased risk-weights on unsecured retail loans to strengthen risk management. This will likely discourage the growth of unsecured loans.

Radhika Pandey is associate professor and Utsav Saksena is a research fellow at National Institute of Public Finance and Policy (NIPFP). Views are personal.

Also read: Lower October tax revenue growth & higher spending as 2024 polls near could strain govt finances