India’s Gross Domestic Product (GDP) growth stood at 4.4 per cent on a year-on-year basis for the quarter ending December. While an unfavourable base (strong growth in December quarter of 2021-22) was expected to result in a moderation in GDP growth, the slowdown was further driven by revisions in GDP data of previous quarters.

Alongside the quarterly numbers, the National Statistical Office (NSO) also released the second advance estimate of GDP for the current year and revised estimates (RE) for previous years. The revised estimates for 2020-21 suggest that with improved data coverage, including estimates to capture the informal sector, the adverse impact of Covid was milder than anticipated earlier.

Slowdown in Covid-impacted year lower than earlier estimates

The NSO released the revised annual GDP data for the previous years: third revised estimates for 2019-20, second revised estimates for 2020-21, first revised estimates for 2021-22. For the current financial year, the NSO released the second advance estimates of GDP.

Revisions in the GDP figure for the Covid-impacted 2020-21 indicate that the quantum of slowdown was lower than the earlier estimates. The provisional estimate for 2020-21 showed a contraction of 7.3 per cent. The first RE showed a milder contraction at 6.6 per cent. The second RE released on 28 February showed an even milder contraction at 5.8 per cent for 2020-21.

This shows that with updated data on production and prices, use of Annual Survey of Industries (ASI), augmented data for non-financial private corporate sector, and actual data on expenditure and receipts in the central and state government budgets, the economy seems to have performed better as compared to earlier estimates.

For 2021-22, the first RE show a growth of 9.1 per cent against 8.7 per cent as per the provisional estimates. The first RE form the base for arriving at the second advance estimates for 2022-23. Even at a higher base of 2021-22, the second advance estimates pegged the growth for the current year at 7 per cent.

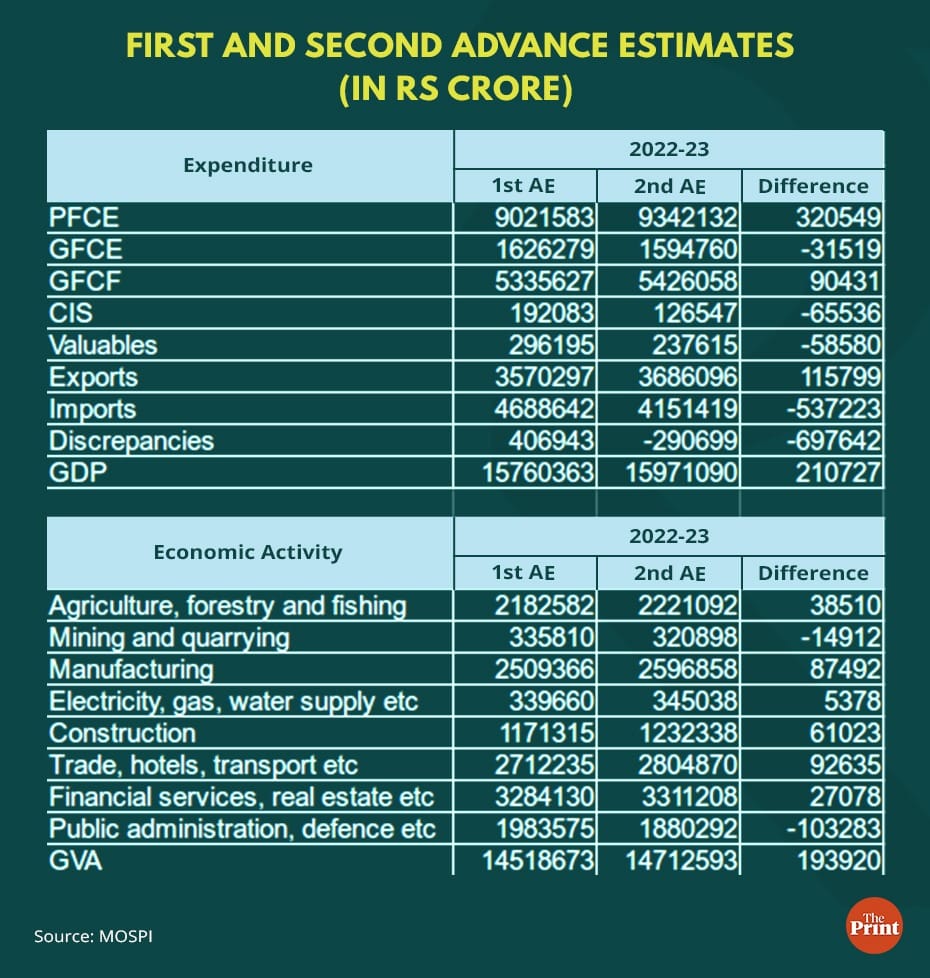

In absolute terms, the second advance estimates exceeded the first advance estimates for the current year by more than Rs 2 lakh crore. This increase has been primarily led by higher estimates for private consumption and investment. Particularly, private consumption is estimated to overshoot the first advance estimate by more than Rs 3 lakh crore. It remains to be seen if such a rebound in consumption will be possible, given the global uncertainty and sustained monetary tightening.

In addition, according to the second advance estimates, exports would fare better while imports will moderate in the current year, thus the component of net exports is projected to support higher growth. It seems that the recent encouraging numbers on the services trade front has led to the favourable revision in exports and imports numbers, while a steep contraction in export financing suggests weak demand for India’s merchandise exports.

Slowdown in quarterly numbers driven by revisions

India’s GDP growth in the October-December quarter slowed to 4.4 per cent, down from 6.3 per cent in the July-September quarter. The revisions in the annual numbers also led to revisions in quarterly estimates for the previous years. Without the revision to the third quarter of last year, the GDP growth for the December quarter would have been 5.1 per cent. The good news is that the sequential recovery did not lose momentum. Sequentially, (growth over the September quarter) came in at 3.5 per cent.

Gross Value Added (GVA) was 4.6 per cent, more than the GDP estimate as the net taxes component was negative, on account of higher subsidy outgo in the December quarter. Sectorally, growth was supported by agriculture and services, while industry saw an uneven growth. Electricity and construction posted a growth of more than 8 per cent (year-on-year). Growth in construction can be attributed to rebound in demand for housing and government’s push on infrastructure.

Manufacturing sector continues to be a pain point with a second consecutive quarter of contraction. Sales of firms in the manufacturing sector have seen a secular moderation over the last two quarters. According to data from the Centre for Monitoring Indian Economy (CMIE), the inflation adjusted sales for the manufacturing sector slowed to 2.98 per cent in the December quarter from 5.98 per cent in the previous one. Profitability of firms has also seen a hit owing to increase in interest expenses. Growth in this sector is critical for job creation. Services continued to post a healthy growth in the December quarter.

On the expenditure front, gross fixed capital formation grew by 8.3 per cent, reflecting the Government’s capex push. The worry is in the sharp moderation in private consumption to 2.1 per cent in the December quarter, from 8.8 per cent in the previous quarter. But this decline is partly owing to an unfavourable base. On a sequential basis, consumption posted a growth of 7.3 per cent but there is a seasonal element at play. Looking forward, private consumption could take a hit due to high inflation and sustained rise in interest rates.

Government’s revenue expenditure is seen to be subdued as reflected in the second consecutive quarter of contraction in government final consumption expenditure.

Looking forward

The imputed growth for January-March quarter based on the annual data and data for three quarters is estimated at 5.1 per cent. While the government’s capex push, services growth momentum and moderation in Wholesale Price Index (WPI) is likely to support growth, the early onset of summer, the moderation in merchandise exports and a likely waning of domestic demand could pose a risk.

Radhika Pandey is a Senior Fellow and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: How services trade surplus, led by robust exports, is helping balance India’s trade deficit