Modi 3.0 government’s full budget for 2024-25 retains focus on fiscal consolidation. The fiscal deficit for FY25 is pegged at 4.9 percent of the gross domestic product (GDP), well below the 5.1 percent target proposed in the interim budget.

The additional fiscal space, owing to the higher-than-expected dividends from the Reserve Bank of India, has been used to increase revenue expenditure in key sectors, while, at the same time, accelerating the path towards fiscal consolidation.

Assuming that the risks from geopolitical turmoil do not exacerbate, the fiscal deficit target of 4.5 percent for FY26 looks achievable. Beyond FY26, the government would focus on reducing the debt-to-GDP ratio. Commensurate amendments to the Fiscal Responsibility and Budget Management (FRBM) legislation would give clarity on the changed fiscal framework.

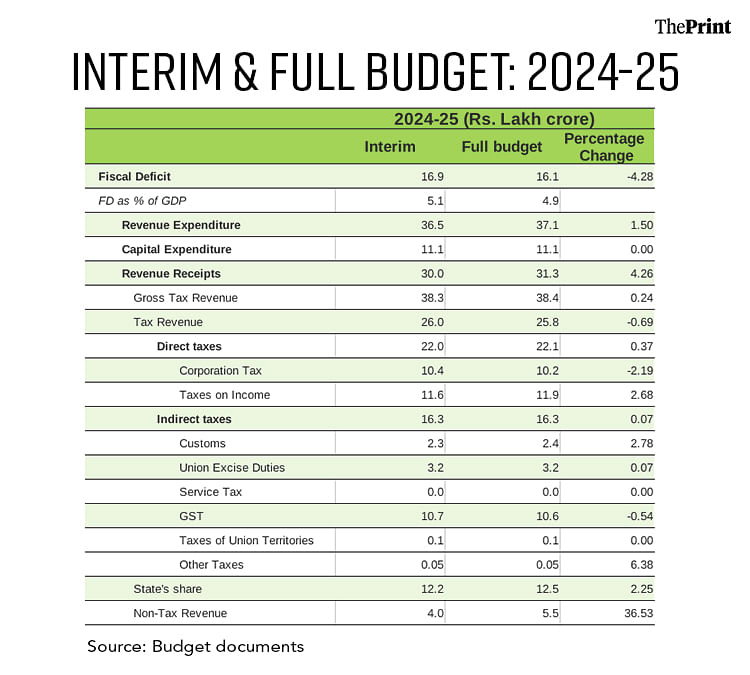

From interim to full year budget

The target for capital expenditure has been retained at Rs 11.11 lakh crore. However, the composition has changed a bit. The allocation for interest-free loans to states has been raised from Rs 1.3 lakh crore in the interim budget to Rs 1.5 lakh crore in the full budget. But this will be conditional upon the state governments partnering with the central government in the rollout of new generation reforms.

In an environment where the government had to manage diverse expectations, it has been able to cap the rise in revenue expenditure to around Rs 55,000 crore, compared to the interim budget. The expenditure would be used towards the additional spending on housing, employment-linked schemes, and financial assistance to Bihar, Andhra Pradesh and a few other states.

The allocations for food, fertiliser and fuel subsidies remain the same as the interim budget, while the outlay on interest payments has been lowered.

Gross tax revenues are broadly unchanged, with a marginal increase of 0.2 percent over interim budget estimates. The upside from higher capital gains tax was offset by income tax relief, lower taxes on foreign companies, and several custom duty cuts, including on gold and silver.

The net tax revenue to the Centre is lower by Rs 18,000 crore. Correspondingly, the state’s share in taxes has inched up by Rs 27,428 crore (an increase of 2.2 percent). As a percentage of gross tax revenues, states’ share stands at 32.5 percent, as against the Fifteenth Finance Commission’s recommendation of 41 percent. The rest is accounted for by cesses and surcharges, which are not shared with the states.

The projection for nominal GDP growth is retained at 10.5 percent, the same as in the interim budget. The growth projection is conservative and may surprise on the upside.

As an outcome of the reduction in deficit, the government has reduced its planned market borrowings through dated securities by Rs 12,000 crore. The new borrowing target is Rs 14.01 lakh crore, down from the Rs 14.13 lakh crore announced in the interim budget.

A standout feature of the borrowing plan in the full budget is the reduced reliance on short-term borrowing. The cut in short-term borrowings will lower yields at the shorter end of the yield curve, and will also lower yields for short-term corporate bonds.

The government has reduced its dependence on small savings for financing its fiscal deficit. This seems like a prudent approach, given that the cost of borrowing is higher, compared to market borrowings.

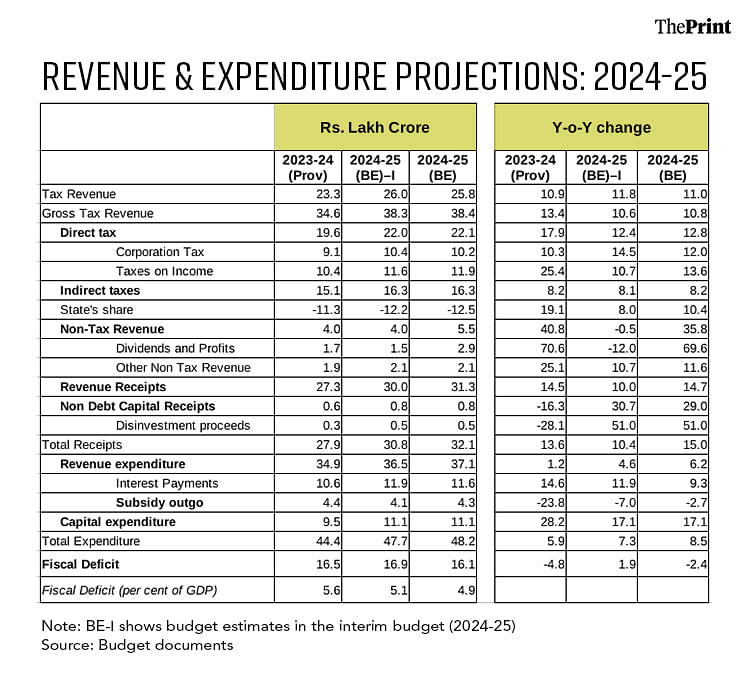

Revenue & expenditure projections

The finance minister has pencilled in a net tax revenue of Rs 25.84 lakh crore in FY25, up 11 percent over the provisional actuals for FY24. Direct tax revenues are projected to grow by 12.8 percent. Last year, direct taxes grew by 17.9 percent, driven by a 25 percent rise in income taxes.

Within direct taxes, corporation tax is expected to grow by 12 percent and taxes on income by 13.6 percent. The projection for corporate tax growth has been revised downwards, compared to the estimate in the interim budget due to decline in profits of companies in the first quarter of FY25.

If the profits continue their downward slide in the remaining quarters, the collections from corporate tax could be lower. While overall tax revenue projections look achievable, there could be some deviation on account of corporate tax collections, if commodity prices surge in the second half of the year.

Non-tax revenues have been raised to Rs 5.5 lakh crore in the full budget from Rs 4 lakh crore in the interim budget, reflecting higher RBI dividend. Overall the government’s revenue receipts are projected to grow at 15 percent.

The government has continued with its strategy of not keeping specific targets for disinvestment and asset monetisation, which it started in the interim budget. Proceeds from both the categories are represented under “other receipts”. Same as last year, an amount of Rs 50,000 crore has been budgeted under this head.

On the expenditure front, a useful metric to look at is the size of the budget. The size of the government budget can be expressed as the ratio of total expenditure to GDP.

There is a gradual compression in the overall size of the budget. It is seen at 15 percent for FY25. The quality of expenditure has seen an improvement over the years with capital expenditure rising to 3.4 percent of GDP from 2.5 percent in 2021-22. Concomitantly, the share of revenue expenditure has seen a decline.

For FY25, capital expenditure is projected to rise by 17 percent, while the revenue expenditure is expected to rise by 6.2 percent. In the first two months of the current year, capital expenditure was muted due to the elections. With eight months remaining, the ability to utilise the allocation for capex will be challenging for both the Centre and the states.

From fiscal deficit to debt-GDP ratio

The budget signalled a shift in the fiscal framework from 2026-27. The finance minister in her speech mentioned that the endeavour will be to fix the deficit, such that the debt as a percentage of GDP is on a declining path.

Clearly, the intent has shifted from targeting a single fiscal deficit number to reducing the stock of debt as percent of GDP. This is a welcome shift.

Rating agencies see India’s high debt, as a percentage of GDP, as a hindrance to upgrading India’s sovereign rating. As a next step, it would be useful to articulate a glide path to bring down the debt-GDP ratio through amendments to the FRBM Act.

Moreover, the states’ debt would also have to be considered while targeting a reduction in the debt as a percent to GDP.

Radhika Pandey is associate professor and Rachna Sharma is a fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.