New Delhi: The Securities and Exchange Board of India (SEBI) investigation into Adani Group’s alleged non-compliance with the rule regarding minimum public shareholding (MPS) requirements remains inconclusive, as it is still awaiting information on 13 overseas entities that have been classified as public shareholders of Adani companies.

In its latest report to the Supreme Court, disclosing the status of the market regulator’s investigation into short-seller Hindenburg’s allegations against the Adani Group, the SEBI said its investigation has covered 13 overseas entities — 12 FPIs (foreign portfolio investment) and one foreign entity.

FPI consists of securities and other financial assets held by investors in another country. FPIs are a component of the non-promoters/public shareholders’ grouping in listed companies.

According to the SEBI, listed companies have to maintain an MPS of at least 25 per cent.

However, “establishing the economic interest of shareholders of the 12 FPIs remains a challenge”, as “many of the entities linked to these foreign investors are located in tax haven”, noted the status report filed in the court Friday.

The regulator added that “efforts are still being made to gather details from five foreign jurisdictions pertaining to the economic interest of shareholders of the FPIs to help SEBI update this report accordingly”.

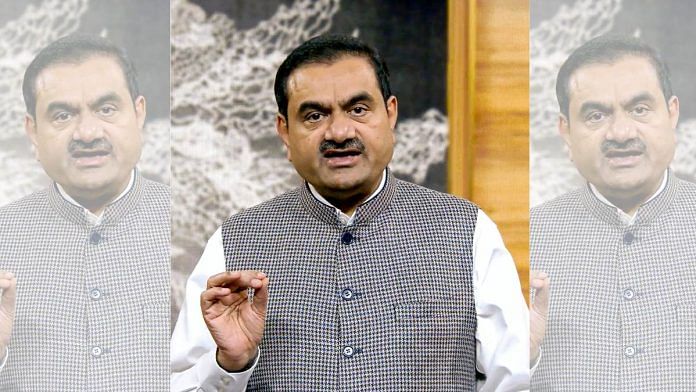

On 24 January this year, Hindenburg Research, a US-based investor research company, had released a report that alleged the Adani Group had “engaged in brazen stock manipulation and accounting fraud schemes over the course of decades”.

The SEBI undertook a probe into many of the alleged violations of the Adani Group following an SC order that was passed after petitions were filed on the basis of the Hindenburg report demanding an investigation into the company’s trading practices.

The top court had in March also formed a six-member panel, headed by a retired top court judge.

Allegations related to MPS norms were key to the Hindenburg report. The court-established panel had noted in its report submitted in May that SEBI had drawn a blank in its investigation, and that it was pursuing a “journey without a destination”.

However, the court had backed the idea of giving more time to the regulator to complete its probe.

Friday’s report also informed the SC that, out of 24 SEBI investigations, 22 were final in nature and two were interim. The one on MPS falls in the second category.

With regard to the interim investigation reports, SEBI has sought information from external agencies/entities, and upon receipt of such information it will evaluate the same to determine further course of action.

Giving an overview of the aspects of its investigation, the report listed out 11 transactions of Adani Group companies with various entities and the possible violations as well as alleged insider trading that have come under the SEBI’s scanner.

The other area in which SEBI has prepared an interim report pertains to the examination of trade pre-and post-release of the Hindenburg report.

According to the report, the regulator is awaiting information from external agencies and entities, without which it cannot give a final opinion on this issue.

(Edited by Nida Fatima Siddiqui)

Also Read: How to survive a bear attack — lessons for Adani in Ambani’s stock market victory in 1980s