Bonds in India may be poised for gains after the government refrained from adding to its near-record borrowing plan for the year, bringing relief to the market battered by rising Treasury yields and oil prices.

The administration will adhere to its plan to borrow Rs 12.05 trillion ($163 billion) in the year through March, the finance ministry said in a statement Monday. Finance Minister Nirmala Sitharaman had earlier indicated that the government may borrow about Rs 1.6 trillion extra, which led to traders expecting higher sales for the second half.

The news may support the domestic bond market weighed by the surge in U.S. Treasury yields on rising bets for the Federal Reserve to start tapering stimulus soon. Market focus will now shift to a key index review by FTSE Russell for the nation’s bonds on Thursday and any potential inclusion will trigger a rally.

“The market would be quite relieved that the government is not changing its borrowing program,” said Harish Agarwal, a fixed-income trader at FirstRand Bank. “It will definitely have some positive impact, with U.S. Treasury yields touching 1.5%, which is negative for the market.”

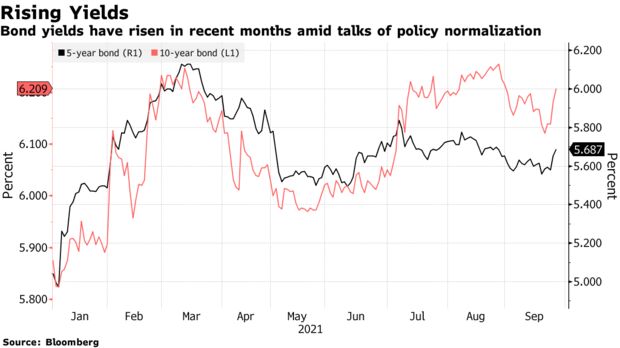

The yield on India’s benchmark 10-year bond has risen nine basis points to 6.21% over the last four sessions to its highest in a month as rising crude prices threaten to exacerbate inflation in the net oil-importing nation.

The Reserve Bank of India’s withdrawal of liquidity from the banking system has further weighed on sovereign debt. The central bank has started making its bond purchase program liquidity-neutral since last week by including an equivalent sell leg to the auctions. It has also started shorter variable rate repo auctions to modulate shorter-term liquidity.

“Based on the borrowing calendar, we expect government bond yields to open gap-down by at least 10 basis points,” said Aditi Nayar, chief economist at ICRA Ltd. “The 10-year yield is likely to range between 6%-6.2% in the coming quarter, with rising crude oil prices to counteract the benign borrowing figures.”

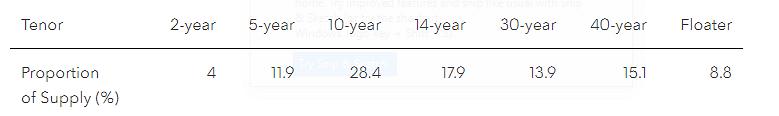

The government plans to sell Rs 5.03 trillion of bonds in the six months to March, compared with an earlier plan of Rs 4.8 trillion. The marginal increase is due to the shortfall in the first half of borrowing. First half borrowings were Rs 7.02 trillion, compared with Rs 7.24 trillion planned, according to the statement. The second-half borrowing will factor in compensating states for a revenue shortfall caused by the pandemic.

The table below shows the break-up of second-half supply:

Finance Minister Nirmala Sitharaman said in May that the government will borrow about Rs 1.6 trillion additional on behalf of states to compensate them for the shortfall in the goods and services tax revenues. Instead of extra borrowings, the central government passed Rs 750 billion from their own borrowings due to improved revenues in the first half.

India’s net direct collections jumped by 74% to Rs 5.7 trillion as of September 22, the government said last week. Revenue collections from goods and services tax rose by 30% to Rs 1.12 trillion, slightly lower than Rs 1.16 trillion in July.—Bloomberg

Also read: Indian investors face crucial week with announcements on bonds, govt’s borrowing plan