Thiruvananthapuram: In 2020, when the nation was grappling with the economic stress induced by COVID-19, Kerala’s then finance minister, Thomas Isaac, said that the Kerala Infrastructure Investment Fund Board (KIIFB) was the state’s strength. He emphasised that KIIFB’s projects would help transform the state into a strong economy, despite reduced income from various sources, including agriculture.

However, once lauded as a landmark initiative in infrastructural development by many, the KIIFB has come under severe criticism from the Opposition in the state this week for becoming a liability, especially at a time when Kerala is already reeling under a financial crisis.

“If we don’t do anything about it (the KIIFB), the financially stressed state will fall deep into a debt trap,” Leader of Opposition V.D. Satheesan said in the Kerala Assembly on 10 February this year.

The KIIFB is the key funding arm of the Kerala government for large-scale social and physical infrastructure projects.

Satheesan’s comment came days after the Kerala government, in a sharp deviation from its 2016 stance, decided to levy tolls on the roads built under KIIFB. In the Budget speech on 7 February this year, Kerala Finance Minister K.N. Balagopal said the state will study and explore the possibilities to transform the KIIFB into a revenue-generating entity.

The Kerala government attributed its move to impose toll on KIIFB roads on the Union government’s 2022 decision to include KIIFB’s borrowings under state limits.

The Fiscal Responsibility and Budget Management (FRBM) Act, 2003, stipulates that the state’s fiscal deficit should be under 3 percent of its Gross Domestic Product. Under the state’s 2025 Budget, Kerala’s fiscal deficit was 2.9 percent in 2023-2024.

The KIIFB used a variety of ways, primarily debt instruments such as General Obligation Bonds, Alternative Investment Funds (AIF), Infrastructure Debt Funds (IDF), revenue bonds, land bonds and making arrangements with banks or other international institutions authorised by the government, to mobilise funds.

The state government also provides budget allocations to cover repayment obligations and operational costs, with 50 percent of the Motor Vehicle (MV) Tax and a portion of the petrol cess designated for this purpose. If KIIFB fails to meet its repayment obligations, the state government, as the guarantor, is liable to cover the shortfall.

Though the KIIFB became a household name in the state after it undertook several projects from roads to school buildings, the Board is dependent on the state for its funds due to the lack of its own revenue sources.

According to KIIFB’s annual reports, it had a total revenue of Rs 5,629.30 crore in 2023-2024 against expenses of Rs 6,600.70 crore. In the same financial year, the body saw a loss of Rs 971.40 crore, with the Kerala government contributing Rs 967.71 crore.

In 2022-2023, the board earned Rs 5,533,3.65 crore and spent Rs 6,186.68 crore. The loss during the year was Rs 853.28 crore, while the contribution from the state government to meet the net loss was Rs 853.33 crore.

KM Abraham, the CEO of KIIFB, told ThePrint that “if the government of India hadn’t targeted the KIIFB, it would have been able to do the repayment through MV cess alone.” He said the revenue from MV tax was steadily growing and the KIIFB wouldn’t have had to look for other revenue-generation sources.

From the MV tax, the Kerala government transferred Rs 2,469.69 crore to KIIFB in 2023-2024; Rs 2068.08 crore in 2022-2023; and Rs 2,172 crore in 2021-2022.

Also Read: Kerala budget brings hikes in taxes & levies amid fiscal deficit crisis

The KIIFB model

The KIIFB was established under the Kerala Infrastructure Investment Fund Act 1999 by the government of the Communist Party of India (Marxist)’s E.K. Nayanar.

In 2016, during the first Pinarayi Vijayan government, it underwent a structural overhaul. Under the change, made through an amendment, the chief minister replaced the chief secretary as its chairperson. It also became a powerful body functioning as the Kerala government’s key arm for large-scale infrastructure investment.

K.G. Jayaprakash, the media coordinator of the KIIFB, told ThePrint that the KIIFB borrowed less than Rs 2,000 crore between 1999 and 2000 before the central amendment to include KIIFB borrowings under state limits.

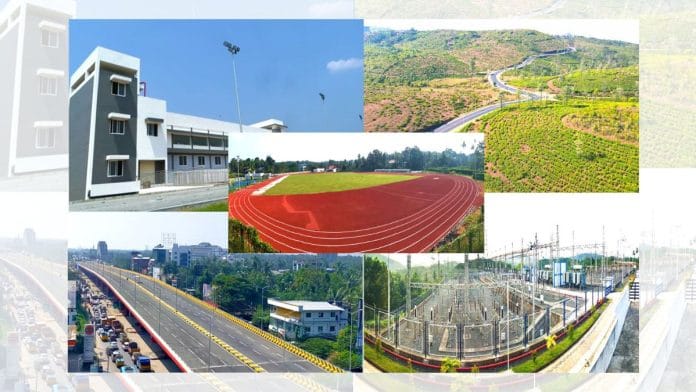

According to the Economic Review 2024, as of 31 August 2024, KIIFB approved 1,103 infrastructure projects worth Rs 86,170.24 crore in sectors, including healthcare, education, roads and transportation, irrigation and water supply, power, ports, inland navigation, drainage and solid waste management, 7 land acquisition projects, and 3 industrial parks.

As of 31 March 2024, Rs 39,749.32 crore, a major share of the KIIFB’s funds, have also been earmarked for the roads and road transport sector.

In 2023-2024, KIIFB approved 50 infrastructure projects worth Rs 2,541.66 crore. In the same financial year, it earned Rs 5,629.30 crore and an expense of Rs 6,600.70 crore. The board’s interest income from revenue-generating projects was Rs 5,58.1 crore, and the state’s contribution to meet the net loss was Rs 967.71 crore.

CEO Abraham said the KIIFB is a “very bold experiment,” adding that it ensures “the quality and timeliness of the project”.

“The state government is doing many projects without the help of the World Bank because of KIIFB,” he said, adding that 20 percent of the KIIFB projects were generating revenue.

Nirmal Roy V.P., an assistant professor at the Gulati Institute of Finance and Taxation, said the KIIFB model was an innovative approach and a crucial moment for sub-national financing, which could have been projected as the “Kerala model” to the world.

“In most parts of the world, a board like this will undertake only one project or one city. Here, the entire state is benefitting,” Nirmal told ThePrint.

Another economist in the state, Shaijumon C.S., explained that a body like the KIIFB is important for infrastructure development to ensure timely completion.

However, both economists suggested that the model could have been more sustainable if the KIIFB had its own revenue sources. Shaijumon said many of the projects undertaken by KIIFB are in social infrastructure, where there is no revenue.

“The government can invest in projects without revenue. But bodies that want to stay independent can’t go without revenue, it’s not sustainable,” Shaijumon said.

Nirmal said that the KIIFB, among its social sector infrastructure projects, should also explore those that generate revenue, such as solar power generation.

The KIIFB should have a “master plan” for its projects and revenue sources and the government should also announce the revenue sources in advance, he said, adding that KIIFB can continue working with available resources, but it will be limited as there is a cap on borrowing without Supreme Court interference.

In 2024, the Kerala government approached the Supreme Court against the Union government’s move. The matter is currently with a constitutional bench.

Abraham said generating revenue in social infrastructure is against the public policy of the state.

“Every government has its policies. Suppose if we have charged for the social sector, Kerala would not have reached where it is now,” he said. “Even in the social sector, we are spending on developing infrastructure that will make more students benefit from it. That will increase the human resources of the state.”

Masala bonds controversy

The 2020 Comptroller and Auditor General (CAG) of India report said the KIIFB “borrowed/raised funds amounting to Rs 3,106.57 crore” from financial institutions till 2018-2019. This included Rs 2,150 crore through masala bonds in foreign countries, which were to be repaid from the fund set apart by the state.

The report said such off-budget borrowings are not in accordance with Article 293 (1) of the Constitution of India. The article says that the state governments have an “executive power” to borrow from the Consolidated Fund of the state—that is, the government account—from time to time.

In 2019, KIIFB became the first Indian sub-sovereign entity to debut a ‘masala bond’ of Rs 2,150 crore on the London Stock Exchange. A ‘masala bond’ is a debt instrument issued by Indian companies in overseas markets, though denominated in Indian rupees.

In November 2020, months before the Kerala Assembly elections, the Enforcement Directorate (ED) began an investigation into the overseas borrowing of KIIFB for the alleged violation of the Foreign Exchange Management Act (FEMA). The ED had also sought clarifications from the Reserve Bank of India for issuing the No Objection Certificate (NOC) to KIIFB in this regard.

The ED summoned Abraham and then Finance Minister Thomas Isaac in this regard against which the finance minister approached the Kerala High Court. The KIIFB alleged that the state was “selectively targeted” by the ED for the inquiry.

Jayaprakash said the ED case fizzled out in 2024 as KIIFB repaid the Rs 2,150 crore it borrowed through a masala bond in time.

“It was borrowed for five years. We paid back the amount with interest even before the time limit,” he said, adding that RBI had also given clarifications to the ED.

(Edited by Sanya Mathur)

Also Read: From Davos pavilion to ‘masala bonds’, LDF pulls out all stops to separate ideology from investments