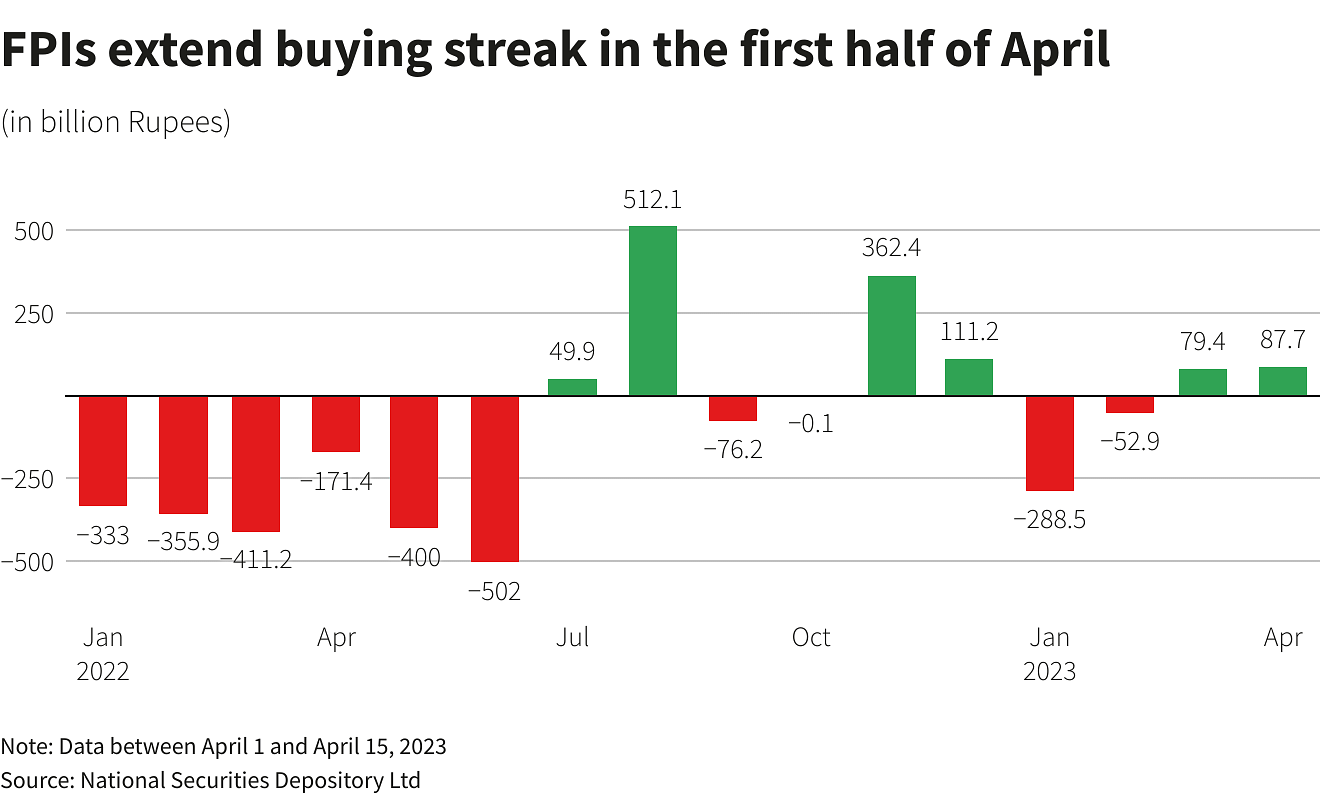

Bengaluru: Foreign portfolio investors (FPIs) started the new financial year buying Indian equities, according to National Securities Depository Ltd (NSDL) data.

FPIs purchased shares worth 87.67 billion Indian rupees ($1.07 billion) on a net basis in the first half of April. They had been net buyers in the previous month too, but that was largely due to U.S. boutique investment firm GQG Partners’ $1.87 billion investment in four Adani Group companies in early March.

The benchmark Nifty 50 slid 4.12% between January and March this year, lowering its price-to-earnings ratio to 20.44 as of March 31, from 21.79 at the start of the year, according to NSE data.

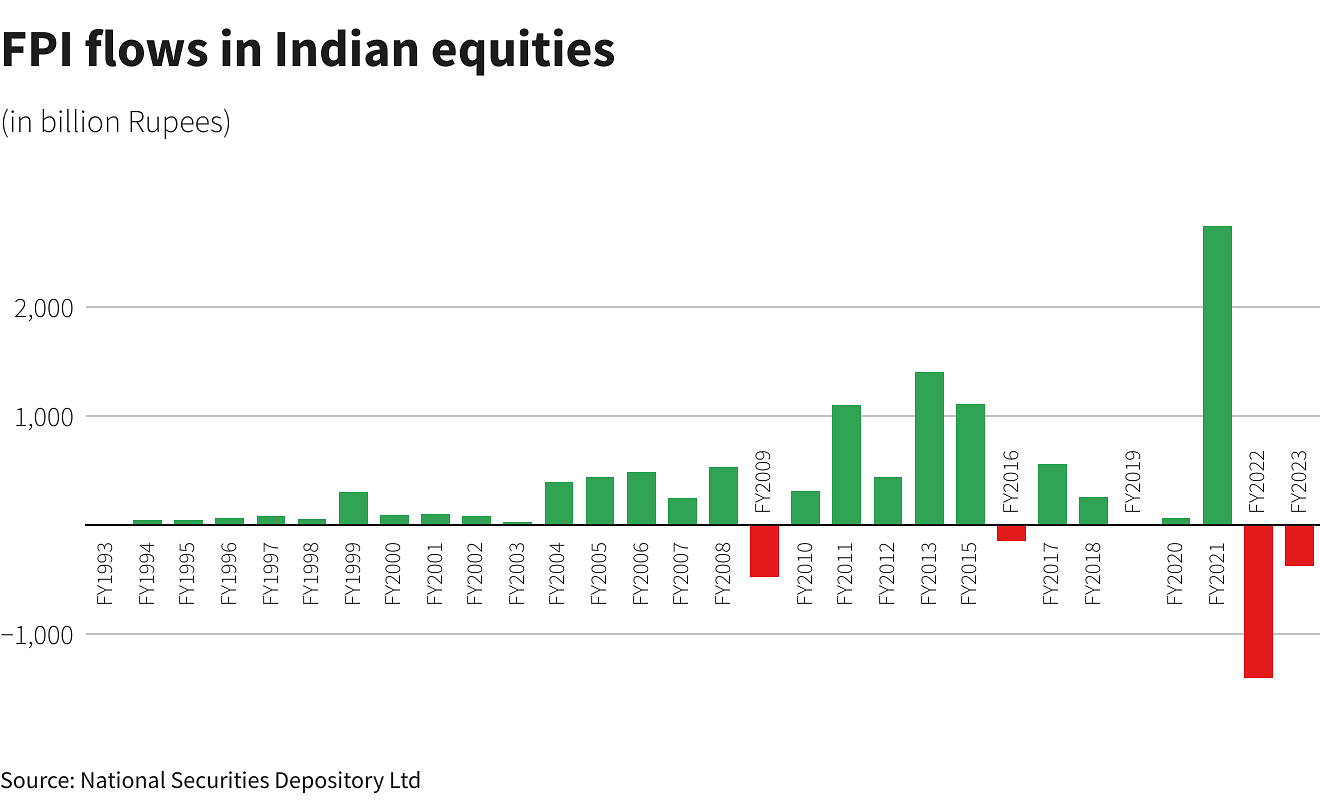

FPIs sold equities worth 376.32 billion rupees in the previous fiscal, marking two straight years of net sales for the first time. The sales came after record purchases of 2,740.32 billion rupees in FY2021.

Analysts expected FPI flows to improve after the selling witnessed in the last two financial years.

“Foreign flows for the last two years have been negative. Rarely have foreign investors been aggressive sellers of Indian equities for three years in a row,” G Chokkalingam, founder and head of research at Equinomics, said.

Aided by the FPI buying, the Nifty 50 rose 2.7% in the first half of April.

Purchases and sales

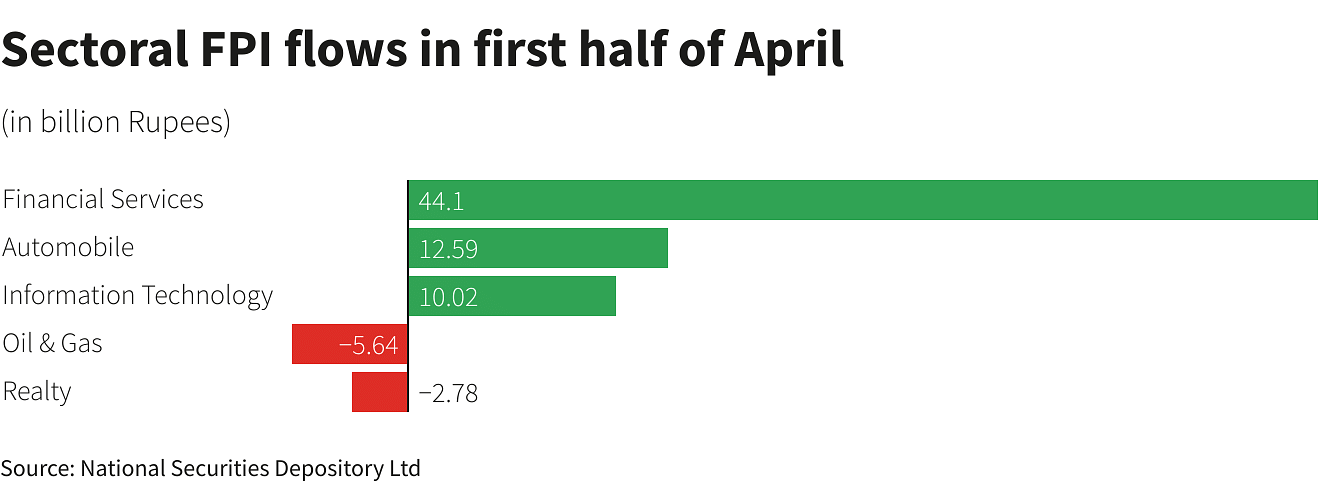

After selling financial services shares worth 299.93 billion rupees in FY2023, FPIs bought 44.10 billion rupees in the sector in the first half of April. Analysts said that easing risks of a contagion in the global financial system and domestic lenders’ strong growth prospects aided sentiment in the space.

Information technology saw renewed interest with foreign investors adding 10.02 billion rupees, while the auto segment also witnessed FPI buying.

The Nifty 50 is down nearly 2.79% in 2023 so far, making domestic valuations attractive.

Broader markets have witnessed a sharper correction than the benchmark Nifty 50 with the smallcap index losing 4% in 2023 so far. The steep fall in smallcap stocks also attracted domestic mutual funds, which bought over 21 billion rupees worth of equities in the segment in March.

($1 = 82.1550 Indian rupees)

(Reporting by Bharath Rajeswaran in Bengaluru; Editing by Janane Venkatraman)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.