New Delhi: From hiding it in wigs, to tucking it away in suitcase linings, to swallowing it, to concealing it in body parts — there are few lengths that Indian gold smugglers won’t go to in order to get the precious metal into the country, if videos of customs seizures are anything to go by. But a whole lot more slips through undetected.

According to the latest ‘Smuggling in India Report’ released this month by the Directorate of Revenue Intelligence (DRI), the country’s apex anti-smuggling body, the government seized 833 kg of contraband gold worth Rs 405 crore in the financial year 2021-22.

But as impressive as that may seem, it’s less than 1 per cent of all the gold that gets smuggled into India, previous DRI data suggests.

In its 2019-20 report, the DRI had noted that roughly 150-200 tonnes of gold are smuggled into India annually. One tonne is 1,000 kg, so 833 kg amounts to a mere fraction of the shiny contraband that makes its way into the country every year.

Also read: India’s laptop imports surged to $5 bn in first 9 months of 2022. Nearly 73% came from China

A market for smuggled gold

India is the world’s second-largest consumer of gold after China, with the precious metal highly sought after not just for ornaments but also as an investment.

However, since India produces gold on a very small scale, it relies largely on imports to meet demand. This is where things start to get murky.

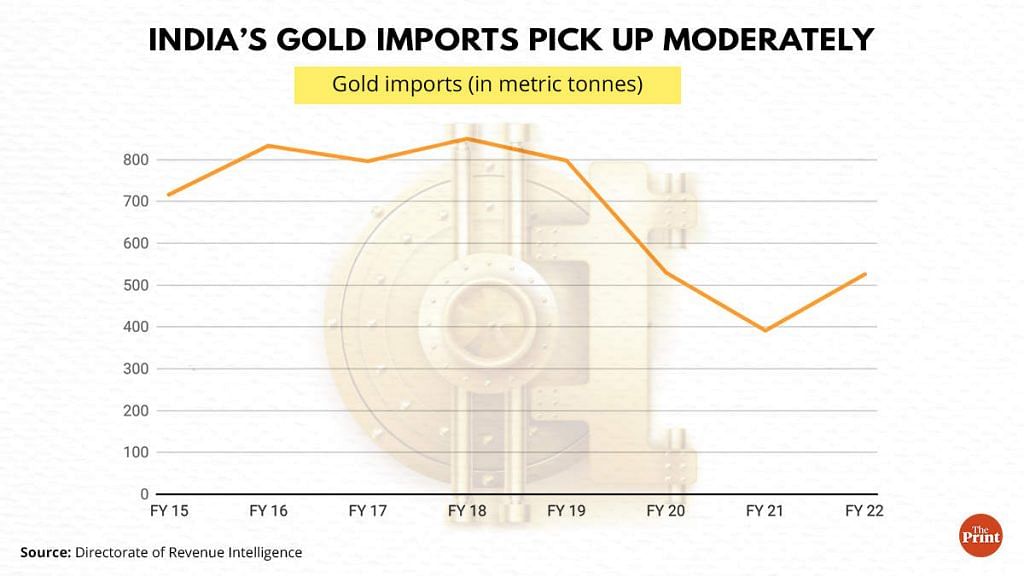

In FY 2021-22, India imported about 525.8 tonnes of gold, which is about 35 per cent higher than the imports for 2020-21, which stood at 391.3 tonnes. Prior to this, from 2016–17 till 2018-19, India imported about 800 tonnes of gold on average every year.

However, these imports fall short of India’s gold consumption, which is where the DRA’s estimates of smuggling come in.

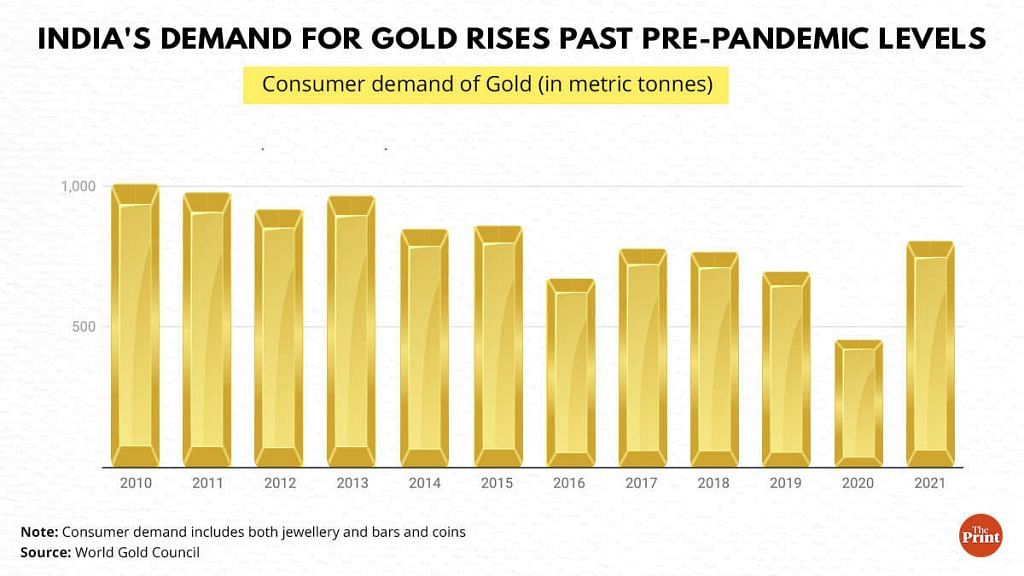

In its 2019-20 annual report, the DRI said: “While the Indian demand for gold is ever increasing, it is estimated that about one-sixth of the total volume of gold entering India is by way of illicit trade. India imports about 800-850 tonnes of gold every year while its annual consumption is around 1,000 tonnes. This suggests that roughly 150-200 tonnes of gold are being smuggled to the country every year.”

Estimates from the World Gold Council, an international trade body, also show that prior to the pandemic, in 2019, 120 tonnes of gold entered India via smugglers. Notably, during the pandemic, when flights were not operating, gold smuggling had decreased.

While the estimates of gold smuggled to India for the current fiscal year are yet to arrive, the 833 kg confiscated by the authorities this year is very likely to be just the tip of the iceberg.

Why gold smuggling is on the rise

India has seen an increase in gold smuggling since 2011, experts say, and this is linked to the quantum of taxation.

“I think there is a clear relationship between smuggling and high taxation and restrictions on gold across the world,” said Chirag Sheth, principal consultant (South Asia) of Metal Focus, a precious metals research firm based in England.

“Gold smuggling wasn’t an issue prior to 2011, when taxes on gold imports were negligible,” he added.

India’s gold tax graph has only gone up in the past one decade, data shows.

Prior to January 2012, gold imports used to attract a duty worth Rs 300 per 10 grams. This in the 2011-12 Budget was raised to 2 per cent. In the 2012-13 Budget, it was doubled to 4 per cent in 2012-13.

As India’s current account deficit (CAD) worsened, the import duty on gold was revised three times in 2013 to contain it. CAD occurs when the total value of a country’s imports exceeds that of exports.

The import duty on gold increased to 6 per cent by January 2013, and then further to 8 per cent and 10 per cent in June and August respectively, leading to protests from jewellers across the country.

Flash forward to 2022, when another current account deficit looms in India. Once again, the government has resorted to hiking taxes. In July this year the import duty on gold was raised to 15 per cent from 10.75 per cent.

Smugglers who channelise gold from countries which are either gold producers or have a low tax policy tend to gain as their tax-free gold is cheaper, and thus finds more takers.

“The smugglers gain only when their gold is cheaper than the market price. But it’s not just them. Even individuals who go on foreign trips try to get gold in illicit ways to finance their travel expenses. This is happening because the price difference is too much,” said N. Anantha Padmanabhan, former chairman of the All India Gem and Jewellery Domestic Council.

So, what’s the solution? According to Padmanabhan, reducing import duty can help curb smuggling.

“Even if the government slashes the import duty to 5 per cent, the organised gold market can supply at a competitive price, which will make smuggling a less lucrative business,” he said.

This is something that the Indian government is mulling over, even if not to 5 per cent. According to a Bloomberg report earlier this week, the trade ministry is considering reducing the import tax in gold to 10 per cent from 12.5 per cent in order to rein in smuggling.

(Edited by Asavari Singh)

Also read: Excess imports, sluggish exports — what makes India’s current account deficit more challenging