New Delhi: Actions taken by the US on curbing solar cell imports from China have meant Indian exports of these items jumped 12-fold in the first eight months of this year, as compared to the same period of the previous year, with most going to the US.

However, this has simultaneously led to a peculiar situation where Indian solar cell manufacturers are focused on exports, while our own solar power developers — who need the solar cells as well — are largely dependent on importing the cells from China and its neighbours, who are increasingly seeing India as an attractive market.

ThePrint analysed government data on India’s exports and imports of two types of solar cells — photovoltaic cells that have been assembled in modules or panels, and cells that have not been assembled.

The data shows that India exported a total of $1.3 billion of these two types of cells in the January-August 2023 period, up from just $108 million in the same period of 2022.

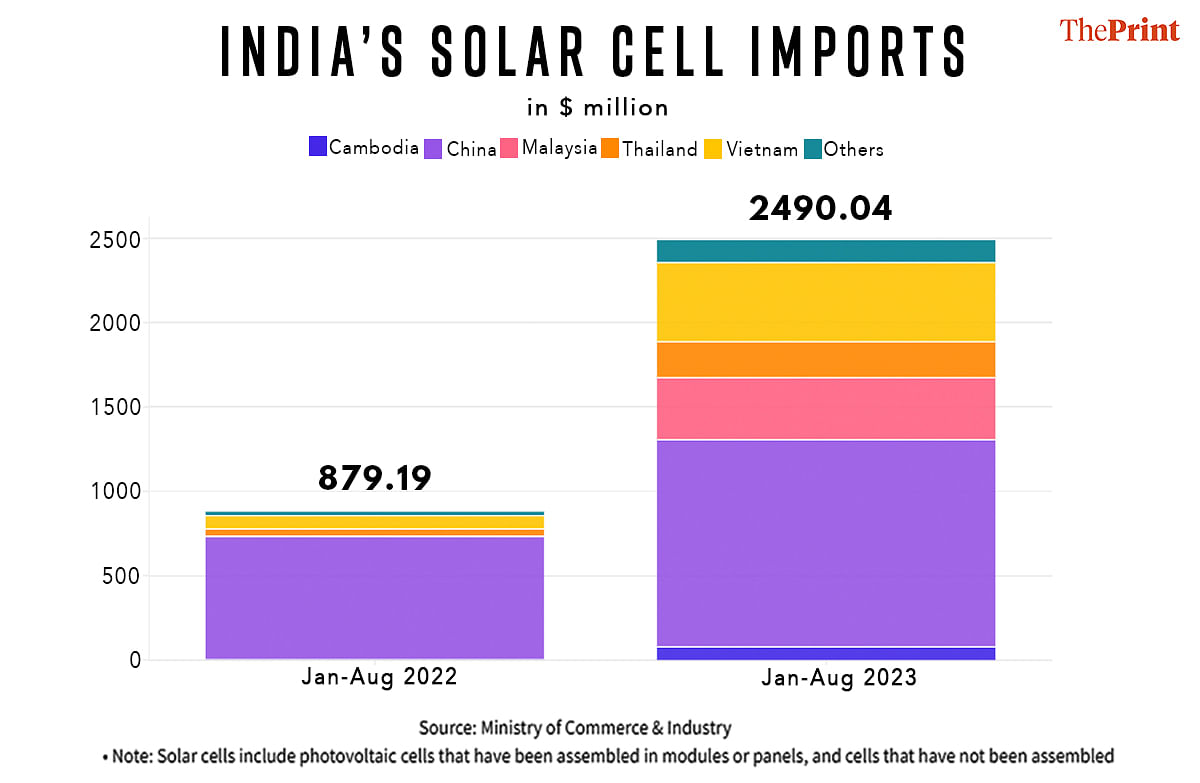

At the same time, though, India’s imports of both types of cells nearly tripled over the same period — from $879 million in January-August 2022 to $2.5 billion in the same period this year.

The reason for this, according to experts tracking and operating in the solar sector in India, is that although the government has taken several steps to encourage the domestic production of these solar cells, the price at which they are sold is still higher than that of imported cells. Further, the government has also eased some import restrictions for the solar sector.

Additionally, countries such as Cambodia, Malaysia, Thailand and Vietnam — against whom the US has imposed import tariffs — have now turned to India to sell their products.

The wafer-thin margins of Indian solar power producers mean that they are still overwhelmingly dependent on imported cells, while the domestic producers of these cells are being increasingly attracted by export markets.

“India has set up an ambitious target for renewable energy and for that we need solar panels come what may from wherever,” Jaideep Malaviya, Managing Director at Malaviya Solar Energy Consultancy, and Secretary General at the Solar Thermal Federation of India, told ThePrint.

“Simultaneously, the government realised that the neighbouring countries were benefiting more from this,” he added. “The government has come up with a PLI (Production-Linked Incentive) scheme, but that will take its own time because it will require a gigantic investment in India for the panels to be produced at competitive rates that can benefit the domestic power producers.”

Also Read: Share of Asian countries in India’s exports is falling, Europe’s is rising. Why this is worrying

US action benefiting India

The US has for some time now been curbing solar-related imports from China over allegations that China was making use of “forced labour” to produce these components.

In June 2021, the US customs department said it would block the imports of polysilicon from a Chinese company due to the alleged use of forced labour.

Then, in December 2021, the US enacted the Uyghur Forced Labor Prevention Act, which came into effect from June 2022. Under the Act, the US blocked the import of “goods mined, produced, or manufactured wholly or in part” in the Chinese province of Xinjiang or any other place listed by the customs department.

“This is a phenomenon we have been noticing since last year, and it’s happening largely for two reasons,” Rajashree Murkute, Senior Director of Ratings at CareEdge Ratings, told ThePrint. “One, is that the US had restricted solar module imports from China and that led to US demand being diverted to other countries.”

“The second is that the US has a mandate to not buy imports from countries that engage in forced labour, which it found China was engaging in, especially in its silicon facilities,” Murkute added.

It was after this that India’s solar export story really turned a corner.

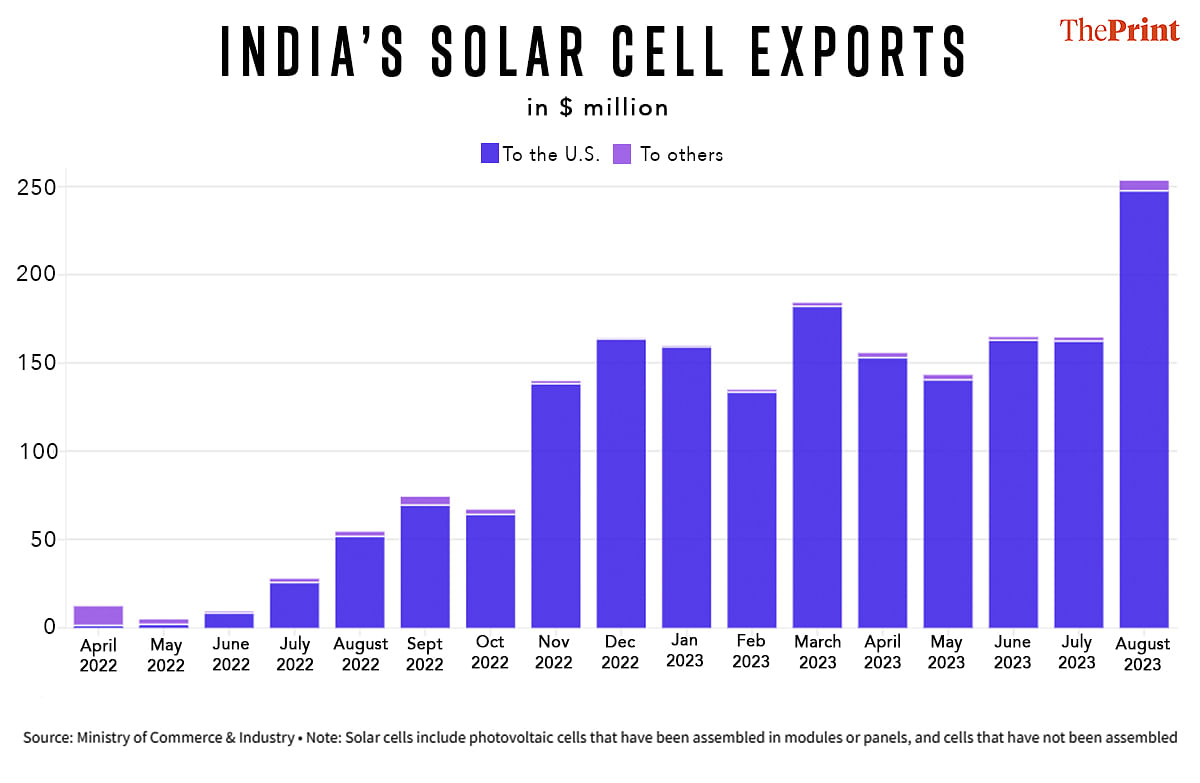

In July 2022, India exported more photovoltaic cells than it did in the previous four months combined, and since then, India’s exports of these components have grown strongly every month — from $54.4 million in August 2022 to $253 million in August 2023.

In all of this, it is the US that is driving India’s solar cell export growth. The data shows that where the US accounted for about 11 percent of India’s solar cell exports in April 2022, by August of that year, its share had shot up to 95 percent. It further rose to nearly 98 percent in August 2023.

According to Murkute, Indian cell manufacturers are able to command prices that are about 1.5 times higher when they export the cells than if they sell them domestically.

However, Malaviya said that it is not as if the domestic manufacturers are only looking to export. Instead, exports are now emerging as a parallel attractive source of revenue for these companies.

“Exports are fetching them good value,” he explained. “Today, what’s happening is that because exports are fetching a good price, they are catering to that market.”

“However, their order books for India are equally full. It’s not that they are only exporting, but the thing is that exports are being explored increasingly now,” he added.

Snubbed by US, South East Asian exporters turn to India

Ongoing actions by the US have not only boosted India’s solar exports, but are likely to have also led to an increase in the nation’s solar imports.

Earlier this year, the US concluded a 17-month long investigation into whether China was routing its solar component exports through other South East Asian countries. The US subsequently imposed varying levels of duties on solar imports from Cambodia, Malaysia, Thailand and Vietnam.

The data shows that these countries have turned to India instead.

Over the last year, not only have India’s solar cell imports nearly tripled, but the shares of each of these countries in these imports has grown significantly.

So, while China’s share in India’s solar imports came down to a still-dominant 49 per cent in the January-August 2023 period from an overwhelming 83 per cent in the same period last year, the gap has been filled by Cambodia, Malaysia, Thailand and Vietnam, the government data analysed showed.

Cambodia’s share has increased 10 times from 0.3 per cent to 3 per cent over this period, Malaysia’s jumped from 0.4 per cent to 14 per cent, Thailand’s from 4.8 per cent to 8.5 per cent, and Vietnam’s from 8.9 per cent to nearly 19 per cent.

India’s import dependence to continue

The Indian government has put in place several incentives and protections for domestic solar cell manufacturers, including an import duty of 40 per cent and 25 per cent on solar modules and solar cells, respectively, and a Rs 18,500 crore PLI scheme for the sector.

However, despite this, Malaviya believes that Indian solar power producers will be dependent on imports for a while now.

“Silicon wafer production is dominated by some countries, and until we set up a comparable scale of manufacturing, we will be dependent on imports,” he said. Silicon wafers are a key component in solar cells.

Murkute added that the government’s decision to extend the deadline by a year for a rule that would have limited India’s solar imports to only “authorised manufacturers” has also eased the import process for domestic power producers.

In March this year, the government exempted solar sector imports from the ‘Approved List of Models and Manufacturers’ requirements until the end of March 2024. This means there are no sourcing restrictions on Indian solar power companies until that time, which has allowed them to import cheaper inputs.

Once the new rules are implemented from April 2024, they will only be able to import approved items from approved manufacturers.

(Edited by Nida Fatima Siddiqui)

Also Read: Why Australia’s Lowy Institute says India is Asia’s 4th biggest power but still an ‘underachiever’