New Delhi: The municipal corporations of four Tier-2 cities in Uttar Pradesh — Agra, Kanpur, Prayagraj and Varanasi — will issue municipal bonds by the end of this year to raise funds from the market for infrastructure development projects.

With this, Uttar Pradesh will become one of the few states in India and the only northern state to have six cities — the other two being Lucknow and Ghaziabad which issued municipal bonds in 2020 and 2021 — raise money from the market through bonds.

Municipal bonds are debt instruments that are issued by municipal corporations to raise funds from the market to build sewer systems, water supply systems, schools, and other civic infrastructure.

While issuing the bond, civic bodies promise investors a specified interest rate and state a time period when the principal will be returned along with interest. For this, civic agencies have to create an account or block a portion of their regular revenue source for payment of the money to investors.

UP government officials told ThePrint that the bond initiative has led to major fiscal reforms in the municipal corporations, bringing transparency and accountability.

“Till a few years ago, one couldn’t have thought of these cities raising money from the market. We were always dependent on the state government for funds,” said a senior official from the Kanpur Municipal Corporation.

According to UP government officials, the state’s focus is on urban development, infrastructure development and upgradation, and addressing basic civic governance and service-related issues.

Amrit Abhijat, principal secretary in the urban development department, told ThePrint: “The UP government believes municipal bonds will emerge as a credible source for funding innovative infra projects and planning for the long term.”

“We are not going for money only. The most important thing is to set up a structure which is lean and an account book that is rationalised. In order to get a good credit rating, you have to be fiscally prudent,” he added.

While the amount the civic bodies plan to raise is not much — between Rs 50 crore and Rs 100 crore each for water supply and other essential service projects — government officials said the exercise has brought about a change in the way finances are managed.

“For issuing of the bond, all annual accounts and balance sheets have to be audited, asset-valuation done and service level benchmarks and bank balance put in order. This leads to better municipal governance,” Abhijat pointed out.

“So far, asset mapping was not being done by urban local bodies. Once the exercise is complete, the corporations will be in better financial condition.”

The UP government is also exploring the possibility of setting up a financial intermediary, which can assist other urban local bodies, especially of smaller cities and towns, to raise money from the market.

“We are exploring the possibility of setting up an Uttar Pradesh finance authority or a similar body based on the work done by states such as Gujarat, Tamil Nadu etc, to help cities issue municipal bonds,” Abhijat said.

The development of civic infrastructure in most cities, especially Tier-2 and Tier-3 cities, has not kept pace with the fast-paced urbanisation in India.

Municipal finance and governance experts told ThePrint that renewed focus on urban development will help cities in the long run.

“In large and fast urbanising states like UP, it is a positive sign that they have started paying attention to urban development, which was not the case earlier. In the past few years, we have seen the state is taking urbanisation and urban development far more seriously,” Srikanth Viswanathan, chief executive officer of Janaagraha, a Bengaluru-based think-tank that has worked extensively on the financial health of municipalities, told ThePrint.

Upside of bond initiative

The Agra Municipal Corporation (AMC) has identified assets worth Rs 5,000 crore in the past one year during an asset valuation exercise undertaken, as part of preparations to issue a green municipal bond (to finance environment-friendly projects) by September, according to its commissioner.

The AMC plans to raise Rs 50 crore from the market through the bond for a Rs 270-crore water supply-cum-solar power project. The exercise has led to financial transparency with accounts being audited by a third-party, AMC commissioner Ankit Khandelwal told ThePrint.

“The preparation for the municipal bond has helped the corporation streamline the accounting system and brought financial transparency, as we had to get our accounts audited. It has helped us identify and plug gaps. The municipal asset valuation, which was never quantified earlier, will play a big role in how we plan our future projects and look for ways to boost our revenue,” he said.

Like Agra, Kanpur and Prayagraj will raise Rs 100 crore and Rs 50 crore, respectively, for water supply projects, senior officials in the corporations told ThePrint.

“We had to change the way we were keeping our accounts, as they had to be audited by a third-party. It was a difficult process. As ours is a water supply project, we also had to get the accounts of the water department in order. It has made the system more accountable and transparent,” the Kanpur Municipal Corporation official quoted earlier said.

Prayagraj has also proposed two solar power projects along with plans to lay water supply pipelines in the city.

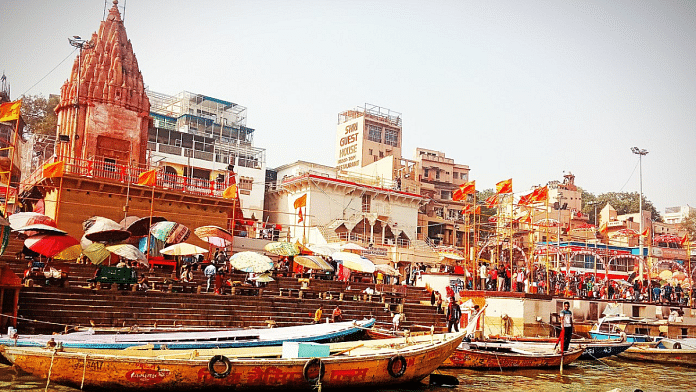

The Varanasi Municipal Corporation, which has an annual budget of about Rs 700 crore, has sent a proposal for three projects, including construction of a budget hotel, to the state government for approval, officials said.

Also Read: Wrong turn? 6 states & UTs failed to meet even 20% of PMGSY rural road goals: MoSPI report

A word of caution

While experts say that municipal bonds are a good way to raise money, it is not the only way to improve the financial health of municipal corporations, which are largely dependent on state governments for funds.

“Once municipal corporations start participating in the market, it makes them more accountable. But municipal bonds are not the only way to fix the accounting system. They shouldn’t issue bonds just for the sake of it. It should be because municipal bonds are best suited for financing a particular project,” Viswanathan told ThePrint.

Presenting the 2023-24 Union Budget, Finance Minister Nirmala Sitharaman had said the Centre would incentivise cities for issuance of municipal bonds. “Through property tax governance reforms and ring-fencing user charges on urban infrastructure, cities will be incentivised to improve their creditworthiness for municipal bonds,” she had said.

Debolina Kundu, professor at the National Institute of Urban Affairs, had a word of caution.

Kundu told ThePrint that municipalities “have an obligation to pay back the principal to investors, for which their most lucrative sources of revenue gets tied to service the bond”. “This can pose a huge challenge for a city, especially Tier-2 or Tier-3, in case there is an emergency like a natural calamity or a pandemic-like situation,” she added.

Kundu pointed out that in the long run, issuing of bonds can “jeopardise the financial health of corporations”, which generally have low share of their own resources and high dependency on state funds, “impacting the overall condition of the municipal corporation”.

According to experts, there is a need for state governments to play a proactive role, because for a sustainable bond market the amount raised has to be much higher.

For this, a state-level urban infrastructure financing entity is needed that can issue bonds on behalf of these cities. “A specialist entity will be better placed to assist cities in raising money from the market, as Tier-2 and Tier-3 cities will not be able to sustainably do this,” Viswanathan told ThePrint.

Kundu pointed out that in states such as Tamil Nadu and Karnataka, pooled financing and financial intermediaries have been formed which facilitate the small cities to access the capital market by providing some cushion at low interest rates.

(Edited by Nida Fatima Siddiqui)