New Delhi: Fifty-seven per cent of all fraud in India happens via online platforms and 26 per cent of Indian organisations have lost over $1 million to such scams, states a new report by financial advisory services firm Pricewaterhouse Coopers (PwC).

The report titled Platforms: The new frontier of fraud in India was released last week and is the second edition in a series of reports titled ‘Platforms: The new frontier of fraud in India. PwC’s Global Economic Crime and Fraud Survey 2022: India Insights’.

While the first part of the series focused on all kinds of fraud and economic crimes suffered by companies, the second focuses on “platform fraud” — the largest source of fraud suffered by Indian companies.

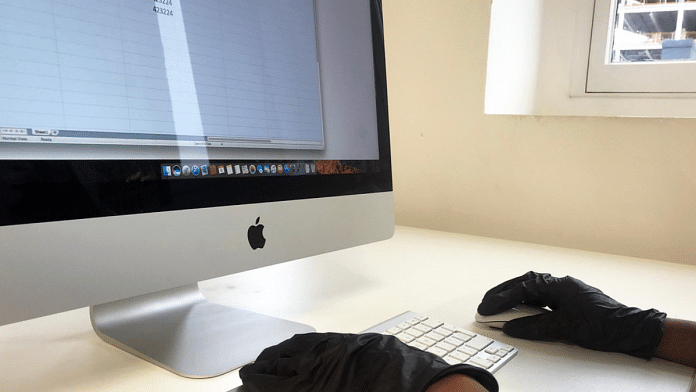

The report described ‘platform fraud’ as those that happen via an online platform such as fraud associated with social media, enterprise, and e-commerce.

The report is based on survey responses from 111 organisations across India, including industries like technology, financial services, banking and capital markets, consumer products and retail, education, healthcare, hospitality and leisure, and industrial products and manufacturing.

According to the report, half the companies had a turnover of over $ 1 billion.

According to the report, fraud perpetrated using online platforms has become more common since the Covid pandemic, when remote work, e-commerce delivery applications and contactless payments — all saw a rapid increase in usage.

“Social media platforms connect us every day. E-commerce platforms provide access to goods and services. And enterprise platforms help companies interact with customers, process transactions and move funds”, the report said.

It added that Indian companies were more susceptible to platform fraud than those abroad.

According to the report, on average, Indian organisations operate five platforms in the normal course of business against the global average of four.

“As a result, the incidence of platform fraud is a lot higher in India”, Puneet Garkhel, PwC partner and leader, Forensic Services, said in the report.

Common methods used in ‘platform fraud’

The most common examples of platform fraud experienced in India were unauthorised transactions, such as card payments, unauthorised transfer or removal of data, and victim-initiated fraudulent transactions, the report stated.

Introducing malicious software, or malware, and ransomware into an enterprise platform the company uses for its work is another example of platform fraud.

Ransomware is malicious software that can be used to encrypt a victim’s computer files, essentially locking the victim out of their own system until a ransom is paid. A user trying to open files locked and encrypted by ransomware will keep getting a message prompt demanding a ransom or showing an email address to contact the hacker.

Identity theft or taking over a company account without permission is also described as a fraud in the report, along with stealing or cloning the contents of a company device.

“Enterprise platforms are most likely to be the site of malware, phishing, money laundering and ransomware incidents. Ransomware, in particular, has grown into a dangerous threat with the potential to inflict catastrophic damage”, the report said.

The report highlighted that 44 per cent of perpetrators commit fraud for financial gain, while 41 per cent of platform frauds were conducted by “internal perpetrators”.

It found that 26 per cent of the platform frauds involved collusion between internal actors and external perpetrators.

“This implies that if companies have stronger internal controls in place, over two-thirds of all platform frauds can be mitigated”, the report added.

(Edited by Richa Mishra)

Also Read: India is the sixth most data-breached country in world, says study by cybersecurity firm