Data released by the Reserve Bank of India (RBI) last week shows a pick up in bank credit, led by credit growth of large companies. This improvement seems to be mainly on account of higher credit disbursal by the State Bank of India (SBI). Credit to infrastructure grew at 18.5 per cent. In credit to industry, the already minute share of small firms fell further.

When RBI had attempted to clean up bank balance sheets, push for recognition of bad assets and put weak banks under the prompt corrective action (PCA) framework, it resulted in a sharp slowdown in bank credit growth.

Recent months have seen a reversal in RBI’s stance under the new governor. It is reported that regulation is more lax and many banks have been taken out of the PCA framework. In addition interest rates have been cut.

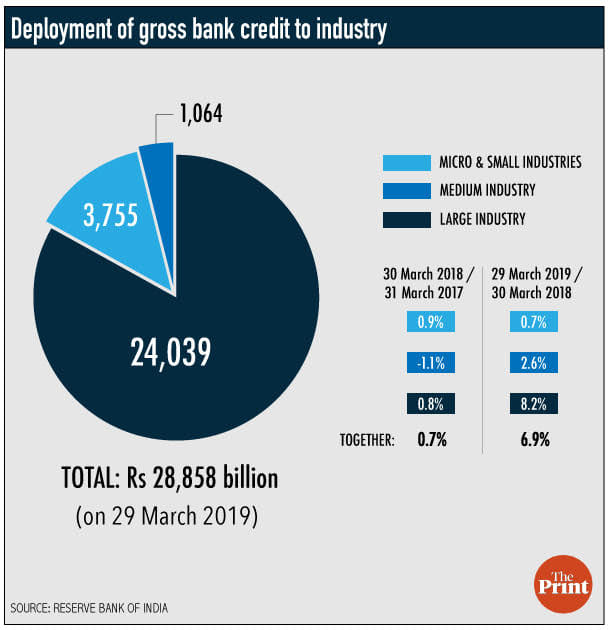

As a consequence, total bank credit grew by 12.2 per cent in the financial year 2018-19. The total credit to industry grew by 6.9 per cent.

Where the growth is coming from

Across firms, large companies have the highest share of bank credit in industry, relative to medium or small and micro enterprises. Growth of credit to industry was driven by large firms at 8.2 per cent. Credit to small and micro firms grew by less than 1 per cent.

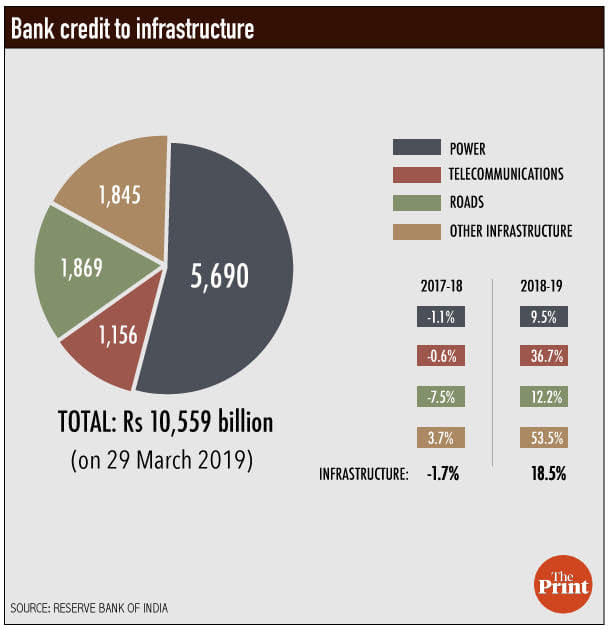

The sectoral composition of bank credit growth shows a sharp increase in credit to infrastructure which grew at 18.5 per cent in the 2018-19 fiscal. The growth rate was negative in 2017-18 at -1.7 per cent. The numbers show the continued dependence of infrastructure on banks. Considering the asset liability mismatch in bank lending to infrastructure, increased credit to the sector raises risk for banks.

Also read: Guide to banks’ annual inspection reports that Supreme Court wants RBI to disclose

Bad health of banks?

Most banks have not released financial statements for the full year ending in March 2019. The latest data available is for December 2018. We find that while banks under the PCA framework continue to be weak, even those outside it are not very healthy. SBI is the exception.

Recently, the RBI has moved many banks such as Bank of India, Allahabad Bank, Corporation Bank and others out of PCA. However, these banks continue to slip on credit growth.

Among the ‘healthy’ banks, Punjab National Bank shows negative credit growth and 16.3 per cent of assets as gross non-performing assets (NPAs). Canara Bank shows positive growth, but this growth rate declined from September to December 2018.

SBI is the only bank for which capital adequacy ratio, gross NPA and credit growth have all shown an improvement. Bank of Baroda shows some improvement but with the capital adequacy ratio worsening.

In other words, the growth of credit does not seem to be coming from a general improvement in the health of the banking system.

The overall picture emerging from the latest data on bank credit highlights the lack of fundamental reform in the banking sector. Small and medium enterprises remain deprived of credit. The lack of a bond market encourages both large corporate and infrastructure companies to borrow from banks.

Unless long term financial sector reform to build a bond market and a competitive banking system is undertaken, small temporary fixes as have been done in recent months by RBI might give some increase in credit growth, but the fundamental weaknesses in the financial system will remain unaddressed.

The author is an economist and a professor at the National Institute of Public Finance and Policy. Views are personal.

Also read: More banking consolidations in India can lead to higher efficiency, say RBI researchers

Tinkering around the margins. The government’s large borrowing programme will harden interest rates, apart from preempting resources away from the private sector. If infrastructure projects are not viable, it matters little whether they are funded by normal bank loans or other “ innovative financial solutions “. Power and banking remains two deeply troubled sectors whose reform should have been taken up in May 2014. 2. Now comes the grudging admission that the economy is indeed slowing down. Automobile dealerships are shutting down, two every week. There is something called the Indian Economic Service. Wonder if anyone takes their advice, listens to them occasionally.

This article is saying nothing new. It is asking for bond market reforms for long term borrowing and banking reforms, both of which are pending for many years but definitely since 2014. Whether a project is financed by bank or bond matters when it fails and no one can ex ante say that a project is going to fail or succeed. Of course, it is also true that most of the infrastructure projects have run into troubles mainly due to various issues which have not been timely addressed by the government. Seeking expert advice from IES cadre is a novel idea! I would rather wish they do their routine work more efficiently than advising government on policy issues. We do have RRR, Kaushik Basu, Amartya Sen for free advice!!