Kochi: Kochi’s LuLu Mall isn’t just a place to shop. As India’s biggest mall, it is more like a sightseeing destination — you can even book a tour package to experience it.

When it first opened in 2013, there was nothing around — senior executives at LuLu Group International remember how there wasn’t even a roadside food cart nearby. Now, the mall has become a bustling new city centre with a metro station that opens directly into it.

India’s nearly 25-year-old mall boom has entered its next heady stage. While powerful builder behemoths such as DLF and the K Raheja Corp dominated real estate development early on, Middle East-based LuLu Group is India’s new mall-builder today. It is leading a second mall boom to build a shiny, new, aspirational India for Indians who are global citizens with global standards.

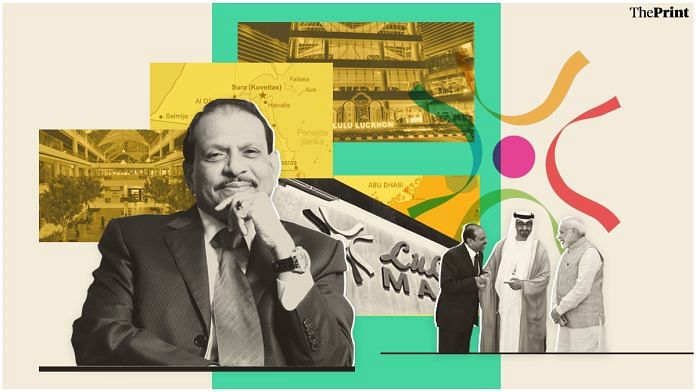

The new projects are helmed by Thrissur-born MA Yusuff Ali, the managing director who is now a sort of corporate ambassador pulling off deals that diplomats dream of.

Ali spans political divides and is building big in both the Bharatiya Janata Party (BJP) and non-BJP states. LuLu Group is turning into the Modi-era mall builder, reflecting a new globalism and assertion. Its growth, however, is occurring at a particularly difficult time for construction czars — when senior professionals of Supertech, Amrapali, Unitech, and Parsvnath have been raided, arrested, or gone bust, and the spectre of ghost malls is also spreading. That is why LuLu is more than just a mall builder — it has insulated itself by foraying into vital infrastructure, IT parks, and food processing projects.

LuLu is present in BJP CMs Yogi Adityanath’s Uttar Pradesh and Bhupendra Patel’s Gujarat, centrally ruled Kashmir, and Communist Party of India (CPI) CM Pinarayi Vijayan’s Kerala. Since 2013, LuLu has opened malls in Thiruvananthapuram, Bengaluru, and Lucknow, and has plans to open more in Hyderabad, Chennai, Noida, Ahmedabad, Prayagraj, Calicut, Kottayam, and Varanasi. It operates convention centres and hotels in these cities and even holds stakes in airports and tech parks. The company is also investing Rs 200 crore in Jammu and Kashmir to set up a food processing and logistic hub.

In July 2022, a video of some men offering namaz in Lucknow’s LuLu Mall went viral and sparked a controversy in the state. Hindu groups protested against the mall authorities and accused Ali and the mall’s management of employing only Muslims and sending profits back to the Middle East. While the mall management team was spared, CM Adityanath directed officials to arrest the “miscreants creating anarchy and communal tensions”.

“Getting into a market like UP, which is perceived to have a challenging business environment, must have been tough for a businessman from South India based in the UAE,” says Bobby Naqvi, former editor of Gulf News. “But his proximity with the Prime Minister’s Office must have helped a lot, which might be why the CM inaugurated the mall too.”

Also read: BJP wooing Kerala cardinals. But Christians say they never take voting cues from church

The ‘Yusuff Ali factor’

Ali isn’t just the chairperson of LuLu Group — he is an important part of the Middle East’s business community and touted by several as a model NRI who works with the Indian government, facilitates the country’s global outreach, especially in the Middle East, and also gives back to the community.

The unassuming billionaire is always spotted at public events with foreign dignitaries — from state representatives to businesspersons such as Gautam Adani, Mukesh Ambani, and the Trump family — ready with his signature smile and a handshake. If a prominent political leader or businessperson visits the Middle East, chances are they will cross paths with Ali.

And Indian Prime Minister Narendra Modi has crossed paths with him multiple times — for Ali, the PM is reportedly just a phone call away.

Their friendship through the years is documented in various photographs at public events, both in the Gulf and India: Ali leaning toward Modi with a plastic folder on his lap during the PM’s first visit to the UAE in 2015; Modi gripping Ali’s upper arm as he introduces him to the King of Bahrain in 2019; Ali congratulating Modi on being conferred Abu Dhabi’s highest civilian honour in 2019; Modi standing by and watching Ali shake hands with the King of Saudi Arabia in Riyadh in 2019; Modi listening intently to Ali in January 2023.

Also read: ‘Selling dreams to small people’—Kerala’s lottery system powers ambition, addiction

Kerala’s knight in shining armour

While his uncle set up LuLu Group, it was Ali who built it into a business empire. It’s now one of the biggest employers in the Middle East, and so ubiquitous that there’s always a LuLu hypermarket nearby. LuLu Mall isn’t a luxury shopping complex like Bengaluru’s UB City or New Delhi’s DLF Emporio — it caters to everyday shoppers wanting a taste of the international at home.

The group serves over 1.5 million consumers a day, owns over 250 hypermarkets, supermarkets and shopping malls in 10 countries, and runs sourcing operations in 26 countries. It’s almost like the Middle East’s Walmart.

Ali is a knight in shining armour for Malayalis — a model immigrant employing thousands of Indians abroad and investing in his home country. He helps Indians navigate the Middle East, even coming to their rescue if they get caught up in legal complexities. The head of LuLu Group paid blood money of nearly Rs 1 crore to secure a pardon for a Malayali man on death row in the UAE.

Ali reportedly moved to the Middle East in 1973 and started out by working at a family-run shop. Stories of his magnanimity abound as he rose to the top, including tales of his family’s generosity back home in Kerala, like when an elderly woman came to return a bangle Ali’s mother had loaned her to mortgage. He reportedly belongs to a traditional merchant family, and his father is said to have kept meticulous records — the flair for business clearly ran in the family. And it seems to be passing down to the next generation—two of Ali’s three sons-in-laws are also Malayali Middle East-based business tycoons with connections to real estate, hospital, and hotel industries, respectively. Shamsheer Vayalil runs hospitals, founded VPS Healthcare, and is a member of the UAE Medical Council — he’s also one of the board of directors of Kerala’s Kannur International Airport. Ali’s second son-in-law is closer to home: Adeeb Ahmed is the founder of LuLu International Exchange and is also managing director of Twenty14 Holdings, which manages LuLu’s hotels across the world.

He’s close to the royal families of Abu Dhabi and Dubai and was, in fact, the first to receive a ‘Golden Card’ from the UAE government, a first-of-its-kind permanent residency program. He and other big investors became permanent residents in 2019.

Over the years, LuLu Group has created its largest footprint in the Middle East. The group was recently awarded “Most Admired Retail Company of the Year”, beating over 135 competitors from across the region. It also struck one of the UAE’s biggest consumer deals in recent years — an Abu Dhabi sheikh invested $1 billion dollars in 2020. Even Amazon has signed a deal with LuLu in the UAE. The original Scotland Yard HQ of the UK’s Metropolitan Police is now a LuLu hotel, run by the Hyatt Group.

“Yusuff Ali is part of the UAE growth story,” says Naqvi.

And now, at a time when the global narrative around Modi is of the persecution of Muslims, Ali is a part of India’s growth story too.

The India-Gulf connection

It was only after achieving success across the Middle East — in Bahrain, Kuwait, Dubai, and Abu Dhabi — that LuLu turned its eye to the Malayali motherland, and Ali chose Kochi as the launchpad. The Middle East, too, is interested in doing business in India.

Modi’s ascension to power in 2014 was good timing for Gulf businesses looking to expand into India. It was also a test of the PM’s approach to foreign investment and big businesses beyond Western multinational companies — Emirati firms like telecom provider Etisalat had tried to enter the Indian market and burned their fingers after participating in the failed 2G auction in 2012. But 2014 was fortuitous timing for all involved — LuLu had just launched its Kochi mall when Modi and Ali met in 2015.

“We see a visible change in India,” says V Nandakumar, the director of marketing and communications at LuLu Group, adding that he hasn’t seen this kind of business activity between India and the Middle East in his 23 years in the Gulf. “PM Modi was the first prime minister to visit the UAE in 30 years. That set the tone.”

Political leaders from Madhya Pradesh, Himachal Pradesh, Uttar Pradesh, and even the Northeast have been visiting the Middle East and meeting with suppliers. A new generation of proactive leaders from both the central and state governments, including Tamil Nadu CM MK Stalin and former Union Minister of Food Processing Industries Harsimrat Kaur Badal, have visited Abu Dhabi. Over the last decade, the axis has been shifting from the West, and the Gulf’s Indian radius is expanding beyond Kerala.

“India has caught the world’s attention,” says Nandakumar. “The relationship between the Gulf and India is at its peak right now.”

The mall boom

LuLu Group is the newest kid on the block (instead of Johnny-come-lately) in India’s dizzying mall boom — and they’re at least a decade late. While the first phase of the boom was a direct outcome of the economic reforms and Indians discovering their disposable income and flexing conspicuous consumption, today, it is more about urban pride and global aspiration.

Even before it built its Kochi mall, LuLu Group had been no stranger to Malayalis — Kerala’s massive diaspora in the Gulf was already shopping at LuLu. Coupled with the “Yusuff Ali factor”, this international reputation massively boosted the mall’s popularity, according to Nandakumar — but the group’s success in Kerala was no fluke.

The Kochi mall was always a shiny spectacle. Buses packed with curious visitors would arrive at Edapally just to see what the fuss was about. And 10 years down the line, in 2023, it still inspires awe — always busy, the crowd ranging from urban brand-conscious shoppers to those travelling tens of kilometres to shop at LuLu’s signature hypermarket. The signal where there were no roadside carts earlier has now transformed into a vibrant hub with hundreds of eateries.

“The LuLu model is a dumbed-down Dubai model. It’s modular, with bling. It’s the IKEA-sation of retail,” says brand strategist Dilip Cherian. “Plus, the distinction between the average developer and LuLu is that LuLu has deeper pockets and the ability to borrow from markets outside India.”

While the mall houses fancy brands, LuLu’s focus area is the hypermarket — it draws customers back every day. From a cheese counter to a bread station with freshly baked kuboos, Malayalis are being handed the world on a platter. The mall is the biggest in the country, with a 2,500-seater food court, a trampoline park, a bowling alley, South India’s largest ice-skating rink, and an auto-parking guide that Malayalis had never experienced before. The running joke in Kochi in 2013 was that the mall was a place one could go to lose their car because it was that crowded — though, of course, such a thing would not happen in the mall’s ample, sophisticated parking lot.

The Kochi mall was almost like a return on investment for the thousands of immigrants leaving Kerala for the Gulf, or like a peak into their lives abroad for the ones left behind. Now, Kerala could boast the same access that Malayalis had in Dubai.

And so, the mall became a lifestyle-changing experience.

“LuLu’s achievement is not the mall per se, but what it has done to the local area, the lifestyle, and the culture,” says Nandakumar. “After our experience in Kerala, we said any city in India is ready. It’s just that we have to give them the right options.”

The West was once the arbiter of trends, but the Gulf’s influence on Kerala has deepened over the past few decades. “What you can get in Dubai, you get in Kerala the next day,” says Nandakumar.

The rest of India is catching up, too. Coimbatore’s LuLu hypermarket opened in June 2023 on a Tuesday — the initial projection was Rs 5 crore turnover by that weekend. The group hit the target within two days. The success in South India is a hopeful blueprint for their ventures into the rest of the country. In fact, the UP government signed a memorandum of understanding (MoU) with LuLu to build six shopping complexes and a hotel in Lucknow. In a departure from the norm, CM Adityanath even defended the group after members of a radical Hindu outfit tried to create a ruckus, claiming that over 70 per cent of the existing LuLu hypermarket staff were Muslim.

For investors, there is often some distance to travel between being India Ready and UP Ready. LuLu has demonstrated that it can read both the national mood and the UP flavour.

Changing the way Indians shop

LuLu has had to do some tailoring to ensure that it meets Indians’ diverse needs. Its Lucknow hypermarket does not stock as much meat as the group does in Kerala, and focuses more on festival-related sales. The combination for a successful mall, therefore, is the right balance of local flavour, international standards, and convenience.

“We’re not here to sell what the consumer wants. We’re here to change the way they shop. We aim to give them more than what they can think of — giving them an international feel,” says Nandakumar.

And Indian consumers certainly want more — post-Covid trends point to a boom in shopping at malls, with a surge in customers wanting global goods.

“The Indian retail industry has shown a remarkable recovery, coinciding with the entry of many global brands into India,” says Anshuman Magazine, chairperson and CEO of CBRE India, Southeast Asia, Middle East, and Africa, the global leader in commercial real estate services and investments. “Riding high on this sentiment, the demand for quality retail space across malls and high streets has touched a new peak,” he says.

Retail demand across investment-grade malls, prominent high streets, and standalone developments has grown consistently since 2020, according to Magazine. And retail space supply is expected to touch approximately 6 mn sq ft in 2023, the highest in five years.

Behind the scenes

While malls are LuLu’s calling card, the group has actually been present in India for decades — and has been instrumental in the food trade in the country. And ironically, it is their mutton and buff exports business.

The group operates Fair Exports, one of India’s largest meat exporters, shipping halal buffalo meat and mutton to the Middle East and Africa. It boasts of a large footprint in UP, Haryana, and Maharashtra, and has won awards for hygiene and meat quality.

In fact, multiple states across India, not just UP, are offering LuLu the chance to set up its food processing facilities. This will not only boost food security in the Gulf, according to Nandakumar, but also help farmers in India get a better rate and maintain the quality of products.

At a time in India when meat is the stuff of politics, it can be a tricky tightrope for businesses.

Radical Hindu groups have demanded the shutting down of abattoirs and slaughterhouses, and Muslims have been lynched by Hindu mobs over suspicions of transporting beef. Amid such a heavily politicised business climate, Fair Exports has had to ensure that it maintains its high standards of quality and managed to stay out of politics.

In the meat industry, political connections and right guarantors make all the difference. And the outpouring of visible political support from across the spectrum for LuLu Group helps strengthen the brand.

Building Kerala’s business landscape

LuLu’s corporate office is ensconced behind Kochi’s LuLu Mall, its four storeys engulfed by the mall’s huge facade.

Not to be confused with the group’s India headquarters — another glittering glass building a few hundred metres from the mall — this office receives several visitors a day, looking for jobs. A security guard from Odisha (who speaks fluent Malayalam) screens everyone. Within an hour, he receives six job applications and two internship requests. He diligently tells every hopeful applicant that HR will get back to them.

And they usually do: LuLu has hired over 22,000 people in India and aims to provide over 50,000 jobs.

Upstairs, the waiting area in the office foyer is lined with awards the mall has won — for retail excellence, the best food court in South India, and the most admired shopping centre in India.

“Many people said that such a big mall cannot be built in Kochi, but I replied to them that they would have to change this opinion,” said Ali, in a recent YouTube video on the Login Kerala channel. “At last, time has proven it…Today, Kochi is bigger and LuLu Mall is smaller compared to the city. ”

LuLu might have humble goals in the Middle East, keeping everyday consumption in mind, but in India, its aspirations are only growing.

“I don’t think people had seen that kind of shopping experience before — ever,” says Shilen Sagunan, a Kochi-based business consultant who has helped organisations like Cognizant and Experion come to Kerala.

The LuLu Group went on to acquire the JW Marriott hotel next to the mall — it owns Marriotts and Hyatts across Kerala — which spawned an entire economy of its own in Kochi. But the pivotal change was getting involved in Kochi’s InfoPark — acquiring the land from L&T allowed LuLu to enter the IT business. It paved the way for making other companies LuLu’s tenants.

“That’s the kind of impact LuLu has had — their social infrastructure is a job multiplier, while they themselves provide high-tech jobs in Kerala,” says Sagunan. “The question is how this growth sustains.”

But construction is also a beleaguered industry in India, staggering under the weight of land mafias, corruption, and competition.

Acquiring land to build malls in a convenient location remains the biggest challenge. Competitors say that if LuLu can find the right land, its model is easily scalable and replicable in any Indian city. It reportedly took years to buy and cobble together land for the Kochi mall — and this seems to be the likeliest roadblock the group will face as it expands across the country.

Meanwhile, customers continue to go to LuLu malls and hypermarkets for a taste of the international.

Back in Kochi’s Edapally, one nervous visitor — wearing a neatly pleated sari and clutching an umbrella — asked LuLu’s security guards if she would have to produce her Aadhaar card to enter the hallowed mall. Almost as if entering an airport to catch a flight of fancy.

(Edited by Humra Laeeq)