New Delhi: With Elon Musk confirming that he will be visiting India and speculation rife about his expected investment announcements, a look at India’s state-wise foreign direct investments (FDI) shows that multinational companies seem to favour just a few states, and stick with those over the years.

Further, auto companies, especially foreign ones, have particular requirements — such as access to ports, a network of ancillary services, and a ready catchment area for talent — that not only make them gravitate towards particular states but also make it difficult for other states to catch up as attractive investment destinations.

On Wednesday, Tesla CEO Elon Musk posted on his social media platform ‘X’ (formerly Twitter) that he was “looking forward to meeting with Prime Minister Narendra Modi in India”.

Coming just about a month after the central government eased import duties for foreign electric vehicle makers, Musk’s announcement elicited much speculation about a potential investment by Tesla in India.

The Ministry of Commerce and Industry provides state-wise FDI data only from October 2019. However, a look at this data up to December 2023 — the latest period for which data is available — provides some insight into which states foreign companies prefer to invest in.

Also Read: Why FDI in India is lowest in 16 yrs — no real ease of doing business, ill-considered treaty moves

Most popular states for FDI

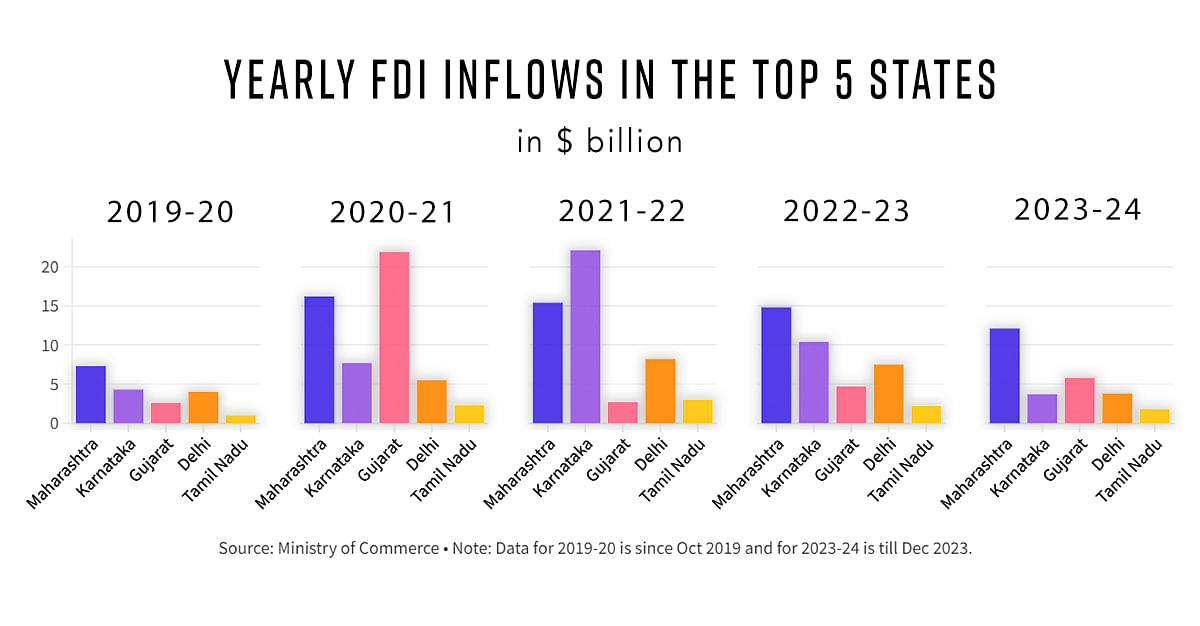

The data reveals that there is a high degree of concentration of FDI in the country. It also shows that the top states attracting the most FDI each year remain largely the same. This indicates that foreign companies have strong preferences when it comes to where they want to invest in India.

The top three states receiving the most FDI each year between October 2019 and December 2023 accounted for no less than two-thirds of the total FDI into the country that particular year and sometimes accounted for as much as 78 percent, such as in 2021-22.

Maharashtra has remained in the top three states for all the years under consideration and has attracted the highest cumulative FDI of $65.8 billion during this period.

Karnataka, too, has been in the top three states almost every year, supplanted by Gujarat in only 2023-24. The southern state has attracted $48.1 billion worth of FDI between October 2019 and December 2023— the second highest of all states.

The state with the third-highest cumulative FDI figures of this period is Gujarat, although it doesn’t feature in the top three for a few of the years (2019-20, 2021-22, and 2022-23) under consideration.

Delhi and Tamil Nadu feature among the top five foreign investment destinations in the country — the only two other states that have attracted double-digit worth of FDI over the period. Delhi attracted $29 billion worth of FDI since October 2019, while Tamil Nadu attracted $10.3 billion.

Interestingly, despite how aggressively the Yogi Adityanath government in Uttar Pradesh has been wooing investors — through multiple investment summits, and a growing reputation of being hard on crime — the numbers show that the state remains low in the priorities of companies looking to invest in India.

Uttar Pradesh has in total attracted just $1.5 billion worth of foreign investments since October 2019, and the annual figures show that this has been evenly distributed through the years rather than increasing with time.

According to investment analysts, a major reason for this is that the state neither has ports of its own nor is close to ports in other states.

The issue of proximity to ports is, in particular, an important one for foreign auto companies, especially the ones that are looking to also export from India, sector analysts said.

The journey of auto FDI in India

The auto industry in India has been an attractive one for foreign companies for a while now, with the sector attracting the fifth-highest cumulative FDI since 2000, of $35.6 billion. However, this investment activity seems to be tapering off in the last few years.

The sector attracted $6.9 billion worth of FDI in 2021-22, which shrank to $1.9 billion in 2022-23, and fell further to $0.9 billion in 2023-24, as of December 2023.

“In the 1980s, all locations were more or less equal, and Suzuki came along with Maruti and set up in Delhi-NCR and so did Honda with Hero and later on Daewoo and Honda cars,” explained Ashim Sharma, senior partner and group head of business performance improvement consulting at Nomura Research Institute.

“But in the last two decades or so, we have seen Hyundai, Renault-Nissan, BMW, Bharat Benz, etc, making Chennai their hub, leading to the city acquiring the name ‘Detroit of India’,” he further said, adding that homegrown players, such as TVS, Ashok Leyland and Royal Enfield, have also contributed to this epithet.

As this was happening, a parallel process saw existing FDI hubs, such as Maharashtra, continue to grow, not only with homegrown investments from Tata Motors, Mahindra and Mahindra in places like Pune and Nashik but also with the likes of Volkswagen and the erstwhile General Motors investing in the state.

“After that, we saw Gujarat start to emerge, around Sanand, which started with the Nano project going there (in 2008), but also in Halol with General Motors, and Ford also went to Sanand,” Sharma said. “Maruti Suzuki is now looking at Hansalpur as well.”

The Andhra Pradesh-Telangana region has also seen some action on account of moves, especially by Kia.

Also Read: Start-ups welcome govt move to liberalise FDI rules for space sector — ‘long-pending reform’

Foreign auto companies need ports

One of the key reasons why foreign auto companies invest in India is because they can produce their products here at lower costs than in other locations. In addition, the only way these companies can make their India investments viable is if they also export their goods.

“Globally (and in India), automotive manufacturers typically aim for around 30 percent of their production to be earmarked for export,” Puneet Gupta, director at S&P Global said. “This strategy is intended to capitalise on economies of scale while ensuring competitive pricing for consumers in India.”

“For instance, if Tesla were to establish a presence in India, they would leverage the local workforce and expertise to manufacture vehicles for both domestic and international markets. Conversely, Volkswagen, for instance, currently exports approximately 70 percent of its total production output,” he added.

Crucial in the calculations by these companies, then, is the cost associated with export, of which transport to the ports is a significant part.

“If you look at all of these regions, there is a proximity of ports and both exports and imports can happen relatively easier from these locations,” Sharma said, speaking about the coastal states, such as Tamil Nadu, Maharashtra, and Gujarat, that have become auto hubs.

Virtuous cycle of auto investments, talent attraction

The other important factor working in the favour of these states is that, having initially attracted auto investments due to their proximity to ports, they made good use of that advantage to develop infrastructure, logistics, and help auto ancillary industries to also come up.

“What also happens is a virtuous cycle where you have investments coming there in the past, and so then that improves the overall infrastructure,” Sharma explained. “But very importantly, it is also a magnet for talent, not just for the original equipment manufacturers (OEMs) but also their suppliers.”

Apart from attracting human resource capital associated with the auto sector, the establishment of large factories by auto manufacturers also led to the establishment of an entire ecosystem of auto manufacturing — from suppliers to mechanics to every other ancillary service.

“This then attracts new companies to invest in these states and it keeps growing,” Sharma highlighted.

According to Puneet Gupta, there are also particular advantages each of these auto hub states has, which makes them attractive to prospective investors for different reasons.

“Over the past decade, Gujarat has emerged as a significant automotive manufacturing hub, offering favourable infrastructure and logistical support,” Gupta pointed out. “Tamil Nadu presents another attractive option, benefiting from a robust supplier ecosystem and proximity to Karnataka, where numerous electric vehicle (EV) companies have established their research and development centres.”

Maharashtra, on the other hand, stands out as a desirable location due to its large supplier base, particularly in Pune, and access to ports, making it conducive for companies seeking to expand their export operations.

Finally, climate also has a part to play, with erratic rains and resultant flooding increasingly influencing auto companies’ investment decisions.

According to a senior manager in a prominent Southeast Asian auto company with heavy investments in India, the company decided to diversify its investments from the southern states and instead move to Gujarat and Maharashtra because floods in some of the states had inflicted serious damage to their manufacturing facilities.

“It’s not as if we are moving out of any particular state,” the manager said. “Instead, we are diversifying our production locations so that we don’t have to close down production entirely due to floods for weeks and months, as we had to a few years ago.”

(Edited by Richa Mishra)

Also Read: Income inequality reducing, one-third tax filers in bottom slab moved up to higher levels since 2014