New Delhi: A combination of stagnant or decreasing incomes, rising expenditure, a profusion of credit cards and ‘Buy Now-Pay Later’ (BNPL) offers has resulted in an increasing number of people spending beyond their means, using credit cards to finance their expenditure.

From an economic point of view, this stress on incomes would be worrisome enough. However, this rapid growth in credit card debt also seems to be accompanied by equal growth in the default of such debt, which economists say could pose future risks to the banking system if left unchecked.

An analysis of data with the Reserve Bank of India shows that outstanding credit card dues rose to Rs 2.13 lakh crore as of July 2023, the latest period for which there is data — an increase of 31.2 percent over July of last year.

Notably, the growth in credit card debt has been accelerating — it was 27.8 percent in July 2022, 25.1 percent in July 2021, and 8.6 percent in July 2020 (although this low growth in 2020 was likely pandemic-affected).

The data also shows that, although credit card loans make up a small part of total personal loans, this share has been increasing since the pandemic. That is, where credit card loans made up 3.9 percent of total personal loans in July 2020, in the early days of the pandemic, that proportion rose to 4.8 percent by March 2023 and remained at a relatively elevated 4.5 percent by July.

Also read: India has ambitious targets to blend ethanol with petrol. But supply remains a major constraint

Shrinking incomes, rising expenditure

The rise in credit card loan growth can be attributed to two simultaneous factors — an increase in spending while incomes have largely remained stagnant or have shrunk, and the profusion of ‘BNPL’ schemes that offer easy credit for current purchases.

“Credit card loans, which are unsecured, have risen significantly over the past couple of years,” Saugata Bhattacharya, chief economist at the private sector Axis Bank told ThePrint. “There is a risk of increased delinquencies in this portfolio, but that would depend on whether the outstanding amounts are a result of cash flow difficulties of households or is a response to the buy now pay later offers.”

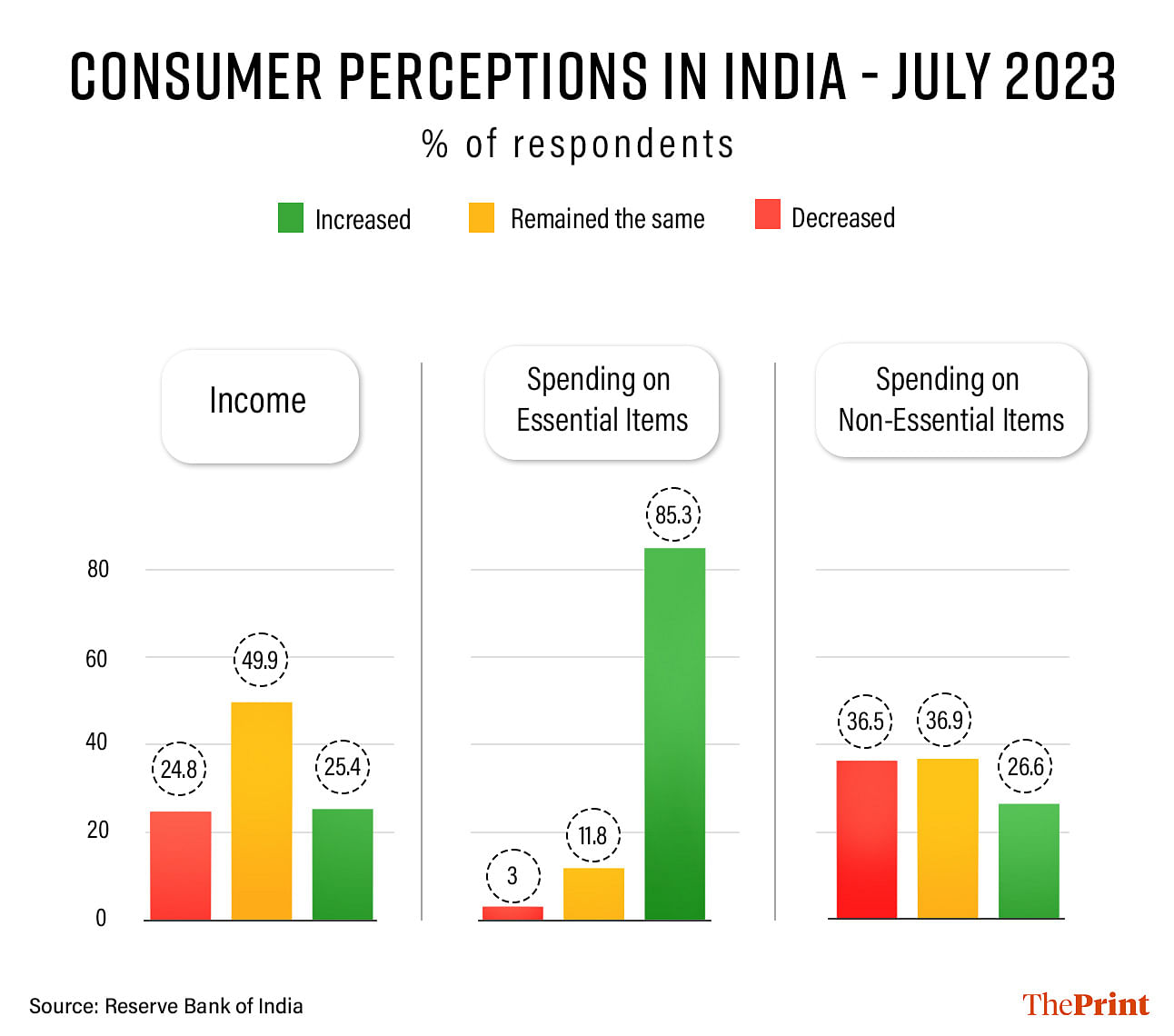

Another dataset by the RBI, its Consumer Confidence Survey, shows that an overwhelming share of people surveyed by the central bank — 85.3 percent — say that their spending on essential items is higher now (as of July 2023) as compared to July last year.

At the same time, 26.6 percent of the respondents said that their spending on non-essentials had also grown, while 37 percent said it had remained the same as last year. Taken together, this means about 63 percent said their non-essential spending was either the same as last year or had increased.

In other words, the vast majority of people are spending more on essentials, and are either also spending more on non-essentials or the same as last year.

Simultaneously, the same survey shows that 50 percent of the respondents in July said their incomes had remained the same as last year, and about 25 percent said their incomes had decreased. That is, only about a quarter of the respondents reported an income increase.

This combination — of incomes remaining stagnant or decreasing, and expenditure rising — could be one of the driving reasons behind increased credit card spending.

“A larger concern can be the growth in unsecured loans — although these are also largely done after credit checks — and in particular, the growth in credit card loans,” Madan Sabnavis, Chief Economist of the public sector Bank of Baroda told ThePrint.

“It is far easier to get a credit card now, and with the rise of BNPL schemes, it looks like people are not sacrificing on their consumption even if their incomes can’t keep up,” Sabnavis added. “There is definitely a need to exercise more prudence here.”

RBI data shows that, by the end of July 2023, there were 8.98 crore active credit cards in the country, nearly 1 crore or 12 percent higher than in July last year. In July 2020, there were just 5.7 crore active credit cards in the country.

Not all credit card debt is bad

D.K. Pant, chief economist at credit rating agency, India Ratings, explained that not all credit card debt is bad, and that credit cards get a bad reputation because they are categorised as ‘unsecured’ loans, or loans that don’t have any collateral like a house or a car backing them.

“On the face of it, credit card loans might be seen as unsecured loans because they don’t have the kind of collateral attached that typical secured loans would have, but banks also don’t give credit cards to everybody,” Pant said.

“They issue cards to those people with high credit scores and who have secure income flows,” he added. “The credit limit is also set based on the income flows.”

Pant explained that it was important to analyse the spending behaviour of people. “A credit card basically offers the customer a 45-day interest-free loan, so people often use that facility even if they have the savings to fund their expenditure,” he said.

People also use credit cards to tide themselves over the last few days of a month before their salaries come in, which they then use to pay off the credit card bill.

“The growth in credit card loans would be a concern if this also meant that credit card delinquencies are also rising faster than the usual rate of delinquencies of loans,” Pant said.

Credit card delinquency rising

The Sunday Express in July reported that, based on Right to Information data it had obtained from the RBI, it had found that credit card delinquencies had grown 30.5 percent in 2022-23 as compared to their level in the previous year.

Over this period, total credit card loans grew about 30.9 percent, which means defaults were growing as fast as the loans being given out.

It is important to note that credit card defaults make up only about 2 percent of total credit card debt, so they don’t yet pose any systemic risk to the banking sector. However, the RBI has taken note of the rise in unsecured lending – of which credit cards are a part — and has reportedly asked banks to cut back on giving out unsecured loans.

In fact, the RBI, in its April 2023 monthly bulletin, pointed out that “delinquencies are reducing in the 90+ days past due bracket across all categories of consumer credit, barring credit cards and education loans”.

(Edited by Smriti Sinha)

Also read: Global economy, crypto regulation, digital public infra — economic issues that G20 leaders agreed on