New Delhi: Indian monetary policy makers’ intolerance for an inflation rate higher than their 4% medium-term target will probably only stay on paper.

In reality, economists see the Reserve Bank of India grin and bear price pressures as it seeks to help Asia’s No. 3 economy recover from one of the world’s worst coronavirus outbreaks. The RBI has chosen to look through a recent surge in inflation because it was supply-side driven, and will only turn persistent when demand kicks in, Deputy Governor Michael Patra said at a briefing June 4.

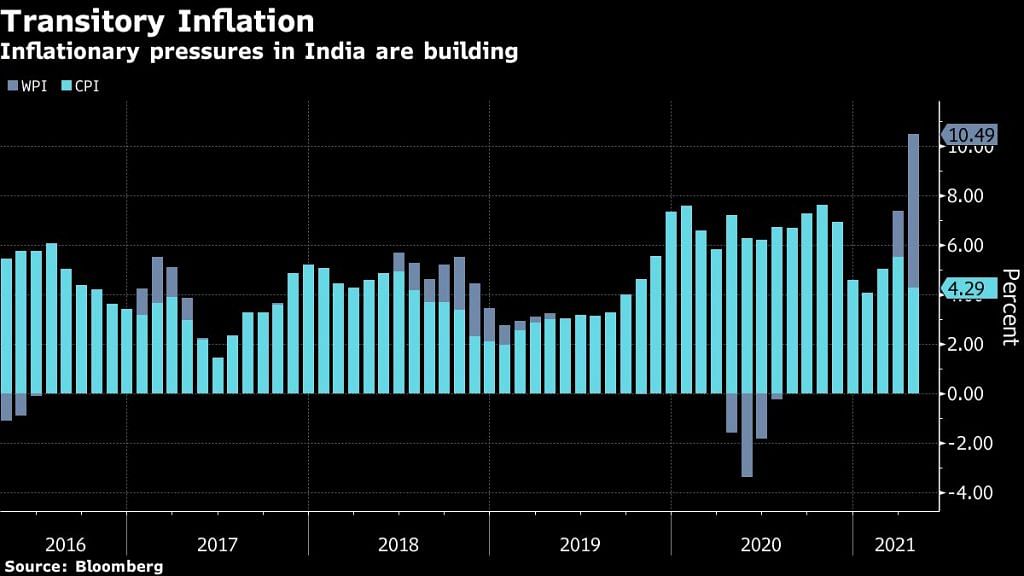

While the wholesale price print due later Monday will probably make for another grim reading, retail inflation is seen hovering above the 5% mark for the third out of five months this year. Monetary policy makers ignored the acceleration and earlier this month retained an “accommodative” stance for as long as needed to restore growth on a durable basis.

“The RBI has clearly turned more tolerant of inflation and by the looks of it, they seem to be okay with the headline rate above the mid-point target of 4%,” said Priyanka Kishore, head of India and Southeast Asia Economics at Oxford Economics in Singapore. “We expect growth concerns to dominate and push out policy normalization well into 2022.”

The RBI isn’t thinking about normalization at the moment, Governor Shaktikanta Das said this month. His rate-setting committee, which cut borrowing costs by 115 basis points in 2020, has kept rates unchanged at a record low for more than a year to support growth after a rare contraction last year. While the central bank sees the economy expanding 9.5% in the year started April 1, that is slower than the 10.5% pace it had forecast before a deadly second wave of coronavirus swept through the nation of more than 1.3 billion people.

A string of lockdowns to stem the pandemic crippled activity and throttled demand in an economy that’s primarily driven by domestic consumption. High taxes and rising unemployment has also left consumers wary of spending, as well as glum about future prospects.

So although data Monday might show wholesale prices grew 13.3%, the highest rate in three decades, it’s unlikely just yet to fully feed into consumer prices. Companies have absorbed some of the increase in producer prices given weak demand in the economy.

This, in turn, will offer comfort to the six-member Monetary Policy Committee, which is convinced that sticky inflation is due to supply-side problems and doesn’t yet warrant withdrawal of the extraordinary measures.

A group of researchers led by a former MPC member Ravindra Dholakia went as far as suggesting that a looser inflation target could help boost growth. They, in an RBI-sponsored working paper last month, concluded that a higher threshold for inflation is conducive for growth in emerging economies.

For India, growth is maximized if inflation is allowed to rule around 6%, and minimized once prices spike to 9.5%, the researchers wrote.

This isn’t the first time that there’s been a call for a looser inflation target. However, the government earlier this year renewed the RBI’s inflation targeting mandate that requires it to keep price-growth at the 4% midpoint of a 2%-6% target band. The central bank expects inflation to end up at 5.1% in the fiscal year ending March.

The latest pick up in inflationary pressures is caused by higher food and fuel prices along with stubborn underlying price pressures, according to Bloomberg Economics’ Abhishek Gupta, who doesn’t expect a hawkish response from the RBI.

“The RBI sees inflation staying below the 6% upper end of its target range this fiscal year,” he wrote. “And its focus now is on supporting a recovery with an accommodative stance.”- Bloomberg

Also read: India’s forex reserves are crossing $600 billion & will help deal with global volatility: RBI