India’s economic indicators show positive signs amid imminent global trade wars and market constraints.

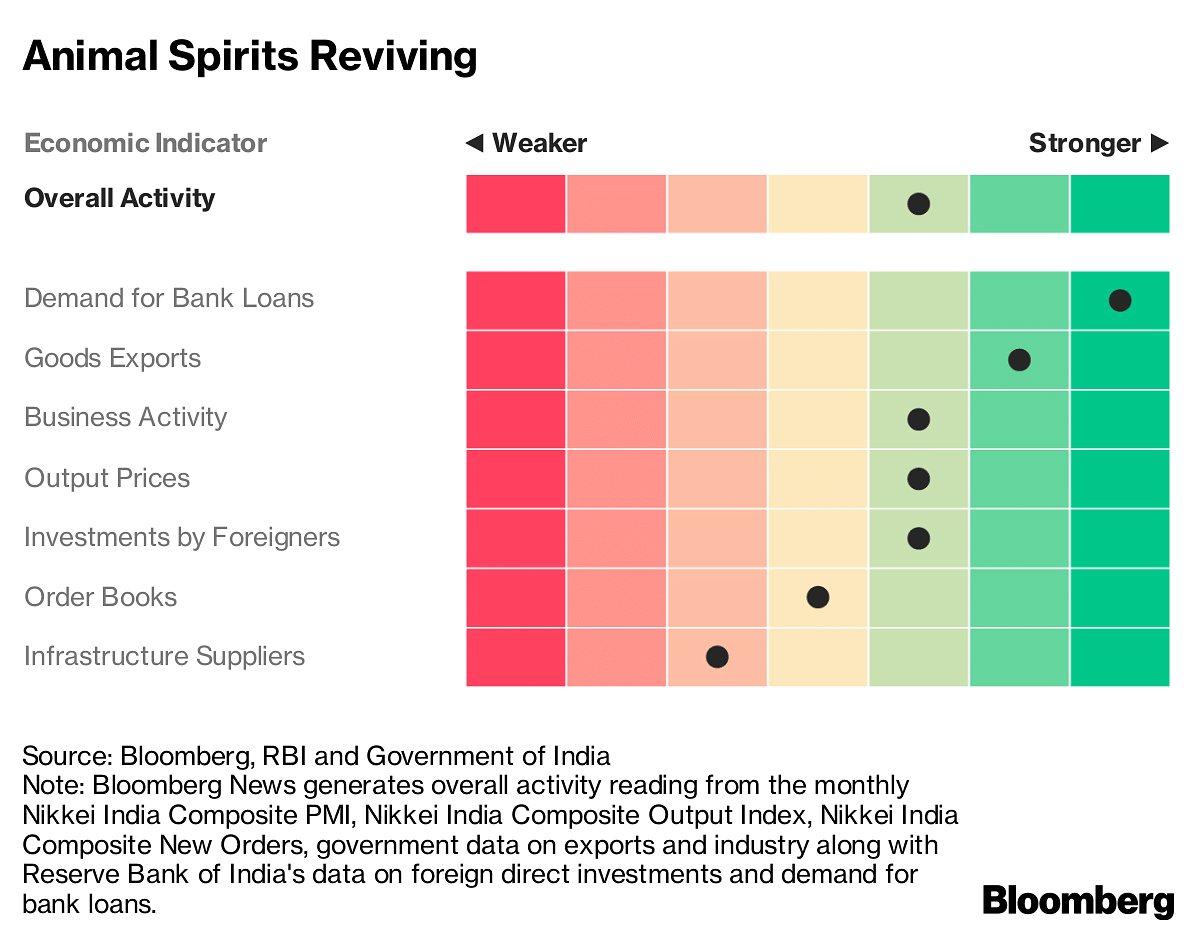

The world’s fastest growing major economy is showing signs of a recovery in animal spirits, suggesting India’s mid-term outlook can weather global trade tensions and emerging market strains.

A cross section of forward-looking indicators compiled by Bloomberg News show largely positive signs. Sentiment in the manufacturing and services sectors – both of which make up nearly 80 per cent of the $2.6 trillion economy – rebounded in June, with new orders picking up pace. Bank loan disbursals are growing while auto sales – a barometer of overall demand – are expanding at double-digits.

The Reserve Bank of India (RBI) is optimistic about growth and a narrowing output gap. The six-member rate-setting committee sees the recovery pushing inflation higher in the coming months – enough to convince analysts and markets that a back-to-back rate increase is due on Wednesday. Any tightening in monetary policy comes amid concerns that the government may ease purse strings and miss budget targets ahead of a federal election in early 2019.

Abhishek Gupta, an economist with Bloomberg Economics in Mumbai who’s among a minority predicting the RBI won’t hike this week, said there’s reason for caution and cited favorable base effects for spurring the pick-up in bank credit.

“That’s one reason we are less upbeat on the economic growth outlook than the central bank,” Gupta said. “We see GDP growth recovering to 7.2 per cent in fiscal 2019 from 6.7 per cent in fiscal 2018, below the Reserve Bank of India’s forecast of 7.4 per cent, as of June.”

Here are the full details of the dashboard:

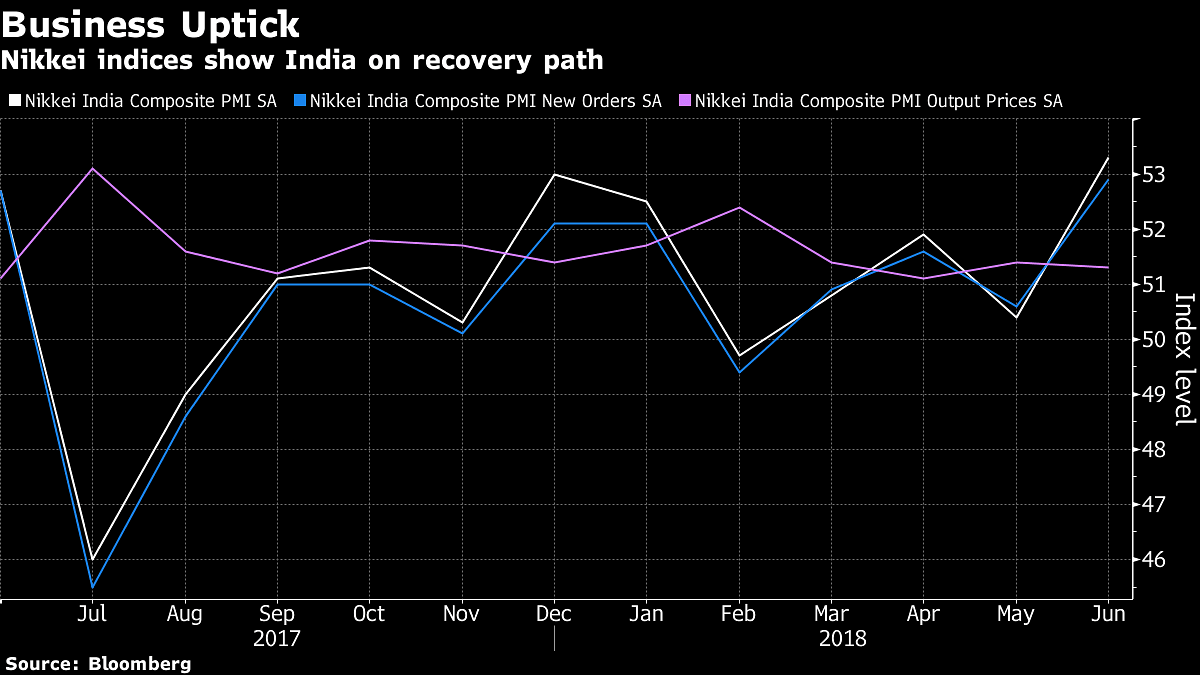

Business Activity

Activity in India’s dominant services industry rebounded in June from a mild contraction the prior month, expanding at its quickest pace in a year. That pulled up the Nikkei India Composite Index to its highest since October 2016 with manufacturing activity also showing signs of growing at a faster clip.

A sure-shot sign of growth in demand is the reading of Nikkei’s index for new orders in June, which also surged to its highest since October 2016. That should give confidence to businesses to produce more and in the longer run draw-down inventories and close the output gap.

Output prices are still rising, although the pace has somewhat stagnated. Nevertheless, the RBI says that companies are increasingly finding their pricing power and transferring higher input costs to consumers. This is likely to stoke inflation and keep the central bank on a hawkish watch.

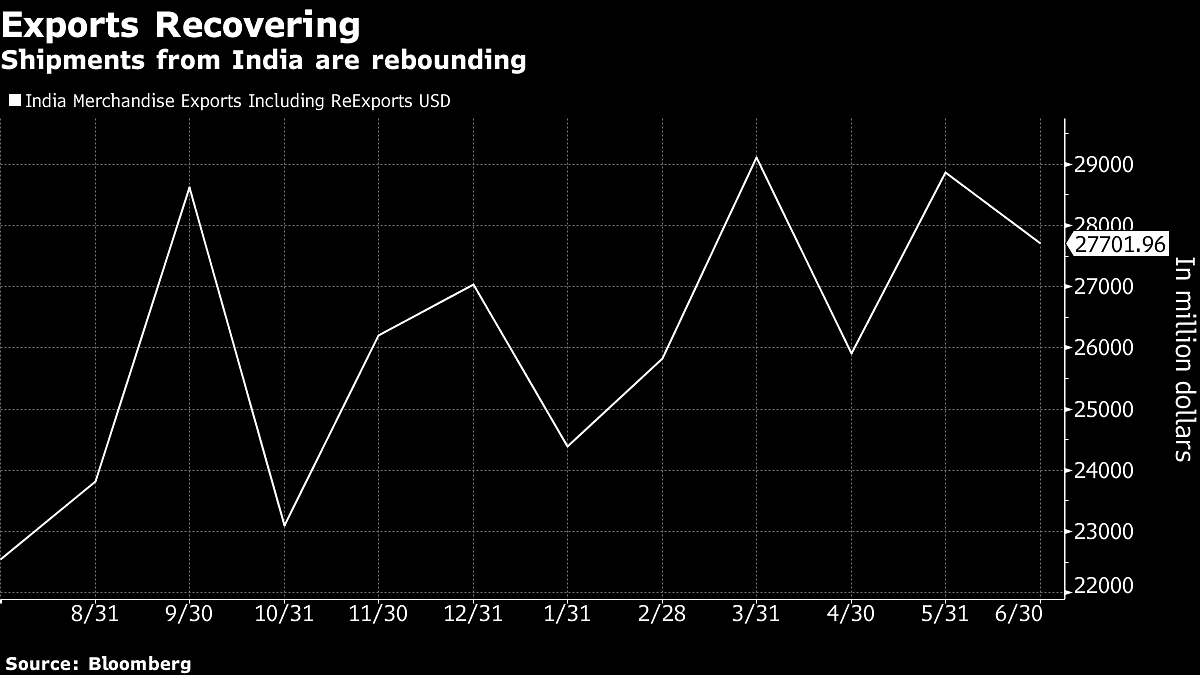

Exports Growth

The export industry is still recovering from the double blow of a cash ban in late 2016 and the chaotic implementation of a consumption tax introduced last year. It lagged the global economic recovery and now with trade war clouds gathering, the outlook isn’t too great. The only silver lining is a weaker rupee which is probably going to make software exports more competitive.

Consumer Activity

Data from the Society of Indian Automobile Manufacturers show that the industry produced nearly 17 per cent more vehicles in the April-June period than a year ago. Passenger vehicle sales grew close to 20 per cent during that period and makes for a handy indicator in a country which has no retail sales data to track consumer spending. The data also shows commercial vehicles sales rose more than 50 per cent and two-wheelers more than 15 per cent.

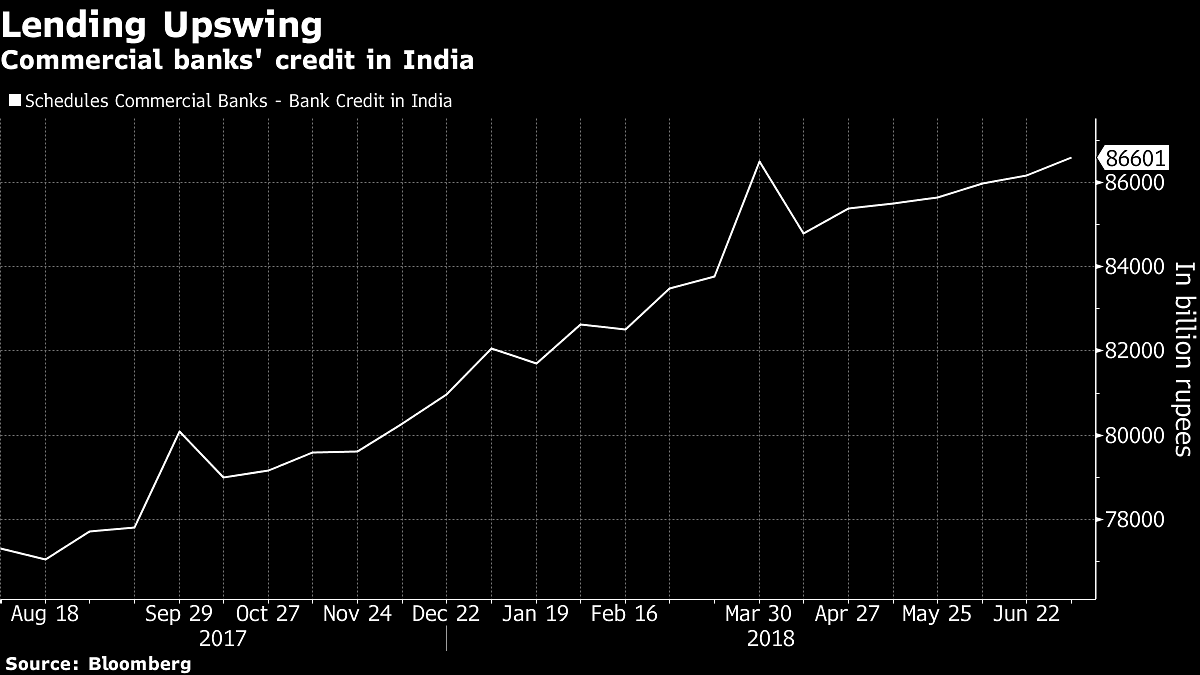

Bank loans are one signal that the RBI believes holds promise. Credit to various sectors including agriculture has risen 12.3 percent year-on-year, data available as of July show.

Not everyone agrees with the RBI’s assessment though. Bloomberg Economics’ Gupta says rising borrowing costs are crimping corporate bond issuances and this indicates that total credit flowing to the corporate sector is weak.

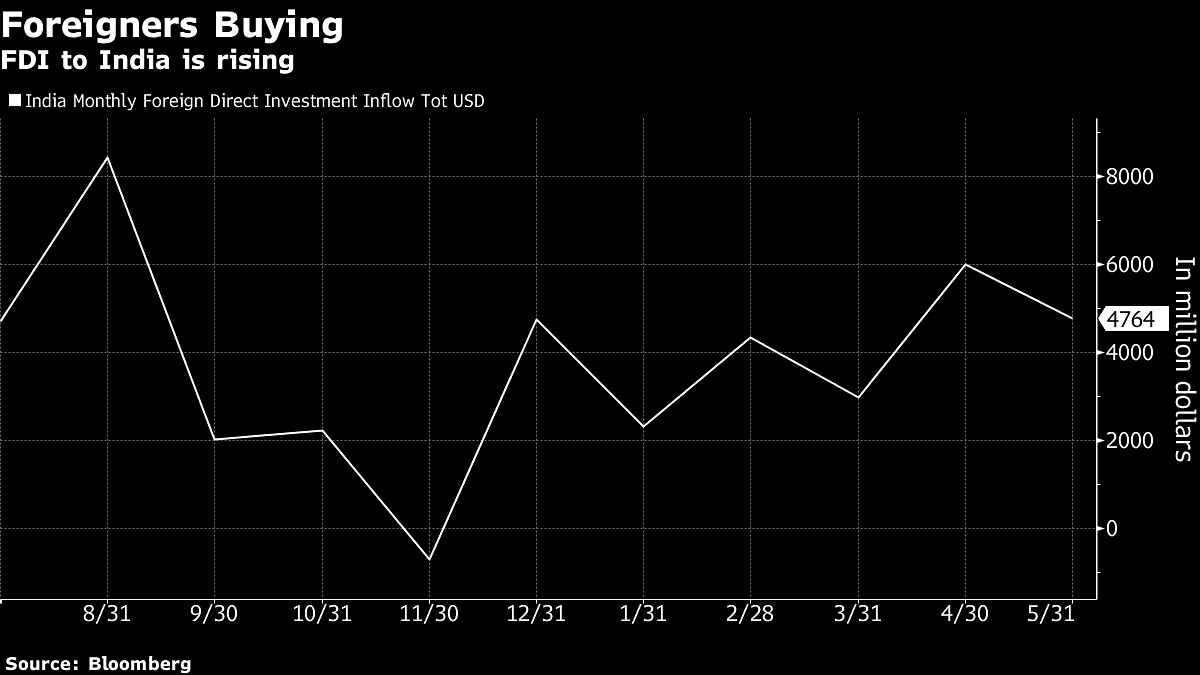

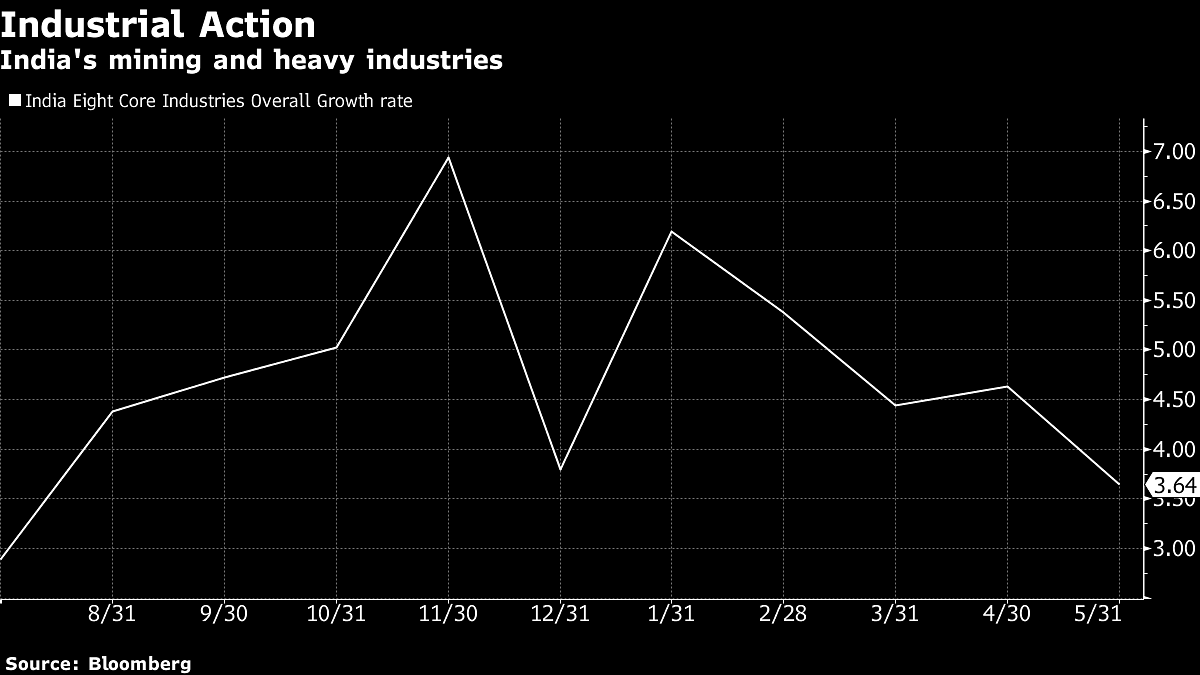

Economic Activity

After a dip in March, foreign direct investments picked up pace in April and May. While that is good news for the broader investment climate, given the risk of an election next year and the threat of policy paralysis before that, inflows could slow in the coming months. That, of course, could have an impact on the India’s external finances, where the current account gap is set to widen in the financial year to March 2019.

Growth in mining and heavy industries – which account for 40 per cent of industrial output – has been rather anemic, easing to a 10-month low in May due to weaker steel and cement output and a contraction in crude and natural gas production. It’s not all bad news though. For instance, coal production rose by double digits for the second month in a row in May albeit at a slower pace. Besides, electricity generation went up 3.5 percent in May compared to 2.1 percent in the previous month.- Bloomberg