New Delhi: With India’s Goods and Services Tax (GST) having completed six years Saturday, taxation experts say that while revenue from the indirect tax system has been growing robustly, there is a need for a few urgent reforms. These include easing the process by which people can appeal against orders by tax authorities, and bringing in at least some petroleum products within the ambit of GST.

While analysis of the collections under GST show that revenue has grown steadily, experts say that key reforms such as the setting up of tribunals that can handle appeals against orders by the tax authorities are urgently needed. Experts also say that exclusion of petroleum products from the tax regime is leading to higher costs in almost every industry in the economy.

But these glitches apart, tax experts that ThePrint spoke to almost unanimously agree that GST has led to a lowering of costs and has improved efficiency across the economy.

“When you reflect back on six years of GST, it is evident that it led to a significant structural simplicity, which in turn has resulted in savings in costs for industry and logistics efficiencies,” Pratik Jain, partner at PwC India and an expert in indirect tax, told ThePrint. “With the buoyancy in collection over the last few months, it seems that compliances are also getting streamlined with a huge thrust on the digital ecosystem.”

Also Read: How GST is killing small businesses with inspector raj and suffocating compliance

Robust growth in revenue

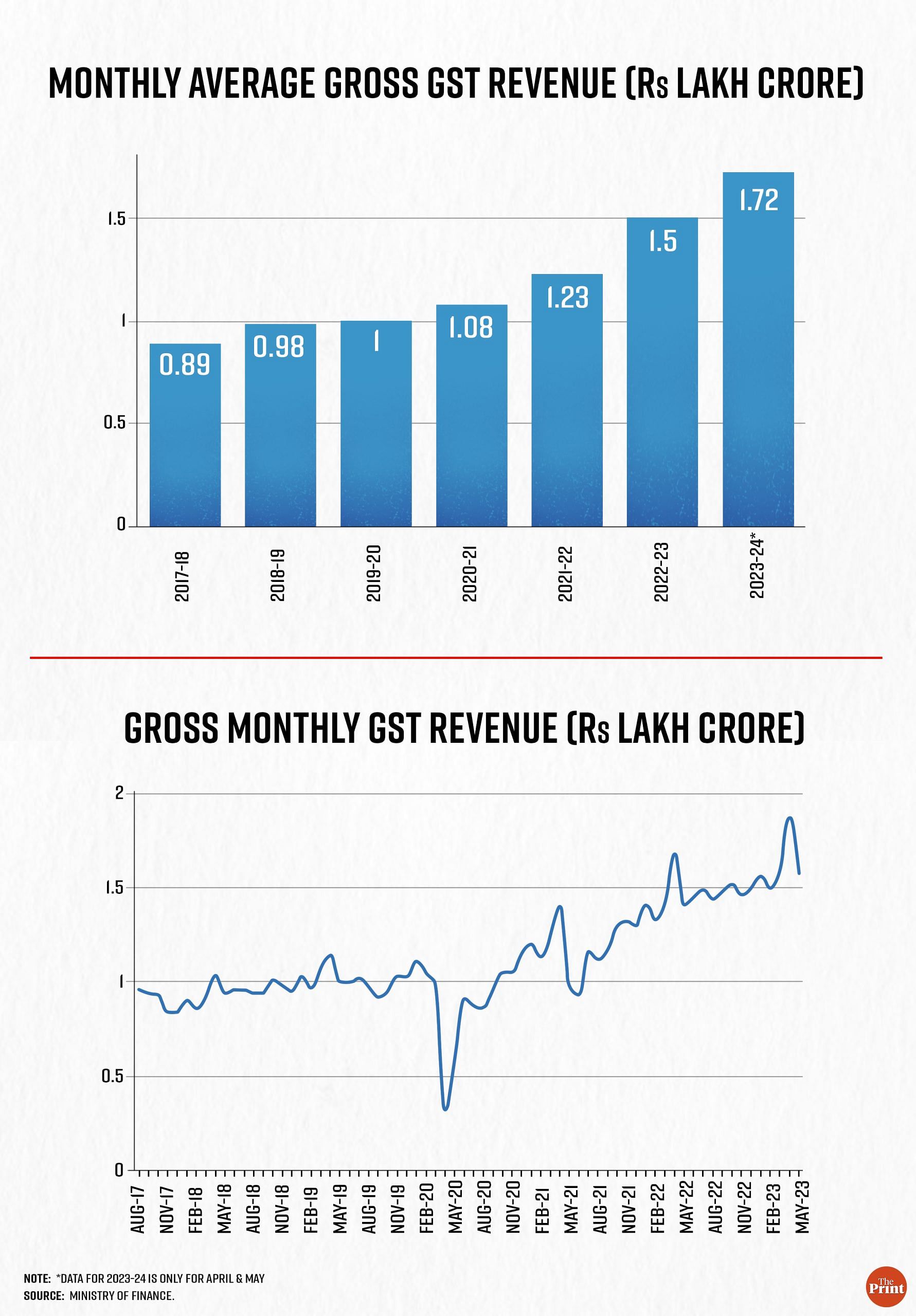

Analysis of the government’s GST collections show that the average amount earned every month has been increasing — even during the pandemic year of 2020-21. For example, the government collected an average of Rs 89,885 crore every month in 2017-18 (starting from July 2017, when GST started). This rose to Rs 1 lakh crore of average monthly collections in the pre-pandemic year of 2019-20.

While the COVID-19 pandemic certainly dented GST collections in the first few months of the lockdown, revenue bounced back quickly as the economy opened up. Average monthly collections in 2020-21 were Rs 1.08 lakh crore — higher than the pre-pandemic period.

For 2022-23, average monthly GST collections stood at a healthy Rs 1.5 lakh crore, government data shows.

The current financial year of 2023-24, too, set off to a great start, with the highest ever collections of Rs 1.87 lakh crore coming in the first month itself.

However, while the overall collections look to have grown robustly, it’s not entirely clear whether the states have fared better under GST as compared to the previous regime. Tax experts attribute this to the nature of the previous regime, under which each state had a different rate of Value Added Tax (VAT) for different items. Further, since fuel is not included in GST, revenue from its sale further complicates the comparison.

However, what’s clear is that the GST revenues of the states have not grown at the rate that the central government predicted.

Prior to the implementation of GST, the Modi government had promised states compensation for any losses of revenue on account of the implementation of GST. This compensation was to be for five years, and the assumption was that states would have seen their revenue grow by 14 percent every year. If their revenue growth was less than this, the central government had promised to reimburse the difference.

Data from the Reserve Bank of India, which analyses the budgets of the union government as well as the states, shows that the latter’s revenues from GST (both state GST as well as their share of central GST) has grown at a compounded annual rate of just 7.8 percent — nearly half of the predicted rate.

Urgent reforms needed

While revenue from indirect taxes is a function of the level of buying and selling activity in an economy, tax experts suggest some structural changes that can be implemented in the current system to help bolster revenues and reduce the compliance burden. Some of these changes, such as setting up tribunals, need to be made urgently, said M.S Mani, senior director of indirect tax at Deloitte India.

“The GST law has a provision for the setting up of tribunals, so that taxpayers have a place to appeal an order by the tax authorities.,” Mani said. “At the moment, six years after GST has been in effect, there are no tribunals and so taxpayers have to approach high courts, which is a lengthy and resource-intensive process.”

This is also the right time for the GST Council — the federal decision-making body for GST — to engage with all stakeholders and undertake a comprehensive legislative and administrative review of GST to reduce disputes and further simplify the laws, Pratik Jain of PwC, quoted earlier, explained.

“Sectoral committees can be formed to discuss and address the sector specific concerns — specifically the new age segments such as e-commerce, crypto currencies, etc.,” he said.

The other major issue that needs urgent attention is the treatment of fuels under GST.

“The central tax on the supply of petroleum crude, high-speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel shall be levied with effect from such date as may be notified by the government on the recommendations of the Council,” the Central Goods and Services Tax Act, 2017, says.

In other words, petroleum products can be included in GST as and when the GST Council decides.

“Almost every industry uses petroleum products as inputs,” Mani of Deloitte India said. “However, since petroleum products are not in GST, they cannot get input tax credits on them, which serves as a significant cost. This needs to be looked at urgently.”

He suggested starting with including the less contentious fuels like natural gas and ATF in the regime before moving to petrol and diesel.

The taxation of petrol and diesel are controversial topics because they are the few items left under states’ control to tax and have been a sore point ever since the implementation of GST.

(Edited by Uttara Ramaswamy)

Also Read: Modi govt clears GST dues worth Rs 16,982 crore, says paperwork delayed on part of 15 states