New Delhi: India’s economy will grow at 4.2 per cent in the July-September quarter and at 5 per cent in the fiscal year 2019-20, according to a State Bank of India research report released Tuesday.

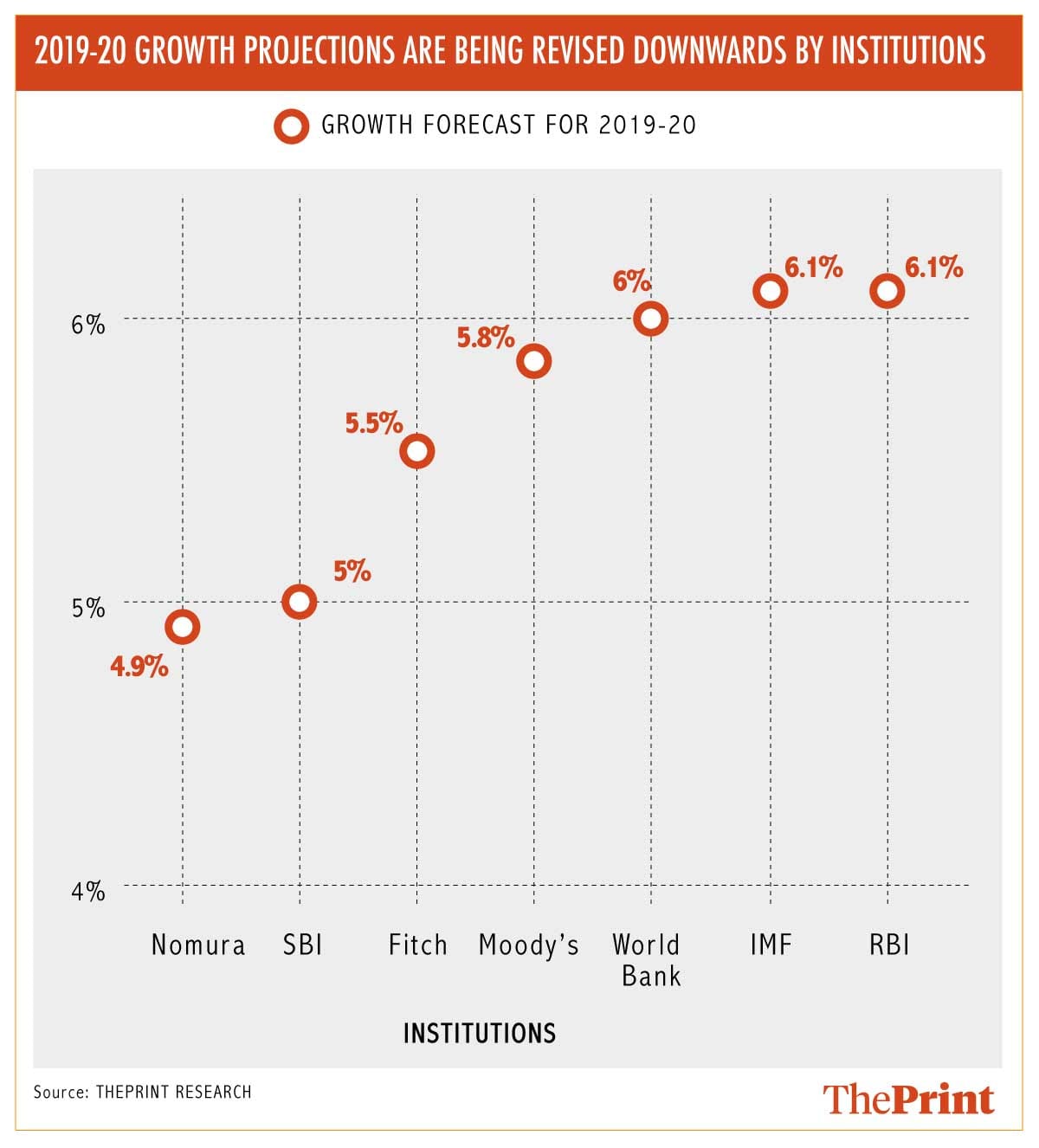

The full-year growth projection is one of the lowest that any institution has forecast so far, and is 1.1 per cent lower than SBI’s earlier prediction of 6.1 per cent. Financial services firm Nomura’s projection of 4.9 per cent GDP growth for the full year has been the most pessimistic.

SBI revised its growth projections after a sharp contraction was reported in the factory output for September, which the bank termed “alarming”.

SBI’s report cites low automobile sales, deceleration in air traffic movement, flattening of core sector growth, and declining investment in infrastructure and construction as the reasons why the economy may grow at only 4.2 per cent in the second quarter, as against 5 per cent in the April-June quarter.

“Against such growth slowdown, it is imperative that India adheres to no negative policy surprises in sectors like telecom, power and NBFCs,” said the report, authored by Soumya Kanti Ghosh, SBI’s group chief economic adviser.

Besides the slowdown in industrial growth, the report also flagged the negative impact of excess rains on agricultural growth — rains have adversely impacted kharif crops in states like Madhya Pradesh, Maharashtra, Gujarat, Karnataka and Punjab.

“Considering all these domestic parameters along with global downturn, we now foresee GDP growth at 5 per cent in the current fiscal,” the report said.

Also read: Fall in GDP growth needs to be reversed before it becomes a sustained downward spiral

Monetary policy not enough, need fiscal policy

The SBI report also advocated the use of fiscal policy to counter the growth slowdown, pointing out that monetary policy may not be enough in the current macro environment.

Monetary policy seems to be less effective than fiscal policy as low interest rates do not guarantee a rise in demand for investment, it said, warning that a large rate cut could lead to financial instability.

“We now expect larger rate cuts from RBI in December policy. However, such rate cut is unlikely to lead to any immediate material revival, rather it might result in potential financial instability…,” it stated.

The Reserve Bank of India’s fifth bi-monthly monetary policy statement is due to be released on 5 December, a week after the government releases the quarterly GDP numbers for the July-September quarter on 29 November.

Economists expect the RBI to further lower its growth projections for the full year from the 6.1 per cent projected in the previous policy announcement in October.

Also read: Indian economy is on a decline. So why are IMF and World Bank’s growth forecasts so high