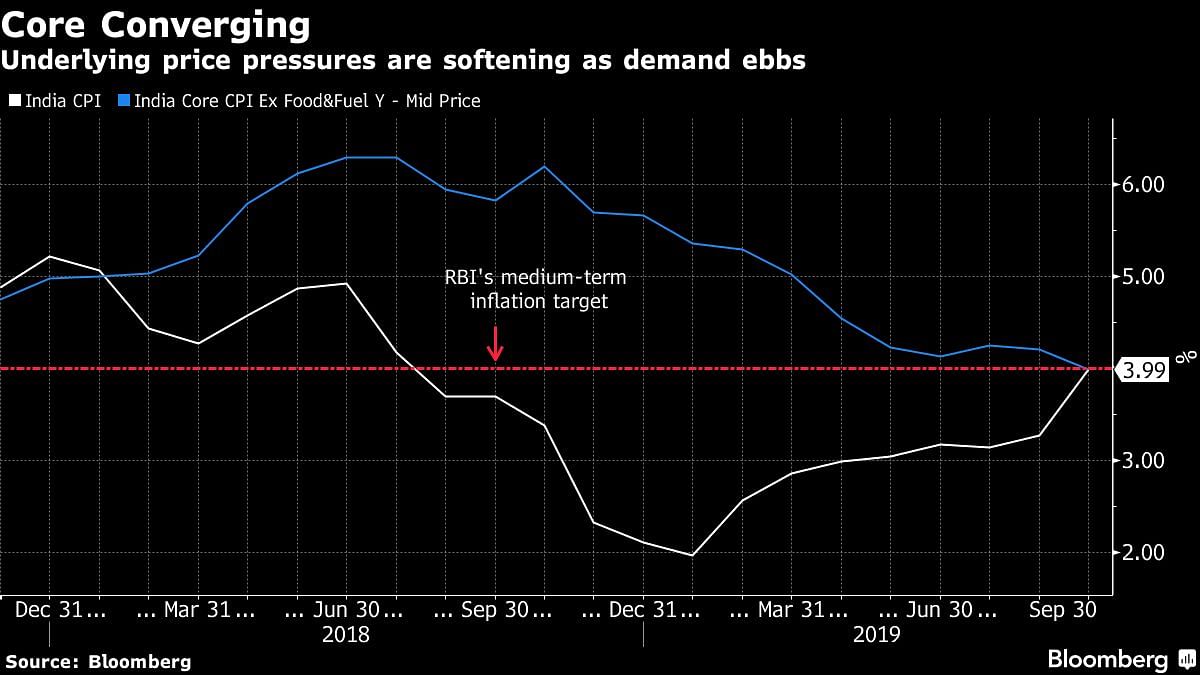

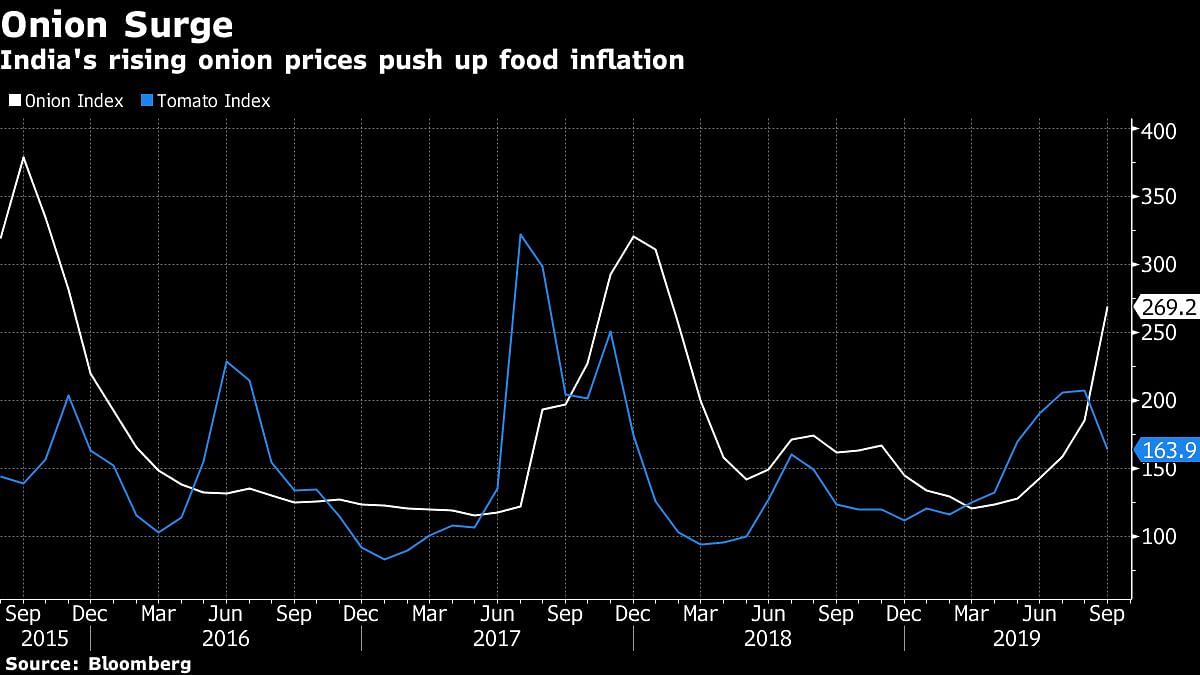

Mumbai: India’s headline inflation probably breached the central bank’s 4% medium-term threshold last month, but that surge — driven by high onion prices — is unlikely to distract monetary policy makers from their focus on growth.

Economists pegged the gains in consumer prices at 4.35% in October, according to the median of 33 economists surveyed by Bloomberg. That would be the first above-4% print since July 2018 and the highest since June last year.

While policy makers will assess the accompanying food-price data, it may not be compelling enough to hold their attention: underlying inflation — a measure of demand in the economy — is expected to remain subdued. First indications came via purchasing managers surveys, which signaled weak manufacturing and services activity in October.

An overwhelming majority of data have pointed to continued weakness in the economy that expanded 5% in the quarter ended June — the slowest pace in six years. The slump gives members of the Reserve Bank of India’s Monetary Policy Committee reason to stick with their accommodative policy stance, although room for a deep cut may be limited given the rebound in headline inflation.

With the RBI already cutting interest rates five times this year, by a cumulative 135 basis points to 5.15%, economists expect the rate to fall further to 4.9% by the end of March 2020.

“We expect the RBI to maintain its easing bias on the back of sluggish growth, and weak generalized inflation pressures,” said Teresa John, an economist at Nirmal Bang Equities Pvt., who sees a 15 basis-point cut at the next policy meeting in December. Should growth numbers “surprise substantially on the downside below 5%, we would not rule out a large rate cut.”

Gross domestic product data for the three months to September is due Nov. 29 and will probably show a mild recovery in growth to 5.5%. Economists, however, say the main reason for that may be more because of a favorable base effect.

Onion Imports

The inflation-targeting RBI expects food prices to stabilize, while forecasting headline inflation to stay well below its medium-term target of 4% for the rest of the fiscal year through March.

India’s government moved to control prices of onions by importing 100,000 tons of the vegetable, Food and Consumer Affairs Minister Ram Vilas Paswan said via Twitter. The kitchen staple will be available for distribution in local markets between Nov. 15 to Dec. 15.

Bloomberg Economics’ Abhishek Gupta said the elevated readings will not last long enough with plentiful rains bolstering farm output and keeping a lid on prices. However, worries about slowing growth will keep alive expectations of more monetary stimulus.

“A widening output gap continues to sap underlying inflation pressures, with the core gauge set to ease further below target — allowing room for further monetary stimulus to spur growth,” he said.

On Monday, data showed industrial production contracted 4.3% in September, the steepest decline in eight years. That follows output in the nation’s core infrastructure industries shrinking to the lowest since at least 2005, amid a prolonged economic slowdown.

Also read: Onion export ban: Is it smart to always protect interest of the consumer over the farmer?

That is Indian Economics. Sheesh