Estimates say India received $69 billion in overseas remittances last year, equivalent to almost 3 per cent of GDP.

New Delhi: India’s vast army of overseas workers should cap the country’s current-account deficit and keep it from joining emerging-market counterparts that have struggled with currency crashes this year, according to Capital Economics.

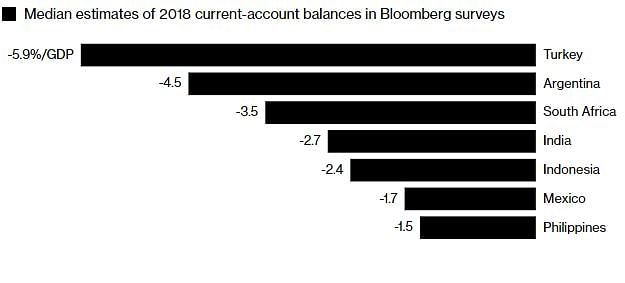

“Remittances from abroad are a vital — yet often under-appreciated — source of funding for India,” Shilan Shah, senior India economist in Singapore at Capital Economics wrote in a note Tuesday. Without that support, the nation’s deficit “would have placed it alongside the likes of Turkey and Argentina — two countries that have suffered a currency crisis.”

- India received $69 billion in overseas remittances last year, equivalent to almost 3 percent of GDP, Capital Economics said, citing World Bank data.

- Without that inflow from an estimated 20 million nationals abroad, India’s current-account deficit would have been around 5 percent of GDP at mid-year, rather than 2 percent, it said.

Remittances should rise 5 percent to 6 percent in the coming years, preventing the deficit from widening past 2 percent to 2.5 percent of GDP, the research group said

Axis of Vulnerability

Note: Indian estimate is for year through March 2019

Diminishing demand for emerging-market assets thanks to U.S. monetary tightening has helped send the rupee down 14 percent against the dollar this year, the most in Asia. It’s also been hit by a rising oil-import bill (India imports more than 80 percent of its needs) and worries over a debt-burdened financial system. The slump itself may encourage more remittances, which should also be helped by technological advances, Capital Economics says.

“Remittances may not grow as fast as the wider economy over coming years but they should continue to increase,” Shah wrote. “This will allow India to maintain domestic demand in excess of potential supply without having to rely heavily on other, more volatile types of inflows.”

-Bloomberg wire