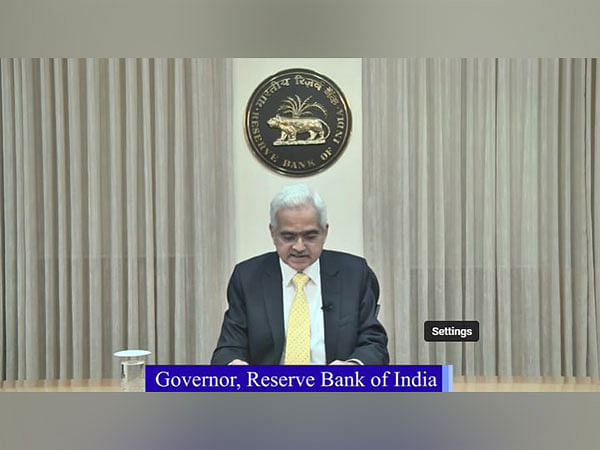

Mumbai (Maharashtra) [India], February 8 (ANI): The Monetary Policy Committee (MPC) of the Reserve Bank of India decided to raise the key benchmark interest rate by 25 basis points to 6.5 per cent on Wednesday. Four out of six members of MPC have decided to go ahead with this hike in the repo rate, RBI Governor Shaktikanta Das said on Wednesday.

Shaktikanta Das-headed Monetary Policy Committee (MPC) started its three-day meeting on February 6 amid the rate hiking spree that started in May last year to check inflation.

With retail inflation showing signs of moderation and remaining below the Reserve Bank of India’s 6 per cent upper tolerance level, and projected slowdown in gross domestic product (GDP) growth in the next fiscal starting April, experts are of the opinion that the central bank may only opt for a 25 basis points hike in the key interest rate.

In its December monetary policy review, the central bank raised the key benchmark interest rate (repo) by 35 basis points (bps) after delivering three back-to-back increases of 50 bps.

Since May last year, the RBI has increased the short-term lending rate by 225 basis points to contain inflation, mostly driven by external factors, especially global supply chain disruption following the Russia-Ukraine war outbreak. (ANI)

This report is auto-generated from ANI news service. ThePrint holds no responsibility for its content.