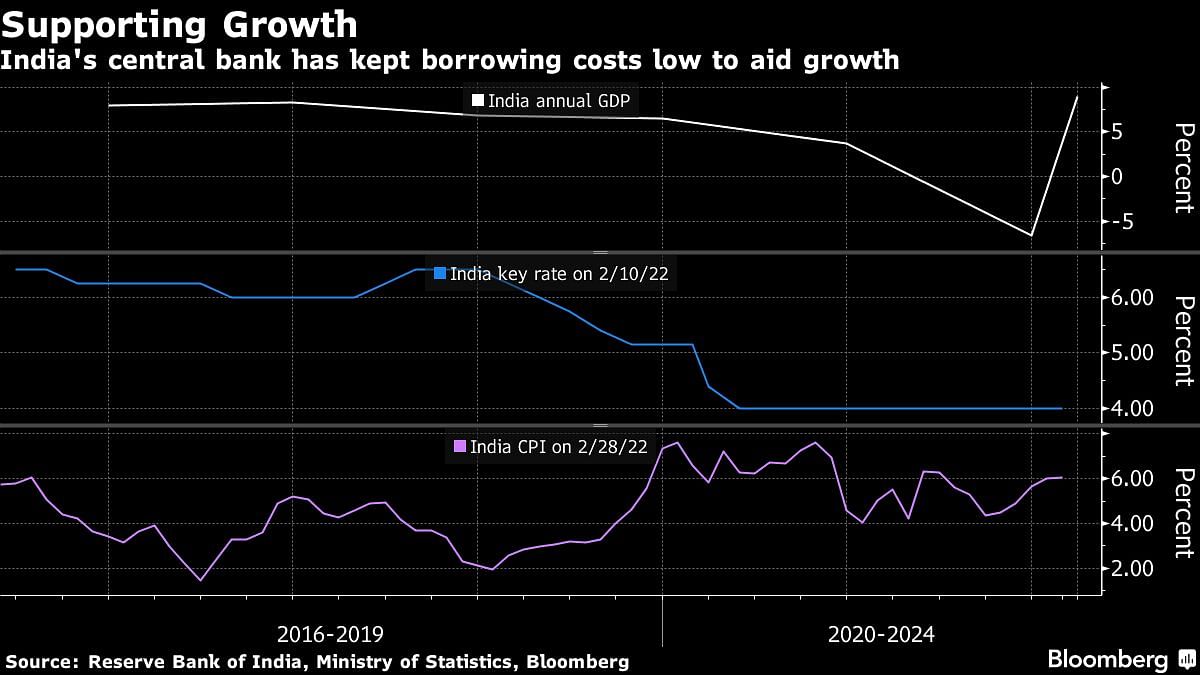

Mumbai: India’s central bank will likely raise its inflation outlook to reflect costlier oil while leaving borrowing costs steady at this week’s meeting.

All economists surveyed by Bloomberg expect the Reserve Bank of India’s six-member monetary policy committee to hold the benchmark repurchase rate at 4% Friday, while just four out of 29 polled as of Thursday morning see a hike in the reverse repurchase rate — a tool the RBI uses to remove excess cash from lenders.

That will shift the focus to any adjustments in language in the policy statement, as investors look for signs of normalizing monetary settings.

Here’s what to watch for in Governor Shaktikanta Das’s speech after the MPC meeting at 10 a.m. in Mumbai:

Policy toolkit

Investors will be looking for clarity on how the RBI — which acts as the government’s debt manager, in addition to its main role of maintaining price stability — plans to support the administration’s 14.31 trillion rupee ($189 billion) debt program and keep the sovereign’s borrowing costs in check when faster global policy normalization is pushing yields higher.

Keeping a lid on costs is crucial for Prime Minister Narendra Modi’s government as it seeks to boost spending on infrastructure, creating jobs and increasing productivity in the economy.

Expectations are for the RBI to consider measures such as open-market operations or Operation Twists — selling shorter-dated notes and buying longer-maturity bonds to keep yields down — to support the market amid record debt supply. It employed both tools during the height of the pandemic.

The central bank will have to buy bonds worth 2 trillion to 2.5 trillion rupees, or 25%-30% of the borrowing plan for the first half of the fiscal year that started April 1, for the program’s smooth passage, Citigroup Inc. economists Samiran Chakraborty and Baqar M Zaidi wrote in a note. This week’s policy should provide some guidance on that, they said.

The RBI may also extend by a year a move that raised the proportion of sovereign bonds Indian banks are permitted to hold in the so-called held-to-maturity category, to 22% from 19.5%. That creates an incentive for banks not to sell government notes, while protecting them from price swings at a time when benchmark yields are up nearly 50 basis points this year.

Language change

Das’s speech will also be closely watched for any change in language that signals a beginning of the end of the current easing bias.

Since October 2019, the central bank has said it will “continue with the accommodative stance as long as it is necessary to revive growth,” adding from March 2020 a reference to Covid-19.

“In the April meeting, we expect the RBI to raise its inflation forecast and prepare markets for future changes via a revised forward guidance,” said Pranjul Bhandari, chief India economist at HSBC Holdings Plc. “Rate changes will likely follow in subsequent meetings.”

Outlook revision

With inflation already running above the central bank’s 6% upper tolerance limit, the RBI is expected to bump up its 4.5% inflation forecast for the current fiscal year to factor in risks from higher global food and energy prices due to the war in Ukraine.

“Evolving risks are likely to challenge the RBI’s sanguine view on fiscal 2023 inflation, prompting a 50-100 basis points upward revision,” DBS Bank Ltd. senior economist Radhika Rao wrote in a note.

The RBI will likely assume oil prices at $95 a barrel for the April-September period, up from October’s $75 a barrel assumption, Deutsche Bank AG’s Kaushik Das wrote in a note. The RBI had pegged oil at $80 in the February policy, MPC member Ashima Goyal said in a recent interview. The oil price assumption is closely watched by the market to understand the foundations of the RBI’s inflation expectations and assess whether monetary settings will be appropriate to ensure price stability going forward.

The central bank revised its inflation forecasting model only last year after a previous version failed to capture price expectations accurately.

Citigroup economists see headline inflation also being driven by food.

“There are still two reasons why we should be worried about the possibility of a further surge in food inflation,” Citigroup’s Chakraborty and Zaidi wrote in a report Thursday. They see higher production costs and a lagged pass-through from wholesale prices pushing consumer price growth up by 25-30 basis points from their base-case assumption of 5.7%.

The RBI will also adjust the growth forecast for this fiscal year, lowering it by a few notches to 7.5% or more from the 7.8% expansion seen in February, according to Ananth Narayan, a senior India analyst at Observatory Group. –Bloomberg

Also read: Jet Airways coming back with hybrid of premium and no-frills services model