New Delhi: The Reserve Bank of India (RBI) Friday announced a series of measures to ease the pressure on non-banking finance companies (NBFCs), and improve credit flow to micro, small and medium enterprises (MSMEs), the rural sector and housing finance companies (HFCs).

The regulator also announced relief to borrowers struggling from the impact of Covid-19 by easing non-performing asset (NPA) classification norms. It also tried to encourage banks to lend to borrowers rather than deposit funds with the central bank by slashing the reverse repo rate by 25 basis points to 3.75 per cent.

It also prohibited banks from announcing any further dividends from profits for 2019-20 as a measure to conserve capital.

This is the second set of measures announced by the RBI within just a month to battle a slowdown in the Indian economy, and impacts of the Covid-19 pandemic.

In the last week of March, the RBI’s monetary policy committee had slashed repo rates by 75 basis points and the bank had announced a series of measures including a three-month loan moratorium to provide relief to borrowers.

‘Macroeconomic and financial landscape has deteriorated’

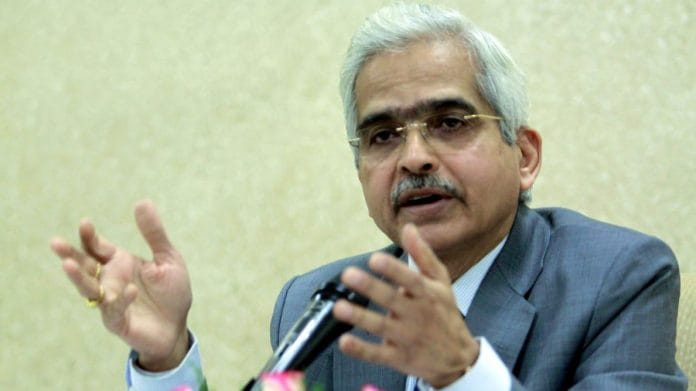

As he announced the changes in a live telecast Friday, RBI governor Shaktikanta Das said the central bank remains committed to preserve financial stability while pointing out that the overall situation has worsened in the three weeks since the RBI announced its last set of measures.

“Since March 27, 2020 when I spoke to you last, the macroeconomic and financial landscape has deteriorated, precipitously in some areas; but light still shines through bravely in some others,” Das said, adding that there is policy space for the RBI to take necessary steps as the situation demands.

“In the period ahead, inflation could recede even further, barring supply disruption shocks and may even settle well below the target of 4 per cent by the second half of 2020-21. Such an outlook would make policy space available to address the intensification of risks to growth and financial stability brought on by Covid-19. This space needs to be used effectively and in time,” Das said.

He added that the overarching objective is to keep the financial system and financial markets sound, liquid and smoothly functioning so that finance keeps flowing to all stakeholders, especially those that are disadvantaged and vulnerable.

Also Read: Limited trading hours for debt, currency markets to continue till 30 April : RBI

Relief for NBFCs, MFIs

In its announcements Friday, the RBI said it will again conduct long-term repo operations or basically a way of providing funds to banks over a period of one-three years amounting to a total of Rs 50,000 crore.

However, this time the funds will come with conditions that will ensure that banks use these to lend to NBFCs and microfinance institutions (MFIs), especially the small and mid-sized ones. This will address the liquidity issues faced by these institutions.

The RBI also allowed loans given by NBFCs to real estate firms to be extended by one year without this being considered as restructuring.

Facilitating credit flow to rural sector, MSMEs and HFCs

The central bank also announced refinancing facilities for National Bank of Agriculture and Rural development (NABARD), Small Industries Development Bank of India (SIDBI) and National Housing Bank (NHB) to facilitate credit flow to rural sector, MSMEs and the housing finance sector.

The RBI announced a Rs-50,000 crore special refinance facility – Rs 25,000 crore to NABARD to fund regional rural banks and MFIs, Rs 15,000 crore to SIDBI to lend to banks that will further lend to MSMEs, and Rs 10,000 crore to NHB to lend to HFCs.

Also read: Economists expect RBI will print money as India battles Covid-19. Here’s what it means

Relief for stressed borrowers from being classified as NPAs

The central bank also announced relief to stressed borrowers by allowing banks to bring in an asset classification standstill before accounts are classified as NPAs.

According to the fresh directive, banks can exclude the three-month loan moratorium period while working out the 90-day NPA norms. This effectively means an account will be classified as NPA in case of non-payment of dues after a total of 180 days during this period.

However, banks will have to maintain a higher provision of 10 per cent on all such accounts.

The regulator has also given banks more time to come up with a resolution plan for large accounts.

More funds for states

The RBI also allowed states to borrow more through ways and means (WMA) advances “to provide greater comfort to the states for undertaking Covid-19 containment and mitigation efforts, and to plan their market borrowing programmes better”.

After increasing the limit of WMA advances by 30 per cent earlier this month, RBI announced that the limit has been raised by 60 per cent over and above the level as on 31 March. The increased limit will be available till 30 September.

The RBI governor concluded his statement on a positive note: “Eventually, we shall cure; and we shall endure”.

Also read: Govt package a relief measure, tax-break stimulus ideal to fight Covid: RBI panel member