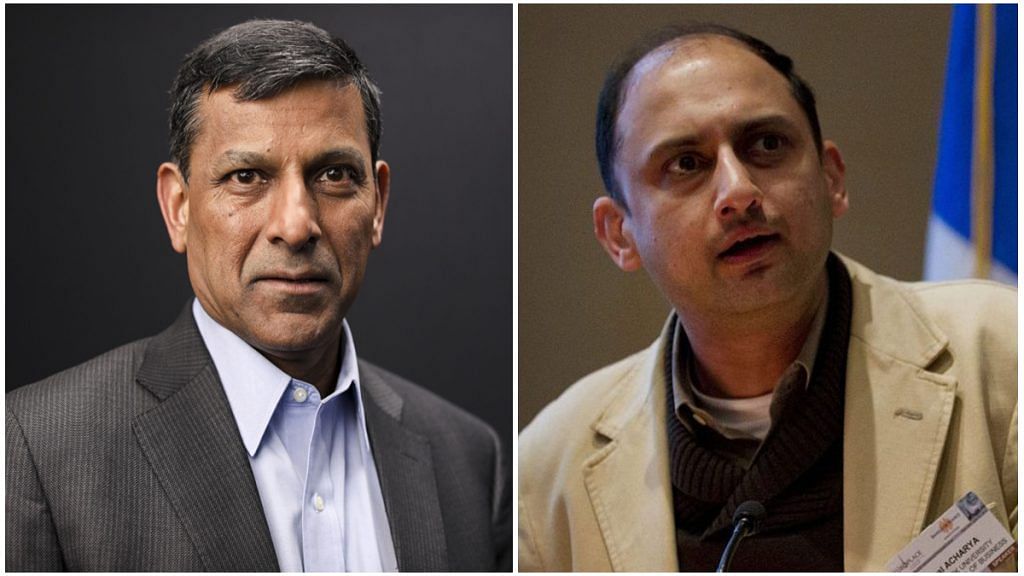

New Delhi: Allowing Indian corporate houses into banking will lead to the concentration of economic and political power in these business houses and the exchequer could be faced with significantly higher bailout costs if these banks were to fail, former Reserve Bank of India (RBI) governor Raghuram Rajan and former RBI deputy governor Viral Acharya have said in a paper.

The paper, posted by Rajan on his LinkedIn page Monday, termed the recent recommendation of an RBI internal working group on allowing corporates into banking a “bombshell” and said this proposal is “best left on the shelf”.

Last week, the RBI released the report of an internal working group on ownership guidelines and corporate structure for Indian private sector banks. The group was tasked to review, among other things, the eligibility criteria for individuals and entities to apply for a banking licence.

Reacting to this report, Acharya and Rajan wrote that it is even more important in today’s times to stick to the tried-and-tested limits on corporate involvement in banking.

They pointed out that if industrial houses need financing, they can get it easily, no questions asked, if they have an in-house bank.

“The history of such connected lending is invariably disastrous — how can the bank make good loans when it is owned by the borrower? Even an independent committed regulator, with all the information in the world, finds it difficult to be in every nook and corner of the financial system to stop poor lending. Information on loan performance is rarely timely or accurate. Yes Bank managed to conceal its weak exposures for considerable periods,” they said.

Allowing the entry of corporates into banking will mean that highly indebted and politically connected business houses will have the greatest incentive and ability to push for licences, they added.

“That will increase the importance of money power yet more in our politics, and make us more likely to succumb to authoritarian cronyism. Can the regulator not discriminate between ‘fit and proper’ businesses and shady ones? It can, but it has to be truly independent, with a thoroughly apolitical board,” they added. “Whether these conditions will always pertain is debatable.”

Also Read: Banks have not signed a single agreement for RBI’s debt recast scheme for high value loans

‘Penny wise pound foolish’

In 2016, the paper notes, the RBI had recognised the risk of excessive exposures to specific houses and announced group exposure norms that limit the exposure the banking system can have to specific industrial houses. “These norms have been relaxed recently,” the paper states.

The internal working group report itself points out that all but one of the experts it consulted were of the opinion “that large corporate/industrial houses should not be allowed to promote a bank”, the authors stated.

Acharya and Rajan also pointed out that even if promoters pass the criteria at the time of the licence being granted, they can turn rogue later, saying India had witnessed such instances.

“…The licensee’s temptation will be to misuse it because of self-lending opportunities. India has seen a number of promoters who passed a fit and proper test at the time of licensing turn rogue. The bailout costs to the exchequer could be significantly more when it comes to bank licences to industrial houses, which will start out big,” they said.

The two also questioned the timing of the proposal as well as the reasons for the urgency.

“One possibility is that the government wants to expand the set of bidders when it finally turns to privatising some of our public sector banks. It would be a mistake, as we have said in an earlier paper, to sell a public sector bank to an untested industrial house,” they said.

“Far better to professionalise public sector bank governance, and sell stakes to the broader public — that would help promote a shareholder culture, as well as distribute wealth more widely,” they added. “It would be ‘penny wise pound foolish’ to replace the poor governance under the present structure of these banks with a highly conflicted structure of ownership by industrial houses.”

Also Read: India’s banking rules need to close the door to tycoon cronyism