Mumbai: Canadian investor Prem Watsa’s Indian bank has started preparations for a stock market listing this year, its chief executive said.

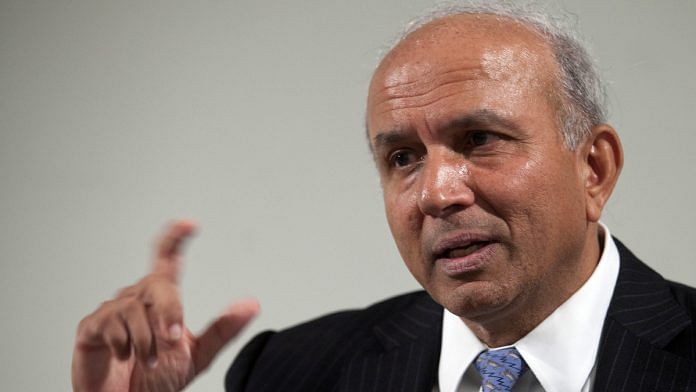

Catholic Syrian Bank Ltd., in which Watsa’s Fairfax India Holdings Corp. received approval to take a controlling stake, is gearing up for a listing that may involve a 4 billion rupee ($58 million) initial public offering, according to Chief Executive Officer C. VR. Rajendran.

Last year, Toronto-based Fairfax agreed to invest $168 million for a 51 percent stake in the bank, the first time the Reserve Bank of India allowed a foreign firm to take a majority interest in a local lender. At the same time, the RBI told privately held Catholic Syrian Bank that it should list its shares before Sept. 30 this year, according to Fairfax India’s latest annual report.

Catholic Syrian Bank has hired Axis Capital Ltd. to manage the listing, and is debating exactly which route to market it will take, Rajendran said in a recent interview. He said he’s seeking approval from the Securities and Exchange Board of India for a direct listing — where all existing shares become tradable without the need for an initial public offering. But if the bank doesn’t get the nod from Sebi, he will instead pursue an IPO that may involve the sale of both new and existing shares, Rajendran added.

The listing of Catholic Syrian will attract many investors, said A. K. Prabhakar, head of research at IDBI Capital Market Services Ltd. “Fairfax investment would have changed a lot of things at the bank, from the way it works to the way it reports.”

Fairfax Financial Holdings Ltd. owns assets around the world, with Watsa particularly enthused by opportunities in India. Since August 2015 he has invested about $1.6 billion in Indian assets, from chemicals manufacturers to financial services providers, according to the Fairfax annual report.

Direct Listing

The advantage of a direct listing is that it won’t dilute Fairfax’s holding in the bank, Rajendran said. But direct listings for companies not already quoted on one of India’s various exchanges are unusual, and so approval from Sebi isn’t a foregone conclusion, according to Sandeep Parekh, a former executive director at the regulator.

The shareholding agreement reached last year gave Fairfax 18 months from October to build its stake to 51 percent via purchases of privately held shares and warrants.

Catholic Syrian is undergoing a change of strategy, reversing a move into large-scale corporate lending after many of the loans soured, Rajendran said. With backing from Fairfax, the bank wants to return to its roots in handing out loans to the gold and retail sectors, and to small and midsized enterprises.

The listing plans aren’t driven by any need for further capital, as the injection from Fairfax will provide sufficient funding for the next two or three years, said Rajendran.

“We don’t need capital. This is only for compliance,” he added.

Also read: No relief for investors after RBI is seen curtailing its support for the bond market