New Delhi: Looking for reserves to push its bid for growth, the Narendra Modi government will now tax India’s super rich more and raise the prices of diesel and petrol even as it promises to reduce some burden on homebuyers and companies.

On Friday, Finance Minister Nirmala Sitharaman announced an increase in surcharge for those earning over Rs 2 crore of taxable income annually.

The hike in surcharge on the income tax paid will be for two groups — for those earning between Rs 2 crore and Rs 5 crore, and above Rs 5 crore.

The effective increase in tax rates for these two groups will be around 3 per cent and 7 per cent respectively, the finance minister said.

The concept of a tax on the super rich was introduced by her predecessor Arun Jaitley who had introduced a 10 per cent surcharge on those earning more than Rs 1 crore.

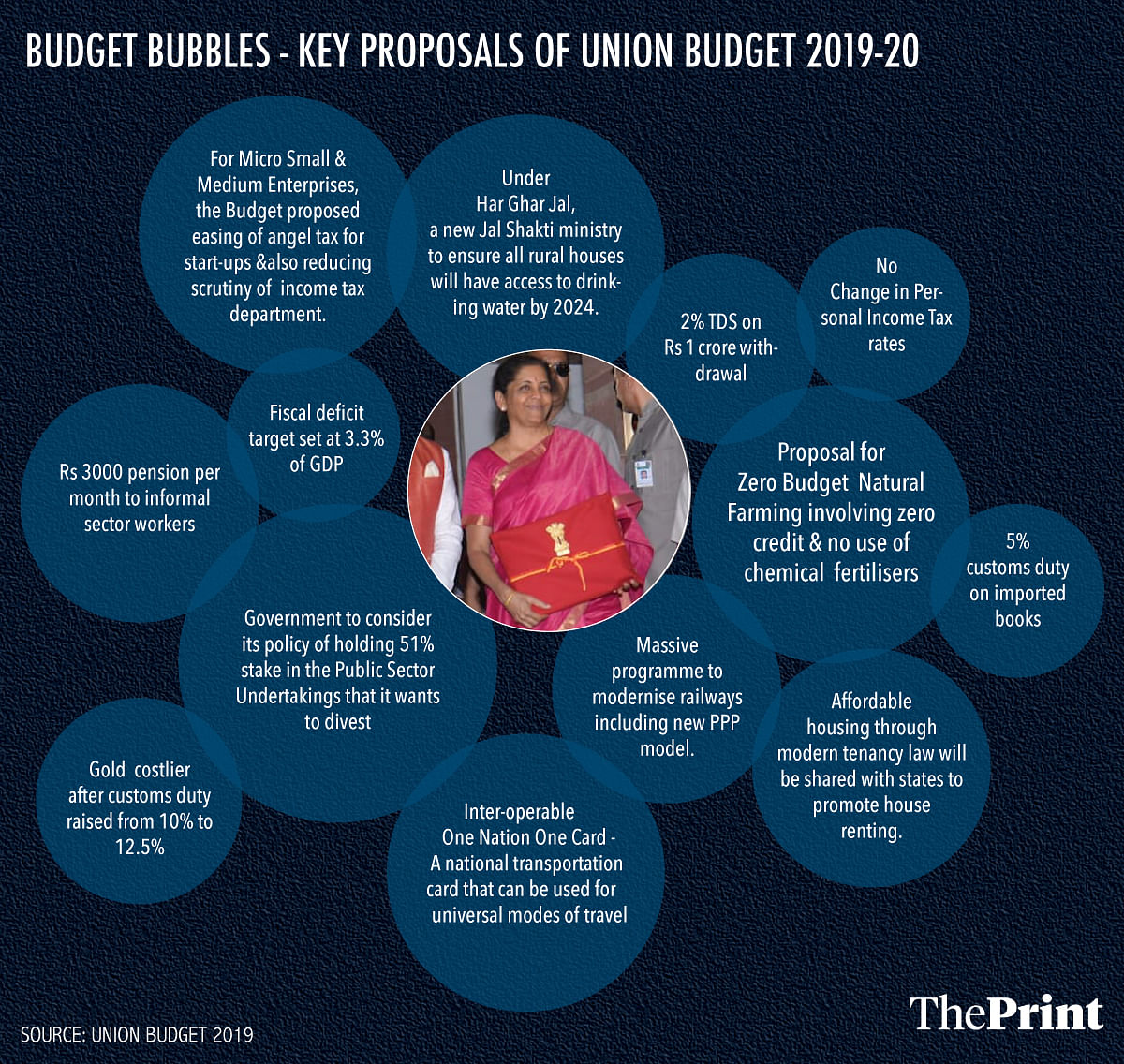

Another burden on rich taxpayers will be the 2 per cent tax deducted on source (TDS) proposed on cash withdrawals of more than Rs 1 crore annually from bank accounts. Sitharaman said the aim of the move is to discourage cash transactions for business payments.

Also read: What is Zero-budget farming – Nirmala Sitharaman’s fix to double farm income

Diesel & petrol to cost more, but incentives for homebuyers & firms

In her maiden Union Budget speech, Nirmala Sitharaman also announced an increase in both the additional excise duty and the cess on petrol and diesel each by Re 1 per litre, a move that is likely to make fuel more expensive for the common man.

The finance minister also retained the full income tax rebate for all individuals having a taxable income of up to Rs 5 lakh announced in this year’s interim budget.

As an incentive for homebuyers, Sitharaman announced an additional Rs 1.5 lakh interest exemption over and above the existing Rs 2 lakh exemption for housing loans availed till March 2020 but the housing price has been capped at Rs 45 lakh.

As a relief to many companies, firms with an annual turnover of up to Rs 400 crore will now pay a lower 25 per cent tax rate. This will effectively cover 99.3 per cent of firms, Sitharaman said.

Earlier, the lower tax rate was only applicable to companies having annual turnover up to Rs 250 crore.

Also read: Petrol prices rise by 83 paise per litre and diesel by 73 paise days after election