Mumbai: The most urgent challenge for Pakistan’s new leaders, other than staying in power, is securing an International Monetary Fund credit line with the nation months away from a financing crisis, investors say.

Lombard Odier and Tundra Fonder AB said it’s critical for Pakistan to get back to negotiations with the IMF, while abrdn sees uncertainty about the coalition government’s ability to implement reforms necessary to get $3 billion of loans.

“The fundamentals are getting more and more challenged,” said Nivedita Sunil, fund manager at Lombard Odier. “Inflation is on an uptrend, FX reserves have fallen, and there’s a large amount going to food and energy imports. It is very crucial for them to find a working balance with the IMF.”

With just enough foreign reserves to cover two months of imports, the clock is ticking on new Prime Minister Shehbaz Sharif to fund a financing gap. The nation faces a funding requirement of $14.1 billion for January-June alone, more than the central bank’s $11.3 billion in reserves, according to Bloomberg Economics.

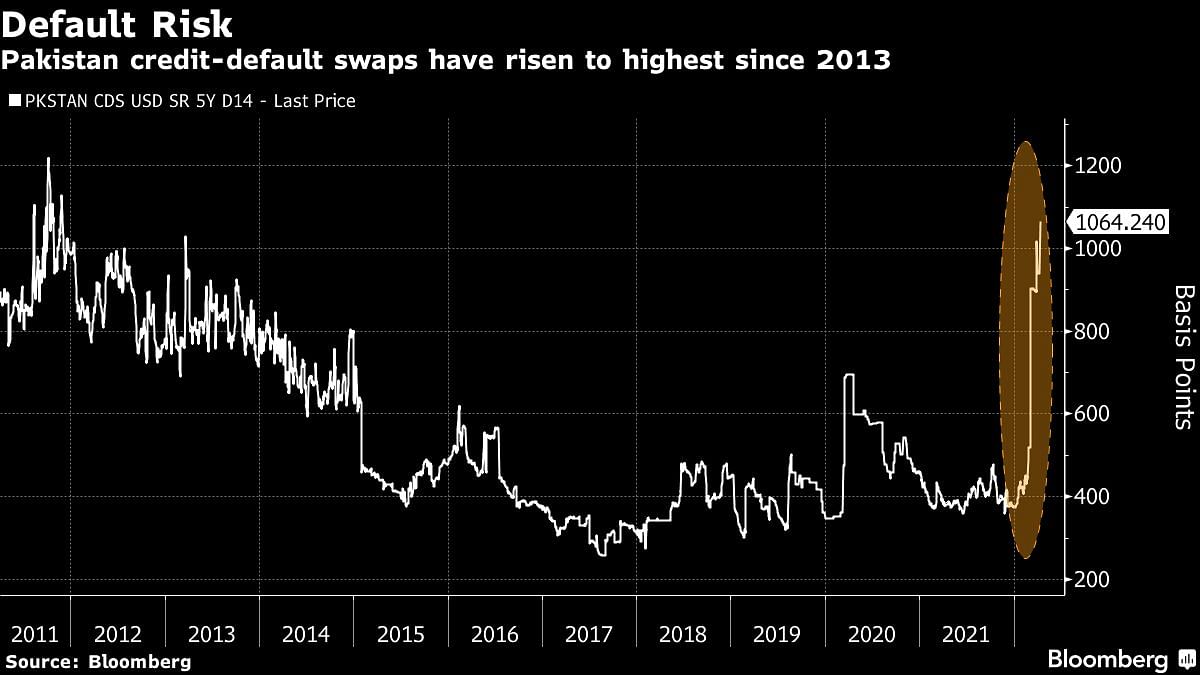

The fear that it would tumble into a profound economic and financial crisis — much like what happened to Sri Lanka — has sent its five-year credit-default swaps to the highest since 2013 even after political stability was restored with the ouster of Imran Khan.

While the frontier market’s stocks and currency have rebounded from lows with the peaceful transition of government, the nation still faces inflation higher than 12%. The current account deficit is expected to be 6.5% of gross domestic product, while the trade gap is likely to reach a record $45 billion in year to June, according to Miftah Ismail, a former finance minister.

“The culmination of the recent political events in Pakistan have calmed markets, however, the country is not yet out of the woods,” said Ruchir Desai, fund manager with Asia Frontier Capital Ltd. Economic growth will weaken given the higher interest rates needed to tackle inflation, while the new government may need to raise taxes to implement IMF reforms, he said.

Loan package

The new administration will work with the IMF to stabilize the economy, said Ismail, who according to the local media is likely to be named the new finance minister. It needs to secure agreement with the IMF for the remaining $3 billion tranche of loans from a $6 billion bailout package agreed to in 2019.

Pakistan is under severe pressure and “must get back on track with the IMF program,” said Mattias Martinsson, chief investment officer of Tundra Fonder AB.

Securing the money could hinge on the new government’s ability to raise energy prices, removing subsidies put in place by Khan. It’s a step that would signal “good housekeeping,” according to Central Bank Governor Reza Baqir, who earlier this month raised policy rates by 250 basis points.

The question will be whether the coalition government can “get laws passed and complete the IMF program,” said Kenneth Akintewe, head of Asian sovereign debt at abrdn in Singapore. “There’s fairly broad agreement that the subsidies are unsustainable.”

“Market will see if the IMF will relax some of its demands given some of the external risks are more acute than before,” said Akintewe. —Bloomberg

Also read: Pursuing maths & music degrees together? Why UGC’s 2-degree programme has divided professors