New Delhi: West Bengal was the highest contributor to small savings collections for nearly two decades beginning 2000, data with the National Savings Institute shows.

This, perhaps, explains the haste with which the government withdrew the Wednesday order announcing sharp cuts in small savings schemes for the quarter starting 1 April.

The government’s decision to withdraw the order comes as a pitched election battle between the BJP and the ruling Trinamool Congress continues in West Bengal. Assembly elections in West Bengal are being held in eight phases, with polling for the second phase taking place Thursday.

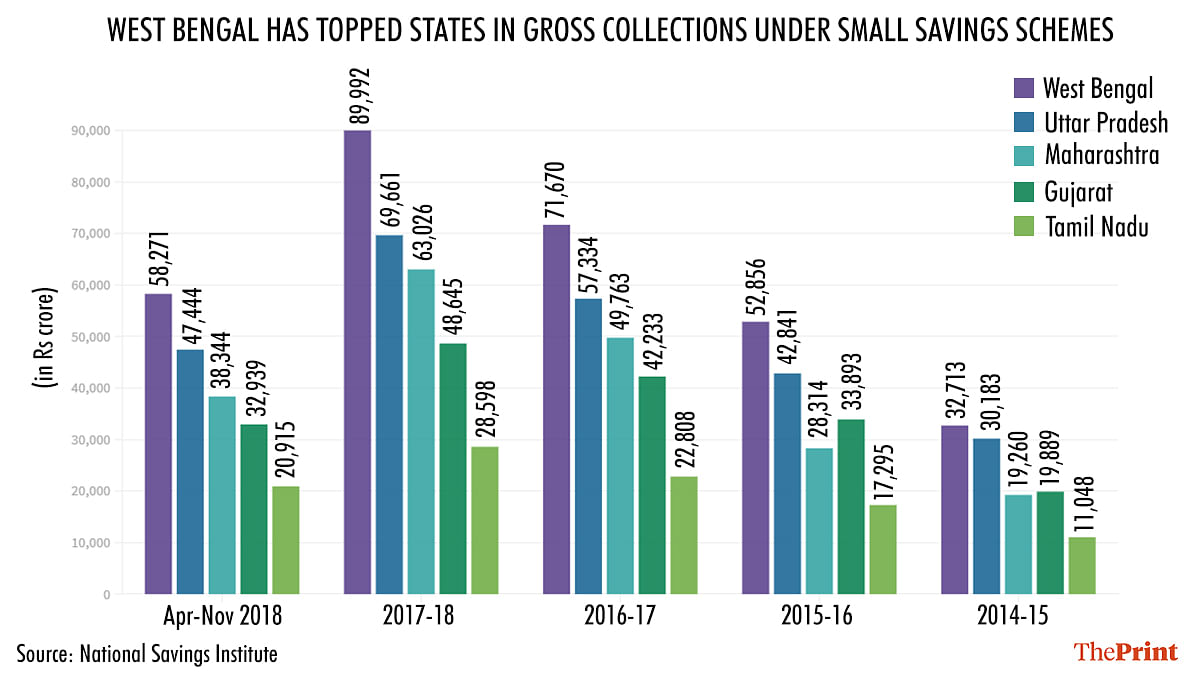

The data, available till November 2018, shows that West Bengal has consistently outranked Uttar Pradesh, India’s most populous state, in small savings collections across post offices and banks.

National Savings Institute is a body under the department of economic affairs with the finance ministry. It is not clear why the data has not been updated since November 2018.

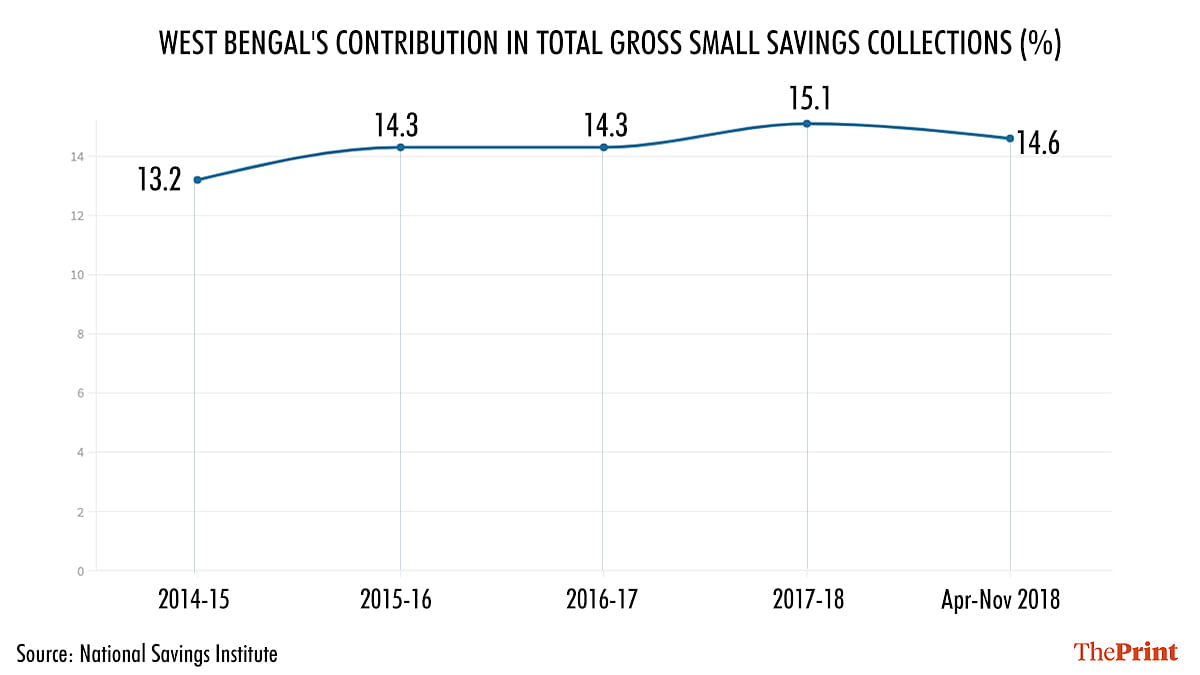

According to data available with the institute, the share of collections from West Bengal in the overall national small savings collections has been in the range of 13-15 per cent over the last few years.

Collections from schemes like public provident fund (PPF), senior citizen savings scheme, post office deposit schemes, National Savings Certificate, Sukanya Samriddhi Yojana and Kisan Vikas Patras are together clubbed as small savings.

A cut in small savings rates would have been a hugely unpopular move as it affects senior citizens, salaried class as well as those segments of the population that use small savings to build a corpus fund.

Collections from West Bengal nearly Rs 90,000 cr

Of the total gross small savings collections of Rs 5.96 lakh crore in 2017-18, collections from West Bengal were at nearly Rs 90,000 crore, followed by collections from Uttar Pradesh at Rs 70,000 crore, Maharashtra at Rs 63,000 crore and Gujarat at Rs 48,000 crore.

Gross collections take into account the inflows without accounting for the outflows from the scheme by way of withdrawals.

For the last few years, the interest rates on the schemes are revised every quarter to align them with the prevalent interest rates in the economy. To date, the interest rates on small savings schemes have been more attractive compared to bank fixed deposit rates.

The flip-flop

The finance ministry, in a routine order on 31 March, announced a sharp cut in small savings schemes ranging from 0.4 to 1.1 per cent for the quarter beginning 1 April.

Among the schemes that saw a sharp cut in interest rates were the Senior Citizen Savings Scheme, a preferred savings option for retired senior citizens. The scheme saw a 90 basis points interest rate cut to 6.5 per cent from 7.4 per cent. The interest rate on PPF, an option used by the salaried class to save on taxes, was reduced by 70 basis points to 6.4 per cent from 7.1 per cent. The interest rate on national savings certificates also saw a 90 basis points cut to 5.9 per cent and the Sukanya Samriddhi scheme saw a 70 basis points cut in interest rate to 6.9 per cent.

However, following an uproar, Finance Minister Nirmala Sitharaman announced Thursday morning that the order was an “oversight” and will be withdrawn.

Opposition attacks Modi govt

Opposition parties attacked the Modi government on both the cuts and then the rollback.

Trinamool Congress leader Mahua Moitra had talked about the sharp cut in interest rates and its adverse impact on the middle class and senior citizens.

@BJP’s Acche Din continues. Interest on small savings cut steeply:

PPF from 7.1% to 6.4%

NSC from 6.8% to 5.9%

Senior Citizens Savings from 7.4% to 6.5%

Why doesn’t @BJP just annihilate middle class & senior citizens in one go rather than this slow painful death?

— Mahua Moitra (@MahuaMoitra) March 31, 2021

After the rollout, she criticised the decision-making process in the government.

What is the biggest April Fool’s joke here?

That a now- rolled back small savings rate cut was issued by “oversight”?

Or that Nirmala Sitaraman is Fin Min of this country?

— Mahua Moitra (@MahuaMoitra) April 1, 2021

Chronology samajhiye!

7 am April 1

ModiShah- What? Rate cut & 5 states go to polls now? Bewakoof- roll back NOW! Announce after election.

7:54 am April 1

Ministry- Yes Sir, no problem Sir. FinMin will tweet rollback just now.— Mahua Moitra (@MahuaMoitra) April 1, 2021

Trinamool Congress leader Derek O’Brien, replying to Sitharaman’s clarification on the savings schemes, said the situation was an “egg on the face” of the government.

Egg on face again🤪

Because MO-SHA too busy throwing petals from trucks and cracking April Fool jokes of false promises at election rallies. https://t.co/SVb0dWrqQU

— Derek O'Brien | ডেরেক ও'ব্রায়েন (@derekobrienmp) April 1, 2021

Congress leader Priyanka Gandhi questioned if the announcement by Sitharaman was more to do with ‘hindsight’ during elections rather than oversight.

Really @nsitharaman “oversight” in issuing the order to decrease interest rates on GOI schemes or election driven “hindsight” in withdrawing it? https://t.co/Duimt8daZu

— Priyanka Gandhi Vadra (@priyankagandhi) April 1, 2021

(Edited by Neha Mahajan)

Also read: By rolling back small savings rate cuts, Modi govt has damaged its image as a bold reformer

Ms. Sitharaman is an absolute liability for this government. India deserves a much more sharp Finance Minister. She is clearly out of her wits and that is the reason why she keeps on messing up time and again.

THis is one of the rare occasions when the BJP owns up a blunder and corrects it. This is in contrast to the demonetization blunder which Mr Modi has never owned up.