New Delhi: The upcoming full budget for financial year 2024-25, set to be announced in the second half of July, is unlikely to vary significantly from the ‘interim’ budget for the year announced on 1 February, according to officials in the government as well as economists who track public finances.

This would be in line with the historical trend as well, with analysis by ThePrint showing that the full budgets announced by new governments have seldom varied significantly from the votes on account — also referred to as interim budgets — announced by previous governments.

This continuity in fiscal allocations largely holds true regardless of whether the incumbent government returns to power or is replaced.

“The budget work is well under way, but there’s currently no plan for any major deviation from the budget announced in February,” a senior official in the Ministry of Finance, closely associated with the budget-making process, told ThePrint. He requested to remain anonymous since the ministry has entered the pre-budget silent period where officials are restricted from speaking to the media.

“The one difference between this full budget and the interim one is the dividend amount received from the Reserve Bank of India (RBI),” the official added. “Discussions are on to decide how best to use this surplus amount.”

The RBI in May announced that it would be transferring Rs 2.11 lakh crore to the government as dividends. This is significantly higher than the Rs 1.5 lakh crore the government had budgeted for in February.

The official said that the options on the table were to either use the full amount to reduce the government’s borrowing and fiscal deficit, which is the amount by which its expenditure exceeds its income, or to spend the amount as additional capital expenditure. The third option is to allocate that extra amount towards social sector spending.

Dividing the amount to do a bit of all three is also being considered, he added.

Also Read: ‘Walked the path of fiscal prudence’ — what economists say about interim budget 2024’s fiscal maths

Increasing capex further not the best idea

According to economists, allocating the entire surplus amount to capital expenditure might not be the best use for it, since the government will have only a limited time to spend this additional amount.

“The higher-than-budgeted RBI surplus transfer would help to boost the Indian government’s resource envelope in FY2025, allowing for enhanced expenditures or a sharper fiscal consolidation than what was pencilled into the interim budget for FY2025,” Aditi Nayar, chief economist and head of research and outreach at credit rating agency ICRA, said.

“Increasing the funds available for capex would certainly boost the quality of the fiscal deficit,” she noted. “However, the additional spending may be difficult to be incurred within the eight-odd months left after the final budget is presented and approved by Parliament.”

In its interim budget, the government had already increased its allocation for capital expenditure by 11.1 percent to Rs 11.11 lakh crore, or 3.4 percent of India’s gross domestic product (GDP).

“The fiscal constraints of the government remain the same before and after the elections,” Madan Sabnavis, chief economist at Bank of Baroda, explained. “When you have only eight months left to implement the budget, there’s nothing drastically new that you can do.”

The first challenge before the government, he added, would be to meet the targets set in the interim budget.

“Beyond that, if something has been promised during the elections, then those could be met, but nothing significant is going to happen, I feel,” he said.

History shows final budgets hold no big surprises

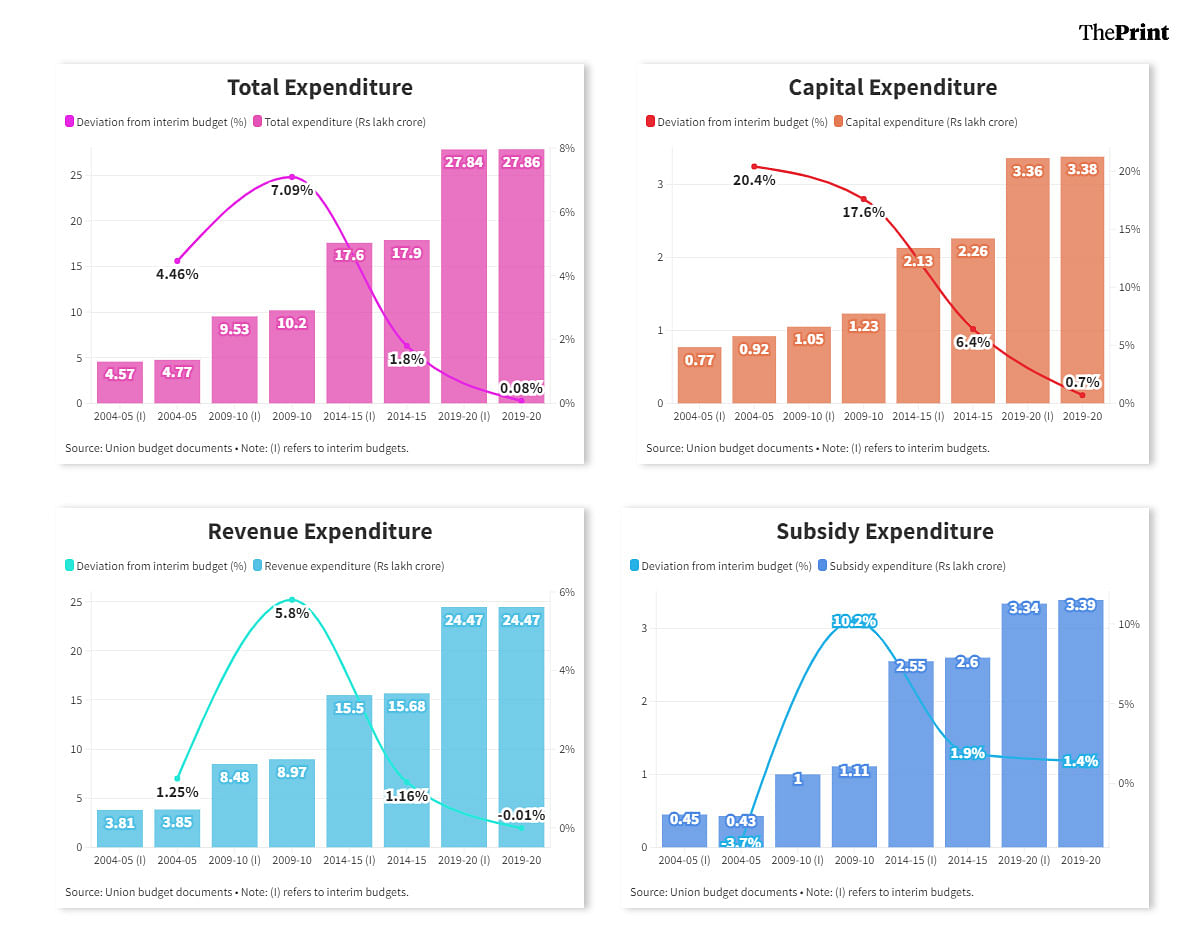

An analysis of interim and full budgets since 2004-05 shows that total expenditure budgeted by the government changed only marginally, and that the divergence between interim and final amounts has decreased over the years. This is despite the fact that the government changed in some of those years and remained the same in others.

For example, the total expenditure budgeted by the new United Progressive Alliance (UPA) government for 2004-05 was only 4.6 percent higher than the amount planned in the previous Vajpayee government’s interim budget.

This divergence between interim and final total expenditure increased to 7.1 percent in 2009-10, when the UPA returned to power, but fell to 1.8 percent in 2014-15 when it was replaced by the Modi government, and further to about 0.1 percent in 2019-20 when the Modi government was voted back to power.

The divergence in capital expenditure announced in interim budgets and final budgets has consistently been falling, from 20.4 percent in 2004-05, to 17.6 percent in 2009-10, 6.4 percent in 2014-15, and 0.7 percent in 2019-20.

Similarly, the divergence in revenue expenditure — which includes salaries, pensions, and subsidies — has been falling over the years, coming in at just -0.01 percent in 2019-20. This means the Modi 2.0 government actually budgeted a marginally lower amount for revenue expenditure than the outgoing Modi 1.0 government did.

(Edited by Nida Fatima Siddiqui)

Also Read: Budget is Nirmala Sitharaman’s first order of business—reduce deficit or create employment?