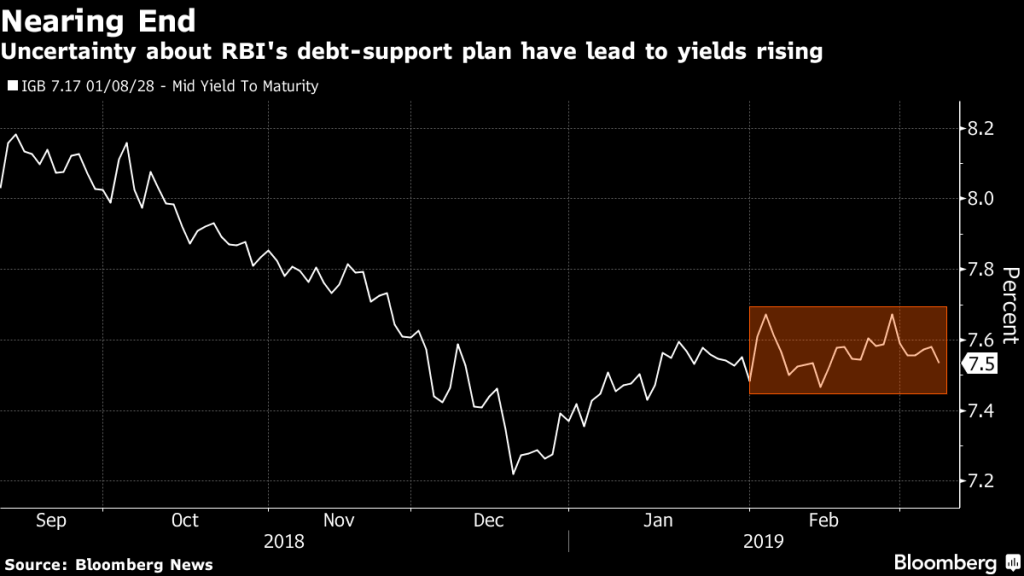

Mumbai: India’s central bank is seen curtailing its support for the bond market, dashing hopes of relief for investors reeling under two straight months of declines.

The Reserve Bank of India may buy 1.7 trillion rupees ($24 billion) of debt in the year starting April 1, according to a Bloomberg News survey of traders and economists. That compares with an estimated record 3 trillion rupees spent on such purchases this fiscal period.

Tightening the spigot on purchases is bad news for a market already jittery about the heavy supply of paper from Prime Minister Narendra Modi’s record $100 billion borrowing plan. The yield on new 10-year debt may climb as high as 7.75 percent over the coming months, according to ICICI Securities Primary Dealership Ltd., a level last seen in November.

Also read: RBI likely to cut policy rates twice more, says market expert

“If the OMOs go out of the picture at a time when we have humongous debt supply hitting the system, we may see bond losses intensifying,” said Naveen Singh, head of fixed-income trading at ICICI Securities.

In a sign of things to come, the Reserve Bank of India on Feb. 26 unveiled purchases for the first two weeks of March after earlier saying it would extend support for the entire month. The central bank may halt fresh buying in the quarter starting April as higher spending by the government will likely boost liquidity in the banking system, Singh said.

The purchases, aimed primarily at addressing the cash crunch in the banking system, have helped absorb a little over half the sovereign bond supply of 5.71 trillion rupees this fiscal year. The support may taper because of an improvement in liquidity, and HSBC Holdings Inc. expects the RBI to cut back buying to between 1.8 trillion rupees to 2 trillion rupees.

Even so, a clear majority for Modi’s party in the upcoming elections may burnish the appeal of Indian assets and lure dollar inflows, reducing the market’s reliance on RBI’s support, according to ICICI Securities. Foreigners have bought about $65.5 million of rupee bonds so far this month, paring the year’s withdrawal to $1.6 billion.

Also read: As RBI transfers reserve surplus to Modi govt, it now has to find ways to manage risks

“If there is a continuity at the center, foreign inflows might surpass our assumption and the RBI may not have to do huge OMOs,” ICICI’s Singh said. “In that case, things can change drastically.” – Bloomberg