Mumbai: In the latest body blow to India’s wireless carriers, billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd. has come out largely unscathed, bolstering its position as the top operator in the world’s second-biggest market by users.

India’s Supreme Court on Thursday ordered phone operators in the country to pay the government a combined 920 billion rupees ($13 billion) in past airwaves and license fees. The ruling came after a two-decades-old legal dispute between authorities and the companies over the payments.

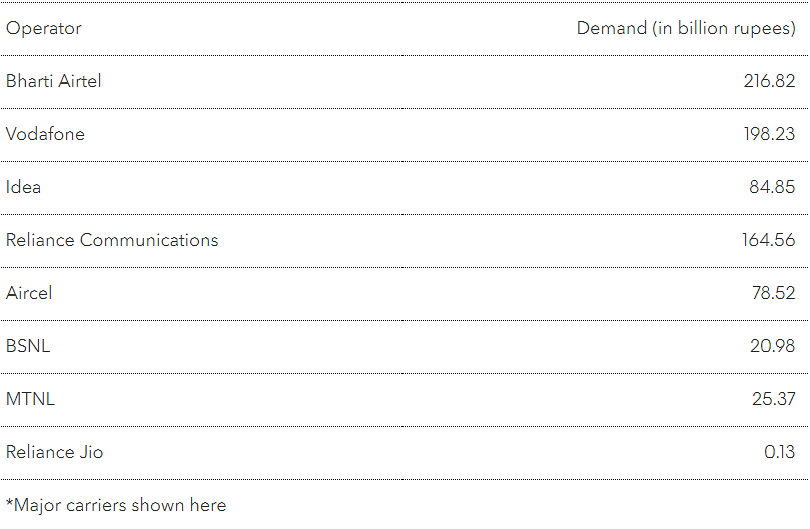

In a market already bruised by a price war since Jio’s 2016 entry with free calls and cheap data, the biggest loser from the verdict is Vodafone Group Plc’s India venture — Jio’s closest rival. The U.K.-based operator and its Indian partner now need to pay the government a combined $4 billion, a huge burden for a carrier that hasn’t made any profit since announcing their merger in 2017. Bharti Airtel Ltd., the No. 3 carrier, faces a bill of $3 billion, compared with Jio’s $1.8 million.

Underscoring the woes of the industry, Bharti Airtel and Vodafone Idea Ltd. have racked up a combined net debt of almost $28 billion and face billions of dollars more in spending on introducing 5G networks. Bharti Airtel, controlled by tycoon Sunil Mittal, reported its first ever loss in the quarter through June.

“In case of full payment, VodaIdea will have no cash for capex or spectrum installments for next three years,” Jefferies said in a research note. “For Bharti, it will mean curtailing of capex. We await more clarity on amount and terms of payment.”

Shares of Vodafone Idea headed for their biggest two-day plunge on record. They tumbled as much as 16% on Friday in Mumbai to a record low, following a 23% drop on Thursday. Airtel was little changed after gaining 3.3% Thursday.

Deep Pockets

Although Jio, backed by the deep pockets of Ambani’s Reliance Industries Ltd. oil-to-retail conglomerate, has spent $50 billion to build its nationwide network and had a debt of 840 billion rupees, it has reported quarterly profits this fiscal year after luring users away from Airtel and Vodafone. Reliance shares slipped 0.5% after rallying 3.2% on Thursday.

Still, the court’s endorsement of the way in which the government calculates the revenue of the telcos — a share of which is paid as license and spectrum fees — means Jio will face some pressure on earnings, according to Bloomberg Intelligence.

What Bloomberg Intelligence says:

Reliance Jio may be less hit than rivals by a one-time demand in arrears from the Indian government’s Department of Telecommunications (DoT), but the Supreme Court’s ruling on the revenue treatment of charges and fees could slow the segment’s profit growth. Jio generated 23% of Reliance’s Ebitda in fiscal 1H, a share that’s poised to grow.

–Henik Fung, analyst

India’s Supreme Court is deciding when the carriers will need to pay the amounts.

Additionally, Vodafone faces the prospect of a $2.2 billion tax bill linked to its 2007 acquisition of Hutchison Whampoa Ltd.’s Indian operations. The U.K.-based carrier’s Indian unit, which agreed to merge with billionaire Kumar Mangalam Birla’s Idea Cellular Ltd., is fighting a government demand that came despite a ruling in its favor by the nation’s top court in 2012.

Vodafone Idea and Airtel have said they are disappointed with the ruling. The telcos may either appeal to a larger bench of the Supreme Court or ask the government to waive the penalties and interest or seek deferred payment options, Jefferies said.

The judgment throws up “two important facets,” according to Alok Shende, a Mumbai-based principal analyst for telecom at Ascentius Insights. “First, the problem can fester for years in the long drawn legal process, ballooning the final impact,” he said. “The second implication is that the policies often have an element of ambiguity that allows for different interpretations.”- Bloomberg

Also read: Amazon, Flipkart & Mukesh Ambani will help save India’s banks

What nonsense are you guys writing just for sake of news you write this crap.

The quality of all the three brand is not upto the level of Jokey or even P3.

Further , the expectatation level of turnover of the owners of those companies is very high. They are not realistic and always try to sell more and more.

In economics , there is a concept of optimum but they donot know the optimum theory.

This is the problem .

Ask Azam Khan to find out why underwear sector is not doing well.

It is 56,370,savarkar godse, pulwama. Surgical, mandir masjid, nrc, will give jobs and 5 trillion to our economy.