New Delhi/Mumbai: MUDRA, the ambitious Modi government scheme that helps small entrepreneurs get loans to expand or set up businesses, was a godsend for Kamlesh Chauhan, a 32-year-old grocer from Surajpur village in Uttar Pradesh. But for Savita Bhoye, a 28-year-old beautician of Thane, Maharashtra, the experience was bittersweet, as she claims to have suffered harassment from the bank before her loan request was granted.

MUDRA, or the Micro Units Development and Refinance Agency Bank, is a public sector agency that supports the “finance institutions… in the business of lending to micro/small business entities engaged in manufacturing, trading and service activities”.

Launched in April 2015, it has managed to meet the aspirations of entrepreneurs across a wide range of social and economic classes. More than 15.73 crore loans have been sanctioned, with the total sum crossing Rs 7.6 lakh crore as of end January 2019. And the loans are being given to a wide range of activities.

Chauhan, for example, runs a successful shop in her village where she sells all kinds of daily-use products, from biscuits and detergent to milk and cold drinks.

But that was not always the case. Until 2018, despite the fact that her shop had a better location, she was steadily losing business to another grocer with a wider range of offerings.

Last year, Chauhan took a MUDRA loan of Rs 1 lakh and bought a fridge, which allowed her to widen her inventory to include perishables like milk and curd, besides cold drinks. She also used the money to purchase items she didn’t sell earlier.

At present, she stocks items worth around Rs 50,000-Rs 60,000 every month, which has helped her regain her lost clientele and capitalise on her shop’s location.

“My monthly revenues have increased to more than Rs 1 lakh from Rs 30,000 last year,” Chauhan told ThePrint.

She now plans to tap her increased revenues to expand her shop’s offerings to plastic chairs and accessories.

Chauhan is one of the success stories of Mudra, who faced a smooth ride all the way from the application to loan disbursal, but Sant Ram, a 28-year-old Delhi-based applicant, faced a tougher going.

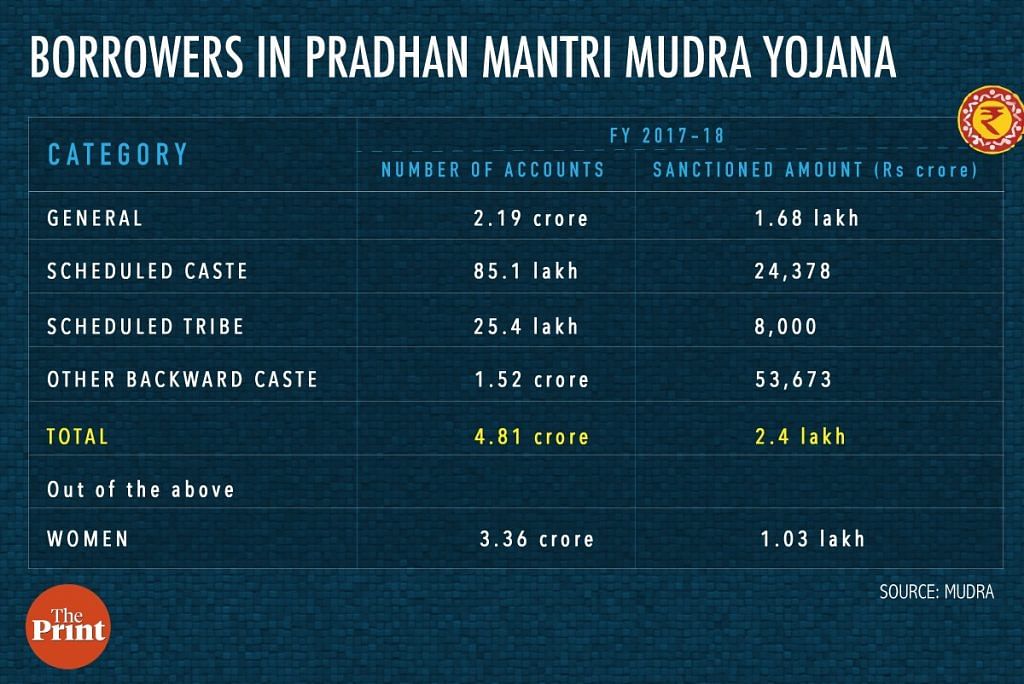

Also read: General, OBC categories make the most of Modi’s Mudra loan scheme for needy entrepreneurs

Struggling to take off

Sant Ram was unemployed and living with his family of six in a one-room house at Pochanpur village, West Delhi, when his mother began to force him to find work. Sant Ram, instead, decided to buy an e-rickshaw, a vehicle that has eased last-mile travel for scores of public transport users.

He approached the local bank for a Mudra loan in November 2017, but he said it took him nearly eight months, endless running around and a multitude of documents to secure a loan of Rs 50,000.

“The scheme is good for unemployed people like me, but getting the loan is not easy,” he told ThePrint. “Bankers are sometimes rude and dismissive.”

Bhoye had a similar experience. An unemployed housewife until a couple of years ago, she trained as a beautician with the hopes of setting up her own beauty parlour.

She eventually took a Rs 3-lakh loan under the MUDRA scheme, repayable in seven years, but she recalls the application process as a harrowing experience.

“When I was studying to be a beautician, a lot of big people would come and talk to us, telling us to start our own business and I was very inspired,” she said. “After the course, I tried to get a MUDRA loan but the bank people really harassed me.”

Although all her papers were in order, she claimed, the bank delayed sanctioning her loan. “They first insisted on a rental agreement for the space where I would set up the beauty parlour. I got it done and showed it to them, but the loan still took time,” she said.

Bhoye set up her parlour in 2017. “The first few months, I had to pay rent from my own pocket,” said Bhoye, whose husband works as a driver. “We are not very well-to-do, so I had to borrow money from my relatives.”

All in all, it took one year for Bhoye’s MUDRA loan to be sanctioned. The loan has given her a breather, though business at her parlour is yet to pick up.

“In anything new, things take time to pick up,” she said. “Even now, I don’t have too many customers coming to the parlour but I do a lot of home visits. Now let’s see how it goes.”

‘A little handholding’

While Bhoye’s endeavour may succeed with time, many MUDRA-fuelled initiatives result in failure.

With several of the applicants being debutant entrepreneurs, there have been many instances of businesses started with MUDRA loans going kaput. This has led to a rise in bad debts.

In fact, the rise in the levels of non-performing assets (NPAs) has been so alarming that MUDRA found itself forced to look for radical measures like lie-detection tests, use of artificial intelligence, and pyschometric tests etc to weed out non-serious borrowers.

According to official data, NPAs of state-run banks under the MUDRA scheme rose to Rs 7,277 crore as of March 2018, as against Rs 3,790 crore in March 2017 and Rs 597 crore in March 2016.

“The intention of MUDRA scheme is very good, and easy access to funds can encourage more entrepreneurs to start their own business,” said S.L. Rao, a former director general of National Council of Applied Economic Research (NCAER), a Delhi-based economics thinktank.

“But the problem is the implementation by banks. MUDRA is all about lending to small borrowers. When one lends to small borrowers, a lot of hand-holding is needed. Bank officials need to sit with the entrepreneurs and help them with the business model,” he added.

“But given the problems faced by banks, they are not able to focus on such accounts the way they should,” he said.

Also read: Modi govt looks at lie detection test to tackle bad loans in Mudra scheme

Making dreams come true

Meanwhile, even as the government tries to find a way out of this conundrum, the scheme continues to fuel dreams.

Mumbai-based Rakesh Raut, 41, a fledgling actor and director, applied for a MUDRA loan so he could get contracts for film editing, which requires specific equipment.

He secured a MUDRA loan of Rs 3 lakh about four years ago, and bought an Apple Mac mini to start his venture. Raut said revenues were lower initially, but the loan at least afforded him an opportunity for steady work.

A mechanic who decided to switch to acting relatively late in life, Raut said his life had now come back on track. His first big short film as an editor is now due for release and he has edited several episodes of a web series titled Punishment.

He also has a short film of his own, Typist Khare, in the works.

Talking to ThePrint, Raut said he was now at the fag end of the tenure of his loan.

“I was not always regular with my monthly instalments, but they never tortured us for repayment,” Raut added.

The way Mudra Loans are disbursed, I am sure this Government is going to leave legacy of Bad Loans for all public sector banks who are used for disbursement under this scheme. As per media reports already 14000 crore worth Mudra Loans are qualified for Non Performing Assets (NPA).

More than half of loans under mudra have gone to women. Women, at least till now, are honest about repayments.

Mudra will need much more fine-tuning. But eventually, it will be the answer to the unemployment issue.