New Delhi: India’s crude output fell 4 per cent from April through February in fiscal 2018-19 to 31.36 million metric tonnes (MMT), but this isn’t a first. Under the Modi government, which had promised to raise output and reduce oil imports, crude oil production has actually seen a steady fall.

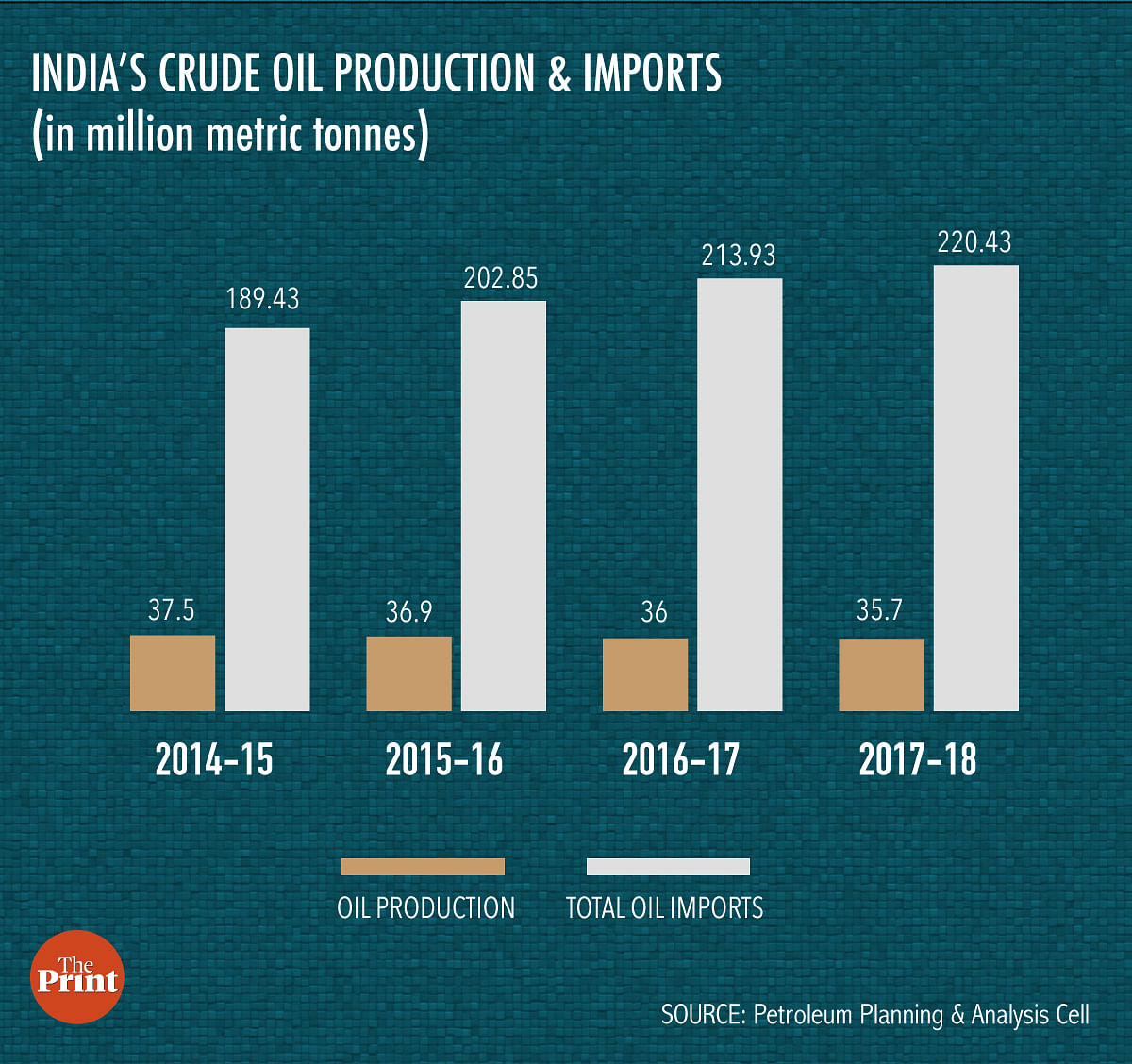

From 37.5 MMT in 2014-15, when the Modi government came to power, India’s total production dropped to 35.7 MMT in 2017-18 — a 5 per cent drop, despite NDA’s promises to the contrary to make India more self-sufficient in oil production.

In the same period, India’s crude oil imports rose from 202.85 MMT in 2015-16 to steadily increase to about 217 MMT, said a statistics website. The 6 per cent rise in imports came even as the Modi government chalked out a roadmap in 2015 to bring down crude oil imports by 10 per cent by 2022.

According to data published by Petroleum Planning and Analysis Cell, under the Ministry of Petroleum and Natural Gas, oil production was lower by 6.1 per cent this February alone.

Data showed public sector oil exploration majors Oil & Natural Gas Corporation (ONGC) and Oil India Ltd (OIL) actually saw a de-growth in production of 5.1 per cent and 6.5 per cent, respectively, in February.

However, a government official who didn’t wish to be named told ThePrint, “India has made considerable progress and many steps have been taken to boost exploration, but it takes time.”

According to a government statement in March, there has been a loss in production due to miscreant activities in operational areas and “less than planned contribution from work over well and drilling wells”.

Also read: India should be cautious of Saudi Aramco’s interest in Reliance refinery for a few reasons

Why imports have risen

Speaking about the higher level of imports, analysts told ThePrint that the development went unnoticed due to overall subdued global crude prices during the 2015-17 period, keeping the oil import bill in check.

“No concrete step has been taken to boost oil production. Our imports have, in fact, gone up. The only thing that has come as a big boon is the global crude oil price which had dropped significantly keeping our import bill in check,” an analyst, who didn’t wish to be identified, told ThePrint.

The analyst added that investments in oil fields have not picked.

“Most banks are not ready to give loans for geological research that needs to be undertaken to find the oil reserves. Until the oil reserves are discovered, there is no money, so there is a risk element attached.”

India is among the top five consumers of crude oil at present, with imports accounting for almost two-thirds of its crude requirements.

In this scenario, a drop in production would mean increased imports and higher outgo for the central government, which could have a direct impact on the current account deficit — the difference in outflow and inflow of foreign currency.

A government study published in 2016 had said the drop in production was due to a host of reasons, including a natural decline of mature fields in Mumbai and “less than envisaged production from new and marginal fields”.

A major chunk of India’s oil production is undertaken by the public sector oil companies.

A former ONGC official said the company focused primarily on the acquisition of Hindustan Petroleum Corporation Ltd (HPCL) in the last fiscal.

“Acquisition of that scale is not easy and this was almost a diktat from the Centre to go ahead with the merger. So these (kind of decisions) disrupt the core activities too,” said the ONGC official on condition of anonymity.

In 2017-18, Finance Minister Arun Jaitley announced in his budget speech that the government was keen on creating integrated oil behemoths, and ONGC’s acquisition of HPCL was aimed at merging the central public sector enterprises with a view to giving them wider capacity and scale.

Also read: Oil prices are climbing again and that’s bad news for inflation outlook

Global crude prices

Crude oil prices have risen considerably in calendar 2019. Analysts said that with supply squeeze, oil prices are likely to remain high in the coming months.

After touching over $110 a barrel a day in August 2013, global crude oil prices have been falling since mid-August 2014. In 2016, prices had crashed below $50 due to a slowdown in emerging markets and China.

However, prices have been fluctuating since and touched over $75 a barrel in October. It closed at almost $72 last week.

“This is even more of a concern. If imports are up and so are oil prices, it will put pressure on the macroeconomic parameters,” said the analyst quoted above.

There are no new oil field finds after BH and naturally production is stagnant.Overseas ventures too proving failures…just pouring money with little returns…

When a price of a commodity (like oil) drops, there is less incentive to increase supply. THis is called demand supply market. This is also because it would take longer to recover the cost of investment. Additionally, oil rigs are not like factories that can be shutdown when there is no demand, once struck, there will be a steady supply. Price of crude has fallen so why would anyone make large investments in setting up new oilfields.

Garbage article. India has rarely increased production as they are unable to find oil or gas. Our production is stagnant despite efforts. Bombay high production is decreasing and so is from Ravva and other fields. Rajasthan fields are making up for it but India has secured more resources from overseas such as in Mozambique, Colombia, Venezuela and Russia but the production has not started. So its dumb to say Modi government has not increased production meanwhile consumption is increasing and we need to stop the waster and allow more drilling to be done but in Tamil Nadu they are not allowing wells to be drilled but they want cheap diesel and petrol.

Socialist Modi murdabad